2017 RANKING & REVIEW

TOP VANCOUVER BANKS & CREDIT UNIONS

Intro: Finding the Best Credit Unions and Banks in Vancouver

There are plenty of credit unions and banks in Vancouver. It is the most populated city in British Columbia and a hub for business and tourism. With so much commerce being generated there, there is large demand for Vancouver credit unions and banks.

There are a large number of financial institutions for consumers to choose from. Vancouver banks and Vancouver credit unions are reliable and convenient, but not all of them are created equal.

With some research, you can determine which Vancouver credit union or Vancouver bank is the right choice for you.

Award Emblem: Best 10 Banks and Credit Unions in Vancouver, B.C. Canada

Using our stringent selection methodology, we have done the research for you and determined the top 10 best banks and credit unions in Vancouver. Our list and reviews of Vancouver banks and credit unions makes a great starting point in your search for the best Vancouver credit union or bank for you.

As you read through our comprehensive reviews of the best banks in Vancouver, it is important to consider which Vancouver credit unions and banks have branches that are convenient relative to your home or place of work with operating hours that are convenient for your schedule.

The Vancouver banks and credit unions on this list cover the entire metropolitan area of Vancouver, so there is sure to be a bank or credit union in Vancouver listed that is conveniently located for you.

Whether you are looking for any BC bank or are specifically in search of Vancouver credit unions, there are sure to be some banks in Vancouver or B.C. credit unions on this list that will work for you.

See Also: Best Credit Unions in the US (Top Ranking List and Reviews)

AdvisoryHQ’s List of the Best Credit Unions and Banks in Vancouver

List is sorted alphabetically (click any of the bank names below to go directly to the detailed review section for that bank):

- Bank of Montreal (BMO)

- CIBC (Canadian Imperial Bank of Commerce)

- Citizens Bank of Canada

- Coast Capital Savings

- Industrial and Commercial Bank of China (ICBC)

- National Bank of Canada

- RBC (Royal Bank of Canada)

- Scotiabank

- TD Bank

- Vancity

Click here for 2016’s Top 10 Banks and Credit Unions in Vancouver, B.C.

Top 10 Credit Unions and Banks in Vancouver | Brief Comparison

Vancouver Banks & Credit Unions | Highlighted Product |

| BMO | BMO SmartFolio |

| CIBC | Smart account |

| Citizens Bank of Canada | Shared interest Visa credit card |

| Coast Capital Savings | Members Get It mortgage |

| ICBC | Easy account |

| National Bank | Hello Canada |

| RBC | Newcomer advantage program |

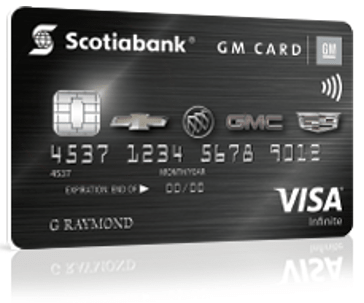

| Scotiabank | GM Visa Infinite card |

| TD Bank | Borderless plan |

| Vancity | Fair & fast loan |

Table: Top 10 Banks and Credit Unions in Vancouver | Above list is sorted alphabetically

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top-Ranking Best Vancouver Banks and Credit Unions

Below, please find the detailed review of each company on our list of top credit unions and banks in Vancouver.

We have highlighted some of the factors that allowed these Vancouver credit unions and banks to score so highly in our selection ranking.

Don’t Miss: Top Banks in Canada—Ranking | Best High-Interest Savings Accounts—Canada

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Bank of Montreal (BMO) Review

The Bank of Montreal was established in 1817 as Canada’s first bank. The long-standing bank provided Canada’s first widely recognized and distributed currency and has played a vital role in the development of Canada as a country.

Today, the Bank of Montreal is one of Canada’s pre-eminent financial institutions and enjoys a significant presence in the U.S. and world financial markets. They operate more than 900 locations across Canada, including many Vancouver banks.

With more than $588 billion in assets, the Bank of Montreal is ranked as one of the top ten largest banks in North America based on asset size. The impressive financial institution with several Vancouver bank branches has not missed a dividend payment since 1829, ranking their dividend payment history as one of the longest in the world.

Their solid reputation and strong financial foundations makes this top Canadian bank a sound choice for anyone looking for a bank in Vancouver.

Image Source: Top-Ranking Best Vancouver Banks and Credit Unions

Key Factors That Enabled This Bank to Rank as One of the Best Banks in Vancouver

Below are key factors that enabled Bank of Montreal to be rated as one of this year’s top Vancouver banks.

