Intro: Pentagon Federal Credit Union

When looking into institutions to finance a loan or mortgage, you definitely want someone you can trust, who gives you the best rates, and that is easy to work with. Why are homeowners using Pentagon Federal Credit Union (PenFed)?

Image Source: Pentagon Federal Credit Union

What do they say in PenFed Reviews? And what makes it stand out among other lenders? We will take a look through three different types of PenFed Credit Union reviews as well as what its employees say.

AdvisoryHQ has researched many of the Pentagon Federal Credit Union reviews from customers, as well as the current rates it offers for an auto loan, PenFed home equity loan, and its mortgages, to provide you with a comprehensive guide to this financial institution. We will cover who it is, the PenFed membership requirements and how you can qualify, and how its rates stack up to the average.

See Also: Top Credit Unions in California (Statewide)

Who Is Pentagon Federal Credit Union (PenFed)?

PenFed is no newcomer to consumer lending. It was first established in 1935 and, today, is one of the country’s most stable financial institutions. It has over 1.4 million members and over $20 billion in assets and is federally insured by NCUA.

It serves members in all 50 states and Washington, D.C. as well as on military bases in Guam, Puerto Rico, and Okinawa. Its motto is “Do Better” and is based upon its mission to help its members realize all their financial goals.

Image Source: PenFed Foundation

It is affiliated with the PenFed Foundation, which is a national nonprofit organization committed to helping members of the military community secure their financial future.

Main Services Offered by Penfed

PenFed Credit Union offers a full array of financial services for its members. These include:

- Mortgages

- Auto loans

- Personal loans

- ATV/RV loans

- Checking and savings accounts

- Refinancing

- Credit cards

- Investment solutions

Current Loan Rates Offered by PenFed

- New auto loans as low as 1.49%

- 30-year fixed mortgage as low as 3.5%–3.62%

- Fixed home equity loans as low as 3.74%

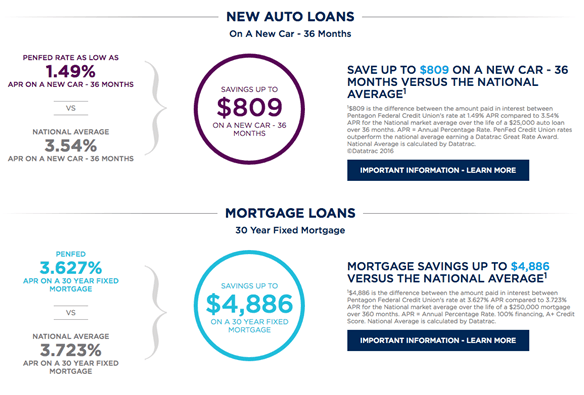

Numbers on rates are all well and good, but they don’t mean as much without a comparison to what else is out there in the loan marketplace. A PenFed Credit Union review often notes its low rates as a key benefit. PenFed makes it easy for you and includes a loan comparison page that covers new auto loans, mortgage loans, and credit cards.

For example (as of May 14, 2016), a PenFed auto loan review shows its rate for auto loans of 1.49% as lower than the national average of 3.54%. When we take a look at a PenFed mortgage review, we see that its 30-year fixed mortgage rate of 3.62% is lower than the national average of 3.72%.

Image Source: PenFed Loan Rates

Don’t Miss: Best Credit Unions in the US (Top Ranking List and Reviews)

(PenFed) Pentagon Federal Credit Union Reviews

Let’s get down to the “nitty gritty” – which is the PenFed mortgage reviews as well as how the credit union is to work with. We all know that if you really what to know about a company and whether you should do business with it, you look at the reviews and what other people are saying.

AdvisoryHQ has taken a look at a few different trustworthy sites to see overall what people think of them and the overall ratings for PenFed Credit Union reviews.

Credit Karma PenFed Reviews:

The overall rating on Credit Karma was a 2.6 out of 5 stars. One of the top 5-star PenFed Credit Union reviews stated, “Outstanding Institution” and praised the credit union’s long-term relationship of 20+ years with the reviewer’s parents, which was then passed down a generation.

One of the 1-star reviews had an issue with the final closing costs of their mortgage.

Bankrate PenFed Reviews:

The overall rating on Bankrate was a perfect 5 out of 5 stars. Some of the comments given by the customers that gave a PenFed review were, “Excellent,” “The service is really fast!” Great service,” and “Best rates.”

Employee PenFed Reviews on Indeed:

To see what the employees of PenFed think, look no further than Indeed Reviews from employees. They were overwhelmingly positive.

You’re always going to get a few disgruntled folks, but the 3.5 out of 5 stars PenFed review rating and a consistent 3 stars or more on work/life balance, management, and culture let’s you know that happy employees are a great indicator of a trustworthy organization.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Mortgage Options from PenFed

When first purchasing a house, trying to make the right choice regarding mortgage can be a daunting task. It’s always helpful to have a mortgage advisor that can help you navigate through all the “bank speak.”

Image Source: PenFed Mortgage

PenFed mortgage reviews show that it has many options available, so you can pick the best one for your family, and it also has helpful advisors to give you the guidance to make the best choice.

Its loan types include:

- 30-year fixed

- 20-year fixed

- 15-year fixed

- 10-year fixed

- 30-Year VA fixed

- 15-Year VA fixed

- 15/15 ARM (adjustable rate mortgage)

- 5/5 ARM

- 3/1 ARM

- 5/1 ARM

- 7/1 ARM

- 10/1 ARM

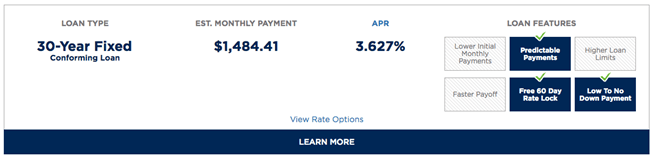

However, don’t let all those terms confuse you. PenFed has it clearly laid out on its site, with estimated monthly payments and notes on what each of those types of mortgages means, along with loan features and additional information.

