2017 Guide: Which is the The Best Bank For Students in 2017? PNC vs Bank of America vs U.S. Bank Student Banking

Once a child graduates high school, he is suddenly faced with adult responsibilities. Financial responsibilities can be some of the most confusing, but important, ones your child will face as he transitions from high school to college.

A student checking account, like the Bank of America student account, for example, can help your child learn how to manage his finances for the future.

In choosing the best banks for students, you and your child will face many options. So, how can you choose the best bank for students that works for both of you?

Source:FastWeb

This 2017 guide to finding the best bank accounts for students will help you. First, we will explain why student banking is so important for your college student in preparing for his financial future.

We will also outline some of the most important features you should look for when searching for good banks for students.

Finally, we will introduce you to our top three picks for the best bank account for students in 2017. The Bank of America student account, U.S. Bank student checking account, and PNC student account are excellent options for your new college student.

See Also: Top Best Banks in New York | Ranking of Banks in NYC, Buffalo, etc.

Why Student Banking Is Important

Checking accounts, like the Bank of America student checking, act as a safe haven for a student’s cash. They give parents an easy way to deposit or transfer money to their child while also storing the student’s money safely.

A PNC, U.S. Bank, or Bank of America student checking account can also give a student easy access to his student loan funds. Most student loan refunds can be direct deposited within a couple of days, compared to the week or more a student waits for a mailed check.

The best bank options for students allow unlimited transactions per month, unlike student savings accounts that often limit the number of transactions you can have or charge fees for going over the limit. The Bank of America student account, for example, does not charge fees for extra transactions because it wants you to have access to your money when you need it.

Source: Financial Avenue

Most student checking accounts also provide students with debit cards, like U.S. Bank, PNC Bank, and Bank of America student accounts.

Why is a debit card important? A debit card teaches students the importance of financial responsibility before they may qualify for a credit card. A US Bank student checking account, for example, provides a debit card that can be used for purchases and ATM withdrawals if needed.

Finally, good banks for students, like Bank of America student checking, allow your student to make automatic bill payments to help take some financial stress off of him. Automatic bill pay lets your student have the money for bills, like a car payment or insurance, to come directly out of his U.S. Bank or PNC Bank student account so he will not forget to pay.

The best bank for students is one that helps teach students financial responsibility while providing little to no extra cost to the student.

Don’t Miss: Top Best Banks in North Carolina (Ranking & Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Are the Features of the Best Banks for Students?

To be a choice for best bank account for students, a student banking account should have several, if not all, of the following features:

- Mobile and online banking. The best bank for students will allow its customers the ability to access their accounts from anywhere. The Bank of America student account, for example, offers a mobile app, online banking, and text banking for free.

- Little to no fees. The best bank account for students is one that will not charge fees to use its services. Do your research on monthly maintenance fees before signing up for an account. For example, the PNC student account has no monthly maintenance fee as long as you provide proof of current enrollment status.

- Low minimum deposit. When searching for the best banks for students, consider those with low or no minimum deposits. The best bank for students is one that does not try to make extra money off low-income students.

- Fraud protection and alerts. Since students are new to student banking, they may need help in monitoring their accounts for fraud. Bank of America student checking offers continuous fraud-monitoring and a debit card lock/unlock feature if a student loses his debit card.

- Parent access. One of the most important things for parents to consider when choosing the best banks for students is the ability for them to access their child’s account. This way, parents can monitor their child’s need for money and help them track their spending or create a budget.

- Debit card issuance. Most checking accounts do offer debit cards, so you will want to search for the best bank for students with debit card access. In addition to offering a debit card, the best banks for students will also provide protection for the debit card in case it is lost or stolen.

- Several ATM locations. Since students are often on-the-go, the best bank account for students will be one where they can access their money from several ATM locations without added fees. The Bank of America student account, for example, offers thousands of ATM locations across the U.S. for free withdrawals.

Our Picks for Best Bank Account for Students in 2017

We found that, in terms of the best bank account for students for 2017, the U.S. Bank student account, the PNC Bank student account, and the Bank of America student account are excellent options.

Source: Income Mark

These three best banks for students offer several of the important features to look for in a student checking account, including debit card protection, account monitoring, and on-the-go banking.

Our choices for best bank account for students stand above their competitors for not only meeting the important standards of low account costs to students, but also offering additional services to help students learn to budget and understand their credit scores.

Related: Top Best Banks for Bad Credit | Ranking & Review

PNC Bank Student Account

The PNC student account is known as Virtual Wallet Student®. The PNC Bank student account is one of our picks for best bank for students because it offers a low $25 minimum deposit, no monthly fees with proof of college enrollment, and no fees for PNC Bank ATM usage.

