2017 RANKING & REVIEWS

TOP RANKING CREDIT UNIONS IN SYDNEY & MELBOURNE

Finding the Best Sydney Credit Unions and Melbourne Credit Unions

Today, the number of Sydney credit unions, Melbourne credit unions, and credit unions throughout the country has continued to grow.

In Australia, credit unions are also frequently referred to as part of the customer-owned banking sector.

Award Emblem: Top 10 Best Credit Unions in Sydney and Melbourne, Australia

These financial institutions offer a full range of consumer banking services, including savings accounts, term deposits, loans, credit cards, and savings accounts.

Credit unions in Sydney and Melbourne offer more favourable interest rates and lower fees, and members also have voting rights as they are owners of the institution.

The following ranking of the top Sydney credit unions and Melbourne credit unions highlights the best in these areas and also details some of the reasons they were included in this ranking and review.

AdvisoryHQ’s List of the Best Sydney Credit Unions and Melbourne Credit Unions

This list is sorted alphabetically (click any of the below names to go directly to the detailed review for that credit union in Sydney or that Melbourne credit union)

- Community First Credit Union

- CUA (Credit Union Australia)

- Firefighters Credit Union

- First Option Credit Union

- MyLife MyFinance

- Nexus Mutual

- People’s Choice Credit Union

- Sydney Credit Union (SCU)

- Unity Bank

- Woolworths Employees’ Credit Union (WCU)

Click here for 2016’s Top 10 Best Credit Unions in Sydney and Melbourne

Top 10 Best Credit Unions in Sydney and Melbourne | Brief Comparison

Credit Unions in Sydney & Melbourne | Highlighted Features |

| Community First Credit Union | Financial Planning |

| CUA (Credit Union Australia) | Just In Case Overdraft |

| Firefighters Credit Union | Protector Home Loan Package |

| First Option Credit Union | iT Saver Account |

| MyLife MyFinance | Accommodation Deposit Loan |

| Nexus Mutual Review (Formerly EECU) | Home Loans |

| People’s Choice Credit Union | Transaction Accounts |

| Sydney Credit Union (SCU) | Visa Credit Card |

| Unity Bank | Power Up eSaver Account |

| Woolworths Employees’ Credit Union | Loan Protection Insurance |

Table: Top 10 Best Credit Unions in Sydney and Melbourne, Australia | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Credit Unions in Sydney and Melbourne, Australia

Below, please find the detailed review of each firm on our list of the credit unions in Sydney and Melbourne. We have highlighted some of the factors that allowed these Australian credit unions to score so high in our selection ranking.

See Also: Best Credit Unions in California | Ranking | Southern & Northern California

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Community First Credit Union Review

As one of the top credit unions in Sydney, Community First offers full-service products to consumers, including credit cards, mortgages, and savings accounts. This credit union in Sydney operates with a mission of helping members achieve their financial goals through the building of mutually beneficial relationships.

Community First has been in operation since 1959, and it delivers superior service, a wide range of products, interest rates that are competitive, and lower fees. Today, Community First maintains locations throughout Sydney, and there are around 68,000 members.

Image Source: Top Sydney Credit Unions

Key Factors That Enabled This to Rank as a Top Sydney Credit Union

When comparing Sydney credit unions, the following are some of the primary reasons Community First was included in this ranking.

Green Loans

This credit union in Sydney offers a full range of loan products, and one of these lending categories is called “Green Loans.”

Green Loans are those personal loan products that allow consumers to make purchases that will reduce their carbon footprint and make their home more eco-friendly, including the purchase of solar panels and hot water systems.

The Solar Loan from this Sydney credit union has no monthly account keeping fees, and it can be paid off early without penalty. The Green Loan is a low-rate unsecured personal loan with no ongoing fees, no penalty for early payout, and options to redraw.

Foreign Cash Passport

When choosing the best Melbourne credit union and Sydney credit union names for this ranking, we looked carefully at unique, signature products that might not be offered elsewhere. One that’s available from Community First is called the Foreign Cash Passport.