Image Source: PenFed Mortgage Loan Features

Other Loan Options

Besides home mortgages, PenFed offers other loans at rates below the national average. There are always those times in life where you’re either shopping for a new car or want to build a new add-on to your home and need a loan to make it happen.

PenFed Auto Loan – It offers auto loans for up to 110% financing on both new and used automobiles. Its website makes it really easy to check the rate against the loan term to choose your best option for financing. You can easily get a PenFed auto loan review to see what rate you qualify for. Its rates are as low as 1.49% as compared to the national average of 3.54%

PenFed Home Equity Loan – It offers home equity loans for as low as 3.74% for any home addition project you may have on the horizon, such as adding a great new backyard gazebo or that new enclosed garage you always wanted.

Related: Best Banks to Bank With – No Fees, High-Yield Savings, Largest Banks, and Credit Unions

PenFed Branch Locations

While in this day and age, you don’t really need a physical location to do your banking or loan applications any longer, it still is nice to know where they are when you need them.

Pentagon Federal Credit Union has several physical locations (and, of course, its virtual presence is available 24/7). States/territories included are:

- Virginia (5 locations)

- Maryland (1 location)

- District of Columbia (DC) (6 locations)

- New York (2 locations)

- North Carolina (1 location)

- Tennessee (1 location)

- Texas (1 location)

- Hawaii (2 locations)

- Puerto Rico (1 location)

- Guam (1 location)

- Japan (1 location)

- Portugal (1 location)

- Turkey (1 location)

Get a downloadable PDF with all the locations listed and access requirements, where applicable, here: PenFed Branch Locations

How Do I Join?

Those of us who have always used traditional banks and aren’t as familiar with credit unions might be in the dark about how to start taking advantage of those great rates and the PenFed membership requirements. It’s an easy three-step process to utilize all of its mortgage, loan, and banking services:

Step 1: Eligibility – Join via your military affiliation, employment, association membership or volunteerism.

Step 2: Personal Info – Tell them a little about yourself and where you live (name, email, phone, address, etc.).

Step 3: Your First Account – You can open a savings account with just a $5.00 initial deposit.

If you are like most, you’re probably okay with Steps 2 and 3 but still wondering if you’re eligible for Step 1. You may not be in the military – but that doesn’t mean you can’t still join to take advantage of the great loan rates.

Image Source: PenFed Membership

Here is some helpful information for you to check to see if you fall into the PenFed eligibility.

The main eligibility requirements are:

- You serve in the United States military or uniformed services

- You are an employee of the U.S. government

- You are related to someone who falls into one of the above categories

- You’re a member of National Military Family Organization

- You’re a member of Voices for America’s Troops

- You’re a Red Cross Donor (according to MyMoneyBlog)

Those who aren’t in the military but still want to use PenFed’s loan services can simply join one of the two charitable organizations mentioned above.

National Military Family Organization has a sign up form for just a $15 donation on its site, and Voices for America’s Troops has just a $14/year membership fee. Both organizations provide charitable services to the US military, and both will qualify you to join Pentagon Federal Credit Union.

Why Choose a Credit Union Instead of a Bank?

This is a huge question for many of us. Why should we move to a credit union instead of a bank, and what exactly is the difference?

According to Bankrate, rising bank fees have caused consumers to turn to credit unions. According to statistics from the Credit Union National Association, 3.7 million people joined a credit union in 2015.

Credit unions are known for superior service, but sometimes there is limited eligibility. Credit unions are known for having fewer strings attached to their accounts but may also have fewer bells and whistles than banks do.

A HUGE difference is that credit unions are not-for-profit organizations that exist to serve their members, unlike banks.

If you’re a member of a credit union, you are more than just its customer, you are part owner. This is because credit unions are structured to be owned and controlled by the members that use their services.

Popular Article: Best Finance Documentaries (Documentaries About Finance & Money)

Why PenFed Credit Union May Be for You

Let’s take a look at why PenFed Credit Union may be the best financial choice for you and your family.

Lower rates on mortgages, loans, and great member services are all reasons that you may want to use this credit union for not only your loan services but also your day-to-day checking/savings or credit card account needs.

When it comes to your financial wellbeing, in both the present and future, every percentage point counts when it comes to a loan or mortgage. A few percentage points less can mean $200 or more in monthly savings on a mortgage or loan payment. That’s something significant to most of us.

To recap the reasons why PenFed may be a place you want to consider in the future:

- Lower interest rates on mortgages

- Lower interest rates on auto loans

- Low rates on home equity loans

- Refinancing options

- Other services, such as checking/savings/credit cards

- Many positive Pentagon Federal Credit Union Reviews online

- Can be as low as $14/year to qualify for membership

The bottom line is that we all want to do the best that we can for our families, so it definitely pays to shop around when getting a mortgage, auto or home equity loan (or other financial services).

It is also really important to read PenFed reviews so you know what experiences others have had with it. Doing your homework can save you big time in your monthly loan payments. You may be pleasantly surprised after reading through PenFed mortgage reviews and looking over all the options that it is easier to qualify as a member than you think and that the benefits can help you and your family get ahead in your financial goals.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.