Secured Card Review: TD Bank vs USAA vs First Premier Secured Credit Card

A secured credit card for bad credit is one of the best products to help you get your credit back on track. For those with bad credit who cannot qualify for credit cards, making reservations or planning for emergencies can be difficult.

Credit rebuilding credit cards, fortunately, help those with less-than-perfect credit have a chance to rebuild their credit through a secured credit card.

There are several secured credit cards currently available, like the First Premier secured credit card. Most banks offer some type of rebuilding credit cards to help their customers gain creditworthiness. But finding the best secured credit cards for bad credit can be difficult with so many to choose from.

We will help you through the process of finding the right secured credit card for you by comparing three of the top secured cards from major banks: the USAA secured credit card, the TD Bank secured credit card, and the First Premier secured credit card.

Each option has plenty to offer its customers with bad credit, so we will outline the major features of each card to help you come to a decision about which secured credit card is best for you. This guide will also explain the benefits of secured credit cards and help you learn how to get a secured credit card.

See Also: Top Best MasterCard Credit Cards | Ranking | MasterCard Rewards, Cash Back, Benefits and Offers

How Helpful Are Secured Credit Cards for Bad Credit?

Secured Credit Cards for Bad Credit

First Premier secured credit cards, and others of this kind, require you to place a deposit that acts as your credit line. In other words, you are securing your credit line with your own money.

This may sound strange, but a secured credit card from TD Bank or another financial institution can help you rebuild your credit faster than if you had no credit card at all.

Most credit lines for a secured credit card for bad credit are $500 or lower. However, some cards allow you to build your credit line up higher over time. The First Premier Bank secured credit card, for example, lets you have a credit line of up to $5,000 once your account is opened.

The key to being successful in rebuilding your credit with a First Premier secured credit card or another secured card is using your card responsibly. For those with a rough credit history, it might be beneficial to stick with a low credit limit until you begin to learn to use your credit wisely.

The USAA secured credit card allows a minimum $250 deposit, which can help you stay on track. The First Premier Bank secured credit card lets you deposit as little as $200.

Once you open a secured credit card for bad credit, stay on top of your purchases and payments. Use the card for small purchases that you can pay back in full when it is time to pay your bill. This shows that you can use your card in a responsible manner while avoiding late fees or carrying a balance.

It takes time for your secured credit card from TD Bank or another bank to improve your credit score, but eventually, your credit report and score will reflect your consistent, responsible use. After at least a year of consistent, timely payments, most secured credit card companies will let you switch to an unsecured credit card.

Learn How to Get a Secured Credit Card

If you want to know how to get a secured credit card, the best place to start is usually your own bank. Since you are already a customer, your bank could give you a special promotion for customers only.

Secured Credit Card for Bad Credit

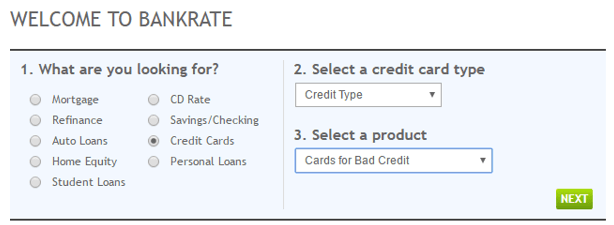

If you do not have a bank or want to look elsewhere, you can compare options online. Bankrate provides an easy-to-use search tool that lets you find credit rebuilding credit cards from a variety of banks.

The list provides both secured and unsecured options, but you can filter the results to only include secured cards. Alternatively, you can narrow your search by a specific card issuer to find out if it has a secured card – like the First Premier Bank secured credit card.

Most banks will let you apply for a secured credit card for bad credit online and you can get your card by mail within a few business days. To apply for the TD Bank secured credit card, you have to apply at your local branch or online. The TD Bank secured credit card does not require you to have a TD Bank account to apply.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Features Do the Best Credit Rebuilding Credit Cards Have?

Our picks for best secured credit cards for bad credit are based on a few important factors you should consider when choosing the best secured card:

- Fees. Most secured credit cards do have an annual fee, like the USAA secured credit card. However, some secured credit cards may seem like great deals on the surface, but the fine print may prove differently. Check for annual fees, late fees, and cash advance fees to determine if the card is worth it. First Premier secured credit cards, for example, have an annual $50 fee but low cash advance and late payment fees compared to other cards.

- Interest rate. Some secured credit cards penalize you for your bad credit with extremely high interest rates. The First Premier secured credit card and the TD Bank secured credit card provide an interest rate between 19% and 24%, which is typical for secured cards. USAA secured credit card customers may qualify for an APR as low as 10.15% if their credit is good enough.

