2017 RANKING & REVIEWS

TOP RANKING BEST WAYS TO SEND MONEY

The Best Ways to Send Money Overseas and in the U.S.

The way we send and receive money has been transformed in recent years. With the rise of an increasingly interconnected world and a global economy, there has been a surge in the demand for innovative, convenient ways to transfer money.

Consumers, businesses, and individuals are no longer reliant on slow, outdated money transfers. Instead, many of the best ways to send money mean people can receive their funds overnight and have almost immediate access to that money.

Award Emblem: Top 8 Best Ways to Send Money Overseas & in the U.S.

From well-known names, like Western Union, to exciting and innovative startups that pair money transfers with mobile-driven technology, there are abundant options when you’re looking for not just the fastest way to send money but also the safest and the easiest.

The names on our ranking of the best ways to transfer money include apps and mobile platforms aimed at transferring money only in the U.S. while other companies on this list specialize in international money transfers featuring currency exchange.

Each of the names on this ranking list represents some of the safest ways to send money, and they also allow consumers to bid farewell to expensive, slow, and outdated methods of sending money across the country or the globe.

AdvisoryHQ’s List of the Top 8 Best Ways to Send Money

This list is sorted alphabetically (click any of the below names to go directly to the detailed review of that money transfer service).

HiFX is another top international money transfer firm. Click here for a detailed review of HiFX.

Why Do People Need Money Transfer Services?

There are many reasons people may need to transfer money, both domestically and overseas. One of the primary uses of money transfer services is to pay contractors and freelance employees.

In today’s modern economy, even a small business may have employees who work across the country or the globe, and money transfer services are an excellent way to pay them quickly and conveniently. Some enterprises also do business with consumers online, and they need to have options for money transfers so these customers can pay for their goods and services conveniently.

Other consumers may also opt to use money transfer services to make international payments because they often have lower exchange rates and transfer fees than you would find using a bank to send money overseas.

Money transfers may be completed for personal reasons as well. Perhaps a consumer needs to get money to a friend or relative quickly, and mailing it just isn’t an option in terms of time or security.

Finally, money transfer services provide a very simple way not just to send money but also to track it and make sure it’s securely arrived at its destination. All of this can happen within a matter of minutes, and the money sender then has a verifiable record a transaction has taken place.

How Do You Compare the Best Way to Send Money?

There are many options available when it comes to sending money to recipients in the U.S. and countries around the world, so how do you choose the right one for your needs?

Image Source: Best and fastest way to send money

The following are some criteria to consider when looking for the best and fastest way to send money:

- How much are the fees? This is one of the primary areas money transfer services may differ from one another. Fees can range significantly, and you can save a lot of money if you take the time to compare them before you settle on the best way to send money.

- If you’re sending money to other countries, you may find that prices change regularly to reflect the changing currency rates. Make sure you’re aware of how this will impact the overall cost of your transfer so there aren’t any surprises on your end as you send money.

- Reliability is essential. When you’re looking for not just the best but also the safest way to send money, it’s better to go with well-known companies that have a good reputation. If you opt for an unlicensed financial institution, you’re putting your money and the transaction at risk.

- Convenience should be considered, and not just regarding how easy and streamlined the process is to send the money; you should also think about the convenience of the recipient. When will he/she be able to access the funds that you send? How can he/she receive the money? Will it come through direct transfer, delivery or would the recipient rather pick it up as cash? If you’re sending money to receive a good or service, you likely want your recipient to be able to get the money as soon as possible, so always look at things from that individual’s end as well as your own.

- Customer service can be essential. When you’re weighing your options for the best way to transfer money, if you do hit a roadblock or something doesn’t go as expected, you want to make sure you’re working with a company that has strong customer service and can quickly help you resolve the issue.

What Are the Differences Between Wire Transfers and ACH Transfers?

Before deciding on a method to send money, it’s a good idea to look at the difference between wire transfers and ACH transfers.

A wire transfer is a more traditional way to send money, and it’s very similar to ACH payments, except the money operates in a way that’s more akin to the use of a cashier’s check.

Wire transfers are usually very fast and are available at the close of business the same day they’re sent, in most instances. However, when you use a wire transfer, it’s usually going to be more expensive because of how rapidly funds are available.

An automated clearing house payment (ACH) is more like a traditional check, but it’s favored by consumers because it doesn’t have the risks of a hardcopy check, such as the possibility it could get lost in the mail.

When you conduct an ACH transfer, it may take a few days, usually up to 3, for funds to clear and be available to the recipient.

