2017 Guide to Finding the Best Money Market Interest Rates

Saving money is important, but it can also seem like a daunting chore. As the cost of living goes up, it seems that interest rates for money market accounts are going down.

Unfortunately, this trend applies to most types of savings accounts, and interest rates on money market accounts are no different.

However, you should not let this discourage you from saving. The interest rates money market accounts can give you are still better than no interest at all. The average money market interest rate for 2016 is 0.26%, but many money market funds’ interest rates are closer to 1%.

This guide will provide tips to find the best money market savings rates so that you can begin to save wisely.

What Is a Money Market Account?

Before we talk more about interest rates on money market accounts, let’s discuss what a money market account is.

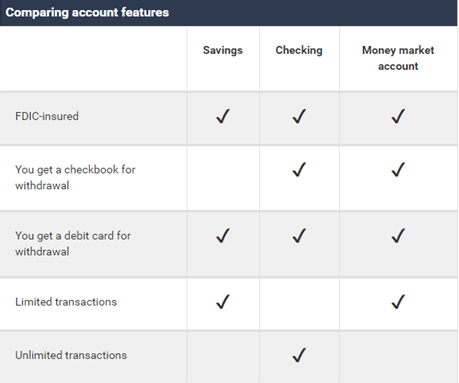

There are numerous ways to save money, but not every option may be the right one for you. A money market account is much like a typical savings account but with the added benefits of a checking account.

Image Source: Money Market Accounts vs Savings Accounts

The interest rates money market accounts offer are usually higher than most savings accounts. However, to receive money market rates, you typically have to keep a higher minimum balance than other savings accounts.

But as an added bonus, money market accounts allow you to write a limited number of checks per month. Think of a money market account as a hybrid checking and savings account.

See Also: Best Money Market Rates | Money Market Accounts with High Rates

Are Money Market Interest Rates Better Than Other Savings Accounts?

Interest rates for money market accounts are typically higher than interest on savings accounts. While the interest rates on money market accounts in 2016 average at 0.26%, interest on savings accounts averages about 0.08%.

This might not sound like a significant difference in savings, but, depending on your starting balance and additional contributions, it could be.

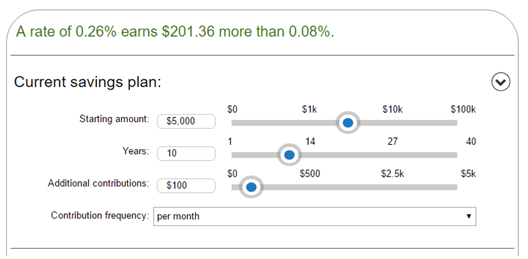

Take, for example, a starting deposit of $5000. Let’s use a money market account with a 0.26% annual percentage yield (APY) and a savings account with a 0.08% APY. To compare savings and money market interest rates, we will add a monthly contribution of $100.

Image Source: Savings Calculator

After 10 years, the money market account interest rates will give you $201.36 more than the savings account interest rates. That is over $200 more that you will have saved without taking it out of pocket.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Now, if we look at the 1% interest rates money market accounts can have, rather than the average money market interest rate, you will gain $1,056.98 more than the savings account with 0.8% interest.

Image Source: Savings Calculator from Nationwide

How do money market account interest rates work? Are interest rates on money market accounts compounded any differently than other savings accounts?

Both money market accounts and savings accounts can compound interest daily, monthly, quarterly or annually. The best money market interest rates are those that are compounded daily so that you can immediately begin earning interest on your interest.

Don’t Miss: Ways Negative Interest Rates Will Impact You (Review)

How Can You Find the Best Money Market Rates?

If you decide that a money market account is the best option for you to save your money, you probably want to know how to find the best money market funds interest rates. Just like other savings account options, money market savings rates can vary greatly between banks or credit unions.

Remember, too, that interest rates for money market accounts vary each year. The money market rates that you see on average one year might go up or down the next year. Likewise, if you own a money market account, you have probably noticed that your money market account interest rates have changed each year.

So, do not get too attached to your interest on a money market account, even if it is one of the best money market interest rates. Just because it is a good rate now does not mean it will be in a year or two. This is why you will want to thoroughly research banks for the best money market interest rates as well as look over the banks’ policies.

Reputable banks should be transparent about money market funds interest rates, including how often you should expect them to change and by how much. Banks and credit unions should be able to have money market interest rates comparable to the current average money market interest rate.

However, with so many financial institutions to choose from, finding the best money market interest rates can be difficult. Below are 5 important tips to help you find the best money market savings rates for 2016–2017.

5 Tips to Find the Best Money Market Savings Rates

Tip #1: Use the Web to Research Money Market Account Interest Rates

Possibly the most convenient and quickest way to find the best money market rates is through researching financial institutions on the Internet. The web has become our greatest tool in finding and comparing information. Researching interest rates for money market accounts is no different, and you can do so completely online.

One of the benefits of researching money market rates online is that you get unbiased information right at your fingertips. If you visit a bank in person to speak to a representative about interest rates on money market accounts, you might be presented with a sales pitch rather than transparent facts. A bank representative discussing money market interest rates is a biased spokesperson. In contrast, a website with no affiliation with any financial institution typically presents an unbiased overview of money market account interest rates.

