2017 Guide: Searching for the Best ISA Rates and Accounts (Cash ISAs, Fixed Rate, Junior Cash)

With tax season just around the corner, many Britons are thinking of ways to maximize their annual Individual Savings Account (ISA) allowance.

If you haven’t maxed out your ISA limit of £15,240 for 2015 or if you are still searching for the best ISA rates for 2015 and haven’t yet opened an ISA account, then it’s time to move quickly.

Why?

If you don’t utilize your full ISA allowance for 2015–16 before April 5, 2016, you won’t be able to carry the unused part of your annual ISA allowance over to the 2016–17 tax year; you’ll lose it forever.

That means you will have left a whole chunk of potential tax savings on the table!

The question, however, is: What ISA account options are available, and which ones offer you the best ISA rates?

See Also: Stocks and Shares ISA (Comparison) Vs. Cash ISAs

ISA Defined

First introduced in 1999, ISA accounts aren’t entirely a novel concept for most UK residents. While offering some of the best ISA rates to consumers, these (relatively) newer savings tools have replaced earlier tax-free savings vehicles such as:

- Personal Equity Plans (PEPs)

- Tax-Exempt Special Savings Accounts (TESSAs)

- National Savings and Investments

- Child Trust Funds

The last of these tools (Child Trust Funds) was phased out in November 2011 and was appropriately replaced by an equivalent product known as Junior ISAs.

ISAs are a way for UK residents to increase their savings without having to pay income tax on the gains made on those savings.

Let’s assume that you deposited £15,240 into an ISA account with an annual equivalent rate (AER) of 1.25%.

After 5 years, that amount would grow to …… (read more: What Are ISAs? – ISAs 101)

Image Source: AdvisoryHQ

List of Best ISA Rates and Accounts

This ISA review and comparison article includes the types of ISAs listed below:

- Top cash ISA rates

- Best fixed rate ISA accounts and rates

- Review of Stocks and Shares ISAs

- Junior ISAs with the highest interest yields

Qualification – Opening an ISA Account

- Must be a resident in the UK

- Must be 16 years of age or over to open a cash ISA

- Must be 18 years of age or over to open a stocks and shares ISA

- Must be a Crown servant (e.g., diplomatic or overseas civil service) or your spouse or civil partner must be if you don’t live in the UK

- You can’t hold an ISA with or on behalf of someone else

- Children under the age of 18 can get a Junior ISA

See Also:

- Top Current Accounts with High Interest Rates

- Best Savings Rates UK – Compare the Best Savings Accounts in the UK

- Top 5 UK Banks | Ranking | Biggest British Banks in the UK

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Best Cash ISA Rates and Accounts

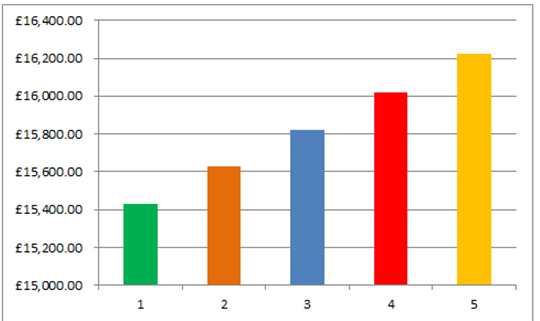

The table below outlines a list of best cash ISA accounts that offer the highest rates across the UK.

Also listed are the minimum balances needed to maintain each of these accounts.

Bank | Cash ISA Account Name | Standard AER Yield* | Min. Balance |

Nationwide | Flexclusive ISA | 1.60% | £1+ |

Nationwide | Inheritance ISA | 1.40% | £1+ |

NatWest | Instant Access ISA | 1% | £25,000+ |

Santander | Direct ISA Saver for 1|2|3 World or Santander Select customers | 1% | £1+ |

Nationwide | Champion ISA | 0.80% | £1+ |

Santander | Direct ISA Saver | 0.80% | £1+ |

HSBC | Premier | 0.50% | £1 |

HSBC | Advance | 0.50% | £1 |

Santander | Easy ISA | 0.50% | £40,000+ |

Lloyds Bank | Cash ISA Saver | 0.25% | £1 |

Halifax | ISA Saver Variable | 0.25% | £1 |

TSB | Cash ISA Saver | 0.20% | £1 |

* Rates are tax-free

The rate details above have been plotted on the chart below to provide you with a visual aid in choosing the best cash ISA account that’s right for you.

Image Source: AdvisoryHQ

While Nationwide is clearly the forerunner when it comes to offering the best ISA rates to its customers, other providers, like Nat West and Santander, have cash ISA rates offering single-digit returns.

