2017 RANKING & REVIEWS

TOP RANKING BUILDING SOCIETIES IN THE UK

Intro: Finding the Top-Rated Building Societies in the UK

Before diving into the in-depth reviews and ranking in this list of the best building societies in the UK, let’s first discuss the unique institution a UK building society is.

A building society is a member-owned, mutually operated financial institution that features many of the services one would find at a conventional bank, with a particular focus on savings accounts and mortgage options. UK building societies are relatively similar to credit unions in the United States. Building societies are usually found in the United Kingdom, Australia, and New Zealand.

Every building society in the UK is part of the Building Societies Association.

Building societies were originally created in Birmingham, which was a highly industrial city, and they worked through the pooling of financial resources by members, which were used to provide funding to build houses for members.

Award Emblem: Best Building Societies in the UK

Along with answering the question of what is a building society, it can also be valuable to compare the difference between a bank and a building society.

The primary difference is that a UK building society is member-owned, and through their savings or other financial accounts, members have the opportunity to vote and have an impact on making decisions that guide the leadership of the bank.

Each member has the right to vote regardless of how much they may have invested in or borrowed from the building society.

Another key factor to consider when comparing the difference between a bank and a building society is the fact that banks are companies. As a result, shareholders own the bank, and all decisions are tied back to pleasing them by increasing profits. Since the members of a UK building society operate as the owners, these UK building societies can provide better interest rates on savings, more affordable mortgage options, and often, higher levels of service.

See Also: Best UK Stock Brokers | Best Share Trading & Online Stock Brokers in the UK

AdvisoryHQ’s List of the Top Building Societies in the UK

List is sorted alphabetically (click any of the names below to go directly to the detailed review section for that building society):

- Coventry Building Society

- Leeds Building Society

- Nationwide Building Society

- Newcastle Building Society

- Nottingham Building Society

- Principality Building Society

- Progressive Building Society

- Skipton Building Society

- West Brom Building Society

- Yorkshire Building Society

Top 10 Building Societies in the UK | Brief Comparison

| UK Building Societies | Highlighted Features |

Coventry Building Society | First-Time Buyers Mortgages |

Leeds Building Society | Access ISA |

Nationwide | Like-For-Like UK Loan Matching |

Newcastle | CustomISA |

Nottingham | Branch Instant |

Principality | Funding for Commercial Projects |

Progressive Building Society | Self-Build Mortgages |

Skipton | Life Goals Tool |

West Brom | Online Savings Accounts |

Yorkshire | 95% Mortgages |

Table: Top 10 Best Building Societies in the UK | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top-Ranking Building Societies in the UK

Below, please find the detailed review of each card on our list of the best building societies in the UK. We have highlighted some of the factors that allowed these UK building societies to score so high in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The Coventry Building Society is the third-largest building society in the UK, with a history that dates back to 1884. The Coventry Building Society was started by Thomas Mason Daffern and a group of local citizens who were interested in protecting members.

Throughout its 125-year UK history, Coventry has remained dedicated to the protection of member interests first and foremost.

Since a merger with Stroud & Swindon Building Society in 2010, this UK building society now has more than 1.5 million members and a staff of more than 1,800 professionals. The Coventry outlines its mission as being committed to providing long-term value to members, with easy-to-understand products that are relevant to their lives.

Key Factors That Enabled This to Rank as One of the Top 10 UK Building Societies

Primary reasons Coventry was included on this list of the top building societies in the UK are as follows.

Savings

The Coventry leads the way in terms of providing some of the best UK building society savings options. There are a variety of types of accounts available to members, including easy access, cash ISA, affinity accounts, bond & notice options, children’s accounts, and both fixed and variable rate savings accounts.

Each of these UK building society savings accounts also offers competitive interest rates, as well as flexible withdrawal options in most cases.

One of the most popular building society savings accounts available from Coventry is the Easy Access ISA, which includes a 0.90% tax-free p.a./AER, and withdrawals and closure options that are available without a charge.

