Overview: How to Find the Best Reverse Mortgage Companies for Your Needs

Let’s start with the basics – what is a reverse mortgage lender? A reverse mortgage lender is a financial institution that facilitates home loans against the equity of a property for people aged 62 years or older.

In simple terms, reverse mortgage lenders:

- Provide reverse mortgage loans for people over 62 years old

- Converts part of the borrower’s equity into cash

- Helps retirees cope with limited income

- Pays the retiree in lump sums/installments – hence the title “reverse mortgage”

A Popular Option

In the reverse mortgage industry peak in 2009, 115,000 people took out reverse mortgages in the U.S. The popularity of reverse mortgage companies fell due to bad loans and falling house prices, but they are back in favor with U.S. retirees who have equity in their homes. The National Reverse Mortgage Lenders Association revealed jaw-dropping statistics that showed that U.S. homeowners over the age of 62 are holding more that $6 trillion in equity in their homes as of the first quarter of 2016.

In 2014, over 23,000 homeowners took out reverse mortgages. In 2016, the numbers are closer to 30,000, showing that there is a steady growth in the market. Reverse mortgage companies are offering more competitive rates and extra protection to borrowers.

See Also: Mortgage Broker Salary – Full Details on How Much Mortgage Brokers Make

Bad Rap

Many reverse mortgage lenders got caught up in a wave of backlash against reverse mortgages. Many reverse mortgage companies developed a bad reputation because of a slew of scams, false advertising, and bad counseling which left older people vulnerable and even homeless.

It seemed that the whole industry of reverse mortgage companies would collapse in 2011 when top reverse mortgage lenders Wells Fargo and Bank of America announced abruptly that they would no longer be acting as reverse mortgage lenders.

Their withdrawal from the market came as a shock to the world of reverse mortgage lenders. The banks cited falling home prices and the minuteness of reverse mortgages in terms of their overall business as reasons for no longer being reverse mortgage lenders.

However, they may have also feared damage to their reputation. Advocacy groups supporting the rights of the elderly were warning that ads from reverse mortgage companies promising happiness, vacations, and a life free of debt were misleading.

There was a growing number of horror stories about how reverse mortgage companies were taking advantages of older people and failing to warn them that:

- Things can become tricky if the loan recipient needs to go into a care home

- Reverse mortgage loans affect other people if the elder moves/dies

- It is risky not to keep up with taxes and insurance payments

- Heirs may be left with the burden of paying off the loan

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

New Regulations for Reverse Mortgage Lenders

The nightmare stories about vulnerable older people and their families being taken advantage of by reverse mortgage companies did not go unnoticed by the government, who introduced new, tougher regulations for reverse mortgage lenders in April 2015.

Don’t Miss: NASA Federal Credit Union Reviews – What You Should Know (Credit Card, Mortgage & FCU Review)

The new rules have really helped to improve the industry’s reputation, reduce the number of scams and protect people who decide to proceed with a reverse mortgage lender. The new rules have even been endorsed by reputed economist, Nobel Laureate Robert Merton.

Image Source: Protect Your Home

The new rules have meant that reverse mortgage lenders have started to provide more competitive loans in terms of premiums, as low as 0.5%. Other examples of how the new rules have improved the protection of the borrower and their family are that:

- The borrower’s spouse, even if they are a non-borrower, is allowed to stay on in the property for as long as it is their primary residence

- Regardless of the size of the loan, the amount to be paid back at the end of loan/at death of borrower cannot be bigger than the appraised value of the home

Reverse Mortgages – The Basics

If you are thinking about approaching a reverse mortgage lender about a loan, here are a few things you should know.