Click here for a detailed comparison review of the best cash ISAs.

Best 1-Yr Fixed Term ISA Rates and Accounts

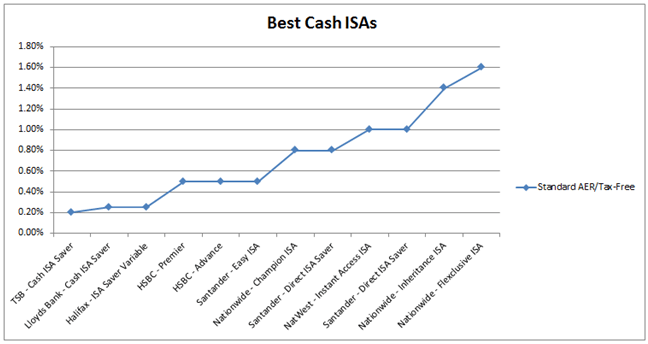

In the table below, we’ve listed the best 1-year ISAs available for savers to grow their money tax-free.

Bank | Account Name | AER* |

Nationwide | 1 Year Fixed Rate ISA | 1.65% |

NatWest | 1 Year Fixed Rate ISA | 1.2% |

Halifax | ISA Saver Fixed – 1 year | 1.15% |

RBS | 1 Year Fixed Rate ISA | 1% |

Image Source: AdvisoryHQ

As seen from the chart above, when it comes to 1-year fixed rate ISAs, Nationwide offers the best ISA interest rates available today.

Click here for a detailed comparison and ranking review of the best 1-yr ISA rates.

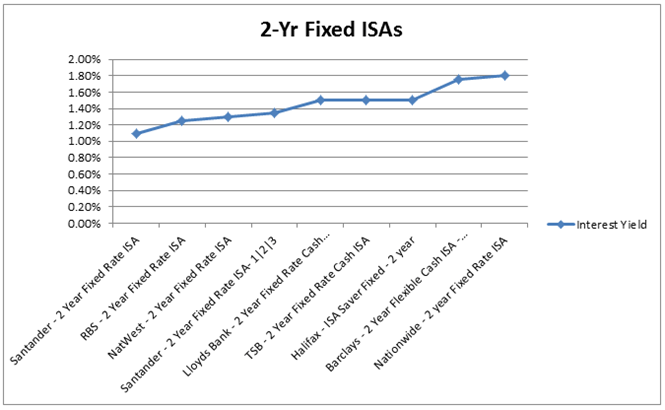

Best 2-Yr Fixed Term ISA Rates and Accounts

The table below summarises information about the best 2-year ISA offerings from some of the nation’s most renowned financial institutions.

Bank | Account Name | Interest Yield |

Nationwide | 2 year Fixed Rate ISA | 1.8% |

Barclays | 2 Year Flexible Cash ISA – Issue 8 | 1.75% |

Lloyds Bank | 2 Year Fixed Rate Cash | 1.5% |

TSB | 2 Year Fixed Rate Cash ISA | 1.5% |

Halifax | ISA Saver Fixed – 2 year | 1.50% |

Santander | 2 Year Fixed Rate ISA- 1|2|3 | 1.35% |

NatWest | 2 Year Fixed Rate ISA | 1.3% |

RBS | 2 Year Fixed Rate ISA | 1.25% |

Santander | 2 Year Fixed Rate ISA | 1.1% |

Let’s plot this data in a graph to help you decide what the best 2-year ISA account is for you.

Image Source: AdvisoryHQ

Clearly, when looking for a fixed rate ISA, Barclays and Nationwide offer the best 2-year ISAs for a fixed interest rate.

Click here for a detailed review of the top 2-year fixed ISAs.

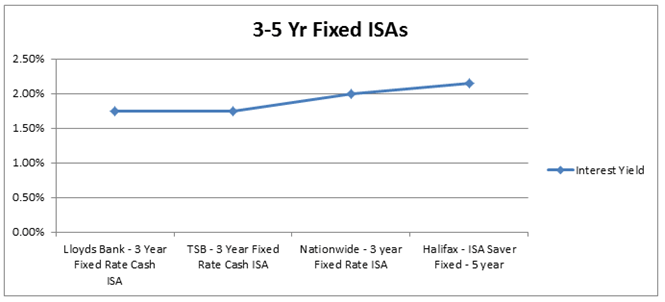

Best 3-Yr and 5-Yr Fixed Term ISA Rates and Accounts

If you have a longer savings time frame and are looking for the best ISA with a fixed interest rate, you’re sure to find a fixed rate ISA of your liking in the table below.

