2017 RANKING & REVIEWS

TOP RANKING SHORT-TERM DISABILITY INSURANCE QUOTES

Discovering the Best Short-Term Disability Insurance

Short-term disability insurance is a very important option to look into if you have been injured while working or have become too ill to work for a short period of time.

Nothing is more important to your livelihood than your work paycheck.

With an individual short-term disability insurance plan, you can take off work feeling safe that you will not miss out on your paycheck.

After all, statistics from the Council for Disability Awareness states that one-quarter of 20-year-olds have a chance of becoming disabled during some point in their career.

Award Emblem: Sites to Find Best Short-Term Disability Insurance Quotes

In order to keep yourself and your family protected in case of such an unfortunate event, looking into the best short-term disability insurance is a must.

However, choosing the best short-term disability insurance plan isn’t as simple as choosing a brand name insurance provider.

After all, each company will provide you with varying short-term disability insurance quotes.

To help save you precious time, we’ve gathered information on some of the best short-term disability insurance plans in order to help you better decide between policy quotes and benefits.

See Also: Top American Express Card Offers & Benefits | Ranking | Compare Top AMEX Card Offers

What to Look for in Short-Term Disability Insurance Coverage

Each short-term disability insurance policy will have different terms and conditions that come into play.

Some of the biggest factors to consider in a short-term disability insurance quote are:

- The start of coverage

- Percentage of your salary that will be paid out

- Duration of coverage

- Tax implications

Start of Coverage

Depending on the short-term disability insurance, short terms disability benefits may only begin to kick in one to 14 days after you are no longer able to work.

If you have existing sick days with your current employer, you may be able to use those before your short-term disability benefits kick in.

It is important to know the exact policies of your private short-term disability insurance.

Salary Percentage

Typically speaking, short-term disability insurance for individuals will pay you around 40% – 60% of your actual weekly salary.

Taking time out to compare a short-term disability insurance quote against another will give you a clearer indication of how much money you can expect to see while utilizing your private short-term disability insurance.

Duration of Coverage

Based on your individual short-term disability insurance policy, the length of your coverage will vary.

On average, even the best short-term disability insurance will typically last somewhere between 9 to 52 weeks.

After that point, it will no longer be considered short-term disability insurance coverage.

AdvisoryHQ’s List of Top 6 Best Short-Term Disability Insurance Quotes

List is sorted alphabetically (click any of the insurance qoutes below to go directly to the detailed review section for that insurance):

Image Source: Pixabay

Top 6 Best Short-Term Disability Insurance Policies | Brief Comparison

Company Name | Benefit Time Period | Injury Pay Start | Elimination Period |

| Aflac | 12 months | 1st day | 14 days |

| ConsumerBenefits.net | 6 to 12 months | varies | varies |

| eHealth Insurance | 12 months | 1st day | varies |

| Growing Family Benefits | 6 to 12 months | varies | varies |

| Mutual of Omaha | 24 months | 1st day | 7 days |

| Zander | 12 to 31 months | 1 – 14 days | 90 days |

Table: Top 6 Best Short-Term Disability Insurance Policies| Above list is sorted alphabetically

FAQ Section

- How much does short-term disability insurance cost?

Short term disability insurance costs will vary depending on the short-term disability insurance quote that you are offered from the company.

On average, short-term disability insurance costs range from $37 – $70 a month for monthly premiums.

- What is the importance of short-term disability benefits?

Your short term disability benefits are incredibly important as they will be helping you keep up your usual standard of living despite being out of work.

You can use many of the short-term disability benefits to pay for food, housing, and other expenses.

- How can I qualify for supplemental short-term disability insurance?

In order to be able to quality for supplemental short-term disability insurance, you must become disabled according to the short-term disability insurance coverage.

You must then remain disabled for the allotted period of time for the short-term disability insurance for individuals to continue staying in effect.

- What happens if I can’t go back to work after my short-term disability insurance coverage runs out?

The best short-term disability insurance policies will help you to move from a short-term disability insurance plan to a long-term policy.

If you are eligible, you will then continue receiving benefits under a different plan.

Don’t Miss: Top Canadian Credit Cards | Ranking | Best Canadian Rewards and Low Interest Credit Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Short-Term Disability Insurance Quotes

Below, please find the detailed review of each card on our list of the top ranking best short-term disability insurance policies. We have highlighted some of the factors that allowed these supplemental short-term disability insurance plans and individual short-term disability insurance quotes to score so highly in our selection ranking.

