2017 RANKING & REVIEWS

TOP RANKING BEST BANKS IN MARYLAND

Intro: Finding the Top Banks in Maryland

Searching for a bank in Maryland can be a daunting task. You want to give your business to only the best, but the amount of research required to sort through a large number of Maryland banks available is mind-boggling.

There is much to be considered when looking at banks in Maryland. It is easy to fall victim to fees hidden in fine print, making it all the more important that you do your research.

At AdvisoryHQ, we have used our stringent selection methodology to determine a list of banks in Maryland that rise above the rest in the quality of services and products. The best banks on this list offer an array of different services and products to meet the financial needs of consumers.

Award Emblem: Top 17 Best Banks in Maryland

Among these top banks in Maryland are banks of all sizes. On this list, you will find everything from big-name national banks to small banks as well as a few local banks in Maryland.

As you browse our list of the best banks in Maryland, pay attention to which of their products and services will best suit your own financial needs.

Whether you are simply looking for a low or no-fee checking account or the right institution to begin helping you save for retirement, we are confident that there is a Maryland bank on this list that is right for you.

AdvisoryHQ’s List of the Top 17 Best Banks in Maryland

List is sorted alphabetically (click any of the bank names below to go directly to the detailed review section for that bank in Maryland):

- 1st Mariner Bank

- Bay Bank, FSB

- Branch Banking and Trust Company

- Capital One

- Citibank

- Community Bank of the Chesapeake

- EagleBank

- First United Bank & Trust

- Hebron Savings Bank

- Howard Bank

- Manufacturers and Traders Trust Company

- Old Line Bank

- Rosedale Federal Savings and Loan Association

- Sandy Spring Bank

- SunTrust Bank

- The Columbia Bank

- Woodforest National Bank

Top 17 Best Banks in Maryland (Statewide) | Brief Comparison & Ranking

Best Banks in Maryland | Highlighted Features |

| 1st Mariner Bank | Dynamic mortgage & home equity lending options |

| Bay Bank, FSB | 360 Banking program for entrepreneurs |

| Branch Banking and Trust Company | Expert investment & retirement services available |

| Capital One | Convenient online/mobile tools & features |

| Citibank | Variety of convenient checking account options |

| Community Bank of the Chesapeake | Financial learning center helps members stay focused on their finances & goals |

| EagleBank | Extensive personal & business lending products |

| First United Bank & Trust | Dynamic My Bank Rewards program |

| Hebron Savings Bank | Wide range of lending & investment options |

| Howard Bank | Multiple overdraft protection options available |

| Manufacturers and Traders Trust Company | Direct Connect integrates Quicken & QuickBooks |

| Old Line Bank | Wide range of business checking & savings accounts |

| Rosedale Federal Savings and Loan Assoc. | FinanceWorks allows members to access all their accounts from one convenient location |

| Sandy Spring Bank | Affordable, convenient checking accounts |

| SunTrust Bank | Balanced Banking helps ease the burden of overdraft fees |

| The Columbia Bank | Wide range of credit cards available |

| Woodforest National Bank | Competitive rates on consumer loan products |

Table: Top 17 Best Banks in Maryland | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Banks in Maryland

Below, please find a detailed review of each firm on our list of top banks in Maryland. We have highlighted some of the factors that allowed these Maryland banks to score so highly in our selection ranking.

Popular Article: Top Banks in Tennessee | Ranking | Review of the Best Tennessee Banks

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

1st Mariner Bank Review

1st Mariner Bank is one of the best hometown banks in Baltimore, MD. They are the largest independently owned bank headquartered in Baltimore as well as one of the most well-capitalized, making them a good choice for consumers looking for local banks in Maryland that serve Baltimore.

Serving the citizens of Baltimore for more than 20 years, 1st Mariner Bank operates 14 branches throughout Baltimore, Harford, Howard, and Anne Arundel counties.

As a local bank, 1st Mariner Bank is among the few banks in Maryland that have been able to develop a deep understanding of the local neighborhoods and business climate, giving them a unique position to better serve the Baltimore community.