Source: PNC Bank

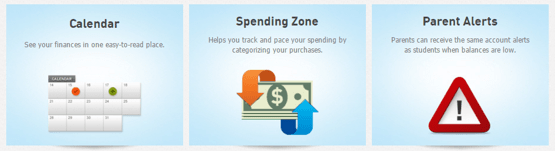

But the PNC student account offers so many more features that help it qualify as a best bank account for students. Virtual Wallet Student® provides several tools that help a student and her parents keep track of the money in the account.

Spending Zone helps students track their deposits and expenses by placing them into purchase categories, like food and entertainment. Good banks for students, like PNC Bank, help students stay on top of their finances by understanding where their money is going.

The PNC student account is also one of the best banks for students to keep parents involved. Parents can choose to receive account alerts when their child’s balance falls below a certain amount, making it easier to know when to send money if necessary.

Finally, PNC Bank is considered a best bank for students because it is three accounts in one: Spend, Growth, and Reserve. The Spend account is a checking account, Reserve is for short-term savings, and Growth is for long-term savings.

Money in the Growth account earns interest so a student can save for big purchases over time while accruing interest. This feature makes PNC Bank student checking an excellent option for best bank account for students who want to create good financial habits.

Popular Article: Top Best Banks in Florida | Ranking & Review

Bank of America Student Checking Account

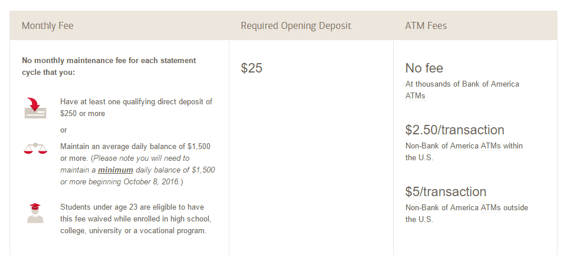

The student checking account from Bank of America is known as the Bank of America Core Checking Account®. Bank of America does have a monthly maintenance fee, but this fee is waived for students under age 23.

The Bank of America student account requires a low $25 minimum deposit and no minimum daily balance for students. There is also overdraft protection available by linking the Bank of America student account to another Bank of America account, like a parent’s account.

Source: Bank of America

Bank of America is a best bank for students because of the fraud protection it provides. The Bank of America student account offers fraud monitoring services for free, providing blocks on potentially fraudulent purchases and alerts for questionable transactions.

Additionally, you can choose to lock your debit card should it become lost or stolen. If you find it, you can unlock your card to begin using it again. Bank of America is one of the best banks for students in terms of financial protection.

Bank of America is also a best bank for students in terms of mobility. Your Bank of America student account can be accessed on the web, through its mobile app, or through text messages, making it a best bank account for students frequently on-the-go.

One of the most unique features of the Bank of America student checking account is its ability to help students save money without having to think about it. Bank of America offers a Keep the Change program, where a student’s purchases are rounded to the next dollar, and the difference is automatically transferred to her savings account.

U.S. Bank Student Account

The U.S. Bank student account rounds out our choices for best banks for students. The U.S. Bank student checking account offers no-fee ATM transactions and account usage, access to a debit card, and free personal checks to make the most of your U.S. Bank student account.

Source: U.S. Bank

U.S. Bank is one of the best banks for students because it provides banking with added benefits that other student accounts do not offer. With a U.S. Bank student checking account, you will gain access to your credit score for free so you can track how your financial habits impact your score.

If your student is new to managing his finances, U.S. Bank is a best bank for students to learn how to spend wisely. In addition to getting free credit score monitoring in real time, U.S. Bank provides a tool called ScoreBoard Access.

This financial education tool provides detailed reports of the student’s spending habits so he can see where his money is going and what habits he may need to change, making this a best bank account for students to stay on top of their budgets.

Like the PNC Bank and Bank of America student accounts, U.S. Bank gives students access to online and mobile banking. Students can access their credit scores and account information, pay bills, and transfer money to friends with U.S. Bank’s mobile access.

Conclusion

The best bank for students is one that helps them learn about controlling their own finances. Students are just beginning their lives as young adults, new to finances and the responsibility they entail.

When searching for the best bank account for students, make sure you choose one with little to no fees, excellent fraud monitoring and protection, and added tools that allow a student both financial freedom and education.

PNC Bank, U.S. Bank, and Bank of America student checking accounts are three options for best banks for students because they go above and beyond the normal services that checking accounts offer.

From free credit score access and monitoring to educational tools to help students prepare for the future, these options for best banks for students are unbeatable.

Read More: Top Best Kentucky Banks | Ranking | Top Banks in Kentucky

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.