Intro: Which Is the Best Mortgage Calculator: Chase Mortgate Calculator, Wells Fargo, or CNN Mortgage Calculator?

Before you sign on the dotted line to purchase your home, you should have a good idea of what it’s going to cost you on a monthly basis. In fact, it is wise to have an estimate in mind before even viewing properties so you don’t fall in love with a home you can’t afford.

Most of us don’t have a clue how to calculate a mortgage payment, which is where a home mortgage calculator can really come in handy.

Chances are that you will want to find a mortgage calculator with taxes and insurance included to get the best picture of what your payments might look like.

With so many different mortgage calculators available, how do you know which mortgage repayment calculator is the best?

AdvisoryHQ wants to help you take a look at a few of the more popular options, including the CNN mortgage calculator, the Wells Fargo mortgage calculator, and the Chase mortgage calculator. We will examine what sets each one apart and exactly what their mortgage calculator has to offer you.

But first, let’s take a closer look at exactly how mortgage calculators work and the math behind these wonderful tools.

See Also: Finding the Best Home Loan Calculators | Top Home Mortgage & Home Equity Calculators

How to Calculate Mortgage Payment

For the most part, we tend to ignore the math behind the CNN mortgage calculator, the Wells Fargo mortgage calculator, and the Chase mortgage calculator.

We leave it up to the banks and mathematicians to determine what our monthly principal and interest should be. However, we might want to consider taking a closer look behind the scenes at exactly how to calculate a mortgage payment.

Image source: Confused.com

Nerd Wallet shares in great detail how they come up with your monthly mortgage payment, and the math isn’t as hard as you might imagine it to be.

On a fixed rate loan, the formula that determines your monthly payment looks something like this:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

In order to use the formula, you only really need a couple of numbers: your starting principal, your monthly interest rate (take your annual interest rate and divide by 12), and the number of payments over the lifetime of your loan.

From here, you simply plug in the numbers where they belong: P stands for principal, I stands for interest, and N stands for the number of payments.

To make it a little bit clearer, we’ll use an example. Let’s say your principal is 200,000, your annual interest rate is 4 percent (making your monthly interest rate 0.334%), and you have a 30-year mortgage (360 payments). Your formula would look like this:

M = 200,000[0.334(1+0.334)^360] / [(1+0.334)^360-1]

If you still don’t feel like doing the math yourself, that’s okay. That is part of why the

CNN money mortgage calculator or the Wells Fargo home mortgage calculator can come in handy. The formulas they use will be similar, and they can also include an approximation of your taxes and insurance as well as your principal and interest payment.

Benefits of a Mortgage Calculator or Amortization Table

Besides being able to avoid the lengthy calculations associated with figuring out your potential monthly payments, using a mortgage calculator with taxes and insurance can give you a more realistic idea of how to budget appropriately for your upcoming home purchase.

When selecting a mortgage calculator, you should be conscious of choosing one that includes all four aspects of homeownership costs: principal, interest, taxes, and insurance (PITI). Using a home mortgage calculator can allow you to get a more realistic estimate of what a potential home will cost you without having to involve a third party.

A good mortgage calculator with taxes and insurance is ideal for those who prefer to calculate things independently or who are determined to complete as much of their mortgage as possible online without involvement from a representative.

Mortgage calculators are great tools for those who are just beginning to shop for homes and want to know what certain homes in different price ranges will cost.

These individuals may also benefit from some of the mortgage affordability calculators that are also available alongside the CNN mortgage calculator, Wells Fargo mortgage calculator, or Chase mortgage calculator.

For those who want to dive deeper into exactly how to calculate mortgage payment, taking a look at an amortization table (available with the Wells Fargo mortgage calculator) can give you a further breakdown of how your monthly payment is spent.

In the beginning of your loan, most of your monthly payment is dedicated to paying down interest with only a small portion allocated for your principal.

As the loan progresses, it changes, with more of your payment spent on the principal and less spent on interest overall. An amortization table or schedule can demonstrate exactly how your payment is split for each and every one of your monthly payments throughout the duration of your loan.