Key Factors That Enabled This Firm to Rank as a Top Bank in Maryland

Below are key factors that enabled 1st Mariner Bank to be rated as one of this year’s best banks in Maryland and Baltimore, MD.

Savings Accounts & CDs

1st Mariner Bank wants to make a saving as easy as possible for their customers. They offer several great ways to save through their personal savings account and CDs.

With options for everyday savings, seasonal savings, and healthcare savings, this bank in Maryland has a savings option for everyone.

Savings and CD options at 1st Mariner Bank are:

- Statement Savings: Basic savings account

- Absolute Savings: For those aged 55 or older

- Winter/Summer Savings: For those who wish to set aside seasonal funds

- Health Savings Account (HSA): Set money aside for healthcare expenses while earning interest

- Fixed-rate CD: Lock in funds to earn at a guaranteed rate of interest

- Flex & Premium Flex CDs: IRS-qualified CDs that allow one withdraw without penalty during the term

- 18-Month Variable Rate IRA CD: Earn interest at a variable rate

Home Equity

While there may be many small banks in Maryland that don’t offer consumer mortgage services, 1st Mariner Bank does. Whether a customer is looking to fund home repairs or secure a line of credit, this Maryland bank can help.

1st Mariner Bank offers both home equity loans and home equity lines of credit. They come with flexible terms and attractive interest rates, making loans and credit lines both convenient and affordable.

This bank in Maryland also has professional loan specialists available to assist customers with any questions they may have throughout the process.

Residential Mortgages

Along with home equity lines of credit and loans, this bank in Maryland also offers residential mortgages. Whether a customer is looking to buy a house or refinance an existing mortgage, this Maryland bank can help.

1st Mariner Bank offers both traditional fixed-rate mortgages and adjustable-rate mortgages. They also offer a variety of loan types to choose from, including conventional mortgages, FHA loans, VA loans, and Rural Housing Service loans.

This bank in Maryland has professional loan specialists available to assist customers with everything from applying for a mortgage to navigating closing requirements. They also have an online application to make the process as convenient and as quick as possible.

See Also: Top Banks in North Carolina | Ranking | Where to Find the Best North Carolina Bank

Bay Bank, FSB Review

Headquartered in Columbia, MD, Bay Bank is a good fit for those looking for local banks in Maryland. Bay Bank serves the Baltimore Metropolitan area with 11 offices located throughout the counties of Baltimore, Anne Arundel, and Harford.

Bay Bank prides itself on being a relationship-based bank that is dedicated to excellence, professionalism, and a high standard of integrity.

They serve businesses and consumers by offering a wide assortment of traditional banking products and financial services including online and mobile banking, commercial banking, cash management, mortgage lending, and retail banking.

Key Factors That Enabled This Firm to Rank as a Top Bank in Maryland

Below are key factors that enabled Bay Bank, FSB to be rated as one of this year’s best banks in Maryland and one of the top banks in Baltimore, MD.

Personal Checking Accounts

Bay Bank offers a variety of personal checking accounts to suit every customer’s needs. Consumers can easily choose the account that best provides for their individual checking needs and leave behind the features that they don’t want or need.

Bay Bank’s personal checking account options are:

- Bay Classic Checking: A simple checking account with all of the basics

- Bay Interest Checking: An interest-bearing account with the first order of checks free

- Bay Silver Checking: An interest-bearing account for those aged 62 years or older with no monthly fee if the minimum balance requirement is met

- Bay Relationship Checking: Account for those with an on-going relationship with Bay Bank through savings accounts, CDs, and consumer loans; comes with free basic checks

All personal checking accounts at this Maryland bank come loaded with free mobile banking, free online banking and bill pay, free Visa Check card, and free telephone banking.

360 Banking for Entrepreneurs

Bay Bank is a bank in Maryland that understands the struggle that today’s entrepreneurs face. That is why they offer their 360 Banking especially designed to make banking cost-effective and convenient for entrepreneurs.

360 Banking offers:

- Entrepreneur banking

- Cash management tools

- Private banking

- Bank at Work

Through their 360 Banking for Entrepreneurs program, Bay Bank is a best bank in Maryland that is dedicated to providing entrepreneurs with support for every aspect of their business.