As long as they’re not on a tight deadline, many people will opt to conduct a transfer using the ACH method because it’s less expensive than wiring money.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the companies that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” to find a detailed review of AdvisoryHQ’s selection methodologies for ranking top firms.

Detailed Review – Top Ranking of the Best Way to Send Money

After carefully considering the best ways to send money, we compiled the following list of the top eight. As you continue reading, you’ll find detailed reviews of each of our picks as well as an outline of the factors used in the decision-making process.

See Also: Best Money Transfer App | Guide | How to Find the Best Apps to Transfer Money

Google Wallet Review

Google Wallet is a mobile app that makes sending money easy and is often considered one of the fastest ways to transfer money. All funds transfers can be done using the Google Wallet App and can also be completed on a desktop through the use of Gmail.

In addition to the Google Wallet app, Android users can also use the Android Pay app, which is a free, fast way to send and request money on any device.

Key Factors That Enabled Us to Rank This as One of the Best Ways to Transfer Money

Below are details of why Google Wallet was included as a best way to send money online in this year.

Simple and Free

The use of Google Wallet and the Android Pay app are surprisingly simple. These are apps that are designed to be some of the fastest ways to transfer money, and you can also quickly request money from anyone.

It’s also free, and once you receive money through a transfer, you can immediately have it sent directly to your bank account using your debit card or a linked bank account.

All you need to use these apps are either a smartphone or a desktop computer and the person’s email address or phone number who you will be sending or requesting money from.

Fraud Protection

Google Wallet Fraud Protection will cover 100% of verified, unauthorized Google Wallet transactions, as long as they are reported within 120 days of the actual transaction. To be eligible for this protection, you must be a U.S. resident and have a Google Payments account that’s associated with a U.S. address.

Google makes it simple to contact it and report unauthorized transactions.

As well as the Google Fraud Protection program, users of Google Wallet also have some rights under the agreement with the bank that issues their debit card, although this is handled separately with the financial institution.

Real-Time Notifications

One of the unique elements of Google Wallet, aside from the fact that it’s one of the fastest ways to transfer money, is its use of real-time notifications.

Users of Google Wallet get a convenient notification on their phone every time they receive money. You can also use the notification window to go directly to where you need to be to send payments if you receive a request for payment.

MoneyGram Review

MoneyGram is a financial services company that is considered by many consumers to be the best way to send money overseas. This trusted financial services company is available in 200 countries and territories, and it operates about 350,000 global locations. MoneyGram also offers some of the cheapest ways to wire money internationally.

MoneyGram defines its mission as helping customers send and receive money, whether that’s through cash-to-cash transactions, a bank account, online or a mobile device.

Key Factors That Allowed This Company to Rank as one of the Best Ways to Send Money

Listed below are reasons MoneyGram was selected for this ranking of the best ways to send money.

Prepaid Cards

MoneyGram is one of the most reputable services and is considered one of the best ways to wire money and send it overseas, and it also has very flexible options, including more than 100 prepaid cards.

With MoneyGram’s prepaid cards, consumers can transfer money to someone else’s prepaid card or their own.

These prepaid cards offer real-time loads, so your funds are available quickly. They’re also affordable and have low fees, and these prepaid debit cards are convenient since there are MoneyGram locations in so many places throughout the world.

Transaction Tracking

Regardless of where you’re sending money, how it’s being sent or the type of transaction you’re conducting through MoneyGram, one of the really great elements of this service is the ability to track the status of any transaction quickly.

You can do this online, and all you need is the authorization or reference number and your last name.

Being able to track a transaction quickly gives consumers peace of mind and ensures their money gets to its proper destination.

Fee Estimation

When you’re sending money internationally, it can become very expensive. MoneyGram is a company that works not only to be the cheapest way to wire money internationally, but it also strives to provide clients with an upfront estimation of how much a transfer is going to cost.

Consumers can simply visit the MoneyGram website and enter a few fields of information, including how they will send money and where it will be sent, and then they will receive an estimate of how much the transfer will cost so there are no surprises when a transaction is sent.

Don’t Miss: How to Transfer Money from One Bank to Another | Guide to Transfer Money Between Banks

PayPal Review

More than 179 million people use PayPal to send money, domestically and internationally, making it not only one of the fastest ways to transfer money but also one of the most trusted and recognized.

Both individuals and businesses use PayPal, and you can link it with not only your bank account or debit card but can also send money online with a credit card.

Key Factors That Enabled Us to Rank This as One of the Best Ways to Send Money

Reasons PayPal was included on this ranking of the top 8 best ways to send money are listed below.