This reloadable card is secure and convenient and designed for overseas travel. It’s used as a conventional debit card, but it is specifically meant for traveling or making purchases online from global retailers. It can be loaded with multiple currencies, including Australian dollars, euros, US dollars, British pounds, NZ dollars, Canadian dollars, Hong Kong dollars, and more.

Balances and transactions can be managed online, and the card can be reloaded online through BPAY or a Community First financial services store.

Term Deposits

One of the main reasons so many people opt to work with a Sydney credit union as opposed to a bank is because of the competitive interest rates on savings and term accounts. Community First offers term deposit options with interest rates for 36 months up to 2.80% p.a.

Money is kept at a competitive interest rate – anywhere from three months to three years – and term deposits from this credit union in Sydney are flexible. Members can invest anywhere from $5,000 to $250,000, and interest can be paid every 28 days, at the end of the term or at regular periods in between.

Term deposit accounts from this credit union in Sydney also include no monthly or account keeping fees.

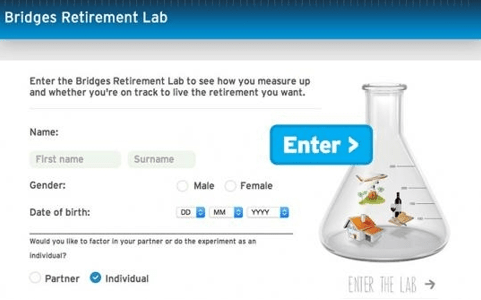

Financial Planning

As a leading full-service credit union in Sydney, Community First offers convenient services such as one of the best Sydney credit union online banking platforms. It also goes further, featuring services such as financial planning.

Source: Community First Credit Union

Community First is partnered with Bridges, a wealth management business, to provide financial planning that’s highly tailored and helps members of this Sydney credit union plan for their future and the lifestyle they want. It’s also designed to make sure that members’ money is working for them.

Members can opt for a quote online, over the phone or by visiting a convenient Community First financial services store.

CUA (Credit Union Australia) Review

Credit Union Australia, a top Melbourne credit union and credit union in Sydney, began in 1946, with the concept of giving Australians access to a fairer deal. Now, CUA exists as the largest customer-owned financial services provider in Australia. Shareholders of this credit union in Sydney and Melbourne have voting rights at the Annual General Meeting.

Members of this credit union in Sydney and Melbourne can also participate in governance and are free to inquire about management and financial performance. Products include affordable, responsible loans as well as credit cards, deposit accounts, and even insurance.

Key Factors That Led Us to Rank This as a Leading Sydney Credit Union and Melbourne Credit Union

Primary reasons CUA is part of this list of the best credit unions in Sydney and Melbourne credit unions are highlighted below.

Everyday Accounts

When selecting a credit union in Sydney or a Melbourne credit union, one of the top priorities for many people is the everyday account options offered. CUA features three main everyday accounts. These are the CUA Everyday Account, the CUA Everyday Youth Account, and the CUA Everyday 55+ Account.

All of these accounts include value-creating benefits for members, including the following:

- No monthly account fees

- Access to rediATM locations, which is the largest ATM network in Australia

- No fee for everyday card purchases and getting cash in-store

- Access to one of the best Melbourne and Sydney credit union online banking platforms

- Mobile banking access

CUA Low Rate Credit Card

In addition to the CUA Platinum Card, this Sydney credit union also features the Low Rate Credit Card. The Low Rate Card from this Sydney credit union features a 0% p.a. on balance transfers for 13 months, with no annual fee for the first year. There is only an 11.99% p.a. on purchases.

This Sydney credit union card also includes online banking access and friendly CUA service.

Members can apply online if they’re at least 18 years old and a permanent resident of Australia.

This card is ideal for members who want “financial breathing room” and overall flexibility as well as the opportunity to keep more of their money.

Overdraft Options

As a leading Melbourne credit union and Sydney credit union, CUA strives to make life as convenient as possible for its members, which is why it features overdraft options with access to emergency funds when needed.

The CUA Just In Case Overdraft is something designed for the occasional slipup, with no monthly fees included.

The Everyday Overdraft is an option for members who might use it regularly. It offers flexibility at only a minimal monthly fee.