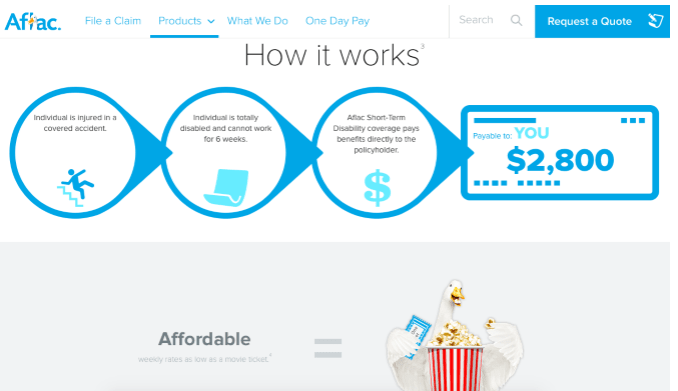

Aflac Review

Aflac has remained one of the best short-term disability insurance providers for workers all throughout the United States.

Aflac understands that the need for short-term disability benefits is important to employees who are undergoing a serious illness or injury.

Overview of the Aflac Short-Term Disability Insurance

Image Source: Aflac

Easily Request a Short-Term Disability Insurance Quote

On their website, Aflac makes it incredibly easy to receive a short-term disability insurance quote that fits into your particular financial and disability situation.

Simply fill out the private short-term disability insurance form with the type of insurance you are looking for along with all of your contact information.

Instead of being emailed a list of possible individual short-term disability insurance quotes, Aflac will put you in contact with a representative from the company that will help you manage your policy.

Affordable Short-Term Disability Insurance for Individuals

Aflac guarantees individuals that they’re one of the best short-term disability insurance providers for those looking to pay a low monthly premium.

Aflac short-term disability benefits are paid directly via direct deposit to the policy holder. Your premium will be based on your age, account, state of issue, and salary replacement.

Related: Top Airline Credit Cards | Ranking | Best Airlines Miles Credit Cards (Reviews)

ConsumerBenefits.net Review

As an insurance agency and brokerage firm, ConsumerBenefits.net offers individuals a fantastic comparison table of some of the top individual short-term disability insurance quotes.

ConsumerBenefits.net claims to offer some of the most affordable short-term disability insurance quotes, allowing you to choose the best plan for your needs.

ConsumerBenefits.net Provides Users With Information on:

- Company name

- State exceptions

- Deductible options

- Coinsurance options

- Money back guarantee

Detailed Review of ConsumerBenefits.net Short-Term Disability Insurance

Variety of Short Term Disability Insurance Quotes

While using the ConsumerBenefits.net website, you’ll be given access to a wide variety of individual short-term disability insurance quotes to choose from.

Each short-term disability insurance quote is directly available from the insurance company’s own plans.

ConsumerBenefits.net lists the lowest prices that you can buy short-term disability insurance for.

Money Back Guarantee

ConsumerBenefits.net offers individuals one of the lowest price guarantees on individual short-term disability insurance.

If you are concerned that you will not have access to the best short-term disability insurance price, then ConsumerBenefits.net will allow you to cancel the policy within 10 days from the date received and get all of your money back.

eHealth Insurance Review

Image Source: eHealth Insurance

eHealth Insurance offers individuals a highly affordable plan to buy short-term disability insurance.

With their short-term disability insurance for individuals, you can find plans that start as low as $0.59 per day.

eHealth Insurance Offers:

- 3,600+ plans

- 16+ carriers

- Affordable rates

- Quick approval

- Flexible terms

Highlights of the eHealth Insurance Short-Term Disability Insurance

Instant Quotes

With access to a wide number of carriers and plans, you can easily be quoted on your short-term disability insurance.

Their private short-term disability insurance planner is simple to fill out, and you are instantly quoted the most affordable price. Once you’ve completed the forum, you’ll be redirected to a page with short-term disability insurance quotes from various companies such as United Health One and The IHC Group.

You can easily see what your deductible and monthly cost will be with each supplemental short-term disability insurance plan.

Flexible Terms

eHealth offers individuals the ability to buy short-term disability insurance for their particular needs.

You can choose to buy short-term disability insurance for 30 days, a month, 6 months, or 12 months.

