Intro – Randolph-Brooks Federal Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in Texas, a list that included Randolph-Brooks Federal Credit Union.

Below we have highlighted some of the many reasons Randolph-Brooks Federal Credit Union was selected as one of the best credit unions in Texas.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Randolph-Brooks Federal Credit Union Review

Randolph-Brooks Federal Credit Union has been serving its members since 1952. This top credit union has grown from a financial institution created to serve the needs of military service members and their families to serving hundreds of thousands of members in Texas and beyond.

RBFCU has a mission of helping its members improve their economic wellbeing and quality of life and prides itself on providing personalized service.

2020-2021 Top Credit Unions

This credit union offers a number of personal and business financial products and services including loans, insurance, credit cards, investments and retirement planning, and more.

It also stands out as it’s been named one of the Best Companies to Work for in Texas for 2020.

Don’t Miss: TDECU Reviews & Ranking

Key Factors Leading Us to Rank Randolph-Brooks Federal Credit Union as One of the 2020-2021 Top Credit Union Firms

Upon completing our detailed review, Randolph-Brooks Federal Credit Union was included in AdvisoryHQ’s ranking of the 2020-2021 best credit unions based on the following factors.

RBFCU Review: Free Checking

A popular account option from RBFCU is the Really Free Checking Account. This account includes everything you’d need from your checking account, plus no monthly service fees or minimum balance requirements.

The account also comes with a Freedom Debit Card, earns a 0.05% APY dividend rate, and includes:

- Free mobile apps compatible with iPhone, iPad, and Android devices

- Free online account access that includes a detailed transaction history and information

- Free online bill pay

- Free standard checks when ordered online

- Surcharge-free access at millions of nationwide ATMs offered through the Co-Op Network

- 24/7 fraud monitoring and zero liability protection on debit cards

RBFCU Review: Credit Cards

Credit cards from RBFCU include benefits like no introductory APR on balance transfers as well as the benefit of cash advances with no fees.

Once someone uses an RBFCU credit card for a balance transfer, that individual has 12 months to pay it back with no interest charged.

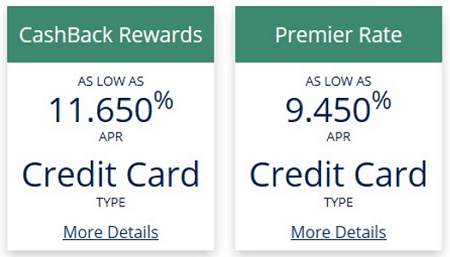

The credit cards available from this Texas credit union include the Premier Rate card, with a low rate, which is currently at 9.450%, and the CashBack Rewards card which earns 2% cashback on all purchases that you make.

RBFCU Credit Card Rates | Best Credit Unions

Both cards have a 25-day grace period on purchases as well as fraud monitoring, zero liability protection, and $1 million in travel accident insurance. There are no annual fees on either one and no foreign transaction fees.

All-in-One Change Management Tools Top Rated Toolkit

for Change Managers. Get Your Change Management Tool Today...

RBFCU Review: Credit Builder

The RBFCU Credit Builder Loan is designed specifically for those members who have had difficulties in the past with their credit and might have been turned down for other loans or who may not have any credit history at all.

This loan is based on money secured in a savings account, and dividends are paid on that balance while payments are made on the loan. Members can request between $300 and $2,500 with a loan term between 6 and 36 months.

The Credit Builder Loan helps you establish a positive credit history, and once the loan is fully paid, that amount is available in the account used to secure it. Members who take advantage of this loan product should make their payments on time for a period of six months to see the impact on their credit report.

Related: NavyArmy Community Credit Union

Review Summary

It’s easy to see how Randolph-Brooks FCU has grown so much over the past several years. With member-friendly benefits like free checking that earns dividends and credit cards with zero fees and low interest, they set themselves apart from other financial institutions.

Randolph-Brooks FCU offers a full array of financial services, including investment and wealth management services, insurance, and a wide range of business services, serving multiple client needs.

With a goal to personalize the banking experience for its members and programs that help people build a better financial future, Randolph-Brooks Federal Credit Union is one of the best credit unions to consider banking with and they’ve earned a 5-star rating.

In addition to reviewing the above Randolph-Brooks Federal Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

Image Sources:

- https://www.rbfcu.org/news/rbfcu-listed-among-best-companies-to-work-for-in-texas-2020-by-texas-monthly

- https://www.rbfcu.org/loans/credit-cards/

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.