Both options are available through CUA everyday accounts, and can be accessed with an existing CUA Visa Debit Card, rediCARD or chequebook. Overdrafts are also accessible through Internet banking, as CUA has one of the best Melbourne and Sydney credit union online banking portals.

eSaver Reward Account

While many savings account options are available from this leader among Sydney credit unions and Melbourne credit unions, one of its premier options is the CUA eSaver Reward Account. This account is flexible and offered online. It includes bonus interest on balances up to $100,000 when $1,000 or more is deposited into an everyday account each month.

The interest rate offered by this credit union in Sydney and Melbourne is highly competitive, and this account is flexible enough to let members make withdrawals without losing their bonus interest.

The CUA everyday and eSaver Reward accounts can be managed together, and there are no monthly account fees when using online and mobile banking.

Also, with the eSaver Reward Account from this credit union in Sydney and Melbourne, members can create automatic transfers to grow their savings more quickly and conveniently.

Don’t Miss: Top Ranked Best Credit Unions in America | Ranking & Reviews | Best U.S. Credit Unions

Firefighters Credit Union Review

A Melbourne credit union, Firefighters Credit Union is designed to serve the financial needs of firefighters and their families and is completely member owned. Firefighters was formed in 1974 when a welfare officer from the Metropolitan Fire Brigade had concerns about the financial hardships of firefighters and their families.

This Melbourne credit union was incorporated in 1976 and was initially known as the UFU Credit Union. In 2005, the Firefighters Credit Union merged with IMG Credit Union so that members of this Melbourne credit union could have access to more innovative and sophisticated products and services.

Key Factors That Allowed This to Rank as One of the Best Melbourne Credit Unions

When reviewing and ranking Melbourne credit unions to include on this ranking, the following are critical reasons Firefighters was included.

Transparency

One of the biggest complaints many consumers have, as well as a big reason why people are moving away from conventional banks, is the low interest rates offered on savings and the high interest rates charged on products, like credit cards and loans. In addition, many consumers have problems with the lack of transparency they feel they face when working with a bank.

Firefighters strives to not only offer some of the most competitive interest rates available, but it is also completely transparent in its operations as a credit union in Melbourne.

Current and possible future members of this Melbourne credit union can visit the website. There are lists of all of the current rates for savings and investments and for loans, laid out clearly and transparently.

Bridges Financial Planning

Through a partnership with Bridges, a wealth management firm, members of this Melbourne credit union have access to valuable financial planning services. The Bridges team can help members of Firefighters with creating wealth, planning for retirement, estate planning, stockbroking, and more.

Bridges is one of the largest financial planning and stockbroking groups in Australia and has been working with members of credit unions and building societies since 1985.

Bridges Financial Planners will work with members of this Melbourne credit union to provide them with valuable, customised advice and service, even beyond their initial investment.

Protector Home Loan Package

Among Melbourne credit unions, Firefighters has some of the most extensive loan products, including its signature Protector Home Loan Package. This package includes a low-interest rate home loan as well as an interest-bearing transaction account.

Many benefits come with this package, including a competitive variable rate and the ability to make lump sum payments without a penalty.

Other benefits of this home loan package include:

- Free direct debits and credits

- A Protector Savings interest rate of 2.00% p.a. on balances over $3,000

- Free BPAY

- Foreign currency products offered at reduced commission charges

- Free NAB deposit book facility

- Free periodical payments

- Acceptance of additional repayments

- No monthly account keeping or admin fees

- Automatic payment through direct credit/payroll deductions or regular payments from a Firefighters savings account

- Flexible repayment options, including weekly or monthly

Visa Card

Visa Debit cards from this Melbourne credit union offer control, convenience, and freedom. They can be used to shop online, by phone, and when overseas, and all Firefighters Credit Union debit cards are equipped with smart chips.

Members of this Melbourne credit union also have access to a global payments network extending across 200 countries, with 1.9 million ATMs.

As a cardholder, you’re also eligible to use the rediATM network, which is one of the largest in Australia. The rediATM network includes NAB and BOQ ATMs, and, as a Firefighters cardholder, there is no direct charge at any of these ATMs.