Image Source: Coventry Building Society

Image Source: Coventry Building Society

Online Services

Members of Coventry have the opportunity to manage their UK building society savings accounts and other accounts quickly and easily through the online services portal. Users register for access, and once they do that, they can log in at any time and do the following:

- View account summaries and check balances

- Manage money with real-time statements

- Monitor transactions

- Transfer money between accounts

- Create standing orders and one-off payments

- Check account interest rates

- Make withdrawals

- Apply for new accounts

- Send and receive secure messages

Online Protection Promise

The Coventry makes a promise to members that online security and protection is one of their utmost focuses. If a member becomes a victim of fraud via their Coventry account, this building society will reimburse them, if the following criteria are met:

- The correct payment details have been provided to Coventry

- There was no consent given for the transaction

- The member’s online security details haven’t been disclosed to anyone, including Web ID and passwords

- All security requirements have been complied with, as they are set forth by account terms and conditions

- The fraudulent activity isn’t the result of the member’s use of an aggregation service

First-Time Buyers

A key service area delivered by Coventry, in addition to conventional UK building society account options, is mortgages. Coventry prides itself on offering access to home-buying for a range of consumers, including first-time buyers.

The Coventry offers mortgage products specifically for first-time buyers banking with this UK building society.

The Coventry offers mortgages up to 90% loan to value, and some first-time buyer products include the Flexx For Term mortgage, which includes a low variable rate.

Don’t Miss: The Share Centre Share Account Review and Ranking

Leeds Building Society celebrated its 140th anniversary in 2015. It was originally formed in 1845 and formally established in 1875. It was with this official establishment in 1875 that this UK building society became known as Leeds and Holbeck Permanent Building Society.

Leeds Building Society now represents the fifth biggest building society in the UK, and along with being the recipient of many awards, this building society also offers excellent customer service, and a broad range of diverse and uniquely tailored products to suit the needs of all members.

Key Factors That Led Us to Rank This as a Top Building Society in the UK

The following list represents some of the reasons Leeds Building Society was included in this review and ranking.

Member Benefits

In a broad sense, members of Leeds Building Society have access to a range of benefits that make them more than just a customer, and instead, signify their ownership of this financial institution.

For example, rather than dedicating funds to wide profit margins for shareholders, this UK building society offers excellent service available through branch locations, online, or by phone.

Leeds Building Society is also known for the delivery of highly competitive interest rates on all products and services.

Members have the ability to shape the future of this building society through voting and participating in their AGM.

Mortgages

One of the top reasons members come to this UK building society is because of their competitive mortgage rates. Along with providing some of the lowest available rates, there are also other benefits that compel members to obtain a mortgage here.

Benefits of taking advantage of Leeds Building Society mortgage rates and products include:

- There are more than 130 products included in the range

- Members join a community of more than 178,000 mortgage customers

- Leeds Building Society processed more than 25,000 mortgages just in 2015

- According to data collected by Explain Market Research Limited, mortgages from Leeds Building Society demonstrated an overall customer satisfaction rate of 93%

- The product range includes specialist options

Payment Difficulties

For customers who already have a mortgage with Leeds Building Society and are struggling to make payments, there are some options available to them.

Leeds Building Society strives to help members when they’re facing hardships that lead to problems making mortgage payments, so by contacting this UK building society directly, mortgage holders can potentially arrange a new payment plan, and discuss debt counselling options available not only through the society but through third-party agencies as well.

If a customer contacts the society, repossession proceedings will only begin once all other options have been fully explored.

Some potential solutions offered by this building society in the UK include changing the way payments are made, changing the type of mortgage a member holds, allowing a member to pay back a mortgage over a longer period of time, or capitalising arrears onto the outstanding balance.

Tax-Free Savings

A popular building society savings option offered by Leeds is the Cash ISA, which is a tax-free savings option. When members open this account, they’re not required to pay taxes on the interest they earn.

There are several different ISA options including the 1-year fixed rate ISA, with interest paid on investment, and only a minimum investment and operating balance of £100. There’s also a 2-year fixed rate ISA, with a higher interest rate.

For those members who want immediate access to their money, along with tax advantages, there is the Access ISA, which includes unlimited withdrawals, which can be made without notice or loss of interest.

Nationwide Building Society was started in the 19th century to provide a means for working-class people to obtain the credit they needed to secure long-term housing. Nationwide’s history began as the Provident Union Building Society, the Northampton Town & County Freehold Land Society, and London’s co-op movement. Through many mergers over the years, Nationwide was born.

