Intro: LendingTree Auto Loans Reviews

When you’re looking to get an auto loan, the options seem endless. You may go with the first or second company that shows up in your search results because you’re simply overwhelmed, but that’s exactly why it’s important to do your due diligence. Many people have heard of LendingTree auto loans, but does that make them the best option for you?

There are lots of LendingTree auto loan reviews out there, but first you need to understand the basics of how it works. LendingTree has partnerships with a trusted network of lenders and car dealerships who will take the information you provide. Then, they essentially bid on who will give you the best loan terms. You’ll be offered many options and choose the one that fits your situation best.

It sounds great, but there are nuances to LendingTree auto loans that you need to know about before you jump in with both feet.

Here are the pros, complaints, and overall reviews to help make your decision a little easier.

Image source: Pexels

Pros

The biggest pro about LendingTree auto loans is that you’ve likely heard of them. Whether it’s because of their advertising and commercials or because a friend got a loan with them, brand name power is a big pro for people. But that’s the tip of the iceberg when it comes to this company.

LendingTree offers auto loans for new and used cars, so you aren’t limited when it comes to what you can get a loan for. They also provide free resources even if you don’t choose to use them as an auto lender. These resources come in many forms, including their online database of articles that you can browse to educate yourself about the lending process before you sign anything.

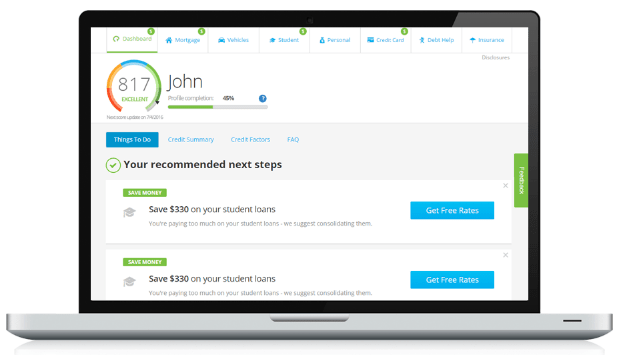

Image source: Lending Tree

For example, they have an easy, free tool that will help you assess your credit score so you know what to expect when you sign a loan. Some of their advice includes:

- Lower credit scores can require higher down payments

- Once your credit score improves, you can consider refinancing your loan

- Making on-time payments improves your credit score

In addition to these resources, LendingTree understands that the auto loan process may be new to you, so on their home page for auto loans, they provide a glossary. This won’t redirect you to other pages. It will quickly and simply help you understand what you’re reading as you go along.

See Also: Can Capital Reviews – Get All the Facts Before Using Can Capital

Anytime a company provides you with free information and research, it’s a good thing. It shows that they care about you and your financial success whether you decide to work with them or not.

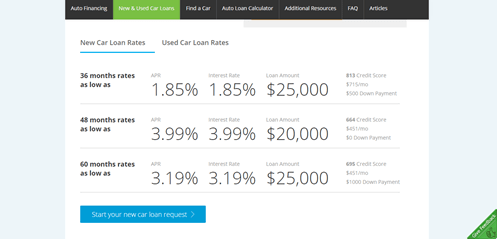

Practical Examples

When you visit the LendingTree auto loans home page, you are given some real-life scenarios of what your loan and payments could look like. For example, if you take out a 48-month $20,000 new car loan with a 664 credit score, you can expect a 3.99% APR and interest rate if you put down $0. This will result in a $451 monthly payment.

Image source: LendingTree

With LendingTree’s tools, you can play around and figure out how to get the most bang for your buck.

Don’t Miss: CuraDebt Customer Reviews – Get all the Facts before Starting with CuraDebt

Help You Find a Car

In addition to giving you resources to make a sound financial decision and the cash you need for your car, LendingTree.com also has options to help you find a car, research various manufacturers, and find what will overall be best for your life and your personal situation.

There’s also a tool to help you research cars, do a comparison between models, and find a car in your area that’s available to buy. If you need any kind of help when it comes to the auto loan process, there’s a good chance LendingTree.com has an asset that can help you, even if you don’t choose to work with them and their partners.

Ease of Research

LendingTree goes by the motto, “When banks compete, you win.” That’s a good rule of thumb, and it’s why many people choose to work with LendingTree. Once you give them your information, you’re matched with banks that are good for your financial situation, whatever that may be. This means that instead of spending time calling every bank you can think of to get auto loan quotes, they’ve already done the work for you. All that’s left is for you to choose the bank you want to work with and sign the papers.

The research assistance doesn’t stop there. There’s also an auto loan calculator that lets you put in variables when it comes to your personal situation. You can choose the loan amount you want, your interest rate, and the term you want to repay it over.

This doesn’t always mean that you’ll get the term you want, but it’s a good place to start.