Don’t Miss: Should You Refinance with Bad Credit – Things You Should Know Before Refinancing a Car or a Mortgage

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Chase Mortgage Calculator Review

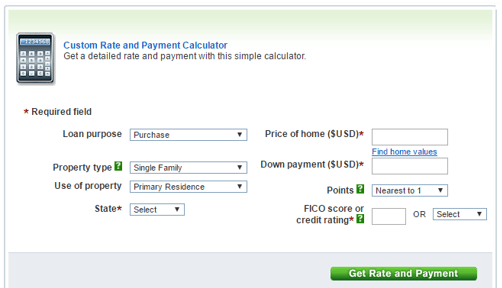

With the Chase mortgage calculator, you can take advantage of a number of features that are beneficial when considering purchasing a new home. They offer their Chase money mortgage calculator, as well as an affordability calculator and a calculator to approximate the value of the home.

The Chase mortgage calculator allows you to choose exactly how you intend to use the property and what type of property it is. It accounts for the location of your purchase, the purchase price, and your down payment amount. If you know your FICO credit score or know the general range where your score falls, it can include potential rates.

Source: Chase Mortgage Calculator

One of the best features of the Chase mortgage calculator is the ability to include points into your estimated monthly mortgage payment. Some lenders will allow you to purchase points, which are fees you pay prior to closing in order to lower your interest rates.

You will usually pay approximately one percent of the mortgage amount, which can reduce your mortgage rates typically by 0.125 percent.

Another compelling feature to note in a review of the Chase mortgage calculator is the ability to view the various loan options and monthly payments all in one convenient location. You can use the Chase mortgage calculator to view the estimated monthly payment for the following loan types:

- 30-year fixed rate

- 20-year fixed rate

- 15-year fixed rate

- 7/1 ARM

- 5/1 ARM

Once finished, you can conveniently move forward with an application for whichever mortgage option meets your needs the best.

Related: (PenFed) Pentagon Federal Credit Union Reviews – What You Need to Know! (Mortgage, Loan & Review)

Wells Fargo Mortgage Calculator Review

Using the Wells Fargo mortgage calculator, you can view the monthly payments as well as affordability, a home amortization calculator, and various other calculators to adjust to different types of mortgages, including adjustable-rate mortgages. You can also use their extra payment mortgage calculator to determine how quickly you could pay off your mortgage in advance.

On the breakdown and pie chart displaying the funds allocated to your monthly payment, it automatically includes private mortgage insurance (PMI) when your down payment totals less than twenty percent of the cost of the home.

Unlike the Chase mortgage calculator that does not include PMI, the Wells Fargo home mortgage calculator includes this incredibly important feature that can make a huge difference in your monthly payments.

The Wells Fargo mortgage calculator calculates the full principal, interest, taxes, and insurance. If you know the property taxes on your potential purchase, as well as the insurance cost, these are adjustable under the advanced section of the Wells Fargo mortgage calculator.

From this same screen, the Wells Fargo mortgage calculator completes a full amortization table according to your inputs. In the chart above, it gives you a brief overview of how the payments are divided at each ten-year point throughout your thirty-year loan. The light blue at the bottom represents the portion of each payment that goes toward your principal and the dark blue represents your interest.

CNN Mortgage Calculator Review

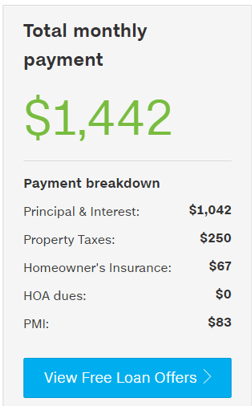

The CNN mortgage calculator works very similarly to the Chase mortgage calculator and the Wells Fargo mortgage calculator. After a brief input of information regarding the type of loan you wish to calculate a payment for, your home price, interest rate, and down payment, you can come up with a conclusive monthly payment.

Unlike the Wells Fargo mortgage calculator and Chase Mortgage calculator, the CNN money mortgage calculator does not include as many options for calculating monthly payments for different mortgage types. Instead, it includes only a basic thirty-year and fifteen-year mortgage calculator with taxes and insurance. The CNN mortgage calculator comes with basic assumptions regarding your property taxes and homeowner’s insurance, which can be adjusted according to the rates for your area.

