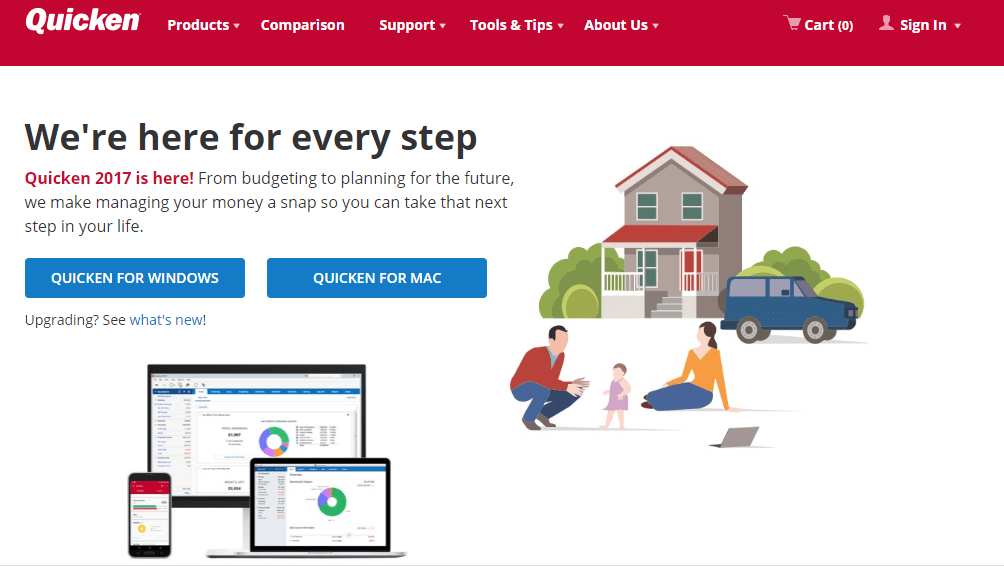

Three Versions of Quicken – Which One is Right for You?

Quicken has three different versions, each one designed for a different type of consumer.

The first version is the Starter Edition, which is the most basic personal financial software out of all three.

Just as the name goes, it is designed for those that are just starting out with using software to manage their financial transactions, or those just looking for a top quality, but basic tool.

With the Quicken Starter version, you can access your bank and credit card accounts in one place

The next level up is the Deluxe version which has everything that the Starter version has, and in addition, it has features that guide you in reducing debt, and seeing all your financial accounts in one place.

Image source:Quicken

The third and highest version is the Premier.

The Premier is designed for individuals that are interested in managing their investments, as well as budgeting, banking, bill payments, and all the features provided by the Starter and Deluxe versions.

Four Great Features (Quicken Review)

1. Access Your Accounts in One Place

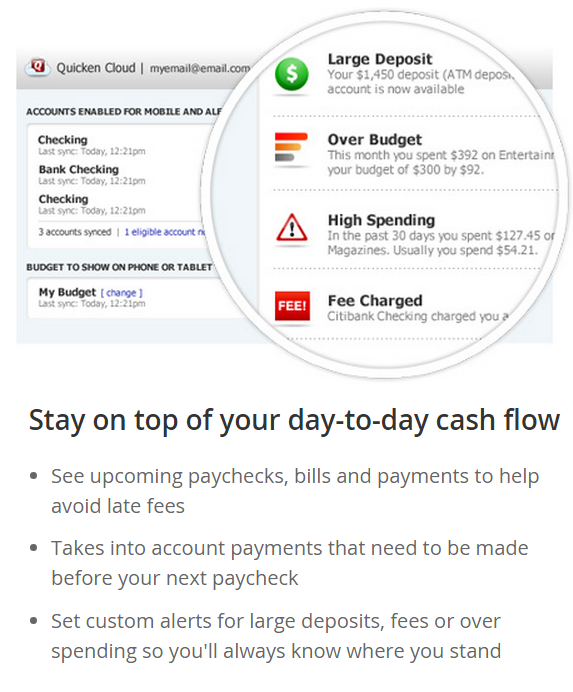

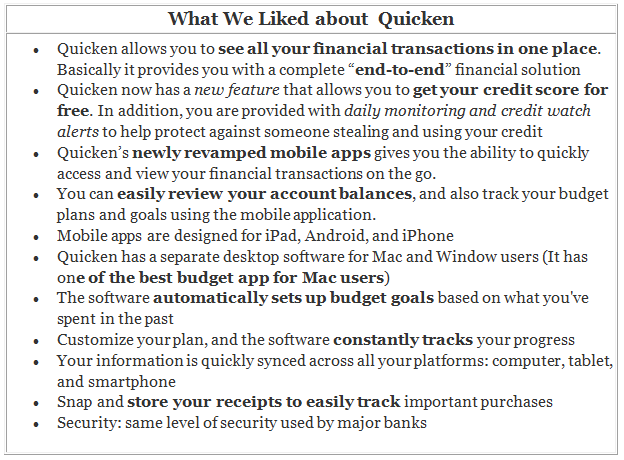

With all editions, you can easily access all your bank and credit card accounts from the same platform. The platform automatically categories your transactions into easy to recognize categories like Phone, Auto, Insurance, Utilities, etc.

2. Free Credit Score

Intuit (owner of Quicken) has introduced a new feature to Quicken. You are now able to get a free credit score, which includes a free summary of your credit report, as well as the factors that are impacting your credit.

See Also: Mint vs. Personal Capital (Best Personal Finance Tools Compared to Quicken)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

3. Enhanced Mobile Apps for Android, iPhone and iPad (Quicken Review)

Quicken recently implemented an across-the-board improvement of its mobile apps. Now, users are able to sync accounts faster using one click updates. This cuts down on the number of clicks you had to perform before to sync your accounts. It also came out with improved graphs that have better “spending chart” graphics.

Using Quicken apps, you can easily check your account balances and track your budget planning goals. In addition, any action you perform on one platform is quickly synced across your computer, tablet, and mobile devices. This allows you to stay on top of your financial transactions with timely updates and alerts.

Image source:Quicken

4. Easy Aggregation

Conclusion – Quicken Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.