Lending Services

Whether you are looking for a personal loan or a business loan, Bay Bank has a lending option that is right for you. This local bank in Maryland offers a variety of loan products and flexible terms to meet consumers’ borrowing needs.

Available loan options are:

- Home equity line of credit

- Home equity loan

- Automobile loans

- Secured and unsecured personal loans

- Overdraft protection line of credit

- New business loan

- Business line of credit

- Commercial real estate loans

- Not-for-profit financing

Don’t Miss: Top Missouri Banks | Finding The Best Bank in Missouri

Community Bank of the Chesapeake Review

The Community Bank of the Chesapeake first opened its doors in 1950 in Waldorf, Maryland, where they are still headquartered today. This small bank in Maryland now operates 21 bank branches throughout Southern Maryland and the Fredericksburg, Virginia region.

Reporting more than $162 million in market capitalization, the Community Bank of the Chesapeake has the resources it needs to quickly and efficiently serve the financial needs of its customers.

This Maryland bank strives to provide its customers with personal services, financial solutions, and warm, meaningful relationships.

Customers of this local bank in Maryland can take advantage of an array of financial services and products, including checking and savings accounts, money market accounts, certificates of deposits, and loans and lines of credit.

Key Factors That Enabled This Firm to Rank as a Top Bank in Maryland

Below are key factors that enabled Community Bank of the Chesapeake to be rated as one of this year’s best banks in Maryland.

Personal Savings Accounts

Community Bank of the Chesapeake offers multiple savings account options to help consumers begin putting money away. With so many quality options to choose from, this Maryland bank has something to suit everyone’s needs.

Savings accounts available at Community Bank of the Chesapeake are:

- Statement Savings: A basic savings account without a high monthly balance

- Spirit Savings: For teens from ages 13 to 18 to learn how to save responsibly

- Kids’ Club: For kids aged 12 and under to learn about saving

- Christmas Club: For those who wish to build savings all year for the holiday season

- CDs & CDARS: For those who want to grow their money with FDIC insurance and guaranteed rates

- IRAs: For building retirement savings with built-in tax advantages

Debit/Prepaid Card Options

Community Bank of the Chesapeake gives customers many debit and prepaid card options. Whether you are looking for a basic debit card for making purchases or want to earn points as you go, this local bank in Maryland has what you are looking for.

- Debit card: A basic debit card for shopping and accessing ATMs

- Reloadable MasterCard: This prepaid debit card allows customers the use of a debit card without having to have a checking account

- Youth card: Helps kids learn responsibility while getting used to how a debit card works

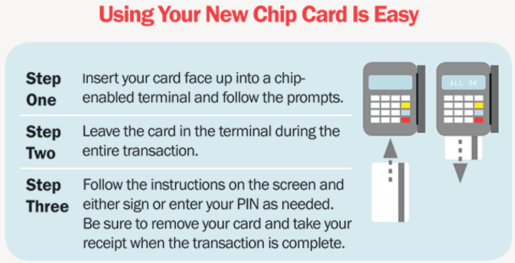

- EMV card: Contains an embedded computer chip to better protect against fraud

Image Source: Community Bank of the Chesapeake

- UChoose reward card: Earn rewards for everyday purchases made with a Community Bank of the Chesapeake bank card

- CardValet: A mobile app that helps customers control when, where, and how their money is spent

Learning Center and Resources

Community Bank of the Chesapeake realizes the importance of consumer financial education. On their website, they provide a financial learning center that houses a litany of resources and information to better educate their customers on a number of financial matters.

This Maryland bank strives to provide customers with advice, support, and the right financial services for whatever is happening in their lives.

They provide resources on:

- Budgeting and money management

- Saving for the future

- Family life

- Planning for education costs

- Financial scholars program

- Investing

- Retirement planning

- Identity theft protection

Online and Mobile Banking

Some consumers may hesitate to bank with some of the small banks in Maryland over concerns that they may not offer the same conveniences as bigger banks.

