Introduction: Best Mortgage Payment Calculators

You are searching for your dream home. You are also burdened by the financial aspects of purchasing a home. How will you estimate mortgage payments? How do you know what other added costs need to be figured into your mortgage payment? And what is the easiest way to calculate a mortgage payment?

It is no secret that budgeting for a mortgage can be confusing and even scary, especially to new home buyers. A home purchase is one of the most important financial commitments you will make in your life. It is crucial to estimate mortgage payments to learn what you can afford before you get too far into house-hunting.

Mortgage Payment Calculator

A mortgage loan payment calculator is one of the most useful tools for potential home buyers. Mortgage payment estimators let you fill in information personalized for your financial goals. If you find your dream home but are not sure if you can afford it when you add on taxes, insurance, and other costs, a mortgage payment calculator can provide you with that information.

How can you find the best way to calculate mortgage payment with a mortgage payment calculator? This article will guide you through the process and provide six tips for you to find the best mortgage loan payment calculator.

See Also: Top Mortgage Lenders | Ranking | Reviews of the Best & Largest Mortgage Lenders

How a Mortgage Payment Calculator Works

Reliable mortgage calculator payment information can, and should, detail the many costs that go into the purchase of a home. Attempting to put all the necessary figures together yourself can prove to be daunting and stressful. A mortgage payment estimator can instead figure in your inputted information and lead you to the answers you need.

Most people turn to mortgage calculator payment information to help them decide how much they can afford to spend on their mortgage payments each month. A calculator makes an estimate mortgage payment based on several factors that should be considered when purchasing a home. The following financial factors are typically included in a mortgage payment calculator to accurately calculate mortgage payments:

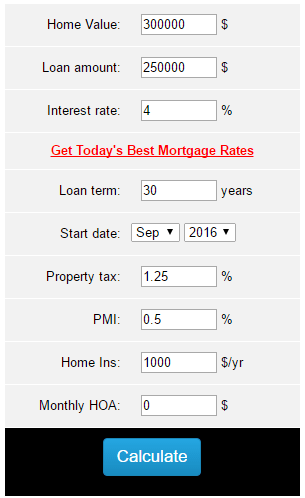

- Face value of mortgage. Also known as principal, the face value of your mortgage is the amount that hasn’t yet been paid. For example, your loan amount is $250,000; this is the starting principal amount. As you pay your mortgage payments, your principal lowers. Accurate payment calculators for mortgages will need to know the face value of your loan.

- Interest rate. You also might hear the term “APY” in reference to your interest rate. Your annual percentage rate, or APY, is the amount of interest your loan accrues each year; the average for 30-year fixed mortgages is 3.46% for the year 2016. If you want to know a specific interest rate for a potential loan, plug the average percentage into the calculator to calculate a mortgage payment.

- Mortgage term. To calculate mortgage payments, a calculator will ask for the term length of your loan. This is the number of months you will be making mortgage payments until the loan is paid off. This figure helps the calculator figure your monthly cost.

Estimate Mortgage Payment

- Down payment. Your down payment information is useful when you do not yet know the specific principal loan amount you will have. If you wish to estimate mortgage payments based on the amount of a prospective home, you should add in the amount of your down payment so the calculator can more accurately calculate mortgage payments.

- Private Mortgage Insurance (PMI). If you cannot afford a significant down payment, your lender may require you to purchase private mortgage insurance (PMI). This is typically required for down payments of less than 20%. You will want a mortgage calculator extra payment figure for PMI so you will have a more accurate idea of monthly costs.

- Homeowners’ insurance. Homeowners’ insurance is a required part of buying a home, but it comes with added costs. Some lenders allow you to bundle homeowners’ insurance with your mortgage payment. You should attempt to calculate mortgage payments with a calculator that allows for at least a ballpark estimate figure for insurance.