However, you might choose to also use the information on a financial institution’s official website. You can use the Internet to conveniently compare money market funds’ interest rates this way. Open up a few tabs in your web browser with information about money market interest rates from different financial institutions. Doing so will allow you to view a side-by-side comparison of the money market account interest rates for each institution.

Related: Top Ways to Send Money (Ranking & Review)

Tip #2: Use a Real-Time Calculator for the Best Money Market Interest Rates

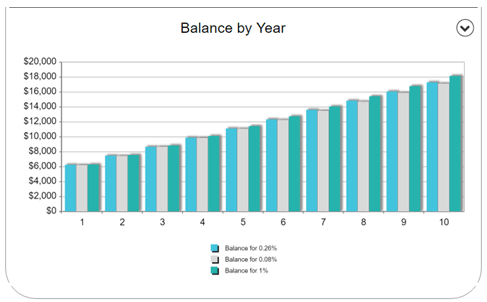

The web provides a plethora of handy financial tools for free. One of the most helpful financial tools is a savings account calculator. This can help guide your search for the right savings or money market account for you by comparing minimum deposit amounts, APYs, and money market account interest rates.

This savings calculator by Nationwide assists you in comparing three different APYs for your current savings plan. So, if you are considering three different money market accounts with different money market rates, you can compare how the interest rates will work for your plan over a specified number of years. Once you have decided on the interest rate you desire, you can then begin to search the web for a money market account with that rate.

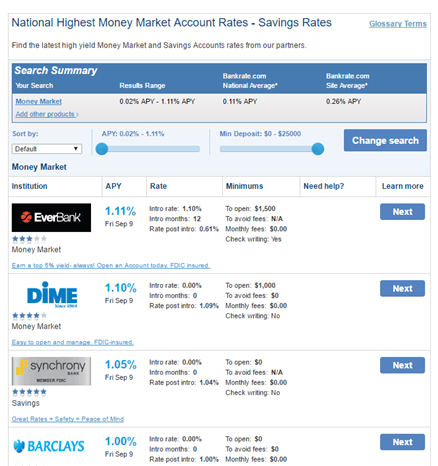

Image Source: Money Market and Savings Account Rates

You can also choose a real-time calculator of money market account interest rates. Bankrate, for example, offers such a calculator that presents the current APYs, money market interest rates, minimum deposits, monthly fees, and other important information for some of the highly-rated money market accounts.

This is a good place to start your research to see what is available and how the accounts compare to each other.

Tip #3: Compare Online vs. Local Banks for the Best Money Market Rates

Whether you feel more comfortable opening a money market account at your local bank or online, make sure you do your research.

Usually, the best money market rates are the ones you find on online savings accounts. This is typically because online accounts take less work from a person to handle than those in brick-and-mortar institutions and, therefore, can offer competitive money market savings rates.

Image Source: Money Market Interest Rates

Understandably, you might be weary of stashing your savings online rather than in a bank vault. However, aside from competitive money market account interest rates, there is little difference between an online and a local bank’s money market account.

With an online money market account, you have access to your money through ATMs, and some even offer a check card. Most online money market accounts allow transfers between your account and other accounts.

So, if the money market interest rates at your local banks are much lower than accounts you found online, you should take this into consideration.

However, interest rates are not the only thing you should take into consideration when searching for money market accounts, and your local banks might take the edge off with other factors.

Popular Article: What Is Amazon Payments? (Send Money, Make a Payment & Review)

Tip #4: Don’t JUST Check the Interest on a Money Market Account

If you are looking to save money for the future, you obviously want the perfect money market rates to help you do that.

However, the interest on a money market account should not be the only factor in deciding the right money market account for you. There are other important things to consider when choosing a money market account that depend on your financial goals and current needs.

One thing you should consider is the minimum deposit. Some money market accounts require a minimum deposit to open the account, and others require a minimum daily balance, which can be thousands of dollars.

Others require both. The best money market interest rates are not as important if you cannot afford the minimum deposit or are unable to keep the minimum daily balance in savings.

You should also ask your prospective financial institution about its fees for withdrawals or dropping below the minimum balance. If you have to consistently pay fees from your account, you will be using up your interest on a money market account very quickly, which negates its purpose.

Finally, research the convenience of the financial institution. For example, the bank with the best money market interest rates might also lack appealing or convenient customer service.

Or it might limit the number of withdrawals you can make per month or have too strict of a limit on writing checks. Ensure that you look at everything the bank offers for your account rather than just the money market account interest rates.

Free Wealth & Finance Software - Get Yours Now ►

Tip #5: Check out Rewards in Addition to Money Market Interest Rates

Just as you need to research possible drawbacks of a financial institution, you should also ask if it offers any rewards that could help you reach your financial goals faster.

You might find yourself torn between two very similar money market accounts. Both offer similar money market interest rates, minimum deposits, and fees, but one offers a rewards system while the other has none.

Some banks offer rewards to their existing customers in the form of boosts for money market rates, a lower minimum daily balance, lower fees, and more.

Sometimes, excellent money-saving rewards can make up for a low interest rate and even push savings beyond an account with a higher interest rate.

Take advantage of the perks, if any, offered by your financial institution before deciding on the account with the best money market interest rates.

Read More: Best Money Management Tips (What You Need to Know About Money Management)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.