Guide: Average Rates on a Savings Accounts (Overview of the Top 10 Savings Account Rates)

A recent Go Banking Rate survey found that the majority of adults in the United States have less than $1,000 in savings, which is why people might be so keen to know what the average interest on a savings account is.

An average interest rate on savings accounts can help you decide between different banks and plans so you can make an informed decision.

In this article, we will go over average savings account interest rates and the different factors that may affect them.

See Also: Home Interest Rates | Tips for Finding the Best Home Mortgage Interest Rates

The Fed and the Average Savings Interest Rate

According to the FDIC, the national average savings account interest rate was just 0.06 percent across all accounts, with deposits under $100,000 averaging 0.08 percent and deposits over $100,000 averaging 0.12 percent. The current average bank interest rate has not changed much since last year.

The Federal Funds Rate, which is the rate at which banks lend money to each other and other institutions, and the Federal Discount Rate, or the rate at which the Fed can loan money to banks, have a big impact on the economy, namely the average interest rate on savings accounts.

When deciding how high or low these rates should be, the Federal Reserve Board’s main goal is to raise employment while keeping inflation low.

This hike of both rates affects the entire U.S. economy and, as a result, average interest rates on savings accounts. “The Federal Reserve has its fingers in your pocketbook to a greater degree than the IRS,” says Certified Financial Professional Michael Reese.

When the Federal Reserve boosts the money available, lenders are more willing to extend credit, boosting the average savings interest rate. How so?

Banks loan money (in the form of credit cards, mortgages, and other loans) and set average savings account interest rates based on how much money they have in their coffers.

That is dependent on deposit amounts from savings accounts. To lure people into depositing their money into these savings accounts, banks hang a carrot: the interest rate you receive from your average interest rate on savings accounts. In order to make a profit, those average savings account interest rates are often less than what the bank is earning from loans.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Average Interest Rate on a Savings Account from a Decade Ago

The fact of the matter is that you’re not going to get much in returns based on average savings account interest nowadays, especially when compared to ten years ago. In 2005, it wasn’t abnormal to find savings accounts and CDs offering four percent annual returns.

Today, you would be hard pressed to find any savings account offering anything higher than 1.5 percent. Why is the average interest rate on a savings account from ten years ago so different from today?

You might recall the Great Recession, the worldwide economic decline in the late 2000s. One of the causes of the Great Recession was the Housing Bubble in the United States, which burst due to mismanagement of housing mortgages and the average interest on a savings account.

The Federal Reserve has low rates right now to keep mortgages low as well. But because of these low rates, there is no reason for companies to look toward deposits and average interest rate on savings accounts to make up the difference.

Banks can get around 0.75 percent of mortgages from the Federal Reserve, so there’s no point in an average savings account interest with anything higher than one percent.

Don’t Miss: How to Find the Highest Savings Account Rates | Guide | Highest Savings Rates

Online vs. Brick-and-Mortar and How Average Savings Account Interest Rates Differ

Image Source: Ally Bank

When you ask yourself, “What is the average interest rate on a savings account?” you may hit Google to try and find some quick answers. What you will encounter is two types of banks: online and physical.

In 2013, a Pew Research Center study found that 61 percent of internet users do their banking online, while 35 percent of cellphone owners use mobile banking. It’s all part of the cultural shift toward digital convenience, which comes as no surprise.

You may, however, be surprised to find out that online banks offer a much higher average bank interest rate than their physical counterparts.

Online banks are able to reduce fees and offer higher returns because they have fewer things to pay for: no physical locations means less staff, less money. Which means a higher average savings account interest rate for you, the customer.

This does, of course, come with its own downsides. Having no physical location to deposit your money can get annoying, and ATMs will be another issue altogether. But if you don’t really handle cash much, you may want to consider an online bank, and a higher average savings account interest rate to boot.