PlanShare

Even with moderate banking plans, banking fees can begin to add up, especially when you require multiple accounts. To help families keep their banking fees economical, BMO offers their PlanShare program.

This banking plan allows customers to share one plan with their spouse or partner which allows them to have up to 20 accounts for just one low monthly fee. The plan can be personalized to suit the needs of each account holder.

Benefits of the PlanShare program offered by this bank in Vancouver are:

- Share one plan with a spouse or partner

- Set up individual or joint accounts

- Bank together while also having the ability to maintain individual accounts

- Open up to 20 accounts under one plan for one monthly fee

- Easily transfer funds between joint and individual accounts

- Plan may be personalized by organizing accounts to suit both people’s needs

There are several different levels of PlanShare plans to choose from, and there are even ways to waive the monthly fee altogether. PlanShare options available from this best bank in Vancouver are:

- Performance Plan: unlimited transactions, monthly fee of $14.95 can be waived by maintaining a minimum balance of $4,000

- Premium Plan: unlimited transactions, monthly fee of $30 can be waived by maintaining a minimum balance of $6,000

- AIR MILES Plan: unlimited transactions, earns AIR MILES reward miles with use of BMO debit card, $14.95 flat monthly fee

BMO SmartFolio

Image Source: BMO SmartFolio

BMO SmartFolio is the personal investing solution for customers of this bank in Vancouver, B.C. The great thing about SmartFolio is that it provides a hands-free investing solution that is both easy and affordable.

With SmartFolio, customers of this top bank in Vancouver can set up an ETF model portfolio that best meets their investing needs right from their smartphone. A team of expert portfolio managers actively manage customers’ portfolios to keep them on track with their financial goals.

Customers who choose to take advantage of BMO’s SmartFolio can track their portfolio’s progress on any of their devices. Investments start at as little as $5,000. Customers who use BMO banks in Vancouver do not even have to visit a branch. They can set their SmartFolio up online and have any questions answered via web chat or by telephone.

Savings Account Options

It is important to set aside money for vacations, unexpected bills, or to establish an emergency fund in the case of unforeseen loss of income or hardship. BMO understands this and offers an array of savings account options to help make it easy for Vancouver banking customers to build savings. They also offer an option that rewards customers for their dedication to putting money aside regularly.

Savings account options available from this best bank in Vancouver are:

- Smart Saver: no monthly savings requirement and a fixed interest rate regardless of the balance

- Savings Builder: rewards customers with bonus interest for adding at least $200 monthly to the account

- Premium Rate Savings: earns daily interest and allows access to funds as needed

- U.S. Dollar Premium Rate Savings: build savings in U.S. dollars and access funds as needed

Related: Union Bank Reviews—What You Will Want to Know! (Mortgage, Credit Card & Reviews)

CIBC (Canadian Imperial Bank of Commerce) Review

CIBC was formed in 1961 as the result of the largest merger of two banks in Canada—the Canadian Bank of Commerce, established in 1867, and the Imperial Bank of Canada, established in 1875. With a history spanning almost 150 years, CIBC is a long-standing financial institution with a strong reputation among banks in Vancouver and across the country.

Today, with about $501.4 billion in assets, CIBC is one of the major five banks in Canada. It is not just a top Vancouver bank. Globally, this impressive Canadian bank serves more than 11 million customers and has international operations in the U.S., Caribbean, Asia, and Europe.

CIBC was named by Bloomberg Markets Magazine as the strongest bank in North America and the third strongest bank in the world. They currently employ more than 44,000 people and enjoy a strong presence among Vancouver banks.

Key Factors That Enabled This Bank to Rank as One of the Best Banks in Vancouver

Below are key factors that enabled CIBC to be rated as one of this year’s top Vancouver banks.

CIBC Smart Account

CIBC designed their Smart Account option for those customers who need an everyday transaction account but don’t want the hassle of having to worry about how much or how little they bank. With the Smart Account, customers of this bank in Vancouver only pay for what they use.

With this specialized account offer by this top bank in Vancouver the monthly fee is capped, so even customers who make lots of everyday transactions won’t pay a lot. Account holders can make as many debit purchases, transfers, and transactions as they like. The monthly fee for this account starts at $4.95 and is capped at $14.95.

Additional benefits of the CIBC Smart account include:

- Monthly fee waived when minimum daily balance is $3,000 and two direct deposits or pre-authorized payments are made

- Unlimited Interac e-Transfers

Lending Options

CIBC is a bank in Vancouver that has a wide variety of lending options available to Vancouver banking customers. With a loan from this top Vancouver bank, customers can consolidate debt, finance their education, buy a car, make home improvements, or even purchase their first home.

