Questions To Ask a Financial Advisor Before Investing

One of the most prevailing myths among investors is that all financial advisors are the same. But those with even a modicum of investing experience know that nothing could be further from reality.

There are critical distinctions between advisors. While these distinctions might look small on the surface, they might have huge implications for you.

For instance, you may sign on with a financial advisor because you want someone to guide you through your investments. Your advisor may appear to be doing just that, offering tips and recommendations on how to maximize your portfolio and everything.

But you might be stunned later to learn that this same advisor is not legally able to manage your portfolio and invest on your behalf. All they’re licensed to do is consult with you about how to reach your financial goals. They can recommend specific products or services, but the actual handling of your investments comes down to you.

No doubt this would be a huge, inconvenient surprise for you, particularly after paying the firm and signing a contract. Your only recourse would be to leave the financial advisor in pursuit of an investment management firm whose suite of services is in sync with your ideals.

Image Source: Pexels

Image Source: Pexels

Most of these problems can be avoided with direct, detailed questions to ask a potential financial advisor that will help you steer clear of a badly fitted business relationship.

But you may be thinking to yourself, “What questions should I ask a financial advisor?”

That’s what this list is here for. The above investment scenario is only one of the many questions to ask your investment advisor. There are several other questions to ask an investment advisor as well, each with their own potential consequences if avoided.

List of 12 Questions to Ask a Financial Advisor Before Using Their Services

- Are you a fiduciary?

- What is your fee structure?

- What credentials, certifications, or licensing do you have?

- What services do you provide? What services do you not provide?

- Do you have a client niche?

- How has your model portfolio performed?

- What is your investment philosophy?

- Have you invested in any of the assets you’ll be recommending to me?

- Do you have an open-door policy?

- Do you review client financial plans as a team?

- What makes you stand out from other financial advisors?

- Do you have a lot of short-term clients?

Are you a fiduciary?

Being a fiduciary is a big deal. So big, in fact, that you will want to exclude any firm that does not count itself a member of the fiduciary community.

Why is that? Because a fiduciary puts your interests ahead of its own. Fiduciaries are required by law to disclose all fees, maintain an open architecture, and “sit on the same side of the table” as you.

With a fiduciary, extra products and services will not be pushed onto you just to line the advisor’s or the firm’s pocket. When a fiduciary makes a recommendation, it’s done with the aim of further growing your investments or bettering your overall financial health.

Similarly, other good questions to ask financial advisors will include asking about past unethical or unlawful behavior. If an advisor has a blemish on their record, you will want to know about it, and in good faith, the advisor should disclose these to you and explain why it occurred, and what the firm has done to ensure it never happens again.

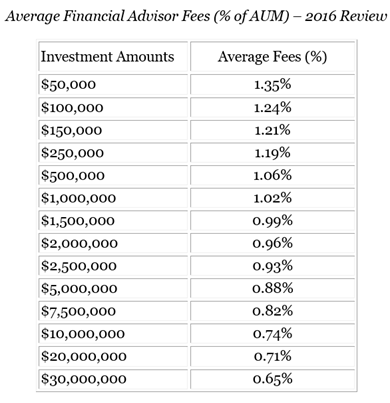

What is your fee structure?

To avoid any surprises on your bill, you will want to ask another of the big questions to ask financial advisors. Namely, the advisor’s fee structure.

Given that fiduciaries place a premium on forthrightness and transparency, they will often take the lead on disclosing fees. They won’t let you walk out the door without making certain that you know what charges to expect.

In the event you choose not to work with a fiduciary, or your fiduciary advisor mistakenly omits this information, it’s imperative on you to request it. Doing so keeps your advisor honest and keeps you from added stress down the road.

Some advisors don’t disclose each fee or charge that they levy on your account. Either the fees are too great in number to review all at once, or the advisor trusts that you will read about the fees in your paperwork.

Don’t Miss: Average Financial Advisor Fees. How Much Does a Financial Advisor Cost?