Related: OptionsHouse Review – Fees, App, Commission, Services, Speed, Trading

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Complaints

When you’re entering into a binding financial agreement with any company, it’s important to not only be sold on the good things they can offer you, but to also look into bad experiences others have had. Then, with all of this information, you can make a decision.

LendingTree has been accredited by the Better Business Bureau since 1998 and has an A+ rating. It’s tough to find too many bad experiences listed, but they do exist. A simple search of “Lndingtree reviews auto loan” brings up mostly positive feedback. That’s not always the case, though.

Too Many Calls

LendingTree.com reviews frequently cite a complaint that centers on the very thing LendingTree boasts of their business model: when banks compete, you win. That can be true, unless a consumer was just casually looking online for auto loans and didn’t necessarily want to sign one right away.

Within these complaints, users state that they didn’t even finish filling out the form with LendingTree, having only entered some of their information, and were already getting calls from banks.

If you’re looking to get a loan right away, this isn’t necessarily a bad thing. But if you are just getting some preparation research done, it can be quite annoying, as many complainants have stated. Think twice before submitting your info.

Accounts Left Open

Other complaints seem to stem from the general process of which information is released when someone signs up for LendingTree auto loans, as noted on the BBB. One key theme in the LendingTree auto loans reviews seems to be that there is no way to cancel an account from the user’s side once it is created. This means lenders continue to call potential borrowers until their account is closed or resolved in some way.

However, it seems that even if an account is half-finished, the information is still given out. One complaint on the BBB states, “I continue to receive unwarranted and unwanted emails and calls concerning a visit to the Lendingtree site where I did not even complete the final process of taking part in the site.”

The lesson here is the same as the previous one: if you aren’t ready to get a loan right now, then this may not be the right time for you to look into LendingTree auto loans. But if you are looking to buy a car within the week, then you have much of your research done for you by fielding these calls.

If you want your account closed, simply call their customer service number and explain your situation to them. It’s an extra step, but it will resolve the calls going forward.

The Single Credit Check Trick

There a semi-hidden trick in LendingTree.com’s offerings: the professed single credit check. You may not know this, but every time your credit gets checked, it shows up on your credit report. This doesn’t necessarily hurt your credit, but it also doesn’t look great to lenders who may wonder why there are so many inquiries. It may signal to them that you’re looking to make a large purchase in the near future.

When you sign up for LendingTree, it states that it will show you your credit score for free. However, each individual lender you work with may have a different process. What this means is that each time you vet a potential lender, you may have that inquiry show up on your credit report. Of course, you’ll have to agree to them running your credit report first, so you won’t be completely blindsided by this.

One of the LendingTree auto loans reviews on CreditKarma.com writes, “I did not officially apply for a loan, just wanted to get information before I go car shopping. BIG MISTAKE! I was matched with two lenders; however, I didn’t know they were going to pull my credit report, I just wanted to know the going interest rates!”

Be aware of these factors any time you apply for a loan of any kind.

Popular Article: CreditRepair.com Reviews and Overview (Before You Sign-up)

Review

When it comes to LendingTree auto loan reviews, you need to take them with a grain of salt. There are clearly some things within LendingTree’s offerings that could be better or explained more clearly to potential members. These include fully understanding their process instead of just telling consumers that banks will compete for their business.

Overall, people seem to have positive things to say about working with LendingTree, but that’s only if you understand what is going to happen. If you know you’re going to receive calls and emails giving you potential, preliminary loan offers, and you’re ready to get a loan today or within the next few days, then this is an ideal platform for you.

However, if you are just looking around and doing research to buy a car down the road, LendingTree may not be what you’re looking for.

Weigh your options, see how close you are to making your new car a reality, and then decide if LendingTree is right for you. If you’re only doing it for the free credit score, there are many other places online where you can get that. Contact your credit card companies, because they may also be able to provide you with a free report.

Trustworthiness

The important thing to note is that in the age of identity theft, LendingTree.com auto loans seem to be a safe and secure place to get your auto loan information from. Be advised that they will send your personal information to other businesses, but these are businesses they trust. You’ll be hard-pressed to find an instance where a LendingTree transaction ended up in fraud or information being leaked.

Image source: Pexels

This is something that is of the utmost importance when you’re choosing a company to work with.

Conclusion

In order to be a savvy car buyer, you need to make sure you’ve explored all of your options. Based on the LendingTree auto loan reviews, you can be assured that if you’re looking for a simple way to get the most lending options in front of you, they are a good direction to take.

However, if you’re just looking at LendingTree auto loans to get a feel for what’s out there and what a loan will cost you, you may want to hold off on signing up for now.

The good news is that, in the meantime, LendingTree provides you with resources to get the research you need to confidently move forward with your loan process.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.