With such a large array of loan options available, there is nothing customers of this best bank in Vancouver can’t achieve. Lending options available are:

- Mortgage products

- Personal loan

- Car loan

- RRSP Maximizer loan

- Personal line of credit

- Home power plan line of credit

- Education line of credit

- Professional edge student program

Small Business Banking Services

Businesses are the backbone of our economy, and CIBC is one of the Vancouver banks that cater to small businesses by providing them with an array of specialized banking and financial solutions.

This top bank in Vancouver offers an array of banking products to meet the needs of small businesses and help them grow and prosper. They offer everything from everyday transaction accounts to loans and financial advisory services.

For day-to-day small business banking needs, this top Vancouver bank offers:

- Business accounts

- Customized access to accounts

- Cash management

- Merchant services

They also offer an array of borrowing and credit options for small businesses:

- Credit cards

- Loans and lines of credit

- Mortgages

- Government-supported programs

For those small business owners seeking financial advisory services, CIBC offers several investing and wealth services specializing in:

- Investment solutions

- Retirement planning

- Specialists

This best bank in Vancouver also offers specialty services for small businesses including:

- Established businesses

- Agriculture

- Indigenous banking

- Banking for professionals

For those small business owners who are already, or would like to begin, doing business internationally, CIBC offers an array of international services for businesses as well, such as:

- Trade finance

- Correspondent banking

- Foreign exchange online

Popular Article: Best Banks in New York | Ranking of Banks in NYC, Buffalo, etc.

Citizens Bank of Canada Review

Citizens Bank of Canada was formed in 1997 as one of Canada’s first online banks. This top Vancouver bank was built on the premise that all companies have a responsibility to use their resources to make a positive difference in the world around them.

In 2008, they became the first North American–based bank to become carbon neutral, making them a good fit for those interested in banks in Vancouver that are environmentally friendly.

The Citizens Bank of Canada participates in no-branch banking, meaning that all transactions are conducted over the phone, online, or through PC banking software. Though they are a virtual bank, Citizens Bank of Canada is owned by Vancouver City Savings Credit Union and is based in Vancouver.

Key Factors That Enabled This Bank to Rank as One of the Best Banks in Vancouver

Below are key factors that enabled Citizens Bank of Canada to be rated as one of this year’s top Vancouver banks.

Shared Interest Visa Credit Cards

A Shared Interest Visa card from the Citizens Bank of Canada is a great way for Vancouver banking customers to help do some good within their community while going about their everyday spending.

This is because each year ten cents for every Shared Interest Visa card transaction is donated to the Shared Interest Fund, where it is used to affect positive social and environmental change.

This special Visa credit card program offered by this best bank in Vancouver allows customers to enjoy the convenience and security of Visa while also earning rewards and helping their community.

There are two types of Shared Interest Visa cards offered by this top bank in Vancouver: the Shared Interest Classic Visa card and the Shared Interest Gold Visa card.

Benefits of the Shared Interest Classic Visa card include:

- Low interest rate

- Tiered annual fee from $0 to $50

- Earns one reward point for every two dollars spent

- Chip-enabled for added security

- 21-day, interest-free grace period on new purchases

Benefits of the Shared Interest Gold Visa card include:

- Low interest rate

- Tiered annual fee from $45 to $145

- Earns one reward point for every dollar spent

- 2,000 bonus points for enrolling, 2,500 bonus points with first purchase, and 3,500 points on each card anniversary

- Chip-enabled for added security

- 21-day, interest-free grace period on new purchases

Foreign Exchange Services

Citizens Bank of Canada is among the banks in Vancouver that offer Foreign Exchange services. This top Vancouver bank offers both personal and business Foreign Exchange services to their customers.

With their personal Foreign Exchange service, this top bank in Vancouver can help customers:

- Conduct foreign currency real estate payments

- Manage payments in foreign currencies to people in other countries

- Make premium payments for exclusive goods purchased outside of Canada

- Pay overseas tuition fees

- Send money overseas

- Send a large monetary gift, charitable donation, or contractual payment to another country

- Transfer money to friends and family anywhere

- Send or receive money to or from more than 200 countries and territories

With their business Foreign Exchange service, Citizens Bank of Canada provides businesses with many solutions, including:

- Sending and receiving payments

- Managing foreign exchange risk

- A variety of risk management tools

- Settlement options

- Market monitoring and overnight orders

- Multi-currency bank drafts

Commercial Mortgages

The Citizens Bank of Canada provides commercial mortgage financing that ranges from $6.5 million to $40 million. This top bank in Vancouver works with real estate operators and developers in selected metropolitan centres across Canada, including Calgary, Edmonton, and the Greater Toronto area.

