2017 RANKING & REVIEWS

TOP RANKING CREDIT UNIONS IN TAMPA, FLORIDA

Intro: Finding the Top Credit Unions in Tampa, FL

Credit unions are popular in Florida, and Tampa is no exception. In fact, Tampa credit unions are among the most reputable in the state of Florida.

Bank fees can be exorbitantly high, leading some people to turn to credit unions. Credit unions, including the top Tampa credit units are similar to banks in their financial product and service offerings, providing checking and savings accounts, loans, and investment products like Certificates of Deposit (CDs).

As member-driven, not-for-profit financial institutions, credit unions in Tampa can often offer significant savings when it comes to fees, as well as high dividends.

These key differences allow credit unions in Tampa to focus on serving their members instead of corporate investors and shareholders.

Award Emblem: Best Credit Unions in Tampa, FL

Award Emblem: Best Credit Unions in Tampa, FL

When you join a Tampa, Florida credit union, your initial deposit makes you one of the owners of the institution. Essentially, a credit union’s members are its shareholders, so they operate in the interest of their members. This is why membership to credit unions in Tampa is normally limited to a specific group of people, such as employees of specific companies and their immediate families.

Though some credit unions may have fewer options than banks, as well as fewer physical locations to choose from, many members report better customer service and greater flexibility.

If you’re considering using a credit union in Tampa, you’ve come to the right place. Tampa credit unions are plentiful, and we’ve compiled a list of the best 11 best institutions in the region.

List of the Best Credit Unions in Tampa, FL

- Florida Customs Federal Credit Union

- Floridacentral Credit Union

- Grow Financial Federal Credit Union

- GTE Financial

- PowerNet Credit Union

- Railroad & Industrial Federal Credit Union

- St. Joseph’s Hospital Federal Credit Union

- Suncoast Credit Union

- Tampa Bay Federal Credit Union

- Tampa Postal Federal Credit Union

- USF Federal Credit Union

This list is sorted alphabetically (click any of the above names to go directly to the detailed review for that credit union)

Methodology for Selecting the Top Credit Unions in Tampa, FL

What methodology did we use in selecting this list of best credit unions in Tampa, FL?

Using publicly available sources, AdvisoryHQ identified a wide range of credit unions that provide services in Tampa and the surrounding areas.

We then applied AdvisoryHQ’s “Breakthrough Selection Methodology” to identify the final list of top credit unions that provide services to communities in and around Tampa, FL.

Top Credit Unions in Tampa, FL

| Credit Union | Location |

| Florida Customs Federal Credit Union | Tampa |

| Floridacentral Credit Union | Tampa |

| Grow Financial Federal Credit Union | Tampa |

| GTE Financial | Tampa |

| PowerNet Credit Union | Tampa |

| Railroad & Industrial Federal Credit Union | Tampa |

| St. Joseph’s Hospital Federal Credit Union | Tampa |

| Suncoast Credit Union | Tampa |

| Tampa Bay Federal Credit Union | Tampa |

| Tampa Postal Federal Credit Union | Tampa |

| USF Federal Credit Union | Tampa |

(List is sorted alphabetically)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Detailed Review – Top Ranking Best Credit Unions in Tampa, FL

Below, please find the detailed review of each firm on our list of top credit unions in Tampa.

We have highlighted some of the factors that allowed these Tampa credit unions to score so highly in our selection ranking.

Florida Customs Federal Credit Union Review

The Florida Customs Federal Credit Union (Florida Customs FCU) has been serving the financial needs of its members in the Tampa region since 1935.

Like most credit unions, however, membership is not available to the general public. Rather, all employees of the Bureau of Customs and Border Protection and the Bureau of Immigration and Customs Enforcement in the state of Florida and their families can become Florida Customs FCU members.

The Florida Customs FCU is overseen by the National Credit Union Administration (NCUA), adding another layer of validity to the institution.

