Moven Review

Moven is a financial service provider with a platform focused on customer mobile experience. With the help of its partner, CBW Bank, Moven provides a digital bank account that allows customers to easily acquire their banking information and finances through an innovative app.

What Is Moven? A New Form of Money Management. See for Yourself.

Moven reviews emphasize the uniqueness of Moven’s mobile-only approach. While many banks offer smartphone applications, Moven is online only—with no brick and mortar buildings to accompany it. The Moven application works with both iOS and Android systems.

Image Source: Moven

The Moven initiative is beneficial and comparable (if not superior) to other banking options in many ways, including the ease of opening an account, no ATM fees, contactless payment as well as a debit card, money tracking features, and many options for depositing money.

There are many Moven reviews online you can explore, but here at AdvisoryHQ, we hope to give you a thorough Moven review that will not only answer the question, “What is Moven?” but will help you decide if this platform is right for you.

See Also: Best Credit Unions in the U.S. (Top Ranking List and Reviews)

How It Works:

History and Future-Moven Bank Review

Moven was founded in 2011 by Brett King—speaker, innovator, and author of banking books such as Bank 2.0 and Bank 3.0. Since its founding, Moven has acquired over $24 million dollars in investments. With its capital increasing, Moven plans to expand from a solely United States company to Canada and New Zealand. The mobile bank and its application were launched to the public in March 2014.

Mobile-Friendly Banking with Moven

“Sign Up and Get Moven”-Moven Review

To begin using Moven, simply download the application to your smartphone for free. From there, you will create a personal login, provide your mailing address, and submit your application. Moven partners with both MasterCard and the Federal Deposit Insurance Corporation to make your banking experience as easy as possible.

Once you are accepted, you will receive a MasterCard Moven card as well as the benefits of zero monthly fees, over 42,000 compatible ATMs with no surcharges, and instant feedback on your spending through the app.

Don’t Miss: Best Bank for Small Business Banking (Best Business Bank Accounts)

What Moven Provides

Moven Reviews will assure that Moven doesn’t come up short compared to your average brick and mortar bank experience. The app allows you to connect your other bank accounts, deposit money, transfer money, cash checks, and deposit cash. As well as having the features of a normal bank, Moven also provides the features of popular mobile apps such as PayPal and Venmo. With Moven, you can pay friends through the app, text, or email. You can also pay bills from your phone, set up bank transfers, and mail a check from your phone.

Unique Features of Moven

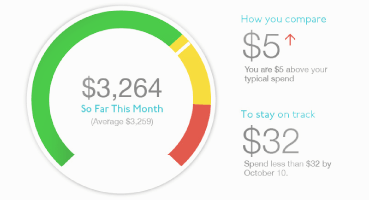

Moven combines the features of the bank, the financial app, and the money-tracking program. With Moven, you can track your spending with the Personal Spending Meter and know instantly if your spending is faster or slower than usual. You can also see your spending as it happens. Moven provides instant digital receipts on all purchases made with your Moven card.

Image Source: Moven

Also, on your smartphone, you can set up instant notifications for these features so you are never out of the loop on your banking habits. Similar to Mint.com, Moven will track the spending of all your bank accounts together if you link them on the app. You can see charts and categorized spending.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Security

Moven provides firewall barriers as well as encryption to keep your banking information safe. Also, like most systems, you will be required to authenticate yourself whenever using your account. With Moven, you will have a password and a PIN number for your Moven card just as you would with a normal bank and debit card. Communication between the device and the customer is encrypted as well for ultimate security. You can feel safe using the Moven app and knowing it is just as secure as any other bank you may have used in the past.

Feel Secure When You Bank with Moven

Know the Fees–Moven Bank Review

While there are no monthly fees with Moven and they do not charge you to open an account, deposit or transfer funds, or make payments, you should be aware of some specific fees. For expedited shipping, there is a $30 dollar fee. To close an account, there is a $10 dollar fee.

To replace a Moven card, it is $4.99 per card after using your two free cards per year. Compared to other banking options, these fees are pretty reasonable. Moven reviews agree that Moven provides an affordable way to deal with your money.

The Downside of Moven

Many customers find comfort in the brick and mortar bank where they can interact with tellers and have a more personal experience. It can feel more secure for customers to physically hand in their cash or checks to the bank. Moven, as an entirely online banking experience, lacks this physical sense of security.

Another downside to not having a typical bank experience is the lack of person-to-person customer service. All of Moven’s customer service is handled through a system involving online case tickets. There is no help-line for customers to call in and talk to a representative about their issues. This can cause problems for people who need specific explanations or help.

A negative accompanying the security aspect of the app is the amount of responsibility placed on the customer if their account does happen to be hacked. For example, it is up to the customer to make sure their account information is secure, including their passwords and PIN numbers. More personal security options, such as fingerprinting, would make Moven a safer option.

Also, there is no solution for a customer whose phone is lost or stolen and their Moven information is taken. Again, this falls on the fault of the customer.

Related: Best Banks in Australia (Ranking: Biggest Banks, Best Savings Accounts)

What Other Moven Reviews Are Saying

On Google Play, which powers Android apps, Moven has received a 3.7 out of 5 stars from customer reviews. Many of the 1 star Moven reviews mention troubles logging in and verification of identity. However, the positive Moven reviews praise Moven for its accessibility, ease of use, and great customer service. In fact, Movencorp, Inc. has personally responded to a lot of the reviews on this page, both good and bad.

Image Source: Pixabay

Customer Moven Reviews on the Apple store are slightly better than those on Android, with Moven receiving 3.5 out of 4 stars. Reviews on Apple praise the app for evolutionary features and how easily it combines accounts. While some customers admit to having technical issues with the app, they say that the customer support is excellent.

Is Moven Right For You?

When deciding whether Moven is right for you, you must consider your personal lifestyle habits in relation to the features offered. Are you constantly on your smartphone and looking to use your smartphone for your finances? Moven can be a great way to do this.

For the Smartphone Loving Customer – Moven.com

Moven will work for you if you have an innovative mind and enjoy the increasingly technological world we live in. This platform is perfect for those who use email as their main form of communication when trying to resolve issues. Many people do not enjoy talking on the phone or waiting on hold for customer service representatives. With Moven, you can avoid this timely process and get your answers sent directly to you in a timely manner.

Also, Moven will be especially helpful for those who have trouble keeping track of their money and spending habits. It is hard for many debit card users to track where their money is actually going. With Moven and your Moven card, staying on top of your expenses is easier than ever. Notifications can be sent to you whenever you are spending too much in a certain category, such as shopping or eating out.

Popular Article: Top 5 Banks in Canada – Ranking | Best High Interest Savings Accounts – Canada

Conclusion

From millenials to tech-loving baby boomers, Moven can provide the perfect platform for tracking and managing your finances. It is a banking solution that incorporates all of the benefits we see in money transferring applications, finance tracking systems, and brick and mortar banks.

With its company expanding exponentially, Moven will soon be even more available and able to deal with other currencies. We hope in the future that Moven will also be able to provide its customers with savings and investment options.

Moven’s Future is Big and Bright – Read About it Here

For those who are happy with their banking system and who have good spending and tracking habits, moving to Moven may not make sense. However, if you need a basic bank account for spending and want a simple way to access your information, transfer or deposit money, and spend your money wisely, Moven is the way to go.

As Moven explains in their oath to their customers, they provide great service and a great banking solution while sticking to three objectives:

- Do no harm

- Prevention before cure

- Care for the community

Be sure to check out Moven.com today to see if Moven is right for you.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.