Commercial mortgages available from this top Vancouver bank are available for:

- Office, industrial, and retail properties

- Land acquisitions

- Industrial, commercial, and investment property developments

- Multi-family residential properties such as condominiums and townhomes

This best bank in Vancouver also specializes in providing flexible financing for social and environmental properties that benefit the community.

Read More: Banks in Illinois | Ranking | Banks in Chicago, Aurora & Other IL Cities

Coast Capital Savings Review

Coast Capital Savings’s roots go back to the 1940s when credit unions were established in communities across Canada to make it easier for citizens to get loans. In the early 2000s, three leading Canadian credit unions—Pacific Coast Savings, Richmond Savings, and Surrey Metro Savings—merged to become Coast Capital Savings.

Altogether, Coast Capital Savings is a BC credit union that has been serving citizens for more than 75 years. This Vancouver credit union is Canada’s largest credit union by membership with 532,000 members.

The credit union in Vancouver operates 50 branch locations throughout Metro Vancouver, Fraser Valley, Vancouver Island, and the Okanagan.

Key Factors That Enabled This Bank to Rank as One of the Best BC Credit Unions

Below are key factors that enabled Coast Capital Savings to be rated as one of this year’s top Vancouver, BC credit unions.

Free Chequing

There are advantages to choosing to do business with a top Vancouver credit union rather than a bank; low- to no-cost chequing is one of them. Because a credit union is owned by its members rather than shareholders, profits are returned to members in the form of better interest rates and lower fees.

Coast Capital Savings is one of the BC credit unions that offers completely free chequing, something that is very difficult to find at a traditional bank.

With Coast Capital Savings’s Free Chequing, Free Debit, and More account, members enjoy these hard-to-beat benefits:

- No monthly fee

- No minimum balance requirement

- No charge for day-to-day transactions

- Free withdrawals and deposits at thousands of ATMs across Canada

- Free in-branch, online, or by-phone bill payments

- Free preauthorized payments and deposits

- Free in-branch withdrawals, transfers, or deposits

- Free in-branch, online, mobile app, or phone access to account information

- Free cheque clearing

- Free online and mobile images of cleared cheques

Members Get It Mortgage

With a Members Get It mortgage from this Vancouver credit union, members get a great rate as well as up to $1,000 in Help Extras. Members who choose to take advantage of this special mortgage program don’t have to choose between homeownership and saving.

Details of the Members Get It mortgage offered by this credit union in Vancouver are:

- $1,000 in Help Extras with new mortgages or renewals for a term of 3 years or more

- $500 in Help Extras with new mortgages or renewals for a term of 1 or 2 years

- Help Extras can be put toward an RRSP, RESP, term deposit, tax-free savings account, or a combination

- Help Extras are assigned once the mortgage is funded

- When it’s time to renew, members are eligible for more Help Extras

- This program is also available for small businesses

- This special mortgage program comes with the Free Chequing, Free debit, and More account

Business Banking

Coast Capital Savings is among the credit unions in Vancouver that offer banking for small businesses. In fact, this Vancouver credit union offers a variety of business solutions for businesses, including day-to-day banking, lending, commercial real estate, and cash management services.

This credit union in Vancouver offers an array of economical, day-to-day banking accounts for businesses, such as:

- The Deposit-for-free Business Account: $5 monthly fee, $0.95 withdrawal; unlimited deposits, transfers, and bill payments

- The One Small Fee, the Rest is Free Business Account: $35 monthly fee, unlimited deposits and withdrawals, unlimited cheque clearing and debit card transactions within Canada

- Community Chequing: for non-profit organizations and registered charities or societies, no monthly fee, unlimited transactions

- U.S. Business Chequing: manage funds and write cheques in the U.S., one free transaction per month, additional transactions are $0.95 USD each

Coast Capital Savings also offers many lending and commercial financing and lease options for businesses as well, including:

- Lines of credit

- Business loans

- Letters of credit

- Coast Visa Business card

- Commercial real estate loans

- Auto financing

- Equipment financing

- Aircraft financing

Industrial and Commercial Bank of China (ICBC) Review

The Industrial and Commercial Bank of China (ICBC) was founded in 1991 as the Canadian unit of the Bank of East Asia Group in Hong Kong. The name was changed in 2010 when a majority stake of the bank was sold to Industrial and Commercial Bank of China. They operate several retail banking branches throughout Canada including banks in Vancouver.

ICBC Canada is a member of the Canadian Bankers Association and is a registered member with the Canada Deposit Insurance Corporation. The bank offers retail banking services catering to expatriate Hong Kong Chinese in Canada. Products offered include personal and business accounts, loans, and business financing.