Image Source: BigStock

Image Source: BigStock

Key Factors that Enabled This Firm to Rank as a Top Tampa Credit Union

Below are key factors that enabled Florida Customs FCU to be rated as one of this year’s top credit unions in Tampa, FL.

Member Benefits

This Tampa credit union is a great choice for eligible members because it offers the following benefits:

- Regular share (savings) accounts offer high dividends

- Free share draft (checking) accounts with direct deposit

- Free ATM/VISA checking card

- Free overdraft protection with checking accounts

- National Credit Union Share Insurance fund insurance of up to $250,000

Once a Member, Always a Member

As mentioned, Florida Customs FCU membership is open only to employees of the Bureau of Customs and Border Protection and the Bureau of Immigration and Customs Enforcement in the state of Florida and their families. However, your membership will not be revoked if you move or change jobs. You can be a member of this Tampa credit union for life if you so choose.

Shared Branching

Though it is headquartered in Tampa, the shared branching function allows members to conduct most financial transactions at CU Shared Service Centers. This shared branching network of credit unions gives members access to over 5,000 locations worldwide.

Loans

The following loans are available to Florida Customs FCU members, making it among the best credit unions in Tampa:

- Auto loans: Qualified buyers can benefit from low rates and up to 100% financing with fixed rates. If you hold an auto loan with another financial institution, refinancing is also an option.

- Personal loans: Up to $10,000 in personal loans with varied rates, depending on the borrowers’ individual financial situation.

- Share Secured Loan: According to the Florida Customs FCU website, “For the lowest interest rate, a loan may be secured or collateralized by shares in your share account.” This allows you to make purchases without dipping into your savings. Instead, you can borrow up to the amount in your share account at a low rate.

Online Banking

Members of this Tampa credit union can sign up for Home Banking with Florida Customs Federal Credit Union. This allows access to accounts anytime and anywhere that has internet access. You can then view account balances, transfer funds between accounts, make loan payments, and balance your account.

PowerNet Credit Union Review

Powernet Credit Union is Florida’s largest labor-based credit union. Since 1961, the Tampa credit union has been serving local Building and Construction Trade Unions and their members across the state. According to Powernet’s website, the following individuals and groups can become members:

“Membership is open to all Florida building and Construction unions, their members, retirees as pensioners or annuitants of said local unions, spouses of members that died while a member, and organizations/affiliations of unions which includes employees of the union and their families.”

To start, new members must deposit a minimum of $25 in a savings account. Beyond the initial deposit, there are no fees to join.

Key Factors that Enabled This Firm to Rank as a Top Tampa Credit Union

In addition to its checking and savings accounts, Powernet Credit Union boasts several unique features that offer added value to members. Below are key factors that enabled Powernet Credit Union to be rated as one of this year’s top credit unions in Tampa, FL.

PowerPay

For $5 per month, members can take advantage of this Tampa credit union’s online bill payment service, PowerPay. After adding a payee, subsequent bill payments can be made with just a few clicks – or even set up for payments to be made automatically. Password protection ensures that payments and account information are secure.

Additionally, if members make one or more payments every 6o days, the monthly fee is waived. One of the following criteria must also be met:

- A regular direct deposit is set up to your Powernet Credit Union account

- Your balance is maintained at an average total of $2,000

- You hold an active loan (excluding MasterCard)

Financial Planning Expertise

Member access to top financial planning and wealth management is another reason Powernet Credit Union is one of the recommended Tampa credit unions. Through a partnership with Money Concepts International Financial Planning Network, this credit union in Tampa has the resources and expertise necessary to offer such services. While professional financial planning was once a luxury service available only to the affluent, both Powernet and Money Concepts aim to offer sound financial planning to everyone.