Their individual short-term disability insurance is adaptable to your requests.

Growing Family Benefits Review

Growing Family Benefits offers financial advice on a variety of different topics, including how to choose the best short-term disability insurance.

Individuals who aren’t well versed in the entire process of short-term disability insurance coverage will find Growing Family Benefits to be highly informative in their short-term disability insurance selection.

Key Features of Using Growing Family Benefits

Informative Advice

Growing Family Benefits is the best short-term disability insurance website to turn to for detailed information on supplemental short-term disability insurance.

Before spending time requesting a quote, the website shows you who would be eligible for short-term disability insurance and who wouldn’t be.

You can save tons of time by reading through the qualifications and coming to your own conclusions about whether or not you’d be approved for short-term disability benefits.

Free Online Disability Quote

Growing Family Advice gives you free access to some of the most affordable prices on individual short-term disability insurance.

You’ll be redirected to a page filled with short-term disability insurance quotes from various partner companies.

Simply provide them with information about your gender, income, occupation, and major health concerns to be given access to some of the best short-term disability insurance plans.

Popular Article: Top Credit Cards for Low Credit Scores | Reviews | Best, Fastest Ways to Build Credit

Mutual of Omaha Review

Having paid over $1 billion in disability claims since 1989, Mutual of Omaha is a committed provider of short-term disability insurance for individuals.

With high rankings from rating agencies such as A.M. Best Company, Inc. and Moody’s Investors Service, Mutual of Omaha is one of the best short-term disability insurance companies.

Mutual of Omaha Provides:

- Needs Assessment Calculator

- Knowledgeable customer service agents

- Disability income choice portfolio

- Disability insurance quote

Key Highlights of Mutual of Omaha Short-Term Disability Insurance

Disability Insurance Quote

Mutual of Omaha makes it easy to compare your short-term disability insurance quote against various premium numbers and monthly benefits.

Their short-term disability insurance quote assessment is up-to-date, and its graphics make it a pleasure to work with.

After you’ve filled out the information, you’ll be presented with a chart of different premium prices on short-term disability insurance coverage. You could get quotes for as little as $18 per month depending in your factors.

Connect with an Agent

After making use of their disability insurance quote, you are under no obligation to sign up with a private short-term disability insurance plan with Mutual of Omaha.

However, if you are interested in solidifying your plan results, you can choose to connect with one of their licensed agents.

Their agents can help you to better understand your short-term disability insurance quote and help you maintain that quote for your short-term disability insurance.

Zander Review

The Zander Insurance Group provides users with a highly detailed short-term disability insurance quote through their website.

Although their disability insurance quote assessment requires more steps to fill out to get your results, you’ll be given careful consideration for your short-term disability benefits.

Overview of the Zander Insurance Group Short-Term Disability Insurance

Instant Quote

With the Zander short-term disability insurance quote, you’ll be asked to fill out very specific and detailed information.

Some of this information includes your occupation class, monthly income, and number of hours you work each week.

All of this information will better assist Zander in providing you with an individual short-term disability insurance quote that is as accurate as possible to what you’ll be paying and receiving.

You’ll instantly receive your quote without having to wait for an agent to get back to you and discuss the best short-term disability insurance plan with you.

The quotes are generally affordable, with the payout matching many of the bigger company premiums and benefits.

AssurityBalanceÒ Century+ Disability Income Insurance

Once you’ve received your short-term disability insurance quote from Zander, you’ll be made aware of whether you qualify for their insurance policy.

Their AssurityBalanceÒ short-term disability insurance policy will protect you in the event that you are unable to work.

Their monthly benefits can reach up to $500 with affordable monthly premiums.

Read More: Top Prepaid Debit Cards | Ranking, Including Prepaid Debit Cards With No Fees

Conclusion — Top 6 Best Short-Term Disability Insurance Quotes

There are a great number of different companies where you can find the best short-term disability insurance.

Many of them offer competitive premium prices and monthly short-term disability benefits that one can choose from.

Receiving a short-term disability insurance quote is as simple as providing your contact information, employment status, and monthly gross income. From there, you can better determine the rates you will be offered by private short-term disability insurance agencies.

Protecting yourself and your family during a disability crisis or illness is of the utmost importance and having a stable income coming in during such a time can help with that.

With this detailed overview of short-term disability insurance for individuals, you can better decide on the best short-term disability insurance plan for your financial situation.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.