2020-2021 RANKING & REVIEWS

TOP RANKING BEST CREDIT UNIONS IN TEXAS

Intro: Finding the Best Texas Credit Union for Your Banking Needs

While some Texans may think that there’s not much of a difference in where you choose to do your banking and that all Texas credit unions and banks are the same, they may be surprised to see how much money they can save just by shopping around.

TX credit unions have some distinct differences from banks that can benefit their members, such as the ability to often offer significantly better rates. Additionally, not all top credit unions in Texas are created equal and one may fit your needs better than another.

If you haven’t used a credit union before, you may not know what you’re missing out on when it comes to the differences in how they operate. For many people, discovering the top credit unions in Texas can open up a whole new world of financial opportunities.

The establishment of credit unions in Texas isn’t new, and many been around since the early to mid-1900s when they were first created by consumers and company employees who wanted a reprieve from high loan interest rates being charged by banks.

Award Emblem: Best Credit Unions in Texas

Award Emblem: Best Credit Unions in Texas

In recent years Dallas, Houston, Austin credit unions, and credit unions around the country have been gaining in popularity as people look for alternate ways to make the most of their savings and find the best loan rates.

We’ve researched the top credit unions in Texas to highlight some of the best financial institutions in the state, each of which is a viable alternative to the standard concept of a bank and that may offer you better checking, savings, and investment options.

So, if you’ve been thinking of checking out a Houston credit union, Dallas credit union, one of the Austin credit unions or a credit union anywhere else in Texas, you’ll want to start here first with these 15 best Texas credit unions.

Top 15 Best Credit Unions in Texas | Brief Comparison & Ranking

| Best Credit Unions in Texas | 2020-2021 Ratings |

| A+ Federal Credit Union | 5 |

| American Airlines Credit Union | 5 |

| Credit Human | 5 |

| Credit Union of Texas | 5 |

| EECU | 5 |

| First Community Credit Union | 5 |

| FirstLight Federal Credit Union | 5 |

| GECU | 5 |

| JSC Federal Credit Union | 5 |

| NavyArmy Community Credit Union | 5 |

| Randolph-Brooks Federal Credit Union | 5 |

| Security Service Federal Credit Union | 5 |

| TDECU | 5 |

| University Federal Credit Union (UFCU) | 5 |

| Texans Credit Union | 3 |

Table: Top 15 Best Texas Credit Unions | Above list is sorted by rating

What’s the Difference Between a Credit Union in TX and a Bank?

If you’ve always used a bank for your checking and savings accounts, you may be wondering why you should consider a credit union in TX and what the difference is between credit unions and banks.

The main difference is that a credit union is designed as a co-op. What this means is that they’re member-owned and member-operated.

They are also not-for-profit organizations, so even when a credit union in Texas does make a profit, it’s reinvested and shared with its members.

This reinvestment comes in the form of cheaper banking products, lower interest rates on loans, and even dividends being paid to members of Texas credit unions.

Unless you happen to be a shareholder, you’ll most likely not see any dividends from being an account holder at a traditional bank.

Best Texas Credit Union 2020-2021

Here’s a quick “cheat sheet” of the main differences between TX credit unions and banks that may help make a choice easier for you.

Texas Credit Union vs Texas Bank:

- Credit unions are not-for-profit, banks are for-profit

- Credit unions typically have fewer and lower fees

- Both have account insurance up to $250,000, but through different entities (FDIC for banks, NCUA for credit unions)

- Both offer similar banking products: checking, savings, investment, and loans

- Banks don’t have membership requirements, TX credit unions do have requirements, generally based upon where you live, work, worship or volunteer

- When you join a Texas credit union, you’re also a part-owner as a member

See Also: Top Credit Unions in Houston, TX

All-in-One Change Management Tools Top Rated Toolkit

for Change Managers. Get Your Change Management Tool Today...

2020-2021 AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Credit Unions in Texas

Below, please find a detailed review of each credit union on our list of top Texas credit unions. We have highlighted some of the factors that allowed these credit unions in Texas to score so high in our selection ranking.

Click on any of the names below to go directly to the review for that firm.