First Option Credit Union Review

Among credit unions in Sydney and Melbourne credit unions, First Option is a standout for many reasons. This Melbourne credit union serves industries, including gaming, leisure, telecommunications, hospitality, and energy. This niche financial services provider has won awards from Canstar and Money magazine as well.

The philosophy of this Melbourne credit union includes remaining a low-fee financial services provider, operating on moderate profit levels with a focus on return benefits to members, and providing personalised service and competitive interest rates in a socially responsible and sustainable way.

Key Factors That Enabled Us to Rank This as One of the Top Melbourne Credit Unions

During the process to research and prepare this list of credit unions in Sydney and Melbourne credit unions, the following are some standouts of First Option that led to its inclusion in this ranking.

Android Pay

A significant part of this ranking looked at innovative offerings, such as Melbourne and Sydney credit union online banking availability, but also other technology-based features. One of these offered by First Option is Android Pay.

With Android Pay, members of this Melbourne credit union can make the way they pay for transactions faster and smarter. Once Android Pay is downloaded, members add their First Option card to make secure and simple purchases.

Users don’t even need to open the app. All they need to do is unlock their device to pay in person, with the tap of their phone. If they’re making an in-app purchase, all they need to do is select the Android Pay icon.

Android Pay by First Option can be used wherever contactless payments are accepted.

First Option will also soon be adding Apple Pay functionality.

BPAY

One of the things offered by many credit unions, including this Melbourne credt union, is BPAY. BPAY is a bill pay service that lets members pay any bill that has the BPAY symbol. All they need to do is register for phone or online banking. There are no transaction fees, and, along with being simple, this is a safe, secure way to make payments.

Other straightforward payment options available to members of First Option include EFTPOS, cheques, direct debits so that bills can be paid automatically, periodic payments that are automatic and set up at regular intervals, and electronic funds transfers.

First Option also offers the ability for members to easily and inexpensively send money overseas.

iT Saver

A key product available from this Melbourne credit union is a savings account, but not all savings accounts are created equally. Some are going to provide more flexibility, more value, and more competitive interest rates than others.

One of the premier savings accounts available from First Option is the iT Saver Account.

This is an online savings account from this top ranked credit union in Melbourne that earns up to 1.60% p.a. interest and yet is simple to maintain and manage. It’s accessible online, there are no account keeping fees. Members can create a regular Direct Credit to build their savings faster and with less effort.

Visa Cash Rewards Card

Many of the names on this ranking of credit unions in Sydney and Melbourne credit unions feature excellent credit card options. One of these products available from First Option is the Cash Rewards Card. This offers the benefits of the First Option Low Rate Credit Card as well as the addition of point-earning capabilities. Those points can then be redeemed for cash rewards.

This card includes up to 55 days interest-free on purchases, with a low monthly fee and no annual fee.

Related: Best Credit Unions in New York, NY (Ranking & Review)

MyLife MyFinance Review

When ranking and comparing credit unions in Sydney and Melbourne, there are quite a few reasons MyLife MyFinance excels. MyLife MyFinance was originally Transcomm Credit Union, which was established in 1971. A partnership was then formed between MyLife MyMoney and Transcomm in 2013.

MyLife MyFinance is regulated by the Australian Prudential Regulation Authority, and deposits are protected by the Australian government deposit guarantee. This Melbourne credit union strives to offer integrity, efficiency, quality products, and professional, friendly service to all members.

Key Factors That Enabled This to Rank as One of the Best Credit Unions in Melbourne

When compiling a list of the best credit unions in Sydney and Melbourne, the following represent key reasons MyLife MyFinance was included.

Key Promises

MyLife MyFinance works to set itself apart from other credit unions in Melbourne with its defined key promises it makes to members. These Melbourne credit union’s ten commitments include the following:

- The credit union will be fair and ethical in membership dealings

- It will focus on members

- Members will receive clear information about products and services

- MyLife MyFinance will operate as ethical lenders

- It will deliver the utmost in customer service and standards

- It will deal fairly with any complaints

- Customer rights are recognised as owners

- MyLife MyFinance will comply with legal and industry obligations

- The credit union will recognise the impact on the wider community

- It will support and promote its Code of Practice

Simple Personal Loans

Sometimes, consumers are searching for Melbourne credit unions that offer straightforward and simple personal loans. MyLife MyFinance meets this criteria, which is an important part of why it’s on this ranking of the best credit unions in Melbourne.