- Minimum and maximum credit line. Make sure the card you choose allows a low minimum credit line that you can afford to pay, but also gives you the opportunity to increase your credit line by making more deposits. First Premier secured credit cards have credit limits that can range from $200 to $5,000, so they can grow with you as your financial situation improves.

- Ability to switch to unsecured credit line. Many secured credit cards will allow you to switch to an unsecured card in the future, usually between 12 to 24 months after you open your account. Your TD Bank secured credit card, for example, may be eligible for graduation starting at month 7 from account opening. Eligibility is determined based on cardholder performance and credit quality.

- Additional benefits. The secured card with the most benefits makes for the best secured card for bad credit. Look for cards with fraud protection and credit monitoring, for example, to make sure you are getting the most from your secured card. A USAA secured credit card review proves that USAA reports your activity monthly to all three credit bureaus, which is especially important when rebuilding credit.

- Online reviews. Searching online reviews for the best secured credit cards can help you decide what real customers say about the cards you are considering. First Premier secured credit card reviews, secured credit card from TD Bank reviews, and USAA secured credit card reviews show satisfaction from real customers.

USAA Secured Credit Card Review

The USAA secured credit card is available for United States military personnel, including active military members, veterans, and their family members. Although some USAA financial products are available to non-members, the USAA secured credit card is only available to members.

USAA Secured Credit Card

USAA secured credit card reviews prove that it is one of the best secured credit cards on the market. One of the most-liked features of the USAA secured credit card is its ability to earn interest on your deposit — something most other secured cards do not offer.

With the USAA secured credit card, you earn a 0.54% APR that will change periodically over two years. During this time, you can still deposit cash to increase your credit limit up to $5,000, and your interest will continue to grow.

Actively-deployed military service members will receive additional benefits from the USAA secured credit card, like a 4% APR on all purchases during the first 12 months of deployment. USAA secured credit card members can also have all finance charges waived during participation in qualified military campaigns.

The USAA secured credit card has some of the lowest interest rates for secured cards for those who are credit-worthy. Interest rates begin at 10.15%, and your rate will stay the same for purchases, cash advances, and transfers using your USAA secured credit card.

TD Bank Secured Credit Card Review

The TD Bank secured credit card, can be applied for at your local branch and online.

TD Bank Secured Credit Card

The TD Bank secured credit card has a low annual fee of only $29, which is among the lowest for many secured cards. Its interest rate is currently 22.99%, but this varies along with the prime rate. You can choose to secure your TD Bank secured credit card with a deposit of $300-$5,000, subject to credit approval, so you can pick an amount that you feel comfortable with.

The TD Bank secured credit card offers 1% cash back on eligible purchases, which is an extra benefit most secured cards do not provide.

Popular Article: Capital One® Quicksilver® vs. Barclaycard Rewards MasterCard® vs. Citi Thankyou® vs. HSBC Platinum Card (Reviews)

First Premier Secured Credit Card Review

The First Premier secured credit card is one of the best choices for secured credit cards because of its credit reporting, FDIC-secured deposit, and a large maximum deposit amount that grows with your financial ability.

First Premier Secured Credit Card

Those with bad credit can still qualify for the First Premier Bank secured credit card. You can choose to secure your credit line with a minimum $200 deposit to get you started using your card.

If you want a higher credit limit as you continue to use your card, the First Premier secured credit card allows you a maximum deposit of $5,000. You can fund your First Premier secured credit card with more money immediately upon opening your account. Upon closing your account or switching to an unsecured card, your full security deposit will be refunded.

Additionally, your activity on your First Premier secured credit card is reported to all three major credit bureaus regularly so you can ensure that your card usage is helping you rebuild your credit.

Several online reviews from customers who use the First Premier secured credit card say that this card has helped them earn back their creditworthiness without making them suffer from high interest rates that many other secured cards have.

Conclusion

A secured credit card for bad credit is one of the most helpful financial products you can use to rebuild your credit history. Although there is a vast number of secured cards currently available from a variety of banks and financial institutions, the best secured cards are those with low fees and interest rates and added benefits like credit reporting and rewards.

We believe that the USAA secured credit card, First Premier secured credit card, and TD Bank secured credit card are among the best choices for secured cards because they allow you to deposit a wide range of money for your credit line and give you opportunities to rebuild your credit as you learn to budget wisely.

Image Sources:

- http://versusbattle.com/plastic-credit-cards-vs-debit-cards/

- https://www.bankrate.com/

- https://www.usaa.com/inet/wc/banking_credit_cards_main?wa_ref=pub_global_products_bank_cc

- https://www.td.com/us/en/personal-banking/credit-cards/

- https://www.creditcards.com/credit-cards/first-premier-bank-secured-credit-card/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.