Key Factors That Enabled This Bank to Rank as One of the Best Banks in Vancouver

Below are key factors that enabled Industrial and Commercial Bank of China to be rated as one of this year’s top Vancouver banks.

Personal Banking Accounts

ICBC offers a variety of personal banking accounts to fit the needs of every customer of this bank in Vancouver. Personal banking account options are:

- Easy Account: multi-currency account available in CAD, CNY, and USD with a great rate and no debit transaction fee, transactions can only be made through electronic channels

- Premium Chequing Account: cheque-issuing capabilities, no passbook provided, $7 monthly fee waived with minimum daily balance of $1,000

- Basic Account: available in Canadian dollars only, $4 monthly fee waived with minimum daily balance of $1,000, no monthly fee for special customer group

- Other Currencies Account: can make RMB transactions, no minimum balance requirement, no monthly fee, CNY deposits are not insured by the CDIC

Cross-Border Services

ICBC is one of the banks in Vancouver that provides cross-border financial services to those about to embark on a journey to study abroad, relocate to Canada, or engage in Sino-Canada trade.

This top bank in Vancouver provides customers with an array of cross-border services to customers, including:

- AOWS

- Services for those studying abroad

- Personal foreign exchange

- Remittance services

- Student GIC

- RMB cross-border B2C payment

- Foreign exchange rates

- UnionPay online payment

Customers who choose to take advantage of this Vancouver bank’s Cross-Border Services will enjoy dedicated service, multi-channel services, and global acceptance.

Commercial Banking

ICBC provides a broad range of commercial banking services to help businesses manage their day-to-day finances effectively. For those businesses looking for Vancouver banks who wish to grow their business funds faster, ICBC offers their Business Smart Savings Account.

This newly introduced business savings account allows business customers of this bank in Vancouver to earn a competitive GIC-like interest rates while allowing them to retain flexible access to their funds.

Features of the flexible Business Smart Savings Account are:

- No monthly fee

- Multi-currency account

- Competitive interest rate

- Unlimited free transfer-in credits from other bank accounts

- Two free debit transactions to other banks per month

- Professional account managers to provide one-on-one business service

- Online banking service

- Automatic transferring service

Other business services offered by this best bank in Vancouver are:

- Business accounts and plans

- GICs

- Cash management services

- Consulting services

- Commercial financing

Related: Best Banks for Bad Credit | Ranking & Review

National Bank of Canada Review

The National Bank of Canada has a history that spans more than 150 years. Established in 1859, the National Bank of Canada is among the oldest banks in Vancouver. Today, with $216 billion in assets, National Bank is the sixth largest commercial bank in Canada.

National Bank enjoys an extensive network of branches which includes more than 450 branches and more than 900 ATMs throughout Canada. The impressive bank in Vancouver also operates several subsidiaries outside of Canada which serve its Canadian and non-Canadian clients.

National Bank offers a number of retail and commercial banking services to customers, including personal banking, commercial banking, payment solutions, and insurance.

Key Factors That Enabled This Bank to Rank as One of the Best Banks in Vancouver

Below are key factors that enabled National Bank of Canada to be rated as one of this year’s top Vancouver banks.

Personal Financing Options

The National Bank of Canada offers a wide array of personal financing options to help all of their customers achieve their dreams. Whether it be to purchase a new car, buy a home, or expand their family through adoption this bank in Vancouver has the financing needed to make it happen.

Personal financing options available from this top bank in Vancouver, B.C. are:

- Mortgage financing

- Lines of credit

- Personal loans

- Car loans

- RRSP loans

- RRSP lines of credit

- Student loans

- International adoption financial package

- Tax strategy solutions

Chequing Accounts

National Bank offers an array of chequing account options to suit the needs of their customers. With so many flexible options to choose from, this top bank in Vancouver truly has a chequing account to fit everyone’s needs.

Chequing account options available from this best bank in Vancouver are:

- AccessPlus: unlimited electronic transactions, fixed monthly fee

- Direct Access: limited number of transactions, fixed monthly fee

- Virtuoso: unlimited transactions with no additional fees, line of credit, discounts on products and services

- Perspective: many free services, 22 free transactions per month, including two at the branch

HelloCanada Assistance Service

Image Source: HelloCanada™

To help customers who are new to Canada get settled in, National Bank offers their HelloCanada Assistance Service for Newcomers. This program offered by this bank in Vancouver was designed to help make newcomers lives easier and help them to get settled in faster.

As part of their Newcomers to Canada program, this top-rated bank in Vancouver offers newbies free access to their telephone assistance service for 12 months from the day their account is opened.