Powernet’s Wealth Management division can help you grow your wealth through:

- Financial planning

- Asset management

- Retirement planning

- Pension rollovers

- Union-friendly and socially conscious investments

- 401(k)’s and IRAs

- Education planning

- Stocks, bonds, and mutual funds

- Annuities (fixed and variable)

- Life and long-term care insurance

Co-op Shared Branches

Powernet is affiliated with the Co-op Network, the Presto! network, the STAR(sm) network, and the Cirrus network. This means that, as a member, your Powernet Credit Union debit card will work at thousands of locations globally, including 300 shared co-op branches in Florida and 5,000 across the United States. You can make deposits, withdrawals, find out your account balance, make loan payments, transfer funds, and purchase money orders at any of these shared locations.

While this is certainly convenient, keep in mind that Point of Sale (POS) purchases, which allow you to make purchases directly with your Powernet debit card, are only available at participating locations. Participating stores include Publix, Wal-Mart, the United States Post Office, and Winn-Dixie, among others.

The good news is that these POS purchases are free of charge. However, if you regularly make purchases with your debit card, you may wish to do more research or look beyond Powernet for a Tampa credit union

Railroad & Industrial Federal Credit Union Review

The Railroad & Industrial Federal Credit Union was founded by 14 railroad employees in Tampa in 1935. The Tampa credit union that originally held just $70 in assets now has over $300 million held by its more than 32,000 members. It has 8 locations in Tampa and the surrounding area, as well as secure online and mobile banking options.

Employees of CSX Railroad and of Railroad and Industrial Company Groups and their families are eligible for membership with this credit union (Tampa). Eligible members can open a savings (share) account with a $5 deposit, after which time they can open other banking and loan accounts.

Like all credit unions in Tampa and nationwide, the Railroad & Industrial Federal Credit Union’s leadership consists of a Board of Directors, Supervisory Committee, and an Executive Team, and it is operated in the interest of its shareholders.

Key Factors that Enabled This Firm to Rank as a Top Tampa Credit Union

So, what makes this Tampa credit union unique? The following factors led it to be ranked among the best credit unions in Tampa and the surrounding area this year.

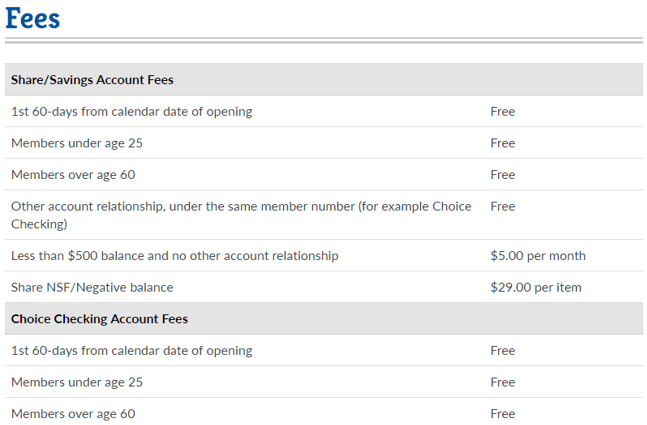

Students and Seniors Bank for Free

The Railroad & Industrial Federal Credit Union recognizes the unique banking needs and challenges of students and seniors. It offers fee-free checking and savings accounts to both of these groups, making it a Tampa credit union of choice. Check out the full fee schedule to review the details.

Image Source: Railroad & Industrial Federal Credit Union

PC Connect

PC Connect is the Railroad & Industrial Credit Union’s online banking program. Available 24/7, PC Connect allows you to check your account balances, manage transfers, make bill payments, set up Text Alerts, and make transfers, withdrawals, and deposits. Best of all, you can enroll in the PC Connect program online or by contacting Member Services.

eAlerts

The Railroad & Industrial Federal Union is an ideal Tampa credit union choice for avid smartphone users. EAlerts allow you to stay updated on your account balances and activity through text messages that let you know when there is activity in one of your accounts. Members using PC Connect can participate by setting up eAlerts on the online banking platform.