Community Bank of the Chesapeake is a local bank in Maryland that has kept up with technological advances, and offers many convenient online and mobile banking options to their customers.

This bank in Maryland offers customers the conveniences of online banking, mobile banking, mobile deposit capture, bill pay, and e-statements. They also offer a person-to-person payment option, making it easy to make secure payments to family and friends.

Related: Best Banks in Arizona | Review | Best Banks in Phoenix, Tucson, Mesa, etc.

EagleBank Review

Founded on the belief that banks should be better serving their communities, EagleBank takes its missive as a community bank seriously. Headquartered in Bethesda, Maryland, EagleBank prides itself on being the go-to community bank for Maryland, Virginia, and Washington, D.C.

Recently reporting more than $7 billion in assets, EagleBank has positioned itself to be one of the top banks in Maryland through consistent growth and a dedication to customer service.

This local bank in Maryland offers an array of banking and financial products to both consumers and businesses.

EagleBank operates on the philosophy that local businesses fuel the economy and therefore focuses on providing business owners with the financial products they need in order to succeed.

Key Factors That Enabled This Firm to Rank as a Top Bank in Maryland

Below are key factors that enabled EagleBank to be rated as one of this year’s best banks in Maryland.

Community Initiatives

Many banks in Maryland claim to be focused on helping the communities that they serve, but few prove it in the way that EagleBank does. At the heart of EagleBank’s operating philosophy is a focus on helping to enrich the communities that they are a part of, and they follow through on that philosophy.

EagleBank shows extreme dedication to helping the members of the communities that they serve through an outpour of community involvement and philanthropy.

They serve their communities through several outreach initiatives:

- EagleBank Foundation: Set up to raise money for breast cancer research, this foundation has raised close to $2.5 million since its inception in 2005

- Eagle Helping Hands: Facilitates employee giving and volunteering in their communities

- Annual Scholarship Program: EagleBank awards an annual scholarship to a student pursuing financial studies at Montgomery College

- George Mason University Alliance: EagleBank partners with George Mason University to provide scholarships to students, hire graduates and alumni, sponsor internships, and more

- Back to School for All: employees donate school supplies annually to the Children’s Program at DASH, which helps homeless families in Montgomery County, MD

- EverFi Program: EagleBank partners with EverFi to bring their web-based financial literacy course to high school students in nine schools located in Virginia and Washington, D.C.

Checking Account Options and Benefits

EagleBank has several great checking account options to choose from, and they all come with great benefits.

Checking account options include:

- Eagle Relationship Checking: A basic checking account with unlimited check writing; maintenance fee can be waived if qualifications are met

- Eagle Relationship Interest Checking: An interest-bearing checking account with all the basics; maintenance fee can be waived if qualifications are met

- Eagle Premium Interest Checking: A full-service premium interest-bearing checking account that comes with free checks

As an added bonus, all EagleBank’s checking accounts come with these great benefits:

- Free online banking

- Free bill pay

- Free online statements

- Free mobile banking

- Free personal debit card

- Four ATM surcharge fee refunds per statement cycle

Commercial & Business Banking

EagleBank considers businesses to be their specialty. As such, they offer many tools to help businesses succeed and grow. From traditional banking services to treasury management and lending, this local bank in Maryland has it all.

Commercial and business banking products and services offered by this bank in Maryland are:

- Checking accounts

- Business savings accounts

- Insurance

- Investment advisory services

- Payables and receivables

- Risk management and fraud protection

- Liquidity and investments

- Information reporting

- Small business lending

- Commercial lines of credit

- Equipment leasing

Consumer Lending

EagleBank offers a full array of competitive loan products for personal use. With competitive rates and terms to fit all budgets, this Maryland bank has the right loan to fit their customers’ financial needs and goals.

Loan options from EagleBank are:

- Construction/personal real estate loans

- Home equity lines of credit

- Home equity loans

- An unsecured personal line of credit with overdraft protection

- Credit cards

Read More: Top Banks in Ohio | Ranking | Review of the Best Ohio Banks

First United Bank & Trust Review

Founded in 1900 and headquartered in Oakland, Maryland, First United Bank & Trust is a local bank in Maryland that has remained locally owned.

