Finding the Best Current Account in the UK

When UK consumers are looking to switch current accounts or find a new current account that best meets their needs, they normally ask a couple of key questions.

Such questions include: “Which UK bank offers the best current account?” “What are the top current account interest rates?” “How can I compare current accounts?” and “What are the best current accounts in the UK?”

Finding the best current account that matches your specific banking needs is extremely important because the current account interest rate yield on an account will impact how fast your money grows.

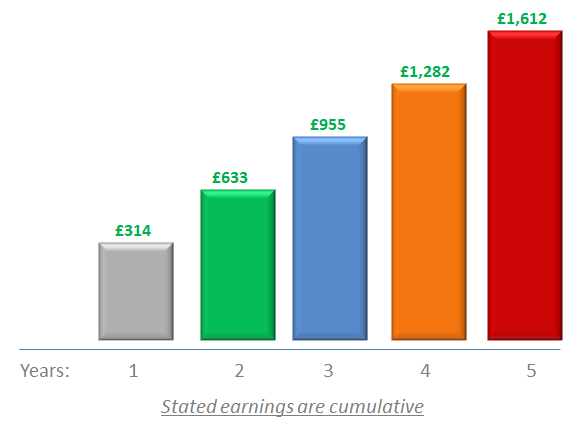

For example, assuming you were to deposit £25,000 into a current account with an annual equivalent rate (AER) of 1.25%, your total savings would grow to be£1,612.33 over a five-year period.

Image Source: Monthly account fee of £0 and a current account interest rate that compounds daily

When comparing current accounts, the high interest rate being offered by each bank should be a key decision factor, but it should not be the only factor (more on this later in the article).

Interested in Money Market accounts? See the Best Money Market Rates in the US

Best Current Account Rates Comparison

This AdvisoryHQ comparison and ranking article presents a detailed comparison review of the best current accounts with the highest interest rates, yields, and AERs.

We’ve also included an overview of the best UK banks that offer these high-interest current accounts.

The best current account comparison table below is sorted by AER (highest to lowest)

Institution | AER | Paid Up To | Min. Monthly Deposits |

Nationwide – FlexDirect | 5% | £2,500 | £1,000 |

TSB – Classic Plus Account | 5% | £2,000 | £500 |

Lloyds Bank – Club Lloyds | 4% | £5,000 | £1,500 |

Santander – 1|2|3 Current Account | 3% | £20,000 | £500 |

Tesco Bank – Current Account | 3% | £3,000 | None |

Bank of Scotland C/A with Vantage | 3% | £5,000 | £1,000 |

Yorkshire Bank – Current Account Direct | 2% | £3,000 | £1,000 |

Clydesdale Bank – Current Account Direct | 2% | £3,000 | £1,000 |

Halifax – CardCash account | 1.51% | above £1 | None |

Investec – Voyage | 1.51% | £1,000,000 | None |

The Coventry | 1.1% | £250,000 | £1,000 |

Virgin Money | 1% | £2,000,000 | None |

Click here for additional information and features on these accounts.

Note: Interest-paying current account rates are subject to change, but the Financial Conduct Authority (FCA) generally requires your bank to give you at least a two-month notice if it plans to reduce your rate. The FCA is there to protect consumers in the financial services industry.

AdvisoryHQ’s editorial staff will update this review on a periodic basis to reflect the most updated rates. So don’t forget to bookmark this page and check back regularly to see the latest best current account interest rates.

Interested in CDs? Check out the Best CD Rates (Highest CD Interest Rates Comparison)

What Are Minimum Monthly Deposits?

Minimum monthly deposits are deposits a bank will require you to make as a condition of paying interest or waving maintenance fees on your current account.

Current Account Monthly Fees

The current account comparison table below presents the monthly fees required by the top current accounts presented in this article.

Most of these high-yield interest paying current accounts do not require a monthly fee.

Institution | AER | Monthly Fees |

Nationwide – FlexDirect | 5% | None |

TSB – Classic Plus Account | 5% | None |

Lloyds Bank – Club Lloyds | 4% | None |

Santander – 1|2|3 Current Account | 3% | £2 |

Tesco Bank – Current Account | 3% | None |

Bank of Scotland C/A with Vantage | 3% | None |

Yorkshire Bank – Current Account Direct | 2% | None |

Clydesdale Bank – Current Account Direct | 2% | None |

Halifax – Cardcash account | 1.51% | None |

Investec – Voyage | 1.51% | £500 |

The Coventry | 1.1% | None |

Virgin Money | 1% | None |

Click here for additional information and features on these banks.

See Also:

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Do I Avoid Monthly Maintenance Fees on My Current Account?

The best and easiest way to avoid monthly maintenance fees is to set up a direct deposit.

A direct deposit involves the electronic transfer of funds into your account on a periodic basis.

A lot of UK banks offer a monthly fee waiver if you have a direct deposit coming into your account on a monthly basis.

Image Source: BigStock

What Are the Requirements for Opening a Current Account?

In order to open a current account in the UK, you’ll need to provide the bank with proof of your identity and address.

You can prove your identity by providing a passport, UK driving licence, identity card from a European Economic Area (EEA) or firearms or shotgun certificate.

To show proof of your current address, you can present a utility bill or local authority council tax bill for the current council tax year or a current driving licence. Many banks will require separate documents for proof of identity and proof of address. If you use your driving licence as proof of identity, you may need something else to show your current address.

See Also: Best Banks to Bank With – No Fees, High-Yield Savings

What Is the Current Account Switch Service (CASS)?