Personal loans from MyLife MyFinance include competitive interest rates, no account service fees, and no penalties for early payouts.

Members can borrow up to $50,000, and there is a choice of loan terms of up to seven years. Repayment options are flexible and include monthly, weekly or fortnightly plans, and there are unlimited extra, free repayments offered.

Approvals are fast, applications can be completed online, and personal loans from this leading Melbourne credit union have low set-up costs.

Source: MyLife MyFinance

Savings and Investments

As with the other names on this ranking of Melbourne credit unions, MyLife MyFinance features a full range of excellent savings and investment account options.

Lifestyle accounts from this leader among Melbourne credit unions include the flexible, secure, and convenient Access Account. There’s also a standard savings account, a Christmas Club account, and a deeming account.

MyLife MyFinance similarly offers cash management accounts and term accounts, guaranteeing members will find the right option that works for their individual needs and financial requirements.

Accommodation Deposit Loans

An accommodation deposit is an amount of money that is required to pay for entrance to an aged care facility for low-level care or a service charge added to receive high-level care. In some cases, families are required to sell their home to fund that deposit or use the equity in a family home to borrow the necessary amount.

MyLife MyFinance offers the unique Accommodation Deposit Loan, which is ideal for members of this Melbourne credit union who either don’t want to sell the family home and instead want to leave it as an inheritance or who feel it’s the wrong time to sell, and the home will continue to increase in value.

This loan lets members of this credit union in Sydney focus on finding the right accommodations while ensuring they have the necessary finances to fund the deposit. Then, once settled, they can move on to fully exploring their options, without time constraints.

Nexus Mutual (Formerly EECU) Review

A premier Melbourne credit union, Nexus Mutual was created for members of the ExxonMobil community. Originally known as EECU, the Melbourne credit union underwent a name change in January 2017.

This Melbourne credit union offers financial services ranging from loans to savings and term deposits. Nexus Mutual membership is also offered to former employees of ExxonMobil. In addition to the Melbourne locations, Nexus Mutual serves members in Sale.

Key Factors That Enabled This to Rank as One of the Best Melbourne Credit Unions

Among Melbourne credit unions, the following are primary reasons Nexus Mutual is part of this ranking and review.

The Nexus Mutual Difference

This Melbourne credit union lays out some ways it’s different than other Australian financial institutions, and these include the following:

- They put their clients at the center of all their activities

- They empathie with their clients

- They prioritize helping members reach their goals

- They make good decisions for their customers and the community

- They treat their members with dignity and respect

- They encourage an inclusive culture

- They are fearless when it comes to innovation

- They abide by clear standards of excellence

24/7 Banking

During the process of researching Melbourne and Sydney credit union online banking capabilities, Nexus Mutual ranked very well. This Melbourne credit union offers access to banking whenever and wherever it’s needed.

With its mobile banking app, members can check balances and view account history, transfer funds, and make payments using BPAY. The mobile banking app can also be used to locate ATMs, access home loan and financial tools and calculators, and contact the credit union. Enhanced security features were also just added.

With Internet banking, members can do most of the same things, and they can also send secure emails to the credit union and create customised account alerts.

Home Loans

This Melbourne credit union features a variety of home loan products for purchasing a home, refinancing, buying land, building a home or upgrading a current home.

Loan products available from this leader among Melbourne credit unions include the Platinum Home Loan, which is a banking package featuring interest discounts and perks like a Visa Platinum Credit Card. The Essentials Home Loan is a simple loan with a low interest rate, and the Standard Home Loan features a competitive rate and flexibility in payments.

The Bridging Loan is offered by this Melbourne credit union to help members who want to buy a new home, but haven’t sold their current one. You can also get a line of credit from this credit union in Melbourne.