Nationwide now serves as the world’s largest mutual financial institution, as well as the second-largest mortgage provider in the UK, and one of the largest savings providers in the UK.

Key Factors That Enabled This to Rank as a Top Building Society in the UK

Primary reasons Nationwide was included on this list of the best building societies in the UK are highlighted below.

Responsible Lending

With all the UK building society account options available from Nationwide, there is a focus on responsible lending. Nationwide outlines this emphasis as being a responsibility to the customers to be open and honest, offer fair treatment, and to maintain security and safety.

As part of this responsible lending approach, Nationwide outlines the following commitments:

- Products and lending criteria are tailored to the needs of the customer

- Prices of products are competitive and shown in a way that’s balanced to demonstrate both benefits and risks

- Nationwide will provide precise information on what borrowing will cost the customer, including any fees and charges, as well as terms and conditions

- When the credit limit is only at the discretion of Nationwide, they will consider the previous and current account activity of the member

- A reasonable notice of interest rate and payment changes will be provided to customers it affects

- Nationwide will offer a limit on borrowing that they feel is reasonable to ensure the customer doesn’t overextend themselves financially

- Personal information is treated confidentially, within the framework of Data Protection legislation

Financial Guides

In addition to offering UK building society account options, Nationwide provides comprehensive financial guides and information to help customers make the best decisions about their money.

They create signature, in-depth financial guides on a range of topics that most affect customers. Some of these guides include:

- “Managing Your Money & Budgeting”

- “Making the Most of Your Savings”

- “Looking After Your Credit Rating”

- “Managing Debts”

- “Borrowing Sensibly”

- “Windfalls and Inheritance”

- “Dealing with Debt Problems”

- “Tax-Free Savings”

- “Building a Safety Net”

Credit Cards

Along with offering some of the best UK building society savings accounts, Nationwide also features credit cards that come with an array of consumer benefits. Nationwide’s credit card options have among the highest customer satisfaction rates among high street competitors, and other advantages of obtaining a credit card from this building society include:

- Nationwide is one the world’s largest UK building societies, so they have the resources and means to reinvest in members in the most value-creating ways

- Nationwide takes seriously the needs and wants of customers

- A focus on ethics guides all products, decisions, and services from Nationwide

Credit card options include the Select Credit Card and the Nationwide Credit Card.

The Select card is for main current account customers, and it includes 0% on balance transfers for 12 months, no balance transfer fee, and 0% on purchases for 12 months. This card also includes options to earn 0.5% unlimited cash back.

The Nationwide Credit Card also includes benefits like 0% on balance transfers for 12 months, no balance transfer fee, and a commission-free allowance that can be used abroad.

Image Source: Nationwide Building Society

Loans

In addition to offering UK building society accounts and credit cards, Nationwide also features personal loans to suit a variety of distinctive needs. Main current account customers can also gain access to exclusive features, including rates that are at least 1% lower than equivalent rates offered to other customers.

Other features and benefits of a Nationwide Personal Loan include:

- A low 3.4% APR on unsecured loans, with terms ranging from one to five years

- A no-obligation quote that doesn’t affect credit rating

- An instant online decision

- Loans that are simplified with fixed monthly payments

- No fees are charged for setting up a personal loan

- The Loyalty Price Promise dictates Nationwide will beat any like-for-like UK loan provider by 0.5% APR on loans ranging from £1,000 to £25,000 for primary account customers

Related: The J.P. Morgan Investment Account Review and Ranking

Newcastle Building Society is the largest building society in the North East region, with more branches than any other regional society. Newcastle is also the eighth largest building society in all of the UK, with assets of more than £3.4 billion.

NBS was originally formed through a joining of the Newcastle Permanent Building Society and the Grainger Permanent Building Society. The basis is on mutuality, and all of the assets are fully owned by the members. The focus of products and services offered by this top building society in the UK is on mortgages, savings, and insurance.

Key Factors That Allowed This to Rank as a Top UK Building Society

Factors that led to the inclusion of Newcastle on this list of the best UK building societies are detailed below.

Financial Education

If you’re weighing your options and working to decide whether a bank or building society is right for your needs, you might consider not just the accounts and services available, but also the extras that show a dedication to the customer. This UK building society goes above and beyond simply providing products and services by also offering a Financial Education programme, available to members of the community.