Service is available seven days a week and can help provide answers on subjects such as:

- Local school systems

- Medical treatment

- Finding a job

- Legal matters

- Housing

- Personal finance

- Immigration assistance

Financial Packages

National Bank offers an array of financial packages for students and professionals that give them access to considerable benefits and a wide range of products and services.

Benefits of a specialized financial package include special credit card offers, banking benefits, financing solutions at an advantageous interest rate, investment solutions with preferential conditions, and access to essential tools for entrepreneurs.

This best bank in Vancouver offers financial packages to professionals and students who are in:

- Healthcare

- Health sciences

- Nursing

- Law

- Accounting

- Notary

- HEC Montreal graduates and students

- Engineering

Don’t Miss: Best Banks in Indiana | Ranking of Banks in Indianapolis, Fort Wayne, Evansville

Royal Bank of Canada (RBC) Review

Founded in 1864, the Royal Bank of Canada has the distinction of being Canada’s largest bank as well as being one of the country’s oldest banks. Originally founded in Nova Scotia, today the company is headquartered in Toronto.

Today, RBC serves more than ten million clients through a network of more than 1,200 branches. With more than more than $1.09 trillion in assets and operations across 41 countries, Royal Bank of Canada is a strong and sound financial institution for those looking for a bank in Vancouver to do business with.

Key Factors That Enabled This Bank to Rank as One of the Best Banks in Vancouver

Below are key factors that enabled Royal Bank of Canada to be rated as one of this year’s top Vancouver banks.

RBC Newcomer Advantage

Image Source: RBC

The RBC Newcomer Advantage provides everything that those who are new to Canada need to get started with their finances in Canada. As Canada’s largest bank, this top bank in Vancouver, B.C., has been helping newcomers for more than 145 years and has service available by phone in more than 200 languages.

The RBC Newcomer Advantage package includes:

- First credit card with no credit history required and no annual fee

- First car with an RBC car loan, no credit history required at more than 3,500 dealerships

- First home in Canada, with no credit history required

- First bank account with no monthly fee for up to 6 months and unlimited free e-Transfers

- Preferred rate on Foreign Exchange transactions in-branch for 12 months

- Preferred interest rates on select GICs

- Small safe deposit box with fees waived for up to 2 years

- Cost-effective way to send money overseas with RBC International Money Transfer

- $50 when any eligible new business account is opened

RBC Direct Investing

RBC provides their customers with the tools and resources they need in order to take control of their investments on their own time and schedule. Their RBC Direct Investing program provides what customers of this top Vancouver bank need to fit DIY investing into their life.

The benefits of RBC Direct Investing are:

- Free practice accounts integrated into their actual online investing site and funded with practice money for an authentic online experience, risk-free

- A community where customers can exchange ideas about potential investments in a secure, anonymous environment

- $9.95 flat fee for stock and ETF trades with no minimum account balance or trading activity requirement

RBC High Interest eSavings Account

Customers of this best bank in Vancouver can enjoy an online savings account offering high interest on every dollar with the RBC High Interest eSavings Account.

This special online savings account makes it easy for customers of this top Vancouver bank to regularly set money aside and earn high interest on every dollar they save.

Features of the RBC High Interest Savings Account are:

- High interest on every dollar

- Free electronic self-serve transfers to any other RBC bank account 24/7 with no delay

- Free access to RBC Online, mobile, and telephone banking

- No minimum deposit requirements

- Ability to set up Save-Matic from banking account

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Scotiabank Review

Founded in 1832, Scotiabank is the third largest bank in Canada by deposits and market capitalization. One of the oldest banks in Vancouver, Scotiabank currently operates in more than 55 countries worldwide and serves more than 23 million customers.

This long-standing Canadian bank shares trade on the Toronto and New York Stock Exchanges and holds more than $896 billion in assets. Headquartered in Toronto, Scotiabank bills itself as being Canada’s most international bank.

Scotiabank is a bank in Vancouver that offers customers a wide range of financial products and services including personal and commercial banking, wealth management, corporate banking, and investment banking.

Key Factors That Enabled This Bank to Rank as One of the Best Banks in Vancouver

Below are key factors that enabled Scotiabank to be rated as one of this year’s top Vancouver banks.

Scotiabank GM Visa Infinite Card

Image Source: Scotiabank

Scotiabank’s GM Visa Infinite credit card was ranked as the 2016 Best Retail Rewards Card by Moneysense, and it isn’t hard to see why.