Moving to Australia

For ExxonMobil employees and their families who are required to move to Australia for work, Nexus Mutual features services specifically geared toward their unique needs. They are offered membership and full access to services and products from this credit union in Melbourne.

Popular Article: Best Credit Unions in Ohio | Ranking & Review

Free Wealth & Finance Software - Get Yours Now ►

People’s Choice Credit Union Review

Among Sydney credit unions and Melbourne credit unions, People’s Choice consistently ranks well. Members of this credit union in Sydney and Melbourne are also owners, as with the other institutions on this list, so they have the opportunity to elect office holders and vote on constitutional changes presented at the Annual General Meeting.

To become a member of this credit union in Sydney and Melbourne, consumers simply have to visit a branch, call the National Contact Center or go to a [email protected] outlet. Membership is gained by buying a $2 share and is open to any resident of Australia.

Key Factors That Led Us to Rank This as One of the Best Credit Unions in Sydney and Melbourne

Essential reasons People’s Choice is ranked as one of the leading credit unions in Sydney and Melbourne are covered in the following list.

eStatements

People’s Choice offers one of the top Melbourne and Sydney credit union online banking portals available, with comprehensive and robust features. In addition to Melbourne and Sydney credit union online banking options, People’s Choice also features e-statements, which are designed to be eco-friendly and also convenient.

This Melbourne and Sydney credit union encourages members to stop promoting the waste of millions of sheets of paper each year and instead register for online statements, reducing the environmental footprint of members as well as the credit union.

Additionally, there are no more inconvenient paper statements for members to deal with, and the reduced costs are then passed on to members.

Statements arrive on time, registration is fast and easy, and members receive an email notification when their statement is ready to be viewed.

Transaction Accounts

While almost every Sydney credit union and Melbourne credit union is going to offer savings accounts, they don’t all offer transaction accounts, and this is just one way People’s Choice is unique.

Its Everyday Account is a flexible transaction account featuring unlimited selected transactions paired with a low monthly fee. The monthly fee can also be waived if certain criteria are met.

The Zip Account is focused on convenience and offers access to money on the go, anytime, and from anywhere.

Finally, the Activate Account is for members who are under the age of 25 and includes no monthly account keeping fees or minimum balance requirements.

Financial Plans

Members of this well-respected Melbourne and Sydney credit union can take advantage of the availability of financial planning. These financial planners can work with members to develop individualised plans for financial strength and help them achieve their personal goals. People’s Choice financial planners can work with members on their short, medium, and long-term goals and create a roadmap.

Some of the areas that might be covered by a financial plan from this leading credit union in Sydney and Melbourne include daily budgeting, tax planning, investments, estate planning, and life and risk insurance, among other topics.

Consultations with financial planners at People’s Choice are complimentary and don’t carry any obligation to members.

Visa Credit Card

Available to members of this top credit union in Sydney and Melbourne is the People’s Choice Credit Union Visa Card. This card features flexibility and more interest-free days than the majority of other options.

The introductory rate is incredibly low for the first six months and applies to balance transfers, cash advances, and purchases. Cardholders can qualify for up to 62 days interest-free on purchases, and there is no application fee.

The process to transfer balances is easy, and the card can be used with the redi2PAY app.

Visa exclusives available to cardholders include Visa Checkout, entertainment offers, and ticket pre-sales, and more.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Sydney Credit Union (SCU) Review

Sydney Credit Union (SCU) is a well-known name among credit unions in Sydney. SCU banking services include everything from online banking to loans and credit cards. SCU banking operates on the vision that it will change the way people think about banking.

Established in 1963, April 2016 marked the 53rd anniversary of SCU banking. SCU initially started as a financial institution for the City of Sydney Council employees, as an alternative to banks, building societies, and payday lenders.

Key Factors Considered When Ranking This as One of the Top Sydney Credit Unions and Melbourne Credit Unions

The details below highlight reasons SCU banking and services are included in this ranking of credit unions in Sydney and Melbourne.

Electronic Services

Always an innovator and a leader among Sydney credit unions, SCU banking includes a full line-up of electronic services, all of which provide complete control and accessibility to money and accounts.

