Overview: Negative Interest Rates Explained—Are Negative Rates Backfiring?

Negative interest rates are a curious financial phenomenon in which interest rates are given a negative value—below zero percent. The Wall Street Journal has a simple negative interest rates definition: “It’s like a normal interest rate, except the lender pays the borrower.”

This slightly bizarre phenomenon of negative interest rates has people scratching their heads. As negative interest rates in Europe have followed negative interest rates in Japan, the focus of world’s financial eyes is looking at negative interest rates in the US.

Image Source: Gold Broker

Negative interest rates are going global, so it is time to understand what they are and how they might affect you and your business. In this article, Advisory HQ will examine the following:

- What are negative interest rates?

- How do negative interest rates work?

- Are negative rates backfiring?

- What are negative interest rates in Europe?

- What are negative interest rates in US?

See Also: Average Rates on a Savings Accounts | Guide| The Top Savings Account Rates

Negative Interest Rates Definition

An interest rate is the amount charged by a financial institution (lender) to a borrower, expressed as a percentage of principal. So what are negative interest rates?

The negative interest rates definition given by Quora is as follows: “A negative interest rate means the central bank and perhaps private banks will charge negative interest: instead of receiving money on deposits, depositors must pay regularly to keep their money with the bank.”

Image Source: Investopedia

Another definition relating to negative interest rates that will be helpful for understanding how negative interest rates work is that of deflation. During periods of economic uncertainty, the price of products may go down—this is deflation.

Although it may seem like a good thing when your groceries are getting cheaper, deflation is a dangerous time for economies, which leads to situations like negative interest rates. The relevance of this will become evident below—negative interest rates explained.

Negative Interest Rates Explained

So, what are negative interest rates, and are negative interest rates backfiring? Here’s some early evidence. When the economy is struggling, banks and governments want people to spend, not save. This is because the movement of money will help to kick-start the economy.

What does this have to do with negative interest rates? When banks want people to spend—not save—they slash interest rates. This means that people will be more incentivized to borrow money at lower rates and discouraged from saving because of low interest rates. Banks have learned that cutting interest rates to 0% is not enough to discourage saving and encourage borrowing, and this is where negative interest rates have come in.

Many observers are agitated by the negative interest rates definition or idea—which contradicts classic economic theory. We will look further at negative interest rates explained and analyzed by financial experts all over the world.

Don’t Miss: How to Find the Highest Savings Account Rates | This Year’s Guide | Highest Savings Rates

Global Differences: Negative Interest Rates in Europe vs. Negative Interest Rates in US

Different parts of the world are having varying economic issues and subsequent effects on inflation (or deflation as the case may be) as well as interest rates—and negative interest rates.

Negative interest rates in Europe were first introduced in 2014, and Japan has since followed. Economists are asking whether the introduction of negative interest rates in US would help to boost the economy.

Image Source: TNooz

The introduction of negative interest rates has not been welcomed by everyone, and the jury is still out on the question—are negative rates backfiring? Below we will have a further look at negative interest rates in Europe and how negative interest rates work—or don’t work—for the economy.

Negative Interest Rates in Europe

Negative interest rates in Europe were introduced because banks were depositing excess money into the central bank. So, the central bank started cutting rates to discourage this. In March of 2014, the European Central Bank introduced negative interest rates of 0.4%.

Cut Rates to Boost the Economy—Negative Interest Rates Explained

As we touched on before, the reason that the central bank feels driven to go into the upside-down world of negative interest rates is that they want banks to push cash out into the economy, not save it away. The idea behind negative interest rates in Europe is that the banks will use the funds that they have to maintain the reference rate at 0%.

Keeping the reference rate low is another effort to boost the economy. The theory is that if the banks are discouraged from saving, they will be forced to offer customers attractive lending rates and the economy will be revived.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Do Negative Interest Rates Work All Over Europe?

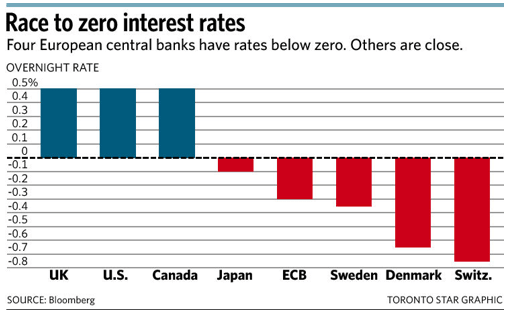

The ECB (European Central Bank), as well as banks in Denmark, Sweden, and Switzerland have had the most experience of negative interest rates in Europe.

Image Source: The Star

What Are Negative Interest Rates for the European Central Bank?

Negative interest rates in Europe have followed the economic boom and downturn—but are only recently going to negative interest rates in order to save the flailing economy.

One of the peak interest rates was in 2008 at 3.25%, just before the economy began to fail. This rate slowly and steadily tumbled toward 0%, which it hit in mid-2012. However, much to the surprise of many who had never considered the concept of negative interest rates, it began to go below 0%.

A brief look at negative interest rates in Europe (ECB):

- June 2008: 3.25%

- June 2012: 0%

- June 2014: -0.10%

- September 2014: -0.20%

- December 2015: -0.30%

- March 2016: -0.40%

Negative Interest Rates Explained: An Example from Denmark

The confusing world of negative interest rates in Europe was examined in The Wall Street Journal, which examined a Danish man’s example of receiving money from the bank for a mortgage loan he had as a result of negative interest rates. Can you imagine getting money from the bank on your mortgage instead of paying them? Sounds crazy, doesn’t it?