This best bank in Maryland is passionate about the people they serve and strive to build customized financial solutions for each individual person or business that they have a relationship with.

First United Bank & Trust currently holds more than $1 billion in assets and has 23 banking offices located across Maryland and West Virginia.

Key Factors That Enabled This Firm to Rank as a Top Bank in Maryland

Below are key factors that enabled First United Bank & Trust to be rated as one of this year’s best banks in Maryland.

My Freedom Checking

Totally free checking at a bank is hard to come by these days, but First United Bank & Trust has it. This basic checking account gives customers the basics they need with no hidden charges lurking in the fine print.

This bank in Maryland does free checking right. Benefits of the My Freedom Checking account include:

- No monthly maintenance fee

- No minimum balance requirements

- Only $50 minimum deposit to open accounts

- Free eStatements

- Unlimited check writing

- Visa Check card

- Free online banking

My Prime Saver

First United Bank & Trust makes saving as easy as possible with their My Prime Saver account. This account is easy to open and even easier to use, without a long list of minimum monthly requirements for customers to worry about.

This savings account offered by this top bank in Maryland is what a savings account should be: easy to use with very little fuss.

Benefits of a My Prime Saver account include:

- Only $100 minimum to open

- No monthly or quarterly service charge

- Earns interest as long as $100 balance is maintained

- Free online banking

- Free eStatements

Visa Check Card with My Bank Rewards

Customers who take advantage of a personal or business checking account at First United Bank & Trust are issued a Visa Check Card that earns My Bank Rewards as they make purchases for everyday items.

Customers earn one point for every $4 they spend by signing up for eligible net purchases made with their debit card and one point for every twenty dollars they spend using their PIN.

My Bank Rewards is just one way that First United Bank & Trust shows their appreciation for their customers.

Digital Banking

First United Bank & Trust has several tools available to make it easy for their customers to manage their financial life anywhere and at any time.

This Maryland bank realizes that their customers’ lives take place out of the realm of bank hours, so they provide the technology necessary to give them the freedom to do their banking on their terms.

Through their online banking and mobile banking platforms, First United Bank & Trust gives both their business and personal customers access to:

- View account balance and activity

- Transfer money between accounts

- Pay bills

- View loan accounts

- Deposit checks via Mobile Deposit Capture

- eStatements

To browse exclusive reviews of all top rated banks in Maryland, please click on any of the links below:

- 1st Mariner Bank

- Bay Bank, FSB

- Branch Banking and Trust Company

- Capital One

- Citibank

- Community Bank of the Chesapeake

- EagleBank

- First United Bank & Trust

- Hebron Savings Bank

- Howard Bank

- Manufacturers and Traders Trust Company

- Old Line Bank

- Rosedale Federal Savings and Loan Association

- Sandy Spring Bank

- SunTrust Bank

- The Columbia Bank

- Woodforest National Bank

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – Top 17 Best Banks in Maryland

Hopefully, as you have browsed this list of banks in Maryland, you have found some viable banks in Maryland that will best suit your own personal financial needs.

Whether you are looking for banks in Hagerstown, MD, or anywhere else, it is important to keep your own personal needs in mind when considering the best bank in Maryland that is right for you.

Things such as whether you frequently use ATMs or whether you plan to open a CD in the future can have an impact on which bank in Maryland will provide the features you need.

The top banks in Maryland provided on this Maryland banks list represent the best that Maryland has to offer. These Maryland banks offer their own unique products and services but all share in a commitment to serving their communities with excellent service and integrity.

If you have questions about any of the products or services offered by any of the best banks in Maryland on this list, they are only a phone call away and will be happy to assist you.

This list encompasses a wide range of banks across the state, including both big and small banks in Maryland. There are also many local banks in Maryland for those who wish to keep their banking local within a tightknit community.

Whatever your preference, we sincerely hope that the informative reviews in this article have helped you to make a more informed banking decision in choosing a Maryland bank.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.