With this special credit card offered by this top bank in Vancouver, customers can enjoy the following benefits:

- 5% GM earnings on the first $10,000 spent annually and 2% thereafter

- Every dollar in GM earnings equals a dollar off the price of or lease of a new GM car

- No expiration on earnings

- No earning or redemption caps

- Card is available in 5 unique designs

- Visa Infinite benefits including travel medical insurance, rental car insurance, and trip interruption service

- Purchase Security and Extended Warranty

- 21-day, interest-free grace period on new purchases

Flexible Chequing Account Options

Scotiabank offers several flexible chequing account options to suit the needs of all of their customers. From accounts designed for those with a low volume of monthly transactions to those for customers who have transactions daily, this top bank in Vancouver has something for everyone.

Chequing accounts available from this bank in Vancouver are:

- Scotiabank Momentum Chequing: 1% back on all debit card purchases up to $300 back a year

- Scotia One: no monthly fee with $3,500 minimum daily balance

- Basic Banking Plan: make up to 25 transactions a month for a low monthly fee and earn SCENE movie rewards

- Basic Banking Plan: make less than 12 debit transactions a month, designed for customers who do not use their debit card often

All Scotiabank chequing accounts come with online banking, mobile banking, telephone banking, and access to nearly 4,000 ATMs.

Mortgage Centre

Scotiabank is a Vancouver bank that strives to help every customer achieve their dreams of homeownership. They offer a wide array of mortgage products to help all customers with their home loan needs.

At this best bank in Vancouver’s online Mortgage Centre, customers can find advice covering the topics of first-time home buying, existing homeowning, making renovations, and buying another property.

There, customers of this top Vancouver bank will also find information on their mortgage products, which include their:

- Fixed-rate mortgages

- Variable-rate mortgages

- Scotia Total Equity Plan (STEP)

- Switch to Scotiabank Program

- Special programs

- Secondary home mortgages

Other resources found in the online mortgage centre include mortgage tools, videos, articles, and solicitor forms.

Free Wealth Management for AdvisoryHQ Readers

TD Bank Review

The Toronto-Dominion Bank and its subsidiaries, collectively known as TD Bank Group, was created in 1955 through the merger of the Bank of Toronto and the Dominion Bank. This top Canadian bank is headquartered in Toronto, Canada, and has more than 80,000 employees in offices worldwide. They operate offices throughout Canada, including banks in Vancouver.

TD Bank serves approximately 25 million customers worldwide with a full range of financial products and services. The top bank in Vancouver holds $1.2 trillion in assets and is the second largest bank in Canada by market capitalization, along with being a top 10 bank in North America. According to Forbes, TD Bank ranks as the 19th overall largest bank in the world.

Key Factors That Enabled This Bank to Rank as One of the Best Banks in Vancouver

Below are key factors that enabled TD Bank to be rated as one of this year’s top Vancouver banks.

U.S. Dollar Bank Accounts

For those customers who travel or invest south of the border, TD Bank offers U.S. dollar accounts to benefit them.

The top bank in Vancouver, B.C., offers two accounts for those who prefer to keep funds in U.S. currency. They are the Borderless Plan and their U.S. Dollar Daily Interest Chequing Account.

Key benefits of the Borderless Plan are:

- Preferred exchange rates

- Fee waived on TD U.S. Dollar Visa Card

- Free U.S. bank drafts, travelers’ cheques, and cheque orders

- Unlimited no-fee transactions

- Transfer funds quickly and securely between TD Bank account and U.S. dollar accounts using the TD app

- $3 USD discount on monthly fee with an All-Inclusive Banking Plan

- Low rate of $4.95 USD per month

- Account fee waived with a minimum monthly balance of $3,000 USD

For customers of this top Vancouver bank who do less extensive banking in U.S. dollars, the U.S. Dollar Daily Interest Chequing Account may be a better fit. Benefits of this account are:

- No monthly account fee

- Ability to write cheques and save in U.S. dollars

- Easy online exchange of U.S./Canadian funds

- Quick and secure transfer of funds between TD Bank account and U.S. dollar accounts using the TD app

- $1.25 USD per transaction

- Transaction fees waived with a minimum monthly balance of $1,500 USD

Cross-Border Banking

TD Bank recognizes that many of their customers live in the U.S. part-time or visit there frequently for shopping, business, or travel. This best bank in Vancouver operates many retail banking branches throughout the U.S., making it easier than ever for their customers to enjoy cross-border banking with ease.

Customers of this top bank in Vancouver can have both a U.S.-based and Canadian-based account, making it easy for them to manage their money on either side of the border.

Customers may also use Visa Direct services to send up to $2,500 a day from their Canadian-based account to their U.S.-based account with the transfer fee refunded.

For those wishing to purchase property in the U.S., TD Bank makes it easy by using their Canadian credit history and income when applying for financing in the U.S.