U.S. News & World Report emphasizes the possibility of growing money faster in an online account:

“In addition to little to no fees, online banks boast highly competitive deposit rates, whether it’s for interest checking, money market, savings or certificate of deposit accounts. Better rates yield higher interest earnings, which most savers wouldn’t complain about.”

It’s safe to assume no one at all would complain about higher average interest rates on savings accounts.

What Is the Average Interest Rate on a Savings Account from a Credit Union?

MyCreditUnion.gov defines credit unions as “not-for-profit organizations that exist to serve their members.” They work like banks but are member-owned, providing “a safe place to save and borrow at reasonable rates.”

Pat Keefe, a spokesman for CUNA, says “Credit unions are cooperatives owned by their members. Their mission is to provide their members with affordable financial services – not to gouge them as profit centers.”

Generally speaking, credit unions offer higher average savings account interest than their counterparts. The numbers reflect this: a 2015 study by the Credit Union National Association, also known as CUNA, found that 3.7 million people joined a credit union.

So what’s the downside to all this? Membership is limited. Unlike banks, potential members can’t just waltz in and open an account. There are membership requirements such as geographic locations, religious affiliations, and employment associations.

There are also fewer amenities, making banking a little less convenient on your part.

The government has a search tool to help you find the nearest credit union, and to find the credit union with the best average interest on a savings account.

Related: Money Market Interest Rates | Ways to Find the Best Money Market Rates

The Best Banks with the Highest Average Interest Rate on a Savings Account

Go Banking Rates, a website dedicated to finding the best interest rates across the board, released a list of the 10 best savings accounts, with special attention paid to its average savings interest rate.

We’ve outlined the best features of each one, highlighting the pros and cons. The list below is more or less ranked by average savings account interest rates.

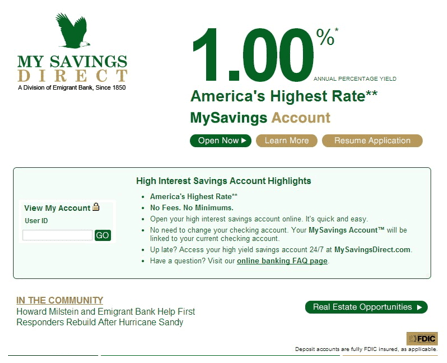

Image Source: MySavingsDirect

#1: MySavingsDirect MySavings Account

Average Savings Account Interest Rate: 1.10 percent APY

Type: Online

It’s no surprise that the best average bank interest rate belongs to an online bank. MySavingsDirect is an offshoot from the brick and mortar Emigrant Bank from New York City, which was established in 1850 by Irish immigrants. This FDIC-insured online bank doesn’t have a minimum balance requirement, monthly fees, or minimum deposit, making MySavingsDirect the best bank in terms of saving.

MySavingsDirect also offers to link its savings accounts to your existing checking account without having to switch over entirely, making transfers between the two easy as pie.

To open a savings account, you must be at least 18 years old, have a legal address in the United States, have a valid tax identification number, and a checking account. You’ll need to note your routing numbers to fund your account.

#2: Ally Bank Online Savings Account

Average Savings Account Interest Rate: 1 percent APY

Type: Online

Continuing the trend of online savings accounts, Ally Bank comes in second. Like MySavingsDirect, Ally Bank is a subsidiary of Ally Financial Inc. and has no monthly maintenance fee and no minimum balance fee. It’s one of the most accessible banks as well, offering 24/7 customer service and an app that allows you to deposit checks and manage accounts.

To combat the inconvenience of accessing cash, Ally Bank offers the ability to withdraw cash from 400,000 ATMs nationwide, with no attached fees. The interest is compounded daily, meaning that the interest is added quickly to your fund so that you can earn interest on the interest. All deposits are FDIC insured.

To open an account, you will have to provide personal information such as your date of birth and Social Security number.

