2017 Guide to Finding “No Money Down Home Loans” | What You Need to Know About Zero Down Home Loans

It is no secret that buying a home is expensive and time-consuming. Between getting a mortgage and paying closing and moving costs, the full price of buying a home can end up much more than you originally budgeted for.

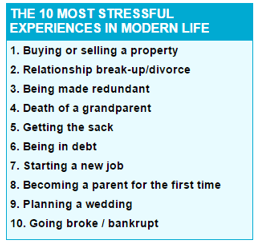

Additionally, the mortgage approval process can be long and stressful. Perhaps this is why buying a house is considered more stressful than divorce, bankruptcy, job loss, or a loved one’s death.

Source: Daily Mail

One of the biggest stressors in the home-buying process is finding the best mortgages. It is easy for realtors and banks to flood you with lengthy and confusing mortgage terms that leave you scratching your head.

You might be left wondering where you will come up with the money for the mortgage down payment outlined in your mortgage quote.

Fortunately, there are mortgage options available for almost everyone. First-time home buyers, buyers with bad credit, and those who require zero down home loans can also receive mortgage approval.

This guide will focus on buying a home with no money down home loans, providing you with tips to find the right mortgage options for you.

See Also: Prospect Mortgage Reviews – What You Should Know (Complaints & Review)

Why Buyers Use a No Money Down Mortgage

Your parents might have told you that, to buy a home, you need a mortgage down payment of at least 20%. Although this might have been true years ago, it is no longer the case. There are various mortgage options that allow for much smaller down payments.

Even some of the most popular, best mortgages only require 3%.

But, what if you want to buy a home and cannot afford any down payment? Fortunately, no money down home loans have become more widely available, and buyers are taking advantage of them for different reasons.

In previous decades, many young people fresh out of college relied on their parents to help them fund getting a mortgage. This was often a gift from parents or grandparents to help the individual jump-start his life as a young adult.

However, as pay decreases, costs increase, and unemployment soars, a lot of families are now struggling to pay their own mortgages. Young adults are forced to look for more affordable mortgage terms.

Additionally, saving for a home is increasingly difficult. Interest rates on savings accounts have reached an all-time low.

Many families live paycheck to paycheck and cannot afford to save more than a few dollars per month, if any at all. This makes finding a zero down mortgage crucial to those who still want to buy a home.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

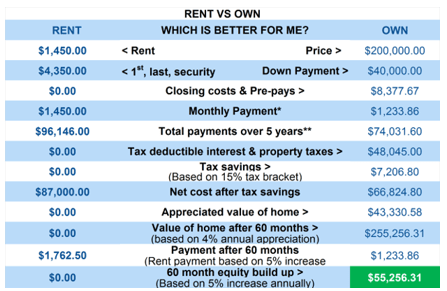

Many people realize that buying a home saves money long-term over renting. Often, the monthly mortgage is lower than the monthly rent. Also, renting does not allow you to gain equity from your home. Look at the Rent vs. Mortgage table below:

Zero Down Home Loans

It is obvious that, over time, buying a home is the better financial choice because it builds equity into the home.

And, as this rent vs. mortgage table shows, you can even save money on your monthly payment by having a mortgage rather than rent. However, the switch from renting to owning can be financially draining and might force buyers to opt for a no money down mortgage.

Don’t Miss: Spot Loan Reviews – Get the Facts Before Using (Pros, Complaints, & Review)

Requirements for Zero Down Mortgage

When buyers search for a mortgage quote, they might be surprised by the bank’s requirements. Banks often have specific requirements, whether you are searching for a traditional mortgage or a zero down mortgage.

A bank will want to know if you are an active or prior member of the military. There are no money down home loans available for military members that are not available to non-military personnel. You do not have to be on active military duty or a veteran to qualify for a zero down mortgage, but if you are, the process is typically quicker, easier, and less costly.

Most banks will, however, require these specific things for you to qualify for zero down home loans:

- Proof of credit rating. Although a bad credit score will not necessarily disqualify you from qualifying for no money down home loans, a bank will want to check your credit report and credit score. The bank will get a good sense for your finances and payment history so it can provide a mortgage quote that best works for you. Your credit score will help the bank determine your interest rate and the best loan package.

- Proof of income. If you are applying for a no money down mortgage, you are probably doing so because you cannot afford a down payment right away. Your bank will want to see proof of income to verify that you are unable to make a down payment. Additionally, the bank may request a list of your assets so it can better understand your current financial situation.

- Private mortgage insurance (PMI). When you ask a bank for a mortgage approval with no money down, the bank will likely require you to purchase private mortgage insurance (PMI) to ensure your ability to pay a mortgage. A significant mortgage down payment signals to a bank that you are financially sound and can pay a mortgage. However, making no down payment creates a risk for the lender. PMI acts as buffer for the lender in case you default on your mortgage payment.

Is a Zero Down Mortgage a Good Choice For You?

