Intro: Best Investment Apps & Micro Investing Platforms for Beginners

The thought of jumping into the world of investing can be an intimidating thought, especially if this is your first time learning how to grow your finances.

While there are plenty of options to choose from for the best investment apps, it isn’t always easy to find the best investing apps for beginners.

Two popular micro investing platforms, Stash and Acorns, are widely considered to be the best investment apps for newbies and young investors to try.

Before you rush to your app store and start the downloading process, how do you know which of these best investment apps will fit your financial needs?

In our comparison review of Stash vs. Acorns, we’ll look at the basic structure, fees, strengths, and weaknesses of these best investment apps to help you decide which best investing app for beginners is right for you.

See Also: Mint App Review – All You Need to Know About Mint App (Reviews and Ranking)

Stash vs. Acorns Review | What is Micro Investing?

These best investment apps are similar in that they offer different types of micro investing. A micro investing platform allows users to invest small amounts of money at a time, rather than hundreds of dollars.

Because micro investing focuses on smaller dollar amounts, these platforms are often considered the best investing apps for beginners in terms of affordability and accessibility.

Of the two, Acorns is the best example of a micro investing platform, since users can quite literally invest pennies at a time by rounding up their purchases.

Although it doesn’t provide the same round-up feature, Stash is a popular Acorns alternative for micro investing since anyone can start investing with $5.

No matter whether you choose Stash vs. Acorns, both micro investing apps carry the same general benefits: they make it easy for investors of all experience levels to grow their savings incrementally over time.

Don’t Miss: (BillGuard vs Mint) BillGuard Review – Is BillGuard Safe? Most Powerful Finance App

Stash vs. Acorns Review | Investing Process

Although these best investment apps share similar goals, there are some key differences when it comes to the investment process and user experience.

Below, we’ll compare Acorns vs. Stash to see the basics of how each best investing app for beginners works.

Acorns Investing Process

The basic process behind this micro investing app can be summed up in three steps:

- Connect any accounts and cards used on everyday purchases

- The app will round up all purchases to the nearest dollar

- Your spare change will be invested

Along with investing spare change, users of this best investing app for beginners can choose recurring or one-time transfers to their investment account. Any investments will be applied to Exchange-Traded Funds (ETFs) comprised of stocks and bonds.

After identifying financial goals and risk tolerance, Acorns will recommend a portfolio of various ETFs for users to invest their spare change in.

While comparing Acorns vs. Stash, our review also found that Acorns increases potential savings through their Found Money® program.

With this program, users spending money with participating brands receive an automatic investment in their account. Participating brands include Apple, Airbnb, Birchbox, Groupon, Warby Parker, and more.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Stash Investing Process

When comparing Stash vs. Acorns, the investing process is slightly more involved—but some users may find that Stash provides a much more personalized experience.

The basic process behind this popular Acorns alternative can be summed up in the following steps:

- Receive personalized recommendations based on financial goals and risk tolerance

- Choose from over 30 ETFs to create your own portfolio

- ETFs are categorized based on personal interests and values

The last bullet-point is what truly sets Stash apart when comparing Stash vs. Acorns (or Stash vs. Any Other Investing App).

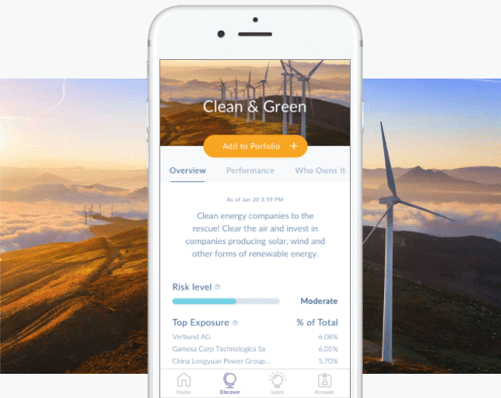

Rather than listing confusing financial jargon, this best investing app for beginners takes into consideration that not everyone is a financial expert. Instead, Stash gives each ETF a nickname based on the values and characteristics of the industries within it.

A few examples include:

- American Innovators—National tech companies that are changing the world

- Clean & Green—Companies investing in renewable energy

- Delicious Dividends—Companies that consistently pay dividends

- Global Citizen—Over 7,000 assets across 40 countries

- Water the World—Companies that help conserve, purify, and transport fresh water

Like Acorns, this best investing app for beginners allows for automatic or manual transfers to your investment account (the recommended amount is $5-$10 weekly).