Denmark has been experimenting with negative interest rates for longer than any other country, and the Denmark central bank currently has a benchmark rate of -0.65%. The central bank in Denmark is pushing ahead with the efforts to boost the economy, as they are competing with the Euro and are trying to make sure that the currency stays steady.

How Do Negative Interest Rates Work in the Rest of Europe?

Its neighbor Sweden also joined in on negative interest rates in Europe in February 2015. Norway has not quite gotten on board yet, but they have not discounted it as an option if their economy continues to experience the negative impact of low oil prices.

When it comes to negative interest rates definition and history, economists are looking at Scandinavia to understand the phenomenon. People like the Danish man receiving money from banks in their mortgage statements might think that negative interest rates are great—but economists do not.

Image Source: ConsumerBankers

They are questioning, “Are negative rates backfiring?” So let’s join them in their analysis—are negative rates backfiring? Here’s some early evidence.

One of the main concerns around negative interest rates in Europe is that borrowers in Europe tend to go for mortgages. The worry is that if interest rates are too favorable for home buyers, there will be a repeat of the property bubble burst in 2008, which will cause even more damage to the global economy.

Negative Interest Rates in US

We have looked at negative interest rates in Europe—so what are negative interest rates in the US? Policy makers and bankers are asking how do negative interest rates work, and will they help the US economy?

Inflation is still low in the US, so economic analysts look keenly at negative interest rates in Europe to see if mirroring this with negative interest rates in the US could be beneficial.

The answer to what are negative interest rates is clear, and negative interest rate definition queries have been answered—but because the question of how do negative interest rates work to improve the economy is still hard to answer because only six banks in Europe and Japan have entered that world below zero, and the rest of the world is still waiting to see are negative rates backfiring.

Although negative interest rates in the US have not come to fruition yet, the US central bank has been examining the possibilities. All signs are pointing to the Federal Reserve raising interest rates at the next opportunity.

What Are Negative Interest Rates Going to Do for the US Economy?

Before we look at what critics are saying about negative interest rates in US, let’s look at why the central bank would be considering introducing them. The idea is that banks will be reluctant to save their excess deposits in the central bank and will therefore offer promising interest rates to their customers, who in turn will borrow money and put it into the economy.

Image Source: Classic Connection

Negative Interest Rates Explained: The Potential Impact on US Banks

However, the worry is that if banks are not profiting from their excesses, instead of lowering interest rates, they will actually make it harder for people to borrow in order to protect the money that they have. One analyst speculated that banks could see a loss of earnings of up to 7% if negative interest rates are to be introduced.

Popular Article: The Best Savings Accounts & Rates | Ways to Find the Best Bank for Savings Accounts

Negative Interest Rates Are No Big Deal

This is what some economists are saying. In the US, interest rates are very close to zero as it is. What some financial experts are saying is that we should not freak out about the idea of negative interest rates in US, because the rates are so low anyway, teetering over the edge of zero should not be regarded as a huge ordeal.

These experts admit that there are risks involved and that if the banks don’t play along with the idea behind negative interest rates—the knock-down effect of lower interest rates and a boosted economy—then it will be dangerous.

Although it is still in the early days for negative interest rates in Europe, the positive thing, analysts say, is that the negative consequences have been minimal—the worst case scenarios dreamt up by some naysayers have not happened.

Below, we will examine some of the negative impacts of negative interest rates in Europe and Japan and what lessons can be learned.

Are Negative Rates Backfiring? Here’s Some Early Evidence

Here are some of the criticisms that bodies such as the World Bank have about negative interest rates:

- They could erode bank profitability

- They could encourage banks to take excessive risks

- They could cause asset bubbles

- The economy could become cash-based

- Pension and insurance companies could struggle with long-term liabilities

What Are Negative Interest Rates Doing to House Prices in Europe?

BureauBB

Skidelsky speculates that if the price of liquidity or assets is rising faster than the quantity of money available, negative interest rates could backfire. For example, as was mentioned earlier, negative interest rates that result in low interest rates for mortgages could result in a rush on buying housing.

However, this can result in the cost of housing rising quicker than the general economic growth and the availability of money in the economy—causing another property bubble, which could burst.

These worries about negative interest rates are echoed by Michael Burry, famed hedge fund manager. He warns that these measures to boost the economy may lead to another global collapse by tricking people into borrowing easy money. He was right in his predictions about the last economic collapse—so could he be right about negative interest rates?

WagSites

Negative Interest Rates—Alternatives

Instead of continuing with negative interest rates in Europe or introducing negative interest rates in US, what the governments should be doing is spending the money themselves, says Skidelsky.

By investing government funding in property, infrastructure, education, and employment, the governments can increase the amount of money in the economy and boost spending that way, instead of entering into risky monetary policies.

Read More: Top Best Credit Cards for Bad Credit | Ranking & Reviews | Bad Credit Cards

Conclusion: Negative Interest Rates Explained

It is only a few years since the first country dipped its toe into the world of negative interest rates in Europe. Due to the experiment still being in its early stages and with only a few countries and banks willing to try this measure, it is still hard to say whether negative interest rates are actually working to boost the economy.

Lending is definitely up and has an annual growth rate of 0.9%, but it is still shaky. Because there has not been any major disastrous effect so far, there is a divide between critics who worry about another economic crash as a result of risky borrowing—and other analysts who say there is not much difference between a very low interest rate circling around 0% to one that is just under 0%.

We will continue to keep a keen eye on how negative interest rates work for the economies Denmark, Sweden, and the European Central Bank. One tell-tale sign of their success will be whether the US and UK follow suit. Watch this space!

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.