Mobile Wallet

If you’re a tech savvy banker, the Railroad & Industrial Federal Credit Union (Tampa) Mobile Wallet platform could make managing your finances easier and more convenient. By linking your debit and/or credit cards with Apple Pay, Android Pay, or Samsung Pay, you can make purchases securely from thousands of merchants globally on your smartphone.

St. Joseph’s Hospital Federal Credit Union Review

Established in 1960, St. Joseph’s Hospital Federal Credit Union (SJHF) is a top credit union in Tampa, FL. The SJHF Credit Union is open to employees and retirees of the following institutions, as well as their immediate families, with an initial deposit of $5:

- St. Joseph’s Hospital

- St. Joseph’s Women’s Hospital

- St. Joseph’s Children’s Hospital

- St. Joseph’s Hospital-North

- St. Joseph’s Hospital-South

- SDI Radiologist

- Baycare Outpatient Imaging

- Same Day Surgery

- Diagnostic Center

- Home Health Care

- Healthpoint

- John Knox Village

- Clinical Billing Systems

Moreover, SJHF Credit Union received a 5-star rating in March 2016 from Bauer Financial, further emphasizing it as a top credit union in Tampa, FL.

Key Factors that Enabled This Firm to Rank as a Top Tampa Credit Union

Below are key factors that enabled St. Joseph’s Hospital Federal Credit Union to be rated as one of this year’s top credit unions in Tampa, FL.

Visa Debit Card with Secure Chip Technology

SJHF Credit Union’s chip-embedded Visa debit card allows members to benefit from greater security and to use their card in more global locations. When you use your card for Point of Sale purchases, a microchip in your card protects against fraud. SJHF Credit Union explains how: “Information programmed into the chip is personalized for your account and each transaction generates a unique code, adding an extra safeguard against unauthorized use and counterfeiting.”

Cards can still be swiped in the traditional fashion if a merchant’s terminal is not yet enabled for chip cards. Existing members will have already received their chip card, as will all new members of this Tampa credit union going forward.

Top Ranking Credit Unions in Tampa, Florida

Visa Secured

Looking to establish or improve your credit? SJHF Credit Union might be the Tampa credit union for you! Its Visa Secured card requires cardholders to make a minimum $500 deposit to establish their credit line. You can then start making purchases with the card and establishing your payment history.

Free Share Draft Checking

With SJHF Credit Union free share draft account, it gives its members the perfect way to manage their finance, with no minimum balance or even a direct deposit requirement. Along with these incentives, it also offers:

- Visa Debit Card: use anywhere Visa is accepted and includes an embedded chip for peace of mind

- Free Online Banking: manage your accounts, transfer money, and conduct your banking online for free

- Free Mobile Banking: manage your accounts on the go with SJHF Credit Union TouchBanking app, mobile we page or text banking

- Free Call 24: access your account anytime by calling 813-870-4560

- Free Online Bill Pay: save yourself a trip to the bank by banking online. You can pay bills, schedule payments and more.

Suncoast Credit Union Review

Founded by several local educators in 1934, Suncoast Credit Union is now the largest financial institution based on Florida’s west coast. Originally serving Hillsborough County teachers solely, this Tampa credit union now extends membership to all school employees and their immediate family members in the following 21 counties: Charlotte, Citrus, Collier, DeSoto, Dixie, Gilchrist, Glades, Hardee, Hendry, Hernando, Highlands, Hillsborough, Lee, Levy, Manatee, Marion, Pasco, Pinellas, Polk, Sarasota and Sumter.

In fact, prospective members can check their membership eligibility quickly and easily on Suncoast’s website.

Suncoast is a full-service Tampa credit union, offering banking, lending, and investment products.

Key Factors that Enabled This Firm to Rank as a Top Tampa Credit Union

Keep reading to learn why this firm is ranked as one of this year’s top credit unions, Tampa, FL.

