Lake Michigan Credit Union Reviews – Top Rated Credit Union

Over the course of its 80+ year history, Lake Michigan Credit Union (LMCU) has not only become one of the largest and most prominent credit unions in the country, it has become an indispensable part of the Michigan economy, with just about one in every six Michigan residents able to boast of having a relationship with it. As you’ll see, most of its members seem to be very happy with the service they receive.

Lake Michigan Credit Union Reviews

Image source: LMCU

Most of the Lake Michigan Credit Union reviews that can be found on the Internet tend to be positive and, unlike a lot of reviews of credit unions, they tend to come from places other than just Michigan. One reason for that may be the fact that virtually any resident of the United States can join Lake Michigan Credit Union, regardless of where they live.

Who Can Open an Account with LMCU?

With the LMCU online banking system – now known as LMCU Anywhere – and LMCU home banking, anyone with a computer or smartphone can bank with the credit union from anywhere, and many do.

All you have to do to become a member of LMCU is make a $5 donation to the Amyotrophic Lateral Sclerosis (ALS) (Lou Gehrig’s disease) Association West Michigan Chapter, and you will then qualify to join LMCU.

Note: You can make the $5 donation as part of your LMCU account application – having the whole process handled at the same time allows for an effortless and amazing customer experience.

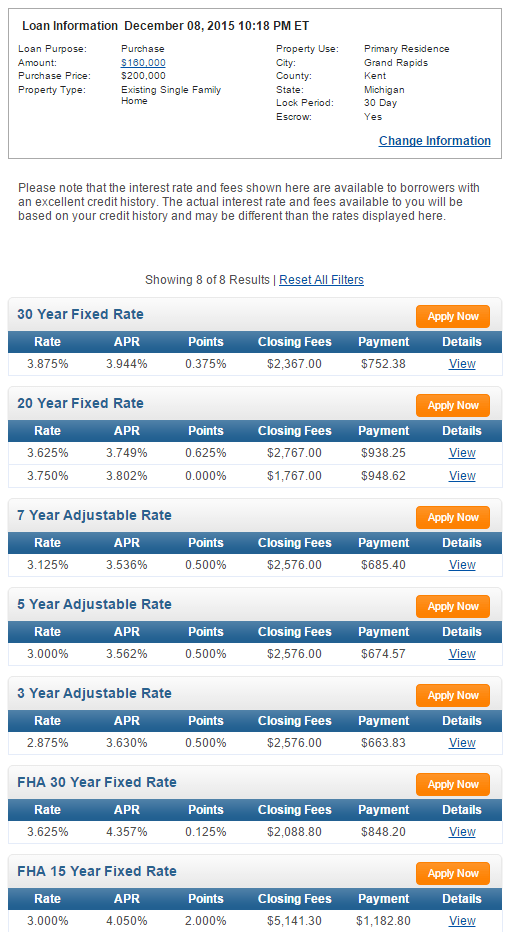

LMCU Mortgage Rates and Review

LMCU is also the leading issuer of mortgages in the state of Michigan.

While many very large banks like to tout their huge size as a major advantage for their customers, LMCU, as a nonprofit credit union owned by its members, takes the opposite approach and claims that it’s bigger because it’s better.

In the credit union’s marketing, it touts its accountability to members and boasts of featuring lower fees and fewer of them as well as lower LMCU mortgage rates and better interest rates on checking and savings accounts.

Lake Michigan Credit Union promises to match any legitimate competitor’s mortgage rate offer or credit the mortgage loan borrower $300 off the closing costs. Note that the “LMCU mortgage rates – low rate guarantee” offer cannot be combined with any other offer.

Image source: LMCU

The state of Michigan gets extremely cold during the winter, and Michiganians who can afford it (mostly retirees) like to spend the winter in the warmer Florida weather and then head back home in the spring when the weather up north is more tolerable. In other words, they “fly south for the winter,” hence the term “snow birds.”

To accommodate them, LMCU recently opened a new mortgage branch in Bonita Springs, Florida (a suburb of Naples).

Also check out the two articles below in which LMCU has been rated as one of the top banking firms of the year.

- Best Banks to Bank With – No Fees, High-Yield Savings

- Best Credit Unions in the US (Top Ranking List and Reviews)

Let’s take a look at other LMCU products and offerings.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

LMCU Checking Accounts

One of the signature LMCU home banking products is the LMCU Max Checking account, which has been touted by a great many Lake Michigan Credit Union reviews as one of the best deals in the entire country.

This checking account offers an interest rate of 3.00% APY, which is among the highest in the country, for balances up to $15,000 (curiously, amounts over that earn no interest). There are also no fees for keeping the account and no minimum balance necessary.

Not only are all LMCU ATMs free to use, but the credit union will reimburse members up to $15 per month in ATM surcharges if they have to use ATMs not owned by LMCU.