#3: Barclays Bank Online Savings Account

Average Savings Account Interest Rate: 1 percent APY

Type: Online

Barclays Bank Delaware is the United States extension of Barclays Bank, an institution from the United Kingdom that has been running for more than three centuries. There is no monthly service fee or minimum deposit amount for a Barclays Bank Online Savings Account, and online transfers to and from accounts is easy. Barclays also offers direct deposit services.

Popular Article: Mortgage Interest Rates Trend | Key Mortgage Rate Predictions, Trends, and Graphs

#4: iGoBanking.com High Interest Savings

Average Savings Account Interest Rate: 1 percent APY

Type: Online

IGoBanking doesn’t require monthly maintenance fees, charges, or minimums and is insured by the FDIC. The iGoBanking Flexible Deposit feature allows you to deposit checks via your mobile phone or computer. You can also access your account any time, from anywhere.

#5: CIT Bank High Yield Savings

Average Savings Account Interest Rate: 1 percent APY

Type: Online

CIT Bank is member FDIC, and although it does require a minimum deposit of a hundred dollars, there is no monthly maintenance fee or minimum balance. When you open a High Yield Savings account with CIT Bank, interest starts compounding daily.

#6: Synchrony Bank High Yield Savings

Average Savings Account Interest Rate: 1.05 percent APY

Type: Online

Member FDIC Synchrony Bank offers a higher APY return than a few others on the list, but it charges 5 dollars a month if your account funds dip below 30 dollars. You do get an ATM card for easy cash access, though.

#7 American Express Bank High Yield Savings Account

Average Savings Account Interest Rate: 0.90 percent APY

Type: Online/Physical

American Express Bank’s High Yield Savings Account offers a lower average interest rate on savings accounts than others on this list, but it doesn’t require a minimum deposit and incurs no monthly maintenance fees. There’s also no minimum balance required, so you have one less thing to worry about.

#8: Bank5 Connect High-Interest Savings Account

Average Savings Account Interest Rate: 0.90 percent APY

Type: Online

Bank5 Connect offers a competitive APY at 0.90 percent, but you won’t earn interest until you have at least $100 minimum. You also need a minimum deposit of $5 to open an account, and you can’t transfer funds to other banks.

There are no monthly maintenance fees, and you get a debit card linked to your account.

#9: Capital One 360 Savings Account

Average Savings Account Interest Rate: 0.75 percent APY

Type: Online/Physical

Capital One 360 is an offshoot of the popular brick-and-mortar Capital One Bank. Although the interest rate is relatively small, there are no fees and no minimum deposits required. Capital One 360 combines an online bank’s features with a physical bank’s dependability.

#10: FNBO Direct Online Savings Account

Average Savings Account Interest Rate: 0.95 percent APY

Type: Online

FNBO Direct just raised its average savings account interest rates from 0.75 percent last year to 0.95 percent this year. To open a savings account with FNBO Direct, you must have a deposit of at least a dollar. There are no monthly fees or balance requirements, but you can also set up a recurring transfer from another account.

Final Thoughts

Although the average interest rate on savings accounts today is a little less than one might remember from years ago, there are still ways to get the best average savings account interest rates with a few other perks included as well.

You won’t find an APY above 1 percent, but you can grow your money by aiming for daily compounded interest, no-fee savings accounts, and other benefits that make saving money a breeze.

Generally speaking, the best average savings interest rate will be found online, with fewer fees and restrictions.

It may be a little less convenient than a brick-and-mortar bank, but if you already do all your banking online, you may as well make a complete move. The 24/7 support that some online banks offer is also a plus, even without considering the average interest rate on savings accounts.

Credit unions are another option, but because credit unions come with membership requirements, there aren’t any on the list above. Still, it might be worth your while to do a little research to see if there are any local credit unions that may offer even better average savings account interest rates than online or physical banks.

Read More: Best ISA Rates and Accounts – Cash ISAs, Fixed Rate, Junior Cash ISAs

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.