Security

Security is an essential component of what PayPal offers, and it’s one of the most trusted ways to send money online as a result. Some of the security features available to users of PayPal include:

- PayPal has fraud prevention in place to prevent suspicious situations.

- Transactions are monitored 24/7.

- PayPal offers dispute resolution, which can be used in the event that there’s a problem with a transaction. PayPal conducts investigations and remains involved in the process until it’s resolved.

- This site and app feature next-level encryption.

Global Transactions

PayPal is one of the preferred and best ways to send money internationally. Using PayPal, clients can both buy and sell around the world, and PayPal has the technology and capability to convert 26 currencies from 203 markets.

When you go through the process to send funds, you can choose the amount you want to send in the currency you want it to be sent in by selecting from a convenient drop-down menu.

As well as being considered one of the best ways to send money overseas, when you send money online to people in the U.S. from your bank account or PayPal balance, it’s free for both parties involved in the transaction.

If you’re buying or selling a product, there is a low rate of 2.9% plus $0.30.

Simplicity

One of the many reasons PayPal is considered one of the best ways to send money is because it’s simple.

When you’re transferring money, all you need is an email address or mobile phone number. As long as the other party has a PayPal account created, the money will go directly into that account.

You can also use PayPal to track your account activity at all times.

Related: How to Transfer Money Between PayPal, Bank Accounts, and Debit, Prepaid, and Credit Cards

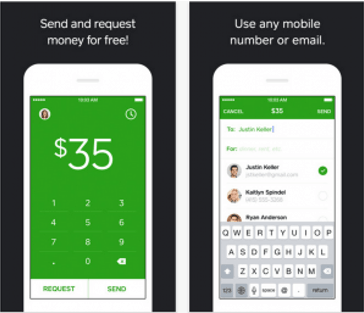

Square Cash Review

Square Cash was designed as an alternative to traditional ways of sending money, including the use of checks, paper currency, and also wire transfers. It’s an instant way to send and receive money, and it can be used to pay for goods and services as well as sending money to friends and family members.

The concept behind Square Cash is that it’s the modernized version of cash, and it includes the benefits of cash, including speed and simplicity.

Key Factors That Enabled This to Be Named as One of the Best Ways to Send Money

Reasons Square Cash was selected for this ranking of the best ways to send money are listed below.

Square Cash for Business

Square Cash is becoming increasingly popular for use among businesses in the U.S. since it gives them secure means to be instantly paid for their products and services. With Square Cash, deposits will arrive at linked accounts in a matter of seconds, and pricing is affordable.

It’s also an easy experience for customers, which will ensure they turn into loyal buyers. For customers paying with Square Cash, all they have to do is complete a rapid and simple payment process.

To create a business account, all you do is download the most updated version of the Cash app, tap “Change Account Type,” and follow the prompts to add a new account.

Friends and Family

If you’re using Square Cash to send money to friends or family for personal reasons, you don’t have to pay any fee, which is a big reason why many people consider it the best way to send money online.

If you’re using Square Cash to send money for personal purposes, you can choose from a selection of $Cashtags, which offer an easy way to share a direct link to your free cash.me profile, and then friends and family members can speed up the process to send money even more.

Square Cash can be used by residents throughout the U.S., as long as they’re at least 18 years old.

Image Source: Square Cash

Low Fees

As mentioned above, if you’re using Square Cash to send money for personal reasons to family members and friends in the U.S., there is no fee to use the service. It’s also one of the most low-cost options for paying for goods and services, which is why it’s increasingly being used by small businesses.

Payments are only 2.75% for vendors and business owners, and their customers pay nothing to send money through the app. This represents significant savings over many other methods of sending money.

Popular Article: The Best Ways to Transfer Money Online | Guide | Instant Online Money Transfer (What You Need to Know)

TransferWise Review

TransferWise is considered by many consumers to be one of the best ways to send money online, with a 5-star rating and more than 29,000 reviews on Trustpilot. TransferWise is a company that lets people send money abroad with low costs and no hidden fees.

The company was founded by Kristo Kaarmann and Taavet Hinrikus, and it’s used for money transfers that involve a currency conversion. Unlike many of the other names on our list of the best ways to wire money and complete online transfers, TransferWise can’t be used to send a specific currency of a country to an account that has that same currency. For example, it can’t be used to transfer US dollars to another US dollars bank account.

Key Factors That Led Us to Rank This Company as One of the Best Ways to Send Money

Below are a few of the significant reasons TransferWise was selected for this ranking of the best ways to send money overseas.