Bank | Account Name | Interest Yield |

Halifax | ISA Saver Fixed – 5 year | 2.15% |

Nationwide | 3 year Fixed Rate ISA | 2% |

Lloyds Bank | 3 Year Fixed Rate Cash | 1.75% |

TSB | 3 Year Fixed Rate Cash ISA | 1.75% |

Image Source: AdvisoryHQ

If you want to use part of your ISA allowance for 2015/16 to save for a 3 to 5-year period, then the best ISA rates for 2015-2016 in that time horizon come from Halifax.

Click here for a detailed review of the best 3 to 5-year fixed ISAs.

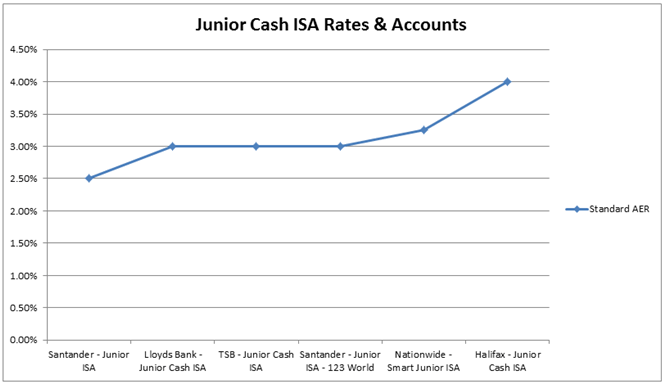

Best Junior Cash ISA Rates and Accounts

Junior ISAs are a great way to get kids to start saving for long-term goals. The table below summarises products offering the best cash ISA rates for 2015.

Bank | Account Name | Standard AER Rates* |

Halifax | 4% | |

Nationwide | 3.25% | |

Lloyds Bank | 3% | |

TSB | 3% | |

Santander | 3% | |

Santander | 2.5% |

A graphical representation of the above data will help put things into perspective for the best Junior ISAs for your child.

Image Source: AdvisoryHQ

Once again, from a high interest yield perspective, Halifax offers the best Junior cash ISA product available.

Click here for a detailed review of the best Junior cash ISAs.

What Is an Inherited ISA Allowance?

Applicable since April 2015, civil partners and spouses of a deceased ISA account holder will inherit an additional ISA allowance that increases their ISA limits.

The Additional Permitted Subscription (APS) amounts to the sum of the value of all the ISA funds that the deceased held when he/she passed.

Civil partners and spouses inherit the APS, in addition to their own ISA allowance, which they can continue to use.

However, the inherited contribution must be used within 3 years after the date of death or within 180 days after estate administration formalities are complete – whichever is longer.

Can I Open and Operate Multiple ISAs Simultaneously?

Absolutely!

If you wish, you can put your entire ISA allowance for 2015 into a cash ISA. You may also choose to put it all in a stocks and shares ISA.

Alternately, you may opt to split the amount, based on your comfort level, into a cash ISA and stocks and shares ISA.

What Investment Vehicles Can I Hold in My Stocks and Shares ISA?

Stocks and shares ISAs allow you to hold a broad array of investment vehicles, including individual company shares, open-ended investment companies (OEICs), exchange traded funds (ETFs), investment trusts or funds holding shares or bonds.

Dividends and other income earned inside stocks and shares ISAs are tax-free.

Additionally, capital gains made on stocks/shares and other holdings are also not taxed.

Can I Transfer My ISA to Another Institution Once I Open an Account?

In most cases, yes!

If you open an ISA account in one institution and subsequently find that the best ISA rates are at another institution, you can transfer your account from one institution to another.

However, make sure that the receiving institution accepts “transfers in.”

If you have a cash ISA, you can also transfer it into a stocks and shares ISA. However, doing the opposite (transferring stocks and shares ISAs to cash ISAs) isn’t permitted.

Free Wealth & Finance Software - Get Yours Now ►

Disclaimer

The best ISA rates/AERs, minimum balance requirements, and other financial data presented on this page are those that have been identified by AdvisoryHQ based on a detailed level of research and due diligence.

AdvisoryHQ’s proprietary ISA account selection methodology focuses on identifying ISA products that offer the best ISA values and rates for retail customers and which are open to the broadest range of consumers.

Most of these types of ISA rates are those offered by online UK banks, building societies, and other savings/investment institutions and are available to any UK resident, usually those 16 years of age and older.

The above lists of ISA accounts and rates do not include every ISA rate imaginable. Please do not consider these lists as “comprehensive.”

The above ISA rates also reflect the minimum deposited amount. Some institutions may offer higher ISA rates for larger minimum deposits or for fixed rate ISA products of longer durations.

Please consult each bank’s/institution’s website for information on the most updated ISA rates and product offerings.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.