Intro – Tampa Bay Federal Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in Tampa, FL, a list that included Tampa Bay Federal Credit Union.

Below we have highlighted some of the many reasons Tampa Bay Federal Credit Union was selected as one of the best credit unions in Tampa, FL.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Tampa Bay Federal Credit Union Review

Like many of the other credit unions in Tampa FL we’ve reviewed, Tampa Bay Federal Credit Union has been in business for many years – since May 23, 1935, to be exact. Fun fact: in its early days, its assets were kept in a Hav-A-Tampa cigar box.

At the outset, Tampa Bay Federal Credit Union served City of Tampa employees. Today, the Tampa credit union has extended its service to the larger Tampa Bay community. Prospective members can join in three ways:

- Join Prime Time Club for a one-time, non-refundable $5 fee.

- Be employed by a company that is a Tampa Bay Federal Credit Union affiliate. Affiliates, or Select Employee Groups (SEGs), can be added if your company is not currently a member, giving your coworkers access to this Tampa credit union, too.

- If someone within your immediate family is a Tampa Bay Federal Credit Union, you can join, too.

Image Source: Tampa Bay Federal Credit Union

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our Tampa Bay Federal Credit Union review, Tampa Bay Federal Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

Tampa Bay Federal Credit Union Review: MoneyDesktop

Members who use the Tampa Bay Federal Credit Union’s online banking function can benefit from its MoneyDesktop feature as well. The online money management tool makes budgeting and controlling your finances easy, in one central location. You can:

- Aggregate: See a holistic view of your finances by aggregating various accounts in one place, including accounts from different institutions.

- Expense Tracking: This feature allows you to see where your money is going by tracking where, when, and how you spend to give you valuable insights into your spending patterns and help you create a budget based on your unique financial situation.

- Budgets: The interactive budgeting tool uses circles, a.k.a. “bubbles,” to illustrate your budgets, including their size, spending progress, and which ones need the most attention.

- Security: Whether you access MoneyDesktop on a personal computer or a mobile phone, the application is private and secure.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

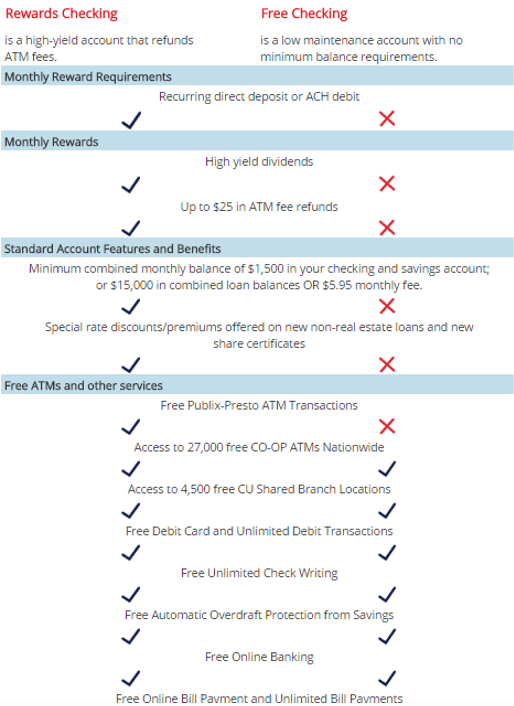

Tampa Bay Federal Credit Union Review: Free or Rewards Checking

Whether you choose the free or rewards checking accounts, there are benefits to be had. If you prefer a low-maintenance account without having to worry about maintaining a minimum balance, the free checking option is for you. On the other hand, if your goal is high returns you’d be wise to choose the rewards checking, which provides up to $25 in ATM fee refunds. The rewards checking requires a $9.95 monthly fee, a minimum monthly balanced of $1,500 combined in your checking and savings accounts, or a minimum $15,000 loan balance. However, you’ll benefit from greater dividends and special rate offers on real estate loans and share certificates.

You can compare the two accounts below:

Source: Tampa Bay FCU Checking

Tampa Bay Federal Credit Union Review: Turn Your Auto Loan into Cash

Refinance your auto loan with Tampa Bay Federal Credit Union and you’ll receive $199 in your pocket as an incentive. Rates start as low as 1.99% APR, so switching to this Tampa credit union could save you even more money in monthly payments. The offer extends to holders of car loans over $15,000.

In addition to reviewing the above Tampa Bay Federal Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

Top Rated Banks

Top Banking firms

Review of Top Mortgage Firms

Bank Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.