Related: Best Budget Apps | Budgeting Software Reviews

Stash vs. Acorns Review | Fees & Pricing

If you’re looking for the best investing apps for beginners, it’s likely that you’re also looking for micro investing apps with the best value for your money.

In the sections below, we’ll compare Acorns vs. Stash to see how each of these best investment apps stack up in terms of fees and pricing.

Acorns Fees & Pricing

Acorns fees are few and far between, making this micro investing platform one of the best investing apps for beginners on a budget.

Creating an account is free, and the Acorns app is readily available on both iTunes and Google Play. Additionally, there are no Acorns fees for the following:

- Moving money in and out of your account

- $0 balances

There are a few Acorns fees that users will need to prepare for, which includes a monthly fee of $1 for accounts under $5,000. Any accounts at $5,000 and over will have an annual fee of 0.25 percent, charged monthly.

While researching Acorns fees, our Acorns vs. Stash review found that Acorns provides additional discounts for college students. Students that sign up with a valid email address receive four years of free service, encouraging early investment habits.

Stash Fees

When comparing Stash vs. Acorns, it’s hard to find a clear winner between Stash fees and Acorns fees.

In fact, both Acorns and Stash have the same pricing structure, making it easy for new investors to find the best investing apps for beginners on a budget.

There are no Stash fees for the Apple or Android app, and users benefit from the following fee-free transactions:

- Free withdrawals

- No add-on commissions or trading fees

Our Stash vs. Acorns review did find a few Stash fees for additional transactions, like insufficient funds or paper statements, though the average user should only rarely encounter these.

The remaining Stash fees match those from Acorns. Accounts under $5,000 have a fee of $1 per month, while accounts over $5,000 will have an annual fee of 0.25 percent.

While Stash does not appear to offer a discount for college students, all new users receive their first month free of charge, making it a best investing app for beginners on a budget.

Popular Article: CountAbout Reviews | Guide | Online Budget Alternative to Quicken & Mint

Stash vs. Acorns Review | Strengths & Weaknesses

Although these best investment apps share many similarities, their varying investment structures highlight a few unique strengths and weaknesses for investors to consider.

Stash vs. Acorns—Strengths & Weaknesses

When comparing Stash vs. Acorns, new investors should consider the following strengths:

- Less confusion due to the elimination of investment jargon

- Ability to choose investments based on values and personal interests

- Customized portfolios based on personas like The Activist and The Trendsetter

- First month without any Stash fees

- Start saving for retirement with Stash Retire

When deciding between Stash vs. Acorns, new investors should consider the following weaknesses:

- Cannot invest in individual stocks or bonds

- Depending on your investment needs, 30 ETFs may be limiting

- Stash fees apply for paper statements or insufficient funds

- Account is only accessible via mobile app

Acorns vs. Stash—Strengths and Weaknesses

As one of the best investment apps, Acorns has a lot of positive characteristics, including the following strengths:

- Automatic portfolio rebalancing

- Easy, hands-off investment strategy

- Free membership for college students

- Earn additional deposits through Found Money®

- Can access via app or desktop

If you’re choosing between Acorns vs. Stash, there are a few weaknesses to consider, including:

- Cannot invest in individual stocks or bonds

- No introductory period for Acorns fees

- No options for retirement savings accounts

- Traditional ETF categorization may be confusing for new investors

Read More: Learnvest vs Mint | Ranking, Comparison & Competitors

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Choosing Stash vs. Acorns for the Best Investing App for Beginners

When it comes to the best investing apps for beginners, Stash and Acorns are both solid choices.

As one of the best investment apps—and a top micro investing platform—Acorns makes investing both affordable and worry-free by dealing with small increments of cash.

On the other hand, with a low investment minimum and creative, value-based categorization, Stash continues to be a strong Acorns alternative.

As far as fees are concerned, comparing Stash vs. Acorns yields similar results, which makes them both affordable options for the best investment apps.

Ultimately, choosing between Acorns vs. Stash will come down to basic investing features.

Would having creative categorization make investing into a simpler, more engaging process? Do you want the option to contribute towards retirement savings accounts? If so, you will want to choose Stash when deciding between Stash vs. Acorns.

Does your personal best investing app for beginners include automatic portfolio rebalancing? Could you potentially earn more through participating in the Found Money® program?

If so—or if you are a college student—you will want to consider Acorns when comparing Acorns vs. Stash.

While these best investment apps are both excellent choices, keep in mind that you should choose the best investing app for beginners that matches your unique financial goals.

Image sources:

- https://www.pexels.com/photo/blur-close-up-depth-of-field-device-407237/

- https://www.acorns.com/

- https://www.stashinvest.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.