Click here to learn more (typical advisor fees)

More unscrupulous advisors delay fee disclosure to a later date after you’ve already signed the dotted line. By knowing what to ask financial advisors and wealth management firms, however, you can prompt them to disclose all fees upfront. As a result, you have a chance to weed out the good advisors from the bad.

From there, it’s a question of which fee structure you feel comfortable with.

Do you want your financial advisor to only charge an initial fee? Are you comfortable with Assets Under Management (AUM)? What if your advisor makes commission from persuading you to add extra products or services to your plan?

If you want to deal with a fiduciary, commissions are out of the question. Furthermore, commissions might compromise the advisor’s ability to provide unbiased advice. Products and services that you don’t truly need, or could do without, might be pushed on you if you choose an advisor who is incentivized by commissions.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What credentials, certifications, or licensing do you have?

While you’re free to choose whichever financial advisor you like, there is very little room for compromise when it comes to certification, credentials, and training. Naturally, it’s foolish to trust an advisor who is without the industry credentials or licensing to guarantee proper management of your money.

With that in mind, credentials and training should not be assumed. Just because the person at the table with you calls themselves a financial advisor doesn’t mean they have been properly educated.

There are several designations intended to highlight an advisor’s training and know-how. Acronyms such as CFP (Certified Financial Planner), CFA (Certified Financial Analyst), CEP (Certified Estate Planner), and CPA (Certified Public Accountant) inform you immediately if the advisor is trained to industry standards.

These designations are important to know because your interests may not align with the advisor’s specialization. If your primary concern is retirement planning, you’ll want to know the retirement planning questions to ask financial advisor experts who specialize in retirement plans.

But if the advisor is a CFP rather than a CRP, you’ll have to decide if you’re comfortable moving forward with them despite the difference in their credentials.

Likewise, designations are important because they set up the advisor for the possibility of continuing education. The best financial advisors and financial advisory firms strive to educate themselves on evolving industry practices, theories, and law.

Again, this should not be assumed. Since the training that your advisor received when they became credentialed may no longer apply today, it’s vital for you to only do business with someone who has kept up with the times.

Diving even deeper into the issue of credentials, you must be aware that not all financial advisors are necessarily college-educated. Most of them will be, but plenty are not. Is this important to you? Or are you comfortable working with someone who, as a bare minimum, has been certified within their industry?

What services do you provide? What services do you not provide?

You’re asking this to ensure that the advisor does everything you’re looking for. If that includes selling investments, you need to ask if the advisor is licensed accordingly.

If all you want is an advisor to dispense investment advice, however, it behooves you to ask specific questions guaranteed to elicit a clear answer. Not all financial advisors can both advise you on investments as well as coordinate those investments for you. Many investors don’t know this, instead entering into a relationship with their financial advisor expecting services that their advisor cannot actually provide.

Likewise, if you want trust planning, estate planning, tax efficiency, or other specific services, you need to ask if your advisor or the firm in general can offer them.

Most advisors can, as a bare minimum, include these considerations within your financial plan. However, they will not always have the training or experience to manage them directly.

In cases like these, the advisor will usually be open to working with the other advisors and consultants in your life. This includes lawyers, accountants, financial planners, and so on.

But the important thing to keep in mind is that you must always confirm these things directly with the advisor. Not every advisor will have the time or the inclination to work as part of your advisory team. If this is important to you, seek out an advisor that doesn’t mind collaboration.

Do you have a client niche?

You have $200,000 or so to invest toward your financial goals. The advisor you’re meeting with has answered all of your questions satisfactorily to this point. What’s more, they seem eager to take you on as a client.

The only concern? The advisor typically handles investments for high net-worth individuals. Why might this become problematic?

Because as well-intentioned as the financial advisor might be, they could inadvertently leave you in the dust when the portfolios of their more affluent clientele require attention. This de-prioritization can occur in the form of delegating your account to an associate or by the advisor becoming unavailable as a result of being tied-up with other clients.

This is not to say that your portfolio is any less important than that of high net-worth clients. It’s also not an indication that any given financial advisor would not behave with the utmost professionalism toward you or your financial needs.

However, the reality is that high net-worth clients form the backbone of many wealth management firms. Neither client is better than the other, but not all clients and firms make good matches.