One of the top electronic SCU banking services is Internet Banking, which is a 24/7 online banking platform available for both personal and business accounts. Electronic SCU banking includes the ability to obtain information and finish transactions, even when branches aren’t open.

Members of this Sydney credit union can check their balances, make bill payments, transfer funds within and between accounts, order cheques, and view and print statements.

Easy Sheets

A frequent complaint that comes from many consumers is that they either don’t know what fees their bank is charging them or they don’t feel like there is transparency when it comes to having an understanding of the specifics of their accounts.

It can be difficult to navigate all of the available services and products a financial institution offers, and, as a result, consumers often feel like they’re blindsided by fees and other issues.

SCU banking offers a different approach. In order to make sure consumers get total transparency and have a full understanding of all SCU banking products and services, this Sydney credit union features something called “Easy Sheets.” Easy Sheets can be requested online, and they offer a summary of each SCU banking product or service.

If the product is customised, such as a home loan, this can also be completed and sent to the consumer from this Sydney credit union.

Easy Sheets include car loans, savings interest rates, investments and financial planning, term deposits, business banking, and Visa credit cards, among others.

Visa Credit Card

This Sydney credit union offers both a Visa credit and debit card option. The Low Rate Visa Credit Card is often ranked as one of the best credit cards in terms of value, and it has won awards including the 2016 and 2015 Mozo Experts Choice Highly Commended Award. It also received a 5-star rating for an outstanding value credit card from Canstar.

This low-rate card is straightforward and easy to use and makes money accessible from thousands of locations around the world.

This SCU banking product available from this leading credit union in Sydney also offers the opportunity for cardholders to minimise their card balance. Approvals for this SCU banking credit card can be made in as few as 48 hours, and it includes Visa Signature perks like Verified by Visa.

Read More: Best Credit Unions in Georgia | Ranking | Comparison of the Top Georgia Banks

Free Wealth Management for AdvisoryHQ Readers

Unity Bank Review

A leader among Sydney credit unions, Unity Bank (formerly Maritime, Mining & Power Credit Union) is a financial co-op owned by the members and has been operating since 1970. The vision of Unity Bank, along with being one of the best Sydney credit unions, is to provide members with lifelong financial prosperity, security, and dignity.

Unity Bank also strives to stand by members and provide them with the most financial value. Perks of working with this leading Sydney credit union include higher savings and term deposit rates, personalised service, and accessibility without high fees and charges.

Key Factors Leading Us to Rank This as a Top Sydney Credit Union

During the comprehensive process of researching Sydney credit unions and Melbourne credit unions, the following are key reasons Unity Bank was included on this list.

Mobile Banking

Like most of the names on this list, Unity Bank is a leader among Sydney credit union online banking platforms. In addition to online banking, however, Unity Bank also features an excellent mobile banking app, with newly added features and enhancements which were added due to member feedback.

For example, the Simple Balance feature allows members to simply swipe and see their available balance without having to sign into their account. Users can decide which accounts are displayed, and if they want, they can also turn Simple Balance off.

Members can view their accounts in a vertical list, improving navigation, and they can locate a nearby ATM without logging into the app.

A few other features include Tap and Pay for purchases under $100, the Pay Anyone service, and fingerprint login for certain devices.

Online Applications

When comparing and ranking Sydney credit unions, convenience was essential. Unity Bank not only offers one of the best Melbourne and Sydney credit union online banking platforms, but it also provides the opportunity to apply for many services and products online.

Some of the examples consumers can apply for on the MMPCU website include:

- Credit union membership

- Home loans

- Personal loans

- Overdraft protection

- Car loans

- Visa credit cards

- Financial planning

Power-Up e-Saver Account

This Sydney credit union offers quite a few distinctive and uniquely valuable savings accounts, one of which is the Power Up e-Saver Account, which it advertises as a “high-end investment account.” This account offered by this leader among credit unions in Sydney features high interest and flexibility as well as access to funds.

Interest is calculated daily and paid monthly, and account holders can only access it via online and phone banking.

Transactions are unlimited and free, and this is a