Overview: How to Get Student Loans Without a Cosigner

Attending college, whether it be a community college or an out-of-state university, can be a costly experience.

Many students cannot afford to pay out of pocket and need to secure student loans. If your parents do not want to or are unable to cosign on your student loans, you could find yourself in a bind. Obtaining student loans with no cosigner is possible, but you need to carefully consider which type to choose.

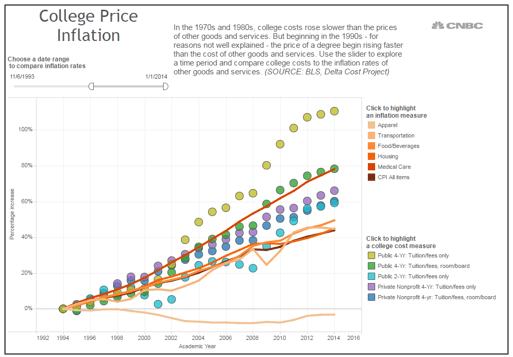

As more students graduate high school and flock to local colleges and prestigious universities, there is an increasing need for outside financial assistance. The fact is that college tuition has been rising steadily, and most families cannot afford to shoulder the cost on their own anymore.

Image source: Gettyimages

In this case, 17 and 18-year-old students must venture out into the world of student loans. These students often have questions, such as:

- What options are there for financial aid and student loans?

- Are there school loans without cosigners?

- Can you get federal student loans without a cosigner?

- Can you get private student loans with bad credit and no cosigner?

- Is it possible to obtain student loans without a cosigner and bad credit or no credit at all?

There are numerous options for funding your college education, but if you find yourself in a tough financial situation, it can be a bit more difficult. If you are looking to go to college and are interested in learning how to get student loans without a cosigner or if it is even possible to get federal student loans without a cosigner, then keep reading.

In this review, we explain how it is possible to get a student loan without a cosigner and even how to obtain student loans without a cosigner and bad credit.

See Also: Finding the Best Student Accounts | What You Should Know

What Options Are Available for College Financing and Student Loans?

College expenses are rising faster than the cost of any other services or goods in the United States. Each year, over $100 billion is borrowed to pay for college. As college tuition continues to rise, families cannot cover the full costs. This leaves students looking for ways to obtain financing such as through student loans with no cosigner.

Source: CNBC

However, it is important to know that there are options besides looking for a private student loan without a cosigner. The total student debt outstanding amasses $1.2 trillion. Before contributing to this debt, it is important to first consider all other options possible. There are several choices for student loans without a cosigner as well as financial aid. Options for financing include:

- Financial aid

- Federal Stafford Loans

- Parent PLUS Loans

- Perkins Loans

- Private student loans

The first step in any college financing should involve applying for any scholarships you may qualify for and filling out a Free Application for Federal Student Aid (FAFSA) form. This form is required by many colleges and will determine how much financial aid you are likely to receive.

Filling out the Free Application for Federal Student Aid (FAFSA) form will also automatically qualify you for low-cost federal student loans. You can get federal student loans without a cosigner, and the annual percentage rates on undergraduate student loans total to about 4.1%.

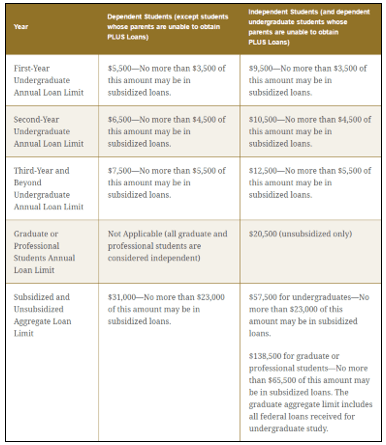

The annual percentage rates on these federal Stafford Loans are much cheaper than other student loans without a cosigner. However, there are limits on the amount you can borrow, as shown below.

Source: Federal Student Aid, an Office of the U.S. Department of Education

You also need to fill out the FAFSA form if you are interested in PLUS Loans for parents. These are loans that are offered through universities or colleges to parents who have good credit. However, these are not student loans without a cosigner. Also, the interest rates on PLUS Loans for parents can be upwards of 7% but are capped at 10%.

Another option for student loans with no cosigner are Perkins Loans. These loans are offered by colleges to students with severe financial need and are capped at an interest rate of 5%. However, the maximum you can borrow is $4,000 per year, for a maximum of $20,000.

If a combination of these options does not cover your total financial needs, then you should think about taking out private loans. However, there are some things that you will want to consider with private loans. This is especially true if you are looking for private student loans with bad credit and no cosigner.