To keep this from happening to you, do your due diligence by asking the financial advisor if they specialize in a certain type of client. If they manage a broad range of client types, you’re probably in good hands.

The reverse is also true: High net-worth individuals will want to consider entrusting their investments to an advisor experienced in handling affluent clients. This way, they stand a better chance of receiving the attention and care that they expect.

How has your model portfolio performed?

Knowing how a firm’s model portfolio has performed is another key question to ask an investment management firm.

Some firms will have a model portfolio to show you as proof that their investment strategies can produce results. Not every advisory firm has a model to produce. But if they do, it can be a win-win for both you and the advisor.

The advisor wins because they have the opportunity to show you tangible, real-world investment growth (assuming that their model portfolio does indeed experience gains).

You win because you see the relative success of the firm’s baseline philosophy within an actual market. Not to mention the fact that you can review the model asset allocation and determine if it meshes with your preferred allocation approach.

Of course, divining the stability and effectiveness of any portfolio requires patience and perspective. These are two factors that are easy to forget during extended market turbulence and its chaotic effects on portfolios of all kinds, including model portfolios of wealth management firms.

Nevertheless, a model portfolio can prove extremely useful for seeing how a firm’s investment philosophy is faring when put to the test.

What is your investment philosophy?

Speaking of investment philosophy, you must know which one your advisory firm holds to. Most advisors highlight this information on their website. However, it is important that you add this to your list of questions to ask a financial advisor.

Choosing an advisor who reflects your values and preferences reduces some of the tension that is inherent when you trust someone else with your money.

Are you passionate about investing in clean energy? Companies with a progressive, socially conscious slant? Will you feel fine profiting from businesses involved in the manufacture of firearms, tobacco, or adult entertainment?

If you consider yourself a socially responsible person, things like clean energy and environmental impact matter to you. You would want to avoid financial advisors whose investment tendencies involve companies with poor environmental records or laboratory testing of animals, for instance.

Agreement between your values and their values not only soothes your conscience, but it makes the client-advisor relationship less stressful. Equally important, however, is knowing that you and your advisor agree on other facets of investment strategy, too.

Ideally, you and your advisor should be on the same page regarding issues like asset allocation, risk tolerance, and goal-setting, to name only a few. The relationship will not benefit you nearly as much if the advisor’s methodology continually pulls you away from your personal preferences.

In contrast, you can forgo your preferences and trust the advisor’s vision for how to grow your finances. Depending on the advisor, this may not prove too difficult; most qualified, reputable advisors will do everything in their power to accommodate you from the start.

However, the best advisors know their stuff, which means they have specific reasons to support their recommendations. In the end, it comes down to whether you want to “share the wheel” with your advisor, so to speak, or you want them simply to navigate from the passenger seat.

Have you invested in any of the assets you’ll be recommending to me?

This question for a financial advisor isn’t as crucial as many of the others on this list for the simple fact that there is not a “one-size-fits-all” investment plan. If there were, this question would be moot, anyway.

Financial plans should always be customized to the individual. Goals, needs, financial posture, viability, and solvency as it pertains to your business—these are variables that apply to greater or lesser degrees across the client spectrum.

The same applies to advisors. Their life and financial situation will not always mirror yours, and it’s this diversity that similarly keeps your respective portfolios from resembling one another.

Regardless, it does not hurt to ask. Furthermore, it doesn’t hurt to ask how popular the recommended investments are with other staff at the financial advisory firm. After all, if the advisor is suggesting certain assets, it helps to know whether the firm considers their own advice.

But each plan is customized, so do not use this as a foolproof way to vet a financial advisor. Instead, treat it as an inquiry intended to better understand the firm’s approach.

Do you have an open-door policy?

Do you have an open-door policy is another key questions to ask a potential financial planner or wealth manager.

The flipside to this question is, “How regularly do you initiate contact with your clients?”

Communication is perhaps the most crucial aspect of the client-advisor relationship. That is why you want to ask these questions in the first place. They get you and the advisor talking and coming to an understanding.