Source: No Money Down Home Loans

So, is a no money down mortgage the best choice for you? If you are simply looking for a cheap way to get a home loan and avoid paying a down payment, then it is not a wise choice. However, for buyers who legitimately want to own a home but are having difficulty navigating the financial transition from renting to buying, no money down home loans can be the perfect solution. Consider the following before making the decision:

- Are you okay with higher mortgage payments? If you have a no money down mortgage, be prepared to have higher monthly mortgage payments. Because you are not putting money down, no amount of money comes off the purchase price and you will, therefore, be paying more in interest and more each month. If skipping out on a down payment is going to make your monthly payments unaffordable, getting a mortgage with no money down is not a wise choice.

- Can you afford PMI? Private mortgage insurance is not usually very expensive, but added to a higher mortgage payment, the cost can quickly send you over the edge of what you can afford. When considering the best mortgages for you, you should add in the cost of PMI to make sure a zero down mortgage is a good choice.

- Do you have some time to wait for approval? No money down home loans usually take longer to approve than those requiring down payments. If you have the funds available to make a down payment, a bank will typically approve your loan faster because of your ability to pay. If you need a zero down mortgage, prepare to wait longer for your lender to complete the approval process.

Related: Top Mortgage Lenders – List of US Largest Mortgage Lenders (Reviews)

Using a No Money Down Mortgage Calculator or Mortgage Table

If you still cannot decide if your lender’s proposed mortgage terms with no down payment will work for you, take advantage of the many mortgage calculators available for free on the web. A calculator or mortgage table can help you compare the long-term differences between buying a home with and without a down payment.

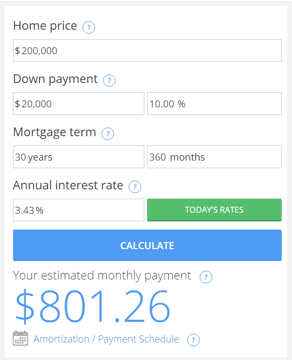

Source: Mortgage Calculator from Bankrate

Take, for example, a $200,000 home with a down payment of 10%, or $20,000. Using an interest rate of 3.43%, the calculator shows an estimated monthly payment of $801.26.

Of course, you can adjust this to match your specific lender’s mortgage terms. How does this payment change for a zero down mortgage?

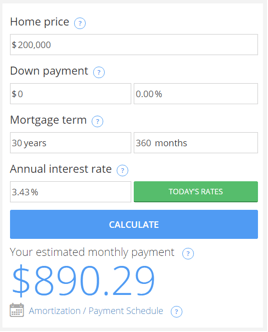

Source: Mortgage Term Calculator

The monthly mortgage cost for a no money down mortgage increases by almost $100, and this is not including the cost of PMI. So, if you simply do not have thousands to shell out for a mortgage but can afford a higher monthly payment, you could benefit from getting a mortgage with no money down.

A mortgage calculator will help you compare this necessary information and decide what will work for your short- and long-term goals.

No Money Down Home Loans for First Time Home Buyers

Now that we have covered the basic pros and cons of no money down home loans, let’s take a look at one of the most popular ways to qualify for a mortgage with no money down: First time home-buying.

First-time home buyers have many benefits available to them that repeat home buyers do not have. Typically, first-time home buyers need financial assistance, and lenders are happy to help get them into their first home.

Although there are no programs that provide a no money down mortgage specifically for first-time home buyers, there are many first time home buyer programs that require very low down payments, as low as 1%, such as Quicken Loans 1% Down Payment Option.

From there, a first-time home buyer can research down payment assistance options to help with the low down payment. Often, the assistance will be enough to cover a 1%-3% down payment, making it a good option for those seeking a no money down mortgage.

Popular Article: Types of Mortgage Loans – What You Need to Know Before (Mortgage Types & Review)

Free Wealth & Finance Software - Get Yours Now ►

No Money Down Home Loans for Bad Credit

If you have bad credit, your hope for getting a zero down mortgage is not lost, but it could take some extra time and patience. Lenders are weary of low credit scores because they want to know that you can and will make your payments on time.

However, getting a mortgage is not completely dependent on credit scores. If you can prove an attempt at fixing your credit and a good recent payment history, you might still qualify for no money down home loans.

The U.S. Department of Agriculture (USDA) offers loans to those with low income and a minimum credit score of 600. However, USDA loans are only given in certain parts of the country that are considered rural areas.

The USDA does not specifically offer a zero down mortgage; however, its applicants can choose to include the down payment and closing costs in the price of the loan, leaving nothing to pay up front.

Those with bad or little credit should also check with their home state for no money down mortgage information. Many states offer their own mortgage solutions for their residents.

The National Council of State Housing Agencies provides information on a state-by-state basis with contact information for your local housing agency, where you can learn more about down payment assistance or no money down home loans specific to your state.

Read More: We Buy Houses Reviews | Is This Firm Legit? Details on Companies That Buy Houses

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.