- A+ Federal Credit Union

- American Airlines Credit Union

- Credit Human

- Credit Union of Texas

- EECU

- First Community Credit Union

- FirstLight Federal Credit Union

- GECU

- JSC Federal Credit Union

- NavyArmy Community Credit Union

- Randolph-Brooks Federal Credit Union

- Security Service Federal Credit Union

- TDECU

- Texans Credit Union

- University Federal Credit Union (UFCU)

Click below for previous years’ rankings

- 2017 Review: Top 15 Best Credit Unions in Texas

- 2016 Review: Top 15 Best Credit Unions in Texas

Don’t Miss: Best Credit Unions in Atlanta, Georgia | Ranking & Comparison

Credit Human Review

Credit Human has been serving members for over 80 years. This San Antonio based credit union in TX is 100% member-owned and member-directed, which means this financial institution operates in the best interest of its account holders.

This top credit union in Texas serves over 200,000 members and manages nearly $3 billion in assets. They were formerly known as San Antonio Credit Union (SACU) and in 2016 became Credit Human.

They believe the new name better reflects their mission of giving credit to the dreams of their members and being more than just a banking institution, and instead of giving a human face to a credit union in TX that makes banking feel more personal.

To become a member of this best Texas credit union you need to meet one of the following eligibility requirements:

- Be an employee or member of one of their employer or organization partners

- Live, work, worship or attend school in the Southern or Western area of San Antonio

- Be a veteran, retiree, active duty member or dependent of a member of the U.S. Armed Forces or National Guard

- Study at one of their trade school, college or university partners

- Be related to or live with a Credit Human member

Key Factors That Enabled Credit Human to Rank as a Top Credit Union in Texas

Low Minimum Account Balances

Big banks can often have a higher barrier to entry than top Texas credit unions when it comes to account minimum balances. One of the attractive features that Credit Human offers is low account minimums, making it easy for anyone to open an account.

For example, their Free Checking has zero minimum balance requirement, and you can open an account with just $25.

For those signing up for one of the best Texas credit unions so they can enjoy the dividends that members can receive, won’t be disappointed with another checking option offered by Credit Human that also has no minimum balance requirement.

Their Dividend Checking also has a minimum deposit of just $25 to open an account that offers competitive dividends paid monthly on any balance amount. You also have unlimited check writing and debit card use.

Rate Preferred Visa®

Another financial benefit of this credit union in TX comes in the form of a Visa® card with a very attractive rate.

The card offers an APR as low as 8.90% on both purchases and cash advances and as low as 7.90% on balance transfers.

Other perks include no annual fee and no balance transfer fee and protections against lost or stolen cards.

While this card doesn’t earn rewards, they do offer another card that does. But for those that are just looking for the best rate on a credit card, this one is hard to beat.

Top Credit Unions in Texas

Rating Summary

Through name and reputation, Credit Human puts a friendly face on TX credit unions. Their account offerings are both budget-friendly and give members the opportunity to earn dividends and save more when they need to use a credit card.

Their membership eligibility requirements are fairly easy to meet, making them one of the more accessible top Texas credit unions.

They also take an active interest in their community and since 1999, they’ve honored 19 San Antonio area teachers that are making a difference both inside and outside the classroom.

With a welcoming philosophy and excellent rates for members, Credit Human scores a 5-star rating as one of the top Texas credit unions to consider banking with in 2020-2021.

Credit Union of Texas Review

Credit Union of Texas (CUTX) was started by Dallas teachers back in 1931 looking for better financial options for their members. From an initial asset total of $65, CUTX is a Dallas credit union that’s grown to over $1.4 billion in assets and 141,00 members.

CUTX is a big supporter of their local community and gives both in volunteer hours and donations. They’ve donated $859,831 through cash and merchandised donations as well as sponsorships and community programs.

This best credit union in Texas truly believes in having its members fully involved in all aspects of CUTX’s operations. They have a volunteer Board of Directors that are elected from membership every year.

A unique aspect of this best Texas credit union is that they have members in all 50 states. Their member eligibility requirements are as follows:

- Anyone who lives, works or attends an institution of higher learning in Dallas, Denton, Collin and Rockwall counties

- Anyone who lives or works in select areas of Grayson, Fannin, Ellis, Tarrant, and Hunt counties

- Any member of a school-related association or organization created to service or assist schools

- Any employee of select partner companies/organizations

- Anyone related (by blood, marriage or adoption) to someone that meets the eligibility or is already a member

Key Factors That Enabled Credit Union of Texas to Rank as a Top Credit Union in Texas

CUTX Perks

CUTX Perks is a rewards program for debit card users that allows them to accumulate points simply by making purchases with their cards. Account-holders are automatically enrolled, so there is no formal process to participate in this valuable member option.