The Current Account Switch Service (CASS) was launched in September 2013 by the UK Payment Council. It is designed to increase competition and quality in the banking industry.__

It makes switching current accounts simpler and quicker for customers..

Additional Review

Nationwide

Nationwide is the world’s largest building society. For the past 3 years, it has been a top-ranking UK retail financial services company with an average ranking of 94%.

It holds 60% of total building society assets. It is relatively safe, with a Common Equity Tier 1 Capital Ratio (CET1) of 19.3%, far exceeding the 4% required by regulators.

Key features of Nationwide’s Flex Direct Current Account:

- High annual equivalent rate

- No monthly fees

- Interest earned will not change for 12 months

- You must pay in £1,000 per month (excluding internal transfers) to get this rate

TSB Bank plc

TSB Bank is both new and old. Although the name TSB originated in 2013, the bank has been operating branches formerly run by the Lloyds Banking Group for over a hundred years.

TSB has more than 600 branches in England, Scotland, and Wales.

Key features of TSB’s Classic Plus Account:

- High annual equivalent rate

- No monthly fees

- You must pay in at least £500 per month to get this rate

Lloyds Bank plc

Lloyds is one of the biggest four banks in the UK. It has been part of British society since the 18th century.

The bank offers an extensive network of 1,300 branches throughout England and Wales.

Key features of Lloyds’s current account:

- High AER of 5%

- Interest paid up to £5,000

- No monthly fees

- You must pay in at least £1,500 per month in at least 2 direct debits

Santander UK plc

Santander is one of the largest financial services firms in the UK. It has over 1,000 branches and serves close to 15,000,000 customers.

A recent poll conducted by Money Saving Expert placed Santander, in terms of customer satisfaction, first among banks with a high street presence.

Key features of Santander’s 1|2|3 Current Account:

- High annual equivalent rate

- Interest paid up to £20,000

- Monthly fees of only £2

- You must pay in at least £500 per month

Tesco Bank

Tesco Bank is a wholly-owned subsidiary of Tesco plc, the largest supermarket chain in the UK. The bank has been serving customers since 1997 and now has over 7 million customer accounts. The Consumers’ Association has given the bank three stars for customer service, clarity of statements, and Internet service.

Key features of Tesco’s Current Account:

- High annual equivalent rate

- Interest paid up to £3,000

- No monthly fees

- No minimum monthly deposits are required

- Voted the 2015 Best All Round Current Account by Moneynet.co.uk

The Bank of Scotland plc

The Bank of Scotland was founded in 1695. It is the second oldest bank in the UK (after the Bank of England).

Key features of the Bank of Scotland’s Vantage Current Account:

Yorkshire Bank

Yorkshire Bank has been around since 1859.

It is a division of Clydesdale Bank which, in turn, is owned by National Australia Bank (NAB).

The bank has earned a solid three stars (out of five) in all categories in a recent Consumers’ Association survey.

Key features of Yorkshire Bank’s Current Account Direct:

- Annual equivalent rate

- Interest paid up to £3,000

- No monthly fees

- You must pay in at least £1,000 per month

Clydesdale Bank plc

Clydesdale Bank is one of the few banks in the world that has the right to issue its own banknotes.

It has two series in circulation at present.

In March of 2015, Clydesdale Bank also issued Great Britain’s first plastic bank note: a £5 note, or fiver.

Clydesdale is owned by National Australia Bank. NAB plans to sell Clydesdale Bank sometime next year.

Key features of the Clydesdale’s current account:

- High AER

- Interest paid up to £3,000

- No monthly fees

- You must pay in at least £1,000 per month

Free Wealth & Finance Software - Get Yours Now ►

Halifax

Halifax is a division of the Bank of Scotland and is the largest provider of residential mortgage loans and savings accounts in the UK.

The bank started in 1859 as a building society.

Key features of Halifax’s Cardcash account:

- Interest is paid on ALL balances

- No monthly fees

- No minimum monthly deposit requirement

Investec

Investec specialises in providing banking services to affluent consumers. As defined by Investec, affluent consumers are consumers earning £150,000 or more a year.

Key features of Investec’s Voyage current account:

- Interest is paid up to £1,000,000

- Exceptional service provided by dedicated private bankers and a 24/7/365 client support team

- An all-inclusive annual fee of £500, with no hidden charges

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

The Coventry Building Society

The Coventry has been around since 1884. It has the amusingly amiable motto: TLC not PLC (TLC stands for “tender loving care,” and plc is an acronym for public limited company).

The Coventry has earned four stars from the Consumers’ Association for dealing with queries and complaints, for clarity of statements, and for customer service.

Key features of Coventry’s current account:

- Interest is paid up to £250,000

- No monthly fees

- You must pay in at least £1,000 per month

Virgin Money plc

Virgin Money was founded by Sir Richard Branson in 1995.

Key features of the Virgin Essential Current Account include:

- Interest is paid up to 2,000,000

- No monthly fees

- No requirement for a regular minimum monthly deposit

This best current account (UK) comparison and ranking publication will be updated on a monthly basis, so check back often.

Disclaimer: The top current account interest rates presented in this page are those that have been identified by AdvisoryHQ based on a detailed level of research and due diligence.

The above lists of current account interest rates do not include every best current account rate imaginable. Please do not consider these lists as “comprehensive.”

Please consult each bank’s website for information on the most updated current account interest rates and features.

See Also:

- Best Banks to Bank With – No Fees, High-Yield Savings

- Best Bank for Small Business Banking (Best Business Bank Accounts)

- Are Bonds a Good Investment Now? Fed Interest Rate Hike Expected – Buy or Sell Bonds?

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.