Not only is charity and non-profit work part of this programme, but so are financial planning seminars, designed to address the needs of varied customers using this top UK building society at different stages of their lives.

For example, topics covered by Newcastle financial seminars include savings and investments, retirement planning, inheritance tax planning, and estate planning.

There are also regular First-Time Buyer events for new homebuyers.

Introductory Mortgage Rates

Newcastle offers a variety of mortgage products, all of which boast competitive rates and terms, and uniquely, this UK building society also features a special initial rate for mortgage holders.

For example, if a member were to obtain a two-year fixed rate mortgage with £999 in fees, their initial interest rate would be only 1.28% for two years. Only after two years would the rate go up to this UK building society’s Standard Variable Rate.

Similarly, a five-year fixed-rate mortgage with £1,599 in fees comes with an introductory rate of only 2.07% for five years.

This UK building society offers different combinations of term lengths, rates, and fees.

The Savings Promise

Newcastle Building Society features what they call the “Savings Promise”, which was put in place to ensure that customers of this UK building society are kept informed of changes to products and services.

All customers are informed of interest rate changes, and there are also published current rates on the Newcastle websites. Customers can also request paperwork detailing current interest rates from this building society in the UK.

Customers are contacted before reaching the end of a fixed-rate investment term so they can learn about the new rates, and they’ll also be informed of the alternative investment products that are available. Also part of this promise is an email Priority Register Service, which lets customers know about new products and services before the general public finds out.

CustomISA

One of the best building society savings accounts available from Newcastle is the CustomISA. This account lets holders spread their annual tax-free allowance across as many Newcastle accounts as they choose, with the objective of helping them attain their personal savings goals.

The CustomISA lets customers have the freedom of no longer being committed to only one ISA product, while still obtaining the tax-free benefits of the account.

This signature product is a great option for members who want to make the most of their allowance by creating accounts tailored to their needs, including the length of a product or the access they’re looking for.

Account holders can choose from easy access, regular saver, and fixed-term accounts with this option.

A member of the Building Societies Association, the Council of Mortgage Lenders and the Financial Ombudsman Service, The Nottingham Building Society was started in 1849. This building society in the UK was founded by a group of Nottingham businessmen, with the goal of helping people own their own home and have a secure place for their savings.

Nottingham includes a network of 61 branches, spread across ten counties. Nottingham is the ninth largest building society in the UK, with assets in excess of £3 billion, and more than 650 staff members.

Image Source: Top Building Societies in the UK

Key Factors That Enabled Us to Rank This as One of the Top Building Societies in the UK

When comparing and ranking the best building societies, below are some reasons Nottingham made this list.

Estate Agency Services

When deciding between a bank or building society, or just comparing all of the building societies in the UK, one notable aspect of Nottingham Society is their combination estate agency services. The Nottingham offers all-in-one services including not just savings and mortgages, but also estate agency and financial planning.

It’s the only UK building society to offer what they call “whole of market” mortgage advice as well. This means they conduct an in-depth search of more than 50 lenders to find the right mortgage for the specific customer.

Branch Instant

One of the most versatile and attractive UK building society savings accounts from the Nottingham Society is the Branch Instant. This account includes full control and instant access to funds when they’re needed.

Other features of this best building society savings account include:

- A competitive variable interest rate

- Withdrawal arranges are instant, so you can get to your money when you need it

- The minimum age to open the Branch Instant account is 16

- It requires just £1 to open this account

Other savings options from Nottingham include the Branch Notice Issue 2, Fixed-Rate Issue 157, and the Fixed-Rate ISA Issue 22.

Image Source: The Nottingham Building Society

Estate Planning

As mentioned, the Nottingham Society is a unique building society in the UK because, in addition to building society account options, there are also estate-planning services.

Members of this UK building society can gain access to will-writing services so they can adequately protect their assets as well as lasting power of attorney designation. There are services and products to help members set up trusts, to determine probate needs, and even to plan funerals.

This proves very valuable to many members because they have the opportunity to manage every aspect of their financial life with their UK building society of choice, rather than having each of their accounts set up at different organisations.