Without open communication—or, more to the point, without an atmosphere of open communication—you won’t feel as comfortable coming to your advisor with questions and concerns.

Some advisors will handle your initial consultations and schedule a few meetings with you throughout the year. Otherwise, your calls will be handled by an assistant qualified to answer your questions. This assistant will work with the primary advisor in managing your portfolio outside of your face-time with them.

This arrangement might not bother certain investors. Other investors, however, will want a financial advisor who takes a more proactive approach. Some investors prefer advisors who regularly initiate contact; these clients want to feel taken care of.

Should this describe you, make sure to ask the advisor if they regularly initiate communication. If not, at least verify that they have an open-door policy where you can freely ask questions and voice your concerns when needed.

Do you review client financial plans as a team?

This is another key question to ask a wealth manager. Oftentimes with smaller, boutique financial advisory firms, the entire staff is involved in reviewing and advising on client portfolios. This team-oriented approach can bring together a wide variety of sensibilities, education, training, and expertise.

Larger firms may accomplish the same thing by passing your financial plan to different departments for review. However it’s structured, the result can be a more well-rounded, comprehensive investment strategy that you might not receive working one-on-one with a single advisor.

Of all the questions to ask your financial advisor that appear on our list, this question comes down to preference perhaps more than any other.

If you are of the “set it and forget it” mindset, you might not care whether your plan is reviewed by more than one person.

On the other hand, if you wish to participate in the managing, rebalancing, and strengthening of your portfolio, a team approach might appeal to you. Having more people contributing to your account might help you feel better about the decisions you make.

What makes you stand out from other financial advisors?

What makes you different is another key question on our list of questions to ask financial advisors. This question may seem to put the advisor on the spot. However, most financial advisors are prepared to tout their firm’s advantages and distinction within their industry.

This assumes, of course, that the advisor doesn’t volunteer this information to start with. A firm’s unique value proposition is typically inserted early into the pitch given to the investor. More than likely, you won’t even have to ask.

Regardless, performing due diligence is your responsibility as a smart, conscientious investor. Don’t be afraid to ask if the advisor doesn’t make the case on their own.

Not advertising their firm’s benefits upfront could simply be a lapse in memory. It isn’t necessarily a red flag.

But not being able to answer the question when prompted? It could be a clue that the advisor, or the firm, is not uniquely positioned to help you grow your portfolio.

Do you have a lot of short-term clients?

This?” is one of the key questions to ask a financial advisor before investing.

If a financial advisor has few long-term clients, that could spell trouble for you down the road. You’ll want to know why their clients don’t stick with them for very long. Otherwise, you might become just another client to fall through the proverbial cracks.

Answering this question should be easy for any financial advisor worth their salt. Financial planning and wealth management firms love to highlight their long-term or “life-long” clients. It evidences stability, trust, and regular client satisfaction, among other traits.

But if a financial advisor has a revolving door of clients, it could betray a host of hidden issues at work behind-the-scenes.

For example, if inferior investments were chosen, the results may have been detrimental to the client’s portfolio growth. Or the client may not have appreciated the advisor’s handling of certain specialized programs, such as trust planning, estate planning, or payroll management, to name a few.

Solid, reputable financial advisory firms will have a majority of long-term clients, rendering moot most of the above questions. Firms worth your time will open themselves up to this kind of scrutiny as an extension of an honest, transparent system and philosophy.

Conclusion

Choosing a qualified, ethical financial advisor starts with one question: “What should I ask my financial advisor?”

After that, you need only know which questions to ask, and, secondarily, what you will do if you don’t get the answers you want.

Financial advisors can’t provide a blanket portfolio to cover every type of investor. Because of this, you’re forced to do some homework and qualify the financial advisor on your own terms.

It might feel like a bit of a hassle, and you may be tempted to skimp on your due diligence. But when we’re talking about such weighty matters as your financial health, retirement, and business solvency, the entire debate takes on great urgency.

You may interview 20 financial advisors before you find one that clicks. It would be worth it in the end, however, knowing you’ll do business with someone who cares about the same things you do. And when your future is on the line, that’s one more added security you can’t afford to do without.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.