Members of this Texas credit union can earn one point for each $100 spent with a signature transaction, and ½ a point on PIN-based debit card transactions.

This Dallas credit union also offers the ability to earn extra points by using their CUTX Perks online eMerchant link when shopping online.

Users can redeem their points for gifts by shopping on the CUTX Perks website, or they can save them up and cash them in for larger rewards, such as travel. Users can also pool points with friends and family to earn them even faster.

Secure Checking

Secure Checking is a signature account offering from this best credit union in Texas. It is designed to give you safety and peace of mind along with benefits and perks not often available with standard checking accounts.

Regarding security, this account includes identity theft protection, credit report monitoring, and benefits like cell phone insurance and extended warranty coverage.

If members of this Dallas credit union upgrade to Secure Checking Plus, they can also get travel, entertainment, and health discounts. Both accounts are also interest-bearing and feature free electronic statements.

Rating Summary

If you’re in the Dallas area or otherwise qualify for their membership requirements, Credit Union of Texas offers some excellent banking options, like perks just for using your debit card and attractive loan rates.

Their checking accounts also offer more security benefits than are usually found at other top TX credit unions, which makes them a great choice if you’re worried about identity theft or payment card fraud.

With a commitment to being run by their members and giving back to the local community, Credit Union of Texas stands out as a top Dallas credit union and best credit union in Texas, earning them a 5-star rating.

Related: Best Credit Unions In North Carolina | Reviews of the Best North Carolina Credit Unions

FirstLight Federal Credit Union Review

FirstLight Federal Credit Union began in 1955 as a way to help military and civilian families on Biggs AFB with more access to financial services and credit. Today this Texas credit union includes over $1 billion in member assets.

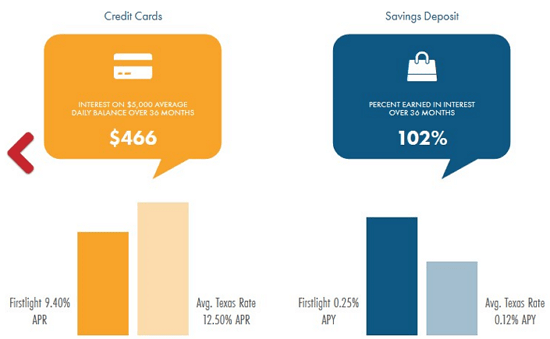

The advantages of becoming a member, which you’ll see advertised on the site’s main page, are their attractive interest rates both on credit and savings. For example, they compare their savings of 0.25% APY with the Texas average rate of 0.12% APY.

The eligibility requirements for joining this top credit union in TX include:

- If you live, work, worship, attend school, volunteer, or your business is located in El Paso County or Dona Ana County

- If you are a member of one of the selected military branches/units or civilian personnel at Fort Bliss

- If you’re a family member of an existing member

Key Factors That Enabled FirstLight Federal Credit Union to Rank as a Top Credit Union in Texas

Top Credit Unions in Texas

Relationship Rewards

As one of the best Texas credit unions, FirstLight offers members the chance to earn rewards on their Simply Checking or Simply More checking account if they meet certain criteria, based on combined loan balances and deposits, which includes a total account balance of $10,000 at the credit union (combined deposit and loan balance).

If the criteria are met, the Relationship Rewards program includes the following benefits:

- Two free non-FirstLight ATM transactions per month

- Free personal money orders, cashier’s checks

- Free telephone balance inquiry

- Free incoming wire transfers

- 25% discount on auto or personal loans

- 25% discount on annual fee rental for safe deposit boxes

Other rewards programs available from this credit union in Texas include the Go Green Rewards Program for people that do their banking online and receive e-Statements and the 50 Rewards program for members that are 50 years and older.

E-Services

As a time-saving convenience for members of FirstLight, the credit union offers all the modern e-services that you’d expect from any financial institution and a few others such as their PAL service.

The Personal Access Line (PAL), is a convenience to those who prefer to have phone access to banking. It allows members to access their money via a 24-hour phone service to check account balances, transfer funds, report a lost or stolen card or stop payments on checks, and more.

Other online convenience services offered by this top Texas credit union include:

- Online Bill Pay

- External Payments

- e-Statements

- Online & Mobile Banking

- Digital Wallets

- Finance Manager

Rating Summary

FirstLight offers members in the El Paso, Texas area multiple conveniences and a single institution to work with for many financial needs, including checking and savings accounts, loans, investments, and even insurance products.