The Mortgage Commitment

Along with searching more than 50 lenders to find the mortgage with the right terms for an individual member, Nottingham is unique because of the signature commitment they make.

Expert advisers from this UK building society search the entire mortgage market and look at criteria well beyond price, reasoning that cheapest doesn’t necessarily mean the best.

They also promise to get to know the member on a personal level to assess their needs through a free consultation.

The expert advisers will not just locate the best mortgage opportunity; they also promise to help the member make the right decision, with the best interest of that member as the guiding force of all services. Advice is impartial, and clients don’t have to worry that advisers from this top UK building society are trying to push them toward any particular product.

Popular Article: IWEB Share Dealing Account Review and Ranking

The sixth largest UK building society, Principality is a mutual operation owned and run by 500,000 members. Principality maintains more than £8 billion in customer assets, and they are covered by the Financial Services Compensation Scheme.

Principality’s history started more than 150 years ago on Church Street in Cardiff. Now, Principality maintains more than 70 outlets, which includes an extensive branch and agency network throughout Wales. Principality is a financially secure UK building society, with a broad capital base, providing protection for members during potential market downturns. Liquidity and balance sheet levels are high as well.

Key Factors Leading Us to Rank This as a Best Building Society in the UK

These are a few of the reasons Principality is ranked as one of the best building societies in the UK.

Commercial

Principality is an excellent building society option for anyone who wants to combine their personal and commercial banking needs under one roof. This is one of the few building societies in the UK that not only provides individual accounts and options, but also funding for property managers and developers.

There is a team of expert Commercial Managers and an accompanying support team that are part of Principality, and they have offered Commercial Property funding solutions for 12 years.

Key areas of commercial funding from this UK building society include investment and development funding. Investment funding includes options for refinancing and acquisition of investment properties across primary asset classes. Regarding development funding, Principality offers residential and commercial development funding.

Member Rewards

When you enrol in your online account from Principality, you simultaneously gain access to a Member Rewards page. This features Principality Stadium competition access, including priority tickets to certain events.

Member rewards also include a 15% discount at the WRU online store and ticket price draws, with automatic entry into giveaways.

Any Principality customer, aged 18 or over, who qualifies as a member of the society, is eligible to receive Member Rewards.

Customers Experiencing Difficulties

As part of a commitment to delivering the highest level of customer service, when you’re a member of Principality, and you experience short-term or long-term difficulties, the employees can help you find solutions that will ease your burdens.

The staff works to make sure every member has a complete and clear understanding of their financial situation and options before making any decisions, and all service is fully customised.

There are also options to help customers including the availability of longer appointments so that everything can be fully covered. The goal of the Principality professional staff is to offer not just financial solutions but support where it’s needed, too.

Savings Accounts

Principality strives to offers some of the best UK building society savings accounts that are well-suited to a range of objectives, whether it’s saving for education, a particular event, or gaining tax-free interest. Each of the building society savings accounts offered by Principality is flexible with favorable and competitive interest rates.

Savings accounts are categorised into:

- Everyday Savings: This includes the e-Saver Issue 16, as well as the Instant Access Account

- Fixed-Term Savings and Bonds: This includes fixed-rate and regular saver bonds, ranging from one to five years

- ISAs: Principality ISAs include fixed-rate cash ISAs, Promise ISAs, and variable rate options

- Children’s Savings Accounts: These include the standard Children’s Account and the Dylan Regular Saver Bond Issue 6

- Notice Accounts: This covers the Promise Saver Issue 10

Free Wealth & Finance Software - Get Yours Now ►

Progressive Building Society is a Northern Ireland–based building society that came about through the merger of five small societies. The Progressive name first came into use in 1914 under the leadership of Samuel Howard.

Now, Darina Armstrong, who once served as the Finance Director, is the CEO of this top UK building society. This building society in the UK continues to build a reputation for quality based on word-of-mouth recommendations made by current members. Progressive’s mission statement is to be the savings and mortgage provider of choice in Northern Ireland.

Key Factors That Enabled This to Rank as One of the Best Building Societies in the UK

This UK building society ranks among the best for the following reasons.

Treatment of Members

If you’re thinking about whether a bank or building society in the UK might be best for your financial needs, you would likely think about customer service, honesty, and transparency. These are all essential elements of everything Progressive does. In terms of how they treat members, they strive to be fair in all dealings with members.