- The property must be a primary residence – not a vacation or investment property

- All taxes on the property must be kept up to date

- The loan is payable at the end of the loan term or upon death of the last surviving borrower. The estate or heirs will pay the mortgage balance, or up to a maximum of 95% of the current appraised value of the property

- The reverse mortgage lender never owns the home

- The amount available for lend depends on home value, interest rates, and upfront costs

- The older the borrower, the more proceeds they can get

- Only 60% of the total loan can be withdraw, in the first 12 months; the rest can be withdrawn in the 13th month

- You may be able to get a bigger loan if you have debts that need to be paid off

Financial Assessment

The reverse mortgage lender is obliged to carry out a thorough financial assessment of the potential borrower to ensure that the loan is affordable to them. The reverse mortgage lender will take into account:

- Living costs

- Property taxes

- Insurance costs

- Various income (e.g. pension)

Image Source: Christian & Small

If you are applying for a loan with a reverse mortgage lender, they will need you to provide documentation to demonstrate that the loan is affordable to you. They may ask you for:

- Tax returns

- Bank statements

If you would like to be prepared before you go to meet a reverse mortgage lender, you can do some quick calculations online yourself through a number of reverse mortgage calculators. Here are just a few that are available online:

- Reverse Mortgage

- All Reverse Mortgage Company

- CHIP Reverse Mortgage

- Retirement Researcher

- Mortgage Calculator

It is important to bear in mind that there are costs associated with setting up a reverse mortgage loan. These are estimated to be around $5,000 – $30,000, depending on your reverse mortgage lender and the terms and conditions of your loan.

These costs include:

- Application fees and disclosures

- Origination fee

- Mortgage insurance

- Appraisal costs

- Closing fees

- Service fee and set aside

- Interest

- Others

Related: Nationstar Mortgage Reviews – What You Need to Know! (Pros, Complaints, & Review)

Who Are the Best Reverse Mortgage Companies?

The big names like Bank of America are not providing reverse mortgages anymore, and you may never have heard the names of some of the top reverse mortgage lenders in the industry. Because of this, you should do a lot of research to find out who the best reverse mortgage companies are for your needs.

Despite all the new regulations, you will still come across some misleading advertisements. Consumer Financial Protection Bureau carried out a test on 97 advertisements by reverse mortgage lenders. They found that almost all the advertisements were misleading, incomplete, or lacking relevant information.

Popular Article: How to Become a Mortgage Broker (Completed Guide: Requirements, Income, Broker Licence…)

Here are a few great tips on how to find the best reverse mortgage companies.

Go directly to the lender: Although comparison sites can often be helpful to find the best deals on a variety of things, in the case of looking for a reverse mortgage, it is advisable to go straight to the lender to get the most accurate information.

There are lots of places for you to find a comprehensive reverse mortgage lender list. One such reverse mortgage lender list is the HUD Approved Reverse Mortgage Lenders List. This list is recommended because the lenders have to pass various standards to be approved by the U.S. Department of Housing and Urban Development in order to get on this reverse mortgage lender list.

Look at their websites: When you are looking for the best reverse mortgage companies, look at their websites to see if they are providing good, easy-to-understand information about their lending terms and conditions. It is a good idea to look out for reverse mortgage lender websites that have:

- Good levels of information

- Easy-to-use online tools (like reverse mortgage calculator)

- Pre-qualification forms

- Easy-to-access customer support (like live chat)

- Information on counseling

- Information on payment options

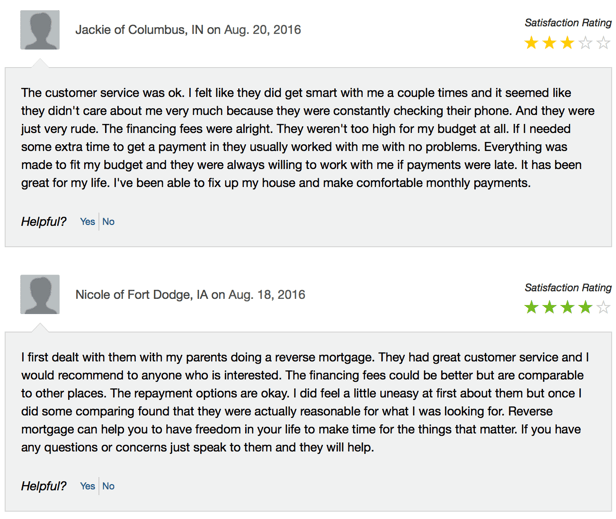

Check reviews and complaints: It is always good to take online reviews with a grain of salt; nonetheless, you might get a good feel for the best reverse mortgage companies in the market by checking out ratings and review sites.

Consumer Affairs is a good place to start when checking out reviews on top reverse mortgage lenders.