Don’t Miss: Sallie Mae Reviews (Loan Forgiveness, Student Loans, & Account Reviews)

Things to Consider When Looking for School Loans Without Cosigners

When searching for student loans with bad credit and no cosigner required, there are several factors to take account of:

- Your anticipated starting salary

- Interest rates

- The loan amount

The first thing that you need to consider when looking for student loans without a cosigner is what the average starting salary in your field will be. If you are getting a biomedical engineering degree, your starting salary will likely be more than someone coming out with a communications degree.

If you need help determining this, you can utilize the U.S. Department of Labor Occupational Outlook Handbook. It is important to know an estimate of what you will be earning after graduation, especially when looking for student loans with no cosigner.

Student loans without a cosigner often come at a cost, which is generally in the form of higher interest rates. While federal loans are capped, private student loans without cosigners can have interest rates that reach 12%. That lofty interest rate also comes with origination fees and other variable charges. Therefore, a private student loan without a cosigner should be your last resort.

When you are taking out a student loan without a cosigner, you need to make sure that you are only taking out what you will need to cover school and basic living expenses. It may seem tempting to take out more when applying for student loans without a cosigner, but this is not a smart decision.

The average cost of tuition and fees at a public four-year school was $9,139 in 2016, and for private four-year schools, this annual number rises to $31,231. When you are borrowing a large sum of money, taking out an extra few thousand to cover a vacation or used car might seem insignificant, but with interest rates that can reach 12%, you will end up paying more than necessary in the long run.

Related: Key Reasons Not to Pay off Your Student Loans Now

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What You Need to Know About Getting Private Student Loans with Bad Credit and No Cosigner

When looking for private student loans without a cosigner, you generally need to meet the following criteria:

- Be a United States citizen: Most private lenders, such as Sallie Mae and Wells Fargo, only offer student financing to U.S. citizens.

- Have good income: To secure a private student loan without a cosigner, you will need to have a stable income. Summer and part-time jobs do not count.

- Have good credit history: Many private lenders are looking for individuals hoping to obtain student loans with no cosigner that have a 660 minimum credit score.

This last requirement really makes getting private student loans with bad credit and no cosigner very difficult. Undergraduate students that recently left high school often do not have credit cards, loans or bills in their names.

This makes it tough for a lending agency to determine if they will make loan payments on time. That is why if you do not have credit or have a credit score falling under 660, you will likely need a cosigner for a private loan.

The chances of getting a private student loan without a cosigner do increase over time. A study by the research firm Measure One shows that, in 2016, 40% of graduate students were able to obtain a private student loan without a cosigner.

This compares to only 6% of undergraduate students who were able to get private students loans without a cosigner. So, if you are able to improve your credit score before applying for a private student loan without a cosigner, that is the best option. If not, you may find yourself paying exorbitant interest rates that will set you back financially.

Where Can You Get Student Loans with Bad Credit and No Cosigner?

To put it simply, it is almost impossible to get student loans without a cosigner and bad credit.When you are looking to achieve this, your options are almost nonexistent. Only federal student loans do not require credit checks.

Private lenders will certainly conduct a credit check, and if you have no credit or a bad credit score, they will require a cosigner on the loan.

If you are seeking student loans with bad credit and no cosigner, your best bet would be to contact a few financial lenders to see if they have minimum credit score requirements for granting a student loan without a cosigner. Private lenders can be found through your university or through sites, like privatestudentloans.com, which help compare private student loan options from reputable lenders.

When you are considering student loans without a cosigner and bad credit, make sure that you do not jump at the first offer.

Chances are that if a private company offers student loans with bad credit and no cosigner required, its interest rates will be exorbitant, or it will be a scam. If possible, always work with legitimate lenders and thoroughly research any company that offers you a loan, especially one that offers student loans without a cosigner and bad credit.

Conclusion

When you are looking to obtain student loans with no cosigner, remember that there are many factors to consider, such as types of loans and interest rates. The same holds true for federal student loans without a cosigner and private student loans with bad credit and no cosigner.

It is important to go through the process of applying for financial help in a systematic matter.

First, apply for any scholarships that your college, high school or local businesses may offer to high school students. Then, apply for financial aid by filling out a FAFSA form, followed by looking into federal student loans without a cosigner. Your last resort should be taking out private student loans.

Also, if you secure a student loan without a cosigner, be sure it is only for the amount that you will need for college and basic living expenses. While obtaining school loans without cosigners is possible, loans are serious financial matters. If taken lightly, you could find yourself in bad credit and debt for the rest of your life.

Popular Article: Best Private Student Loan Providers – Best Place for Student Loans

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.