Similar to the Wells Fargo home mortgage calculator, the CNN mortgage calculator also adds PMI into your projected monthly payment for lower down payments.

From the CNN mortgage calculator, you can quickly view more customizable rates through a link directly leading you to Lending Tree where you can view offers from a number of lenders. The Chase mortgage calculator and Wells Fargo mortgage calculator can offer mortgage rates directly through their respective companies, but the CNN mortgage calculator will link to other choices.

Source: CNN Mortgage Calculator

There are a handful of other mortgage calculators available through the CNN Money mortgage calculator. You can determine affordability and whether your home was a good investment. However, you will not find an extra payment mortgage calculator through the CNN Money mortgage calculator.

Popular Article: Union Bank Reviews – What You Will Want to Know! (Mortgage, Credit Card, & Reviews)

Benefits of Making Extra Payments

Making extra payments on your mortgage can significantly shorten the length of your loan term. Not only does it put you one step closer to being debt-free, but you can also encounter substantial savings through making extra payments. The extra payments go directly toward your principal, which can decrease the amount of money that you will pay toward your interest.

Discover points out that making extra payments toward your mortgage can be detrimental as well, though. It locks up your funds and doesn’t leave you with that additional money if an emergency crops up or if you choose to save for other important events in your life. If you do decide to make any extra payments on your mortgage, make sure to indicate that you request the money to go toward your principal and not your interest.

Interested to know how much you need to pay on your mortgage each month in order to shorten your loan term or to save a certain amount in interest? You can find an extra payment mortgage calculator. Of the three mortgage calculators discussed in our review, only the Wells Fargo mortgage calculator offers an extra payment mortgage calculator.

With this calculator, you can select how much to contribute on a monthly basis to your mortgage as well as how long it will be until the extra payments begin. The payoff section of this calculator will show how quickly you can pay off your mortgage using this tactic.

Side-by-Side Comparison

So, which of the mortgage calculators is the best choice for you to use for a mortgage calculator with taxes and insurance? The CNN mortgage calculator, Wells Fargo mortgage calculator, and the Chase mortgage calculator all feature the full principal, interest, property taxes, and insurance for you to budget accordingly before you purchase a home. Where does each of the mortgage repayment calculator options shine?

The Wells Fargo mortgage calculator and the CNN mortgage calculator are best for individuals and families who intend to use a down payment of less than twenty percent. These two choices will automatically calculate private mortgage insurance, or PMI, if it is required by your lender. The Chase mortgage calculator is better used for individuals whose lenders do not require PMI or who have larger down payments to include with the purchase of their home.

The Chase mortgage calculator and the Wells Fargo mortgage calculator also include the option to calculate monthly payments for adjustable rate mortgages, while the CNN mortgage calculator does not.

If you were planning to purchase points, the Chase mortgage calculator is the only one of the three that includes this as a potential option. While you could adjust the interest rate on the other two to reflect the new interest rate resulting from purchasing points, it does not include that cost into potential closing costs (which the Chase mortgage calculator does).

If you were interested in seeing the full amortization of your loan, the Wells Fargo mortgage calculator can also display a full table of the information you can expect for how your monthly payment is allocated between principal and interest.

Keep in mind that there are more than just these three mortgage calculators available for your usage. You may want to consider checking the potential mortgage payment on a new property on several of these programs to get a realistic range of what costs you may incur.

Read More: Tesco Bank Reviews – Is Tesco Bank Safe? (Complaints, Loans, & Mortgage Review)

Conclusion

Determining your monthly payment using a mortgage repayment calculator can help you to prepare more adequately for the purchase of a new home. Particularly if it is your first home, the use of a mortgage calculator with taxes and insurance can assist you in determining what to expect from your impending mortgage.

The CNN mortgage calculator, the Wells Fargo mortgage calculator and the Chase mortgage calculator all have excellent features that make them viable choices for potential homeowners. The mortgage calculator with taxes and insurance available through these outlets can assist you in making an accurate budget without having to learn how to calculate mortgage payments on your own.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.