- Taxes. As a homeowner, you will also need to consider property taxes. Property taxes vary by state, so your best bet would be to learn your state’s requirements and add that information to your mortgage payment calculator with taxes included. Some calculators allow you to plug in your state and will estimate mortgage payment with property taxes included for you.

Don’t Miss: Top Online Mortgage Lenders | Ranking & Reviews

Tip #1: Find Out How Much House You Can Afford

Before you use a mortgage payment estimator, you need to figure out how much house you can afford. A payment calculator mortgage affordability estimate is essential for you to understand the loan amount you can afford. Just because you want a beautiful 4-bedroom ranch with a huge yard in your dream neighborhood does not mean you can afford it.

How Much House You Can Afford?

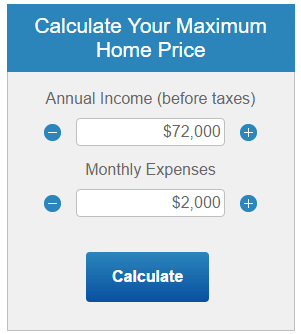

Fortunately, there are ways to calculate a mortgage payment based on potential home prices. U.S. Bank, for example, offers a simple affordability calculator that factors in your yearly income and monthly expenses to provide you an estimate mortgage payment.

You should also take into consideration how much of a down payment you can afford, your credit history, closing costs, and mortgage application fees. These all have an impact on your mortgage payment. More complex calculators can work in these numbers for you, like a mortgage payment calculator with taxes.

Tip #2: Gather Your Mortgage Calculator Payment Details

The best thing you can do before you attempt to use a mortgage loan payment calculator is to gather all financial information you will need to make a calculation. Therefore, you should have a few prospective homes that interest you. Contact your realtor to give you the information for the homes so you can easily compare them when it is time to get your mortgage calculator payment estimate.

Here is the most important information you should gather to estimate mortgage payments:

- Home value. Gather the prices of each home. When you know the value of your prospective homes, you can more easily figure out your down payment amount.

- Down payment amount. You should have a set down payment amount that you are able to afford. When you calculate mortgage payments, you will be able to decide whether that amount will be enough for each home you are considering.

- Loan term. The value of a home often affects the loan term. Higher-price homes usually have a longer loan term. Consider what loan term you are comfortable with before using a mortgage payment calculator.

- Possible interest rate. You should have a few prospective lenders in mind for your mortgage and, therefore, should have a few interest rates to consider. Your mortgage payment calculator will show you how the interest rates will affect your mortgage payment.

- PMI. Are you putting enough down that you will not need to add on private mortgage insurance? If not, you will want to gather some quotes for PMI for each home to input into the mortgage payment calculator.

- HOA fees. Are any of your prospective properties part of a Homeowner’s Association? If so, you should ask your realtor what fees are associated with the HOA.

Once you have your necessary information for a detailed estimate mortgage payment, it is time to search for the best mortgage payment calculator.

Related: Best Mortgage Lenders and Companies | Ranking Comparison | Best Mortgage Companies

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Tip #3: Look for a Mortgage Payment Calculator with Taxes Added

Prospective homeowners can easily forget important information needed to calculate mortgage payments. Property tax is a figure that can be overlooked when calculating a mortgage, but it is an important figure to remember, as it can add hundreds to a mortgage each month, depending on where you live.

Mortgage Payment Calculator with Taxes Added

It is good practice to search for a mortgage payment calculator with taxes added in. You will then be able to add your state or area’s property tax rate to the calculator to figure in with your potential mortgage payment.

Popular Article: Finding the Top Online Mortgage Lenders | What You Need to Know

Tip #4: Mortgage Calculator Extra Payment Information Is Important

The best way to calculate mortgage payments is to use every bit of financial information about yourself and your potential home and loan that you know. Therefore, it is in your best interest to find a detailed calculator that can figure in everything from PMI to HOA fees to property taxes.