This top Vancouver bank also offers the U.S. Dollar Visa card so customers can enjoy making purchases in the U.S. directly in U.S. dollars.

Student Banking

TD Bank is a bank in Vancouver, B.C., that wants to help students get the most out of banking. That is why they offer an array of banking options for students.

Banking options available from this top Vancouver bank for students are:

- TD Everyday Chequing Account with Student Discount: no monthly fee, 25 free transactions per month, free deposits, no minimum monthly balance requirement

- TD Every Day Savings Account: No monthly fee, unlimited free transfers, interest paid on every dollar and calculated daily, 1 free debit transaction per month

- Student Visa cards: no or low annual fee of $25, competitive interest rates

- TD Student Line of Credit: access to credit through TD Access Card, competitive variable interest rates, interest-only monthly payments while in school and 12 months after school, monthly payments start a year after school and are as little as 1% of the outstanding balance or $50

Popular Article: Best Private Banks | Ranking | Top Private Wealth Management Banks

Vancity Review

Founded in 1946 to provide financial services to people from all walks of life, Vancity is a member-owned financial co-operative with 59 branches in Metro Vancouver, the Fraser Valley, Victoria, Squamish, and Albert Bay. They are Canada’s largest community credit union with $19.8 billion in assets.

This top credit union in Vancouver serves more than 519,000 members and their communities in the Coast Salish and Kwakwaka’wakw territories. They operate with a focus on helping to improve the financial well-being of their members while at the same time helping to develop healthy communities that are socially, economically, and environmentally sustainable.

Key Factors That Enabled This Bank to Rank as One of the Best B.C. Credit Unions

Below are key factors that enabled Vancity to be rated as one of this year’s top credit unions of BC.

Chequing Accounts

At Vancity, members can enjoy low- to no-cost chequing account options that are hard to find at traditional banking institutions.

Chequing account options available at this top credit union in Vancouver are:

- E-Package: unlimited everyday transactions when a minimum monthly balance of more than $1,000 is maintained, otherwise $7 monthly fee

- Pay As You Go Chequing: no monthly fees and pay only for the everyday transactions that are made

- Chequing Plus: no fee for members under 25 or over 65 and unlimited everyday transactions

- U.S. Dollar Chequing: access to U.S. funds, manage the exchange rate, no monthly fees, one everyday transaction free per month, earns interest in U.S. currency

Enviro Visa Cards

Enviro Visa cards offered by this top Vancouver credit union allow customers to enjoy competitive rates and rewards that help them achieve their financial goals all while giving back to their community.

Every year, a portion of this top Vancouver credit union’s enviro Visa card’s profits are distributed back to the local community through the enviroFund program.

There are several enviro Visa cards for members to choose from:

- Enviro Classic Visa: no annual fee and earns one My Visa Rewards Plus point for every $2 spent

- Enviro Gold Visa: earns one My Visa Rewards Plus point for every dollar spent

- Enviro ExpenseGold Visa: designed for small businesses and organizations, earns one My Visa Rewards Plus point for every dollar spent

Vancity Fair and Fast Loan

For those members who need cash in a hurry, this top Vancouver credit union offers their Vancity Fair and Fast Loan.

This special loan program is a loan solution that helps struggling members get back on their feet fast. The loan features no fees and a low cost of borrowing that allows members to get as little as $100 and as much as $2,500 within the same day.

This special loan offered by this top credit union in Vancouver bridges the gap between a payday loan and a traditional loan and helps members find a way to break the payday loan cycle and establish a better credit history.

Conclusion—Top 10 Vancouver Credit Unions and Banks

Vancouver is a bustling metropolitan area, and its people and businesses have unique needs for financial services and products. The majority of the BC credit unions and banks in Vancouver on this list have a rich local history and local decision-making process. These Vancouver credit unions and Vancouver banks also enjoy a stable financial foundation and outstanding reputation in the communities they serve.

Whether you are looking for the best banks in Vancouver or the best BC credit unions, each financial institution on this list provides the financial services and products Vancouver residents need in order to take control of their finances and enjoy flexibility with their banking.

Considerations taken into account when creating this list of banks in Vancouver and credit unions in Vancouver include financial services and solutions, the cost of doing business with them, features of the individual products that they offer, and the level of customer service with which they serve their customers.

As you narrow down your selection of top BC credit unions and banks in Vancouver, it is important to compare the differences between utilizing a credit union in Vancouver and a bank in Vancouver. A Vancouver credit union often requires customers to meet eligibility requirements for membership, whereas a bank is open to everyone.

Whatever type of financial institution you are in the market for, there is sure to be a Vancouver credit union or bank on this list to suit your financial needs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.