This El Paso, TX credit union offers robust business services in addition to their personal banking, which makes them an excellent option for business owners who may be shopping for better rates for their company accounts.

With a history of putting their members first and attractive rates that are lower than the state average, FirstLight Federal Credit Union scores 5-stars as one of the best Texas credit unions to consider in 2020-2021.

Popular Article: Top Credit Unions in Pennsylvania | Reviews of the Best Pennsylvania Credit Unions

JSC Federal Credit Union Review

JSC Federal Credit Union is a Houston credit union that’s been serving their community for over 55 years. They are committed to helping their members become financially self-sufficient and successful.

JSC was initially begun to serve employees of Johnson Space Center in Houston. Today, this best Texas credit union offers a full array of financial products and services and has over 124,000 members and over 2,000 Community Business Partners.

This Houston credit union makes it easy to open an account online if you meet their eligibility requirements, which include:

- If you live, work, worship, attend a school or regularly conduct business in the City of Houston, Galveston County or Texas City

- If you’re employed by one of the thousands of member organizations or associations

- If you’re a member of a local church

- If you’re a member of a local homeowner’s association

- If you’re the immediate family member or live in the same household as a current JSC FCU member

Key Factors That Enabled JSC Federal Credit Union to Rank as a Top Credit Union in Texas

Online Account Opening

In today’s world, many people have become accustomed to doing all their banking online, and the ability to open an account with a credit union in Texas without needing to visit a branch is a real convenience.

JSC FCU strives to make it as simple and easy as possible for new members to join. All residents of Texas who are eligible for membership can apply online, and the application process usually takes about 5-10 minutes if you’re not already a member.

Members that wish to open secondary accounts can also do that online without needing to visit a branch.

The online account opening services offered by this top Houston credit union also include the ability to upload any necessary documents and check the status of your application online.

MoneyFIT

MoneyFIT is a program that aims to enable members to become financially fit. This program includes a variety of relevant financial education and workshops and online education modules.

The MoneyFIT program is designed to help members learn more about important financial topics so they’ll have more control over charting a successful future.

Through the program, members can access MoneyFIT Financial Independence Tools that are provided at no cost and include financial seminars and workshops.

Some of the topics covered by the education seminars and workshops include auto buying, estate planning, home buying, holiday spending, ID theft, and social media.

This type of financial education program can make a real difference in many people’s lives and help them gain a better understanding of activities that will put them on the right track to being financially fit.

Rating Summary

Through their low loan rates and attractive checking and savings accounts, JSC has a lot to offer eligible members looking to make the most of their money by partnering with a credit union in TX.

Their focus on financial education is also a bonus for individuals looking to gain more control of their financial future.

Other benefits they offer include the ability to open an account online and their “best rate guarantee” for mortgage loans with no lender fees.

With a wide array of services and a commitment to their members’ financial success, JSC Federal Credit Union is a standout that has earned a 5-star rating as a top credit union in the state of Texas.

Read More: Ranking of the Best Credit Unions in NYC | Top NYC Credit Unions

Conclusion – 2020-2021 Top 15 Credit Unions in Texas

Houston, Dallas, or Austin credit unions or those throughout the rest of Texas and the U.S. differentiate themselves from banks by having their members as their owners.

Membership in a credit union in TX gives you distinct advantages over opening an account at a for-profit bank, which includes the ability to earn dividends and enjoy lower loan rates and higher savings rates.

If you’ve been worried that credit unions in Texas may not have the same offerings as banks, these top TX credit unions show that that’s not the case at all. They offer many identical services including savings/checking accounts, investment products, loans, and even online banking services that are just as robust as a bank.

Each of the top credit unions in Texas included on this list have excelled not just in maintaining their dedication to their members’ financial success, but they’ve also shown a dedication to supporting their local communities in multiple ways.

We hope that this list of the top credit unions in Texas offers you a great starting point for shopping the best financial services for your needs for accounts, loans, and more.

Rate Table Disclaimer

Click here to read Advisory HQ’s disclaimer on the rate table(s) displayed on this page.

Image Sources:

- https://pixabay.com/photos/dallas-texas-city-cities-urban-1740681/

- https://www.credithuman.com/

- https://www.firstlightfcu.org/

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.