TransferWise for Business

One thing that clients often find advantageous about this pick for one of the best and fastest ways to send money is its support of business-related transfers.

Some benefits and features of using TransferWise for business include:

- Transfers, including for business transactions, are completed very quickly. Along with being one of the cheapest ways to wire money internationally, TransferWise also ensures that the majority (95%) of payments to Europe, India, and Nigeria are delivered by the end of the following business day.

- TransferWise offers in-house business support, which includes teams on the ground in the U.S., Europe, Australia, and Japan so you can find local assistance when you need it.

- This method of sending money is very secure: TransferWise is regulated by the FCA, and interactions are also encrypted.

Currency Converter

Uniquely, one of the reasons TransferWise is named as one of the best ways to send money internationally on this ranking is because of its robust features and tools, which include the TransferWise Currency Converter.

The currency converter is available on the TransferWise website, and it lets users quickly calculate the value of money when it’s converted into another currency at the mid-market rate.

The benefit of this currency converter is that you get to check the real exchange rate and also see the exchange rate history over the past 30 days, which provides transparency for clients.

Customer Support

Along with giving clients the opportunity to see, in a straightforward way, how much they’ll be paying to send money internationally, TransferWise is also backed by an active, engaged customer support team.

There is technical support available, and customers can contact the support center to speak with a live representative. In line with the international concept of TransferWise, you can speak to the support team in a variety of languages.

Emails can be sent in English, Spanish, and German, and there is also a dedicated support team for business clients. If you’re calling, you can get in touch with representatives in the U.K., the U.S., Canada, Germany, Spain, Australia, and Brazil.

Read More: The Best Ways to Transfer Money (India to USA/USA to India) | Guide | Money Transfer to India

Free Wealth & Finance Software - Get Yours Now ►

Venmo Review

Venmo is a service of PayPal, and it’s a licensed money transfer service. This convenient, free app lets users make and share payments, and money is sent instantly. You can sign up quickly using your Facebook account or your email address.

The Venmo mobile app is downloadable for both iOS and Android devices, and you can send money from your actual Venmo account or using your bank account or debit card. Essentially, Venmo is a simple wallet app, and its convenience is one of the reasons it was included on this list of the fastest ways to transfer money.

Key Factors That Led Us to Rank This Platform as One of the Best Ways to Send Money

Highlighted below are reasons Venmo was named one of the best ways to send money.

Social Connections

One of the primary ways Venmo is unique from the other names on this ranking of the best ways to send money online is because of the social element. Venmo is a mobile app that not only connects to your bank account or debit card, but it also links your Facebook friends and email address contacts to your bank account.

This makes it an easy way to do things like splitting meal payments among friends or just casually sending money between friends and family.

Expenses that are accrued among your Facebook contacts show up in a stream, but if you don’t want that to be public, you can make the information private.

Ease of Use

While Venmo isn’t a way to complete international or business-related money transfers, it’s ideal for paying and being paid by friends and family. The app makes it incredibly easy to do that as well.

It takes about four clicks total to either send or receive a payment, as long as you have the other party set up as one of your Venmo contacts.

It’s ideal for a situation where you’re out with friends and someone picks up a small tab, and rather than having to visit an ATM to pay them back, you can just send them money using Venmo. It’s an effortless, safe, and cheap way to send money.

Security

Even though Venmo prides itself on being a fast, easy way to send money, it takes security very seriously. Venmo utilizes the most advanced systems and data encryption to protect against theft of customer data as well as unauthorized transactions.

All data and financial information are not only encrypted but also stored on secure servers, and the goal is to constantly make sure all security measures are the most advanced available.

There are also specific measures in place that can help customers, if they believe their phone has been stolen or their data is being used, which can be deployed remotely by logging into a Venmo account from any device.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Western Union Review

Western Union is one of the most widely recognized financial services, often named as one of the best ways to wire money as well as one of the best ways to send money internationally. This leading global payment services company serves consumers in countries all over the world, and it has options for individuals seeking the fastest way to send money as well as businesses who need to conduct money transfers.

In 2015, Western Union was responsible for the movement of more than $150 billion, and they offer services in more than 200 countries and territories. Transactions are conducted in more than 130 currencies.

Key Factors That Led Us to Rank This Company as One of the Best Ways to Transfer Money

The list below represents some elements of Western Union leading to its inclusion on this ranking of the best ways to transfer money.

Flexible Ways to Send Money

Western Union offers a myriad of flexible, convenient ways to send money. These methods include:

- Sending money online: You can log into the Western Union website and use your Internet browser to send money anytime. You can register for a free profile, select the Money in Minutes service, enter the recipient’s name and address, and pay with either your credit or debit card. You can also send money using your bank account.