Exceptional Operational Efficiency

Interestingly, the firm boasts expense ratios that are at least half that of other Tampa credit unions, according to Suncoast’s website. This allows it to operate more efficiently than its competitors. In turn, members receive significantly higher dividends and lower rates.

Pet Insurance

Not all credit unions in Tampa, FL, offer pet insurance. Fortunately for pet owners, Suncoast Credit Union does. Veterinary care can be extremely high, making coverage a no-brainer. Benefits of pet insurance with Suncoast include:

- Nationwide coverage for dogs, cats, birds, and exotic pets for broad medical problems caused by illness and accidents

- 5% discount for Suncoast members

- Care by any licensed veterinarian

- Additional coverage for routine medical care like vaccinations, deworming, and spay/neuter procedures

It’s a win-win for you and your four-legged sidekick.

Umbrella Insurance

Insurance policies can be confusing, not to mention stressful when you’re near your policy’s limits. In times like these, umbrella insurance kicks in once your existing policy is exhausted, ultimately providing an extra layer of protection.

Umbrella insurance coverage starts at $1,000,000, though higher coverage is available, covering all family members as well as legal fees.

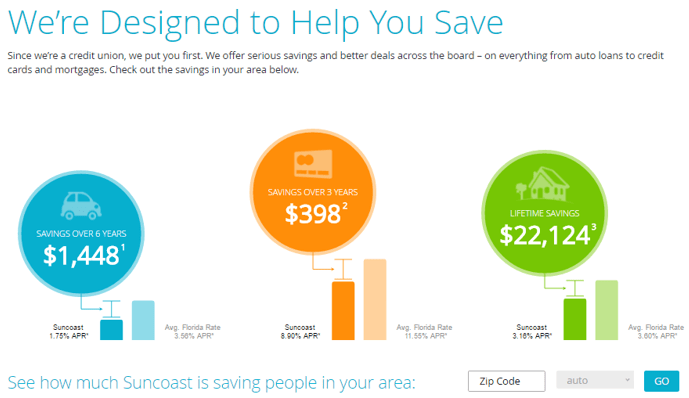

Greater Savings

One of the useful, illustrative features on Suncoast’s website is a visual that demonstrates how much Suncoast members save when compared to other Floridians. For example, Suncoast members save an average of $22,124 in interest over the term of their mortgages compared to the average Florida rate. You can even search by zip code to compare the savings to be had relative to other people in your area.

Image Source: Suncoast Credit Union

Overall, Suncoast offers by far some of the most extensive products and services of credit unions in Tampa, FL.

To browse exclusive reviews of all top rated credit unions in Tampa, Florida, please click on any of the links below.

- Florida Customs Federal Credit Union

- Floridacentral Credit Union

- Grow Financial Federal Credit Union

- GTE Financial

- PowerNet Credit Union

- Railroad & Industrial Federal Credit Union

- St. Joseph’s Hospital Federal Credit Union

- Suncoast Credit Union

- Tampa Bay Federal Credit Union

- Tampa Postal Federal Credit Union

- USF Federal Credit Union

Conclusion – Top 11 Best Credit Unions in Tampa, FL

As you’ve reached the end of our report on the top 11 credit unions in Tampa, FL, you’ll see that there are numerous firms in the region that offer sound everyday banking, lending, and investment products and services. Many also provide innovative programs aimed at improving financial literacy and give back to the community, making Tampa credit unions an attractive choice.

As you can see, however, not all credit unions in Tampa are created equal. While all offer checking accounts, savings accounts, and loans, rates and additional products and services vary by credit union. While all of the institutions we’ve reviewed have their merits, it’s always a good idea to speak to the Tampa credit union you’re considering joining to make sure it’s a good fit for you.

Additionally, bear in mind that each credit union in Tampa, FL, has different eligibility requirements for membership. The good news? There is no shortage of Tampa credit unions. If one is not suited for you, we’re confident another will meet your financial needs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.