What is an ISA Account? (Definition of Individual Savings Accounts)

Individual savings accounts (ISAs) are a way for Britons and UK residents to put away a certain part of their savings each year, without having to pay income tax on the earnings/interest or gains made on those savings.

In other words, the interest yields you earn on these accounts are tax-free.

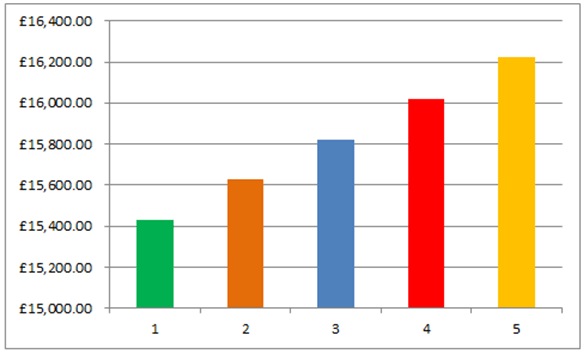

Let’s assume that you deposited £15,240 into a UK ISA cash account with an annual equivalent rate (AER) of 1.25%.

After 5 years, that amount would rise to £16,222.90, and you wouldn’t have to pay tax on the interest yields.

Year | Start balance | Interest Yields | End balance |

1 | £ 15,240.00 | £191.70 | £15,431.70 |

2 | £ 15,431.70 | £194.10 | £15,625.80 |

3 | £ 15,625.80 | £196.55 | £15,822.35 |

4 | £ 15,822.35 | £199.02 | £16,021.37 |

5 | £ 16,021.37 | £201.52 | £16,222.90 |

* Assuming that the interest compounds on a daily basis

Image Source: AdvisoryHQ

See Also:

- Top Cash ISA Rates

- Best Stocks and Shares ISAs

- Best Fixed-Rate ISA Accounts and Rates

- Junior ISAs with the Highest Interest

- Best Stocks and Shares ISAs

ISA 101

Interest earned on money deposited into a regular high yield current or savings account is subject to personal income tax deductions based on the individual account holder’s income and personal tax circumstances.

Image Source: What Is an ISA Account

However, savings that are held in a cash ISA or in a stocks and shares ISA are allowed to grow tax-free – with certain caveats; one of them being a limit on the amount of money that individuals are allowed to put away each year in ISAs.

ISA Allowance

The UK government has an ISA allowance for 2015 of £15,000 per person that can be held in aggregate across various types of ISAs.

For the subsequent tax year, 2015–2016, this ISA limit is set at £15,240 for adults, with a £4,080 limit set for Junior ISAs.

At their very basic, ISAs come in two broad flavours:

- Cash ISAs: These are accounts that are typically offered by banks and building societies, in which you deposit money (up to your allowable ISA limit) that grows tax-free.

- Stocks and Shares ISAs: These accounts can be used by investors to buy and hold their favourite stocks and other similar investments. Earnings (in the form of dividends) and capital gains from the stocks are not taxed, allowing you to keep more of your money invested in the stock market for longer.

Which of these two products are well suited for you, and where can you find the best ISA rates for products that meet your needs?

Click here for additional information and answers to these questions: Review of the Best ISA Rates and Accounts.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Related:

Best Money Market Rates | Money Market Accounts with High Rates

Best CD Rates (Highest CD Interest Rates Comparison)

Best Credit Unions in the US (Top Ranking List and Reviews)

Best Bank for Small Business Banking (Best Business Bank Accounts)

Best Banks to Bank With – No Fees, High-Yield Savings

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.