- In person: Western Union is unique because it not only offers some of the cheapest ways to wire money internationally, but it also has more than 500,000 locations throughout the world so that you can send money in person.

- By phone: If you prefer, Western Union is also one of the fastest ways to transfer money by phone. The company offers a toll-free number, and customer service representatives can ensure the transaction is as quick and seamless as possible.

Western Union Rewards

Distinctively, Western Union has implemented the My WU program, which is a rewards program that lets clients earn points every time they send a qualifying transfer, whether that’s at a Western Union location, online or using the mobile app.

Every $2 spent on qualifying transfers is eligible for 1 point. Once you accumulate enough points, you can earn rewards such as reductions in service fees.

You’re automatically enrolled in the program when you sign up for an account at westernunion.com or mywu.com.

Online Security Center

In order to make sure custom information and financial data is secured in the most rigorous way possible, Western Union has put in place in-depth guidelines which fall under its Online Security Center.

When people first register through Western Union, they’re required to go through a comprehensive identity validation process, which ultimately protects users against fraudulent transactions.

Other technologies include the Secure Sockets Layer (SSL), which shows users their information is being encrypted.

Related: Ria Money Transfer Review | What You Should Know About Ria Fees & Online Transfer

Free Wealth Management for AdvisoryHQ Readers

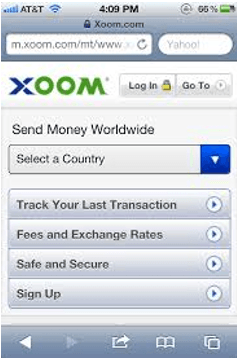

Xoom Review

Xoom is part of the PayPal family of companies that operates as a convenient way to transfer money to any of the 50 eligible countries, and that’s one of the reasons Xoom was selected as one of the best ways to send money overseas.

Xoom, in addition to being backed by the technology and reputation of PayPal, is one of the leading platforms to send and receive digital payments. While Xoom is part of PayPal, you don’t have to have a PayPal account to use it, but it is important to note this particular platform only supports international money transfers.

Image Source: Xoom

Key Factors That Led Us to Rank This Company as One of the Best Ways to Transfer Money

Detailed below are some of the reasons Xoom was included in this ranking of the best ways to transfer money.

Transfer Tracking

Essential to the process of using Xoom is the idea that tracking money is as important as the initial process of sending it. Xoom offers several ways to receive tracking information and status updates, which is one way it excels as one of the best ways to send money internationally.

Tracking features include:

- When users provide their mobile phone number to Xoom when a transfer is authorized, they can automatically have a text message sent to their phone, letting them know when the money arrives.

- Email updates are another good way to track transfers. They’re automatically delivered to a user’s inbox, and when you provide the recipient’s email address, he/she receives updates as well.

- In addition to the above ways to receive updates, Xoom also features live customer support and the ability for users to access their account 24/7 to receive the most updated information on recent transfers.

Fast Service

Xoom is one of the best ways to transfer money because speed is an important part of the concept. You can sign up and begin sending money in minutes, and all you need to include to get started is the recipient’s payment information.

Additionally, once you enter the information of a beneficiary, it’s saved because of the Quick Send feature, so Xoom securely keeps that data, and then the next time you need to send money to the same recipient, you can use the two-step feature to make it even faster.

Money-Back Guarantee

Along with being committed to providing the highest possible levels of security and protection against fraudulent transactions, Xoom also offers a money-back guarantee.

This guarantee states says that when money is sent, it will be received by the intended party, or Xoom will refund the transaction in full.

If money sent through Xoom doesn’t get to the right person, it invites users to contact it so the issue can be resolved and to fulfill the money-back guarantee.

Conclusion – Best Ways to Send Money

Whether for business or personal purposes, there is a myriad of reasons people need to send money in today’s modern world and economy. Perhaps it’s sending money to a family member living abroad or maybe you’re a small business owner who works with global partners, customers or freelancers.

Whatever the reason, it’s essential to be able to rely on a money transfer service that’s safe, secure, and reliable.

The platforms and companies listed above are not only representative of the fastest ways to send money, but they’re also among the best ways to send money online and otherwise.

Each of the names featured on this ranking take security seriously, protect users against fraud, and have unique features that make it easy and fast to send money. The names on this ranking of companies offering the best ways to send money also include platforms that specialize in international transfers as well as options useful for sending money domestically, whether for business or personal purposes.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.