The mortgage calculator extra payment information can actually change the estimated cost of a mortgage by hundreds. What seems like small cost each month can add up significantly. The more detailed your calculator, the more accurate your estimate mortgage payment will be. When you figure in your current financial situation, you can better prepare for your future financial situation and see how your potential mortgage payment will affect it.

Tip #5: Study Payment Calculator Mortgage Breakdown Information

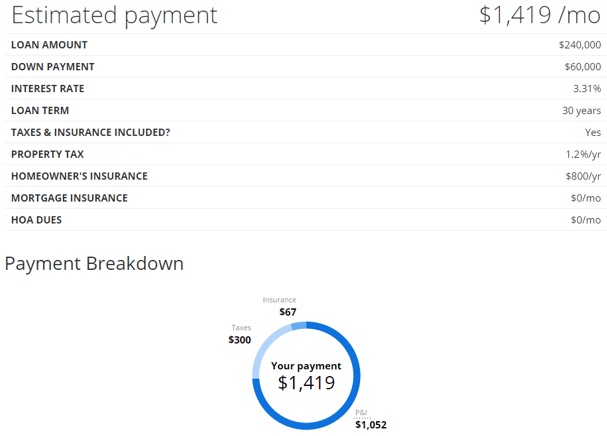

Some mortgage payment calculators offer benefits far greater than others. Zillow, for example, offers a detailed mortgage calculator that provides you both a detailed list and a visual breakdown of your inputted information and how much each financial factor adds to your monthly payment.

Calculating Mortgage Payment

When you calculate mortgage payment with a detailed calculator like Zillow’s, you will easily see what factors you might want to play around with to achieve your final mortgage payment goal. In the example above, the principal and interest lend to the majority of the mortgage payment, a healthy ratio.

Tip #6: Calculate Mortgage Payments for Specific Loans

If you are considering a specific type of loan, like a VA loan or FHA loan, you should check with the lender’s official website for a calculator specific to that type of mortgage loan. Specific loan calculators will help you calculate mortgage payment by inputting information needed for that loan, like the required term or down payment amount.

The FHA has a mortgage payment calculator on its website that allows you to see what type of home you may be able to afford with the FHA loan. After inputting your information and answering a few basic questions, you can choose to receive more information about the FHA loan and begin the process to qualify for one.

You can do the same for a VA loan to estimate your mortgage payment. A VA loan calculator lets you view the results of your inputted information in real-time. This is beneficial to see how certain factors influence the final resulting monthly payment.

Conclusion

Before you begin using a mortgage payment calculator, be sure to have all the required information you will need to create an accurate estimate. Once you gather your information, search for a detailed calculator that factors in things like HOA fees, property taxes, PMI, and current monthly debt obligations.

Basic calculators are helpful for quick calculations when looking at homes, but to provide you with the most accurate estimate mortgage payment, you will want to use a more advanced calculator. Remember to search for calculators specific to your special loan type, if applicable.

Read More: Best Mortgage Lenders for First-Time Buyers | 1st Time Home Buyer Loan Guide

Image Sources:

- https://www.usbank.com/home-loans/mortgage/mortgage-calculators/mortgage-affordability-calculator.html

- https://www.mortgagecalculator.org/

- https://www.zillow.com/mortgage/calculator/payment/ModernPaymentCalculatorAdvancedReportPage.htm?%7b%22homePrice%22:300000,%22downPayment%22:60000,%22rate%22:3.31,%22rate30Year%22:3.31,%22rate15Year%22:2.569,%22rateARM5%22:2.648,%22term%22:%22Fixed30Year%22,%22propertyTaxRate%22:1.2,%22includeTaxesInsurance%22:true,%22includePropertyTax%22:true,%22annualHomeownersInsurance%22:800,%22includeHomeownersInsurance%22:true,%22includePMI%22:true,%22monthlyHOA%22:0,%22includeHOA%22:true,%22isARM%22:false,%22dti%22:36%7d

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.