There are only a few small requirements that must be met each month to earn and maintain the 3% rate:

- You must have a direct deposit set up in your LMCU account

- You must make at least 10 debit card purchases per month

- You must log into LMCU home banking at LMCU online at least four times every month.

- You must “go paperless,” meaning you sign up to receive e-statements and e-notices

If you can do all of those things, you will have a great checking account that won’t cost you a lot in fees and also has one of the best interest rates in the business. In fact, the interest rate on this account is actually higher than the rate for its 5-year certificate of deposit. As long as you can manage to keep those requirements, it may be one of the best bets for many people.

For those looking for a free checking account with fewer bells and whistles and requirements, LMCU also features a free checking account, meaning no monthly fees and no minimum balance. These accounts come with free LMCU ATM usage but no reimbursement for non-LMCU ATM fees, and there are no interest payments.

Another option is the LMCU Investor Checking account, which is a relatively simple checking account that boasts of a three-tiered interest rate, with interest computed daily and paid monthly. The tagline for the account is, “The more you save, the more you earn,” but the fact of the matter is this: The current rates aren’t so good.

To earn any interest at all, your balance has to be above $2,500; the first two tiers have to be $2,500–$4,999 and $5,000–$24,999 respectively and both feature an interest rate of 0.25% APY; for balances of $25,000 and over, it rises to 0.35%. If you maintain a minimum average daily balance of at least $2,500, there are no fees, but if the daily balance falls below that, the charge is $10 per month.

All in all, for the vast majority of people, the LMCU Max Checking account would seem to be the most obvious choice, with free checking being a second choice for those who hardly use their checking account.

Savings Accounts

As is the case for most credit unions, Lake Michigan Credit Union has a wide variety of ways for individuals and families to save money, including everything from a savings account for a child that will grow with him/her and short-term accounts that can be set up for special events/special purposes to accounts that pay for college and retirement accounts for the golden years. They really do seem to have a product for everyone’s needs.

The selection begins with some basic, traditional savings accounts. A standard share savings account is about as basic as it gets; you can start one with as little as $5, and with a $300 average minimum daily balance, you can avoid the $5 monthly maintenance fee. Right now, the interest rate is 0.25%.

Other very popular savings accounts offered by LMCU include their Kids’ Club and Teen Club accounts, which feature no minimums and pay a full 1.00% on the first $1,000, dropping to 0.25% on amounts above that.

The Kids’ Club account also features rewards for developing good savings habits. When an account is opened for a child, he/she receives a piggy bank. When $250 is reached in savings, the child receives a Max the Monkey backpack. At $500, he/she receives a Max the Monkey, all while receiving a better-than-average 1.00% interest rate.

LMCU also has a short-term Holiday Club (formerly, Christmas Club) account, which allows people to save money for the holidays every year. These accounts have no minimum deposit, no fees, and deposits can be made at any time. Then, on September 30, all of the money is dumped into your checking account. The interest rate on these accounts is 0.25%, so don’t expect a lot of interest, but it could be a good way to save for the holidays and avoid some massive debt.

CDs and Money Markets

LMCU also has a variety of certificates of deposit (CD) and money market accounts available for your savings needs, but they suffer from the same problem that many large banks have; they provide little incentive to commit your money to one account over a long period of time.

Their CD accounts cover a range of lengths, from 3 to 60 months, and their interest rates go higher the longer the term, but the rate for a 60-month CD is 2.00%, which is only a bit higher than the 1.65% rate offered for a 36-month CD, and that is only a bit higher than the 1.40% rate for a 12-month CD.

As is the case with most banks, given the possibility of higher interest rates in the future, the question becomes: Do you want to tie your money up for 3-5 years for such a small interest rate hike? Keep in mind, too, that all of these accounts assess penalties for early withdrawal so that should be factored in as well.

As for money market accounts, the interest rates are currently lower, ranging from 0.25% to 0.50%, with interest accruing, but the potential to go higher is there, looming over the market. Interest on these accounts is variable; you’re allowed to make up to six withdrawals or electronic debits per month without a penalty, and if interest rates rise, so will the interest on your money market. Sure, you can make 2.00% on a CD if you tie your money up for five years, but what if you need your money before then?

Conclusion – Lake Michigan Credit Union Review

Based on its offerings, as well as reviews, Lake Michigan Credit Union has quite the following. However, nothing it offers seems to draw more praise than the LMCU Max Checking account. The reviews for this product are almost uniformly stunning, primarily because you don’t see any kind of account that offers a 3.00% interest rate these days. If there is a downside, it’s that it only offers that rate on the first $15,000, but for a free checking account, that’s still not bad.

One thing that seems to be true about LMCU is that it appears to be persistent in keeping members happy, and it succeeds in doing this, based on the extremely high level of customer satisfaction ratings that the credit union has received.

According to several research firms that assess credit unions for quality, LMCU ranks first in growth of assets, and it also has a high member return rate of 99.53%, which is the best in the business.

LMCU is easy to join, no matter where you live in the U.S., and it seems as if once you’re in, you won’t want to leave.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.