Image Source: Consumer Affairs

You can also check up on the reputation of reverse mortgage lenders by finding out if there are many regulatory actions or complaints against them. A comprehensive report released by The Consumer Financial Protection Bureau gives interesting insight into complaints against reverse mortgage companies between 2011 and 2014.

The most common complaints center on changing loan terms and problems communicating with reverse mortgage lenders, but bear in mind that this report came out before new regulations kicked in.

Another way to do the research would be to enter the name of the reverse mortgage lender you are considering with the term regulatory complaint.

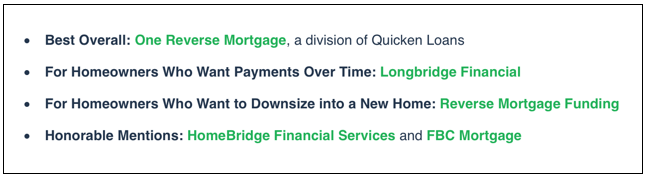

Research sites: There are reviewers out there who have done significant research into the top reverse mortgage lenders, and they can give you a helpful snapshot of who might be the best reverse mortgage lender for you.

Simple Dollar, a reputable personal finance blog, carried out their own research into the best reverse mortgage companies. They based their ratings of top reverse mortgage lenders on:

- Response time to enquiries

- Knowledge of the market and services

- Friendliness of loan officers

Their best reverse mortgage lenders list was categorized according to different needs of borrowers.

Image Source: The Simple Dollar

You can also check out ratings at:

Read the small print: As is the case with any legal arrangement you are entering into, it is vital to read every word of documentation that you receive from your reverse mortgage lender. If you do not understand or are worried about something, talk to your loan officer. You can also talk to representatives from the Department of Housing and Urban Development for an objective view.

Other Options

Reverse mortgages can be confusing, expensive, time-consuming, and worrisome for your family who will have to deal with the aftermath at the end of the loan term. If it does not sound like it is the right option for you and your family but you do need a way to free up some money, there are lots of other options out there for you.

- Refinance: You can approach your bank or mortgage lender about your current traditional mortgage. There may be options for you to lower your payment or lower the interest rate of your payment that will give you a bit more money to play around with.

- Home Equity Line of Credit: This lets you take out credit when you need it – for emergency repairs for example. Don’t forget, though – you will have to pay this back.

- Home Equity Loan: This is like a second mortgage that leverages the equity in your property. One benefit of this type of loan is that the interest is usually tax deductible up to $100,000. However, there are some downsides, such as interest rates that are normally higher than those for Home Equity Line of Credit. Remember, if you do this, your home will be used as collateral.

- Downsize: Is it possible your current home is too big? Are the property taxes too much to manage? Are you finding it hard to maintain your property? One option might be to downsize.

This could be difficult if you have lived in your home for most of your life, but it is a good way to free up some money and live in an environment more suitable to your needs. If you are reluctant for the home to leave the family, you could think about selling it to your children.

Read More: Mortgage Banker (Full Job Description) – What Do Mortgage Bankers Do?

Think It Through

Reverse mortgages can be a great option for people who find a reverse mortgage lender with terms and conditions that suit their needs. Due to the new regulations and improvements in the property market, reverse mortgages are becoming a viable and safe option for retirees once again.

Image Source: Reverse Mortgage

A reverse mortgage could be a sensible way to take the stress from you and your spouse/children about your financial stability in your later years. Some commentators say that reverse mortgages are a great way of preparing yourself for an emergency; even if you never have to draw down on the loan, if you have the mortgage set up, you can quickly access financing, should you need it.

As long as you are aware of the costs, conditions of the loan, and any impact it may have on your family, a reverse mortgage can be a helpful tool to have in your toolbox as you age. In terms of finding the best reverse mortgage companies for you, here are some top tips:

- See if the rules of reverse mortgages are suitable to you

- Use reverse mortgage calculators to get a rough idea of costs and affordability

- Talk to your spouse and family about the process and decision

- Research the best reverse mortgage companies that are accessible to you

- Do not feel pressured by loan officers

- Read all the documentation

We hope you now feel well-equipped to make an informed decision about exploring this route – best of luck with it, and enjoy your golden years!

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.