Responsibilities to members include:

- Fairness in dealings with members is central to the culture of this society

- New products are designed and marketed to meet the needs of member groups

- All products include clear and fair terms and conditions

- All necessary information is to be provided to members not only before but also during and after the point of sale

- Advice should be suitable and offered within the framework of members’ unique circumstances

- Products will perform as members have been led to believe they will

- The staff provides members with friendly, professional, efficient service

- No unnecessary barriers should be put in place that would prevent members from moving to another institution or changing products

- Complaints are dealt with fairly and comply with FCA rules and guidance

Instant Access

The Progressive Building Society offers instant access accounts that can be an excellent option for those members who want to save money but also want to be able to access their funds quickly when required.

These accounts include the Progressive Saver and the Investment Share.

The Progressive Saver includes a two-tiered interest rates, with the higher rate for higher balances. The maximum investment is £1 million, and the minimum opening balance is only £1,000. It’s available to existing members and new customers who reside in Northern Ireland.

The Investment Share savings account is flexible with a variable interest rate of 0.25% Gross/AER and withdrawals are permitted.

Self-Build Mortgages

Self-build mortgages are an option with Progressive, and unlike traditional mortgages, this lending option features funding released in stages as you build your dream home. The building stages range from foundation level to completion, as well as agreed-upon milestones that occur during construction.

These Self-Build mortgages from this UK building society are available only to properties within Northern Ireland. What’s beneficial to this type of mortgage is the fact that it can be the starting point for beginning a building project.

Insurance

As well as mortgages and some of the best UK building society savings accounts, Progressive also features insurance products that can cover buildings, contents, and possessions.

Progressive offers complete home and contents insurance through ASA Insurance. The goal is to deliver both value and protection if a home is damaged or contents are stolen.

The claims process is simple and efficient, and members quickly get an online insurance quote through this UK building society’s website.

Read More: Interactive Investor Share and Fund Account Review and Ranking

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Skipton Building Society was established in 1853, meaning its history across the UK dates back more than 160 years. Skipton now includes a network of 98 branches, which demonstrates significant growth since George Kendall originally founded it.

This full-service UK building society offers savings accounts, mortgages, retirement options, insurance, legacy planning, and financial advice and planning services. Skipton is the fourth largest building society in the UK, focusing on offering straightforward, value-creating products and services to customers.

Key Factors That Led Us to Rank This as a Top UK Building Society

Detailed in the list below are some of the reasons Skipton was included on this list of the best UK building society accounts and services.

Skipton Online

Skipton Online is a secure online portal that simplifies how members of this UK building society manage their accounts. When members register for online services through the Skipton Online portal, they can handle transactions anytime. In addition to viewing their savings balance, members can view their mortgage balance and make faster, easier payments.

Members can eliminate the need for paper statements and streamline the management of their personal details.

The Skipton Online portal also includes a secure messaging service.

Retirement Planning

As well as conventional UK building society savings accounts, Skipton also features retirement planning and related services. Retirement planning options and benefits include:

- Online tools that are free and include a retirement countdown tool and a guide called the “DNA of Retirement”

- Members can receive a complimentary in-branch Retirement Review, to go through their retirement objectives as compared to their personal finances

- The retirement team of Skipton can provide tailored financial and retirement recommendations from the Preferred Product/Fund Range

- Branches are located across the country, making face-to-face meetings convenient and accessible

- There is a no-pressure promise: Skipton retirement professionals are committed to offering guidance without being pushy

Savings

When it comes to providing UK building society savings accounts, Skipton is considered a leader. Skipton has been the recipient of many awards, naming them one of the best building society savings accounts providers.

This building society in the UK’s selection of savings accounts include easy access, ISAs, limited access, fixed-term and children’s accounts.

There are also Specialist ISAs, which include flexible withdrawals and tax-free interest rates.

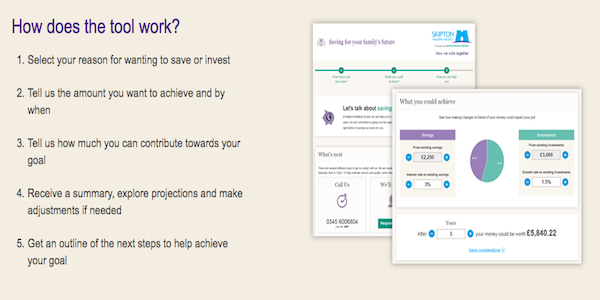

Life Goals Tool

Image Source: Skipton Building Society

An exclusive feature available to UK building society account holders at Skipton is access to the Life Goals Tool. This proprietary tool lets users plan their future in a simple, user-friendly way. This tool first works by having the user select the reason they want to invest or save money. They then enter the amount they hope to have saved by a set deadline.

Next, users enter how much they can contribute toward their goal.

Once that information is received, the user receives a summary and helpful projections. The tool also then provides an outline of the next steps the user should take to meet their goal.

Eight tailored goals are included with the use of the tool. These goals are:

- Saving for the unexpected

- Saving for future education

- Making more of your money

- Saving for a specific goal

- Saving for the future of your family

- Taking an income from your money

- Saving for a new home

- Help with a lump sum

Free Wealth Management for AdvisoryHQ Readers

West Brom Building Society is the seventh-largest building society in the UK, with around 446,000 members and a range of products and services that include savings and mortgages. West Brom includes a network of locations across Birmingham, Black Country, mid-Wales, and Shropshire.

With a history that goes back more than 160 years, West Brom is one of the top building societies in the region it serves. This building society in the UK was originally founded as a mutual organisation by 20 local citizens in 1849, and since then has remained committed to serving the community as it did during its initial formation.

Key Factors Considered When Ranking This as One of the Best Building Societies

Criteria that was heavily considered in the ranking of the West Bromwich Building Society as a top UK building society are featured below.

Online Savings Accounts

In recognition of the convenience and accessibility offered by online accounts and tools, West Brom features not only excellent branch-based building society accounts, but exclusive online accounts as well.

The signature online account is the WeBSaverR 2, which is an account that features unlimited withdrawals, and a variable rate of 0.75% Gross p.a./AER and a minimum opening balance of £1,000.

Another building society savings account available online from West Brom is the WeBSaveR ISA 2, which also features easy access to unlimited withdrawals and tax-free interest.

Transparency

If you’re in the process of deciding whether a bank or UK building society is right for your financial needs, a sense of transparency is likely important in your decision-making. Transparency and honesty are areas where West Brom and many building societies in the UK excel.

One way West Brom demonstrates transparency is through their guide explaining mortgage fees and costs. They emphasize the importance of understanding that the expense of buying a new home goes beyond the price of the property.

They created a signature first-time buyers guide that encourages home buyers to factor into their decision elements such as the booking fee, the completion fee, stamp duty, legal fees, and even costs that come into play after a home is purchased.

Customer Panel

The Customer Panel is designed to maintain the objective of this UK building society, which is always to uphold the interests and well-being of members first and foremost. The customer panel is an exclusive area of business at West Brom that is designed to offer the opportunity to listen to the views and opinions real customers have regarding the products and services available from this building society in the UK.

Panel members are invited to provide their feedback regarding a range of topics, and they also are regularly asked to participate in online surveys. The advantage of being a member of the customer panel is that you’re a leading driver of decision-making and policy-making for West Brom.

As a general advantage, members of this UK building society have the peace of mind of knowing that their financial institution wants to hear what real members think, and what products and services will best serve their needs.

Financial Planning

For members who want to integrate their UK building society accounts with more comprehensive financial services, West Brom partners with Wren Sterling to offer personalised, one-on-one service and financial advice.

Wren Sterling is one of the UK’s top national independent financial advisory businesses, and their services are driven by the concept that financial planning goes much deeper than simply where money is kept.

Wren Sterling’s advisement services aren’t tied to any particular company or product, so all information and guidance are unbiased and objective.

Free Money Management Software

The Yorkshire Building Society has a 150-year history and now serves the needs of 3.5 million members. The products and services available to members of YBS are based on concepts of solidarity, dependability, and trustworthiness. YBS is considered one of the largest building societies in the UK, and it includes more than 250 branches, as well as countrywide agencies.

YBS maintains its head office in Yorkshire. Yorkshire has been built over the years through UK building society mergers, which have included the Chelsea Building Society and the Barnsley Building Society.

Key Factors That Led to Our Ranking of This as a Leading UK Building Society

Essential reasons Yorkshire was included on this list of the best UK building societies are highlighted in the following list.

Clear Vision

When a consumer is deciding on a bank or UK building society, or trying to understand the difference between a bank and building society, it’s critical to take note of the overall vision of the organisation first. With a conventional bank, the vision is often guided by increasing profits and the desires of shareholders.

With a building society in the UK, the vision is typically based on the customers’ needs first and foremost.

This is certainly true at YBS. Their vision is to be the most trusted provider of financial services in the UK.

They strive to achieve this by delivering the following:

- Attracting and retaining talented employees who share a vision of a building society based on trust

- Providing a superior customer experience built on the principles of empathy, simplicity, and trust

- Creating a sustainable, risk-aware financial performance that creates true security for members

- The delivery of products and processes across a network that are straightforward and easy to use

- Support of local communities

Fast Lending Decisions

A key area of service offered to members of YBS is mortgage lending. Members of this UK building society can apply online and receive an Approval in Principal in just 10 minutes. This means members can quickly apply and then almost immediately find out not just whether YBS can lend to them, but the amount as well.

The benefit of an Approval in Principle is that members can show they’ve been approved by a UK building society, so they’ll be taken seriously as a buyer during their search for a property, as well as the process of making an offer.

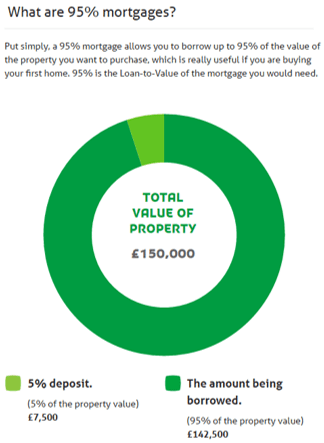

95% Mortgages

Available through YBS are 95% mortgages, which let members borrow up to 95% of the value of the property they’re going to purchase. This tends to be most useful for first-time buyers. This is advantageous if you want to make a smaller deposit, although it is important to recognize that repayments will be higher.

Yorkshire Building Society bases the amount they lend a member on factors including basic salary, other income sources, and financial commitments.

On the YBS website are calculators so members and applicants can quickly determine how much of a deposit they would need if using a 95% mortgage.

Image Source: Yorkshire Building Society

Savings Pledges

One of the primary areas of service delivered by YBS are savings products. This UK building society’s commitment is to help savers maintain a sense of trust that their organisation is acting in their best interest. With this in mind, YBS outlines Savings Pledges, to show how they’re protecting the interests of these members.

The Savings Pledges from YBS include:

- If members share their email address, they’ll be one of the first people to learn about new opportunities in terms of savings accounts

- If a member sees an available savings account and books an in-person appointment, the account is guaranteed available for the next 14 days, even if it’s withdrawn from sale

- The YBS employees will work to make sure members have the right savings account for their needs, and make sure they’re getting the best deal on associated interest rates

- If within 14 days of opening a Fixed-Rate ISA or Bond, the building society launches an equivalent account with a higher interest rate, the members have 14 days to switch to that account with no restrictions

- YBS believes all savers should be treated equally, so if they meet eligibility criteria, they can take advantage of any account, whether they’re a new or existing customer

- YBS strives to provide support when members need it most, particularly if their circumstances change

Related: The Best Current Accounts in the UK | Guide to Top UK Current Accounts with Benefits

Conclusion—Understanding and Ranking Building Societies in the UK

This UK building society has long been a part of the history and financial landscape of the area, and these unique cooperatives remain one of the backbones of the UK’s financial services sector.

Many consumers tend to favour working with a building society in the UK because they offer benefits including higher interest rates on savings accounts and lower interest rates on mortgages and loans.

Building societies in the UK are also more committed to customer satisfaction, community engagement, education, and transparency. It’s this shared spirit of cooperation and interests that led to the original creation of the UK building society, and it remains a pivotal part of everything they do and offer.

The above list represents not just the best building society savings accounts and mortgage options, but it also highlights the names of the best building societies overall. Each of the names have managed to maintain a sense of tradition and heritage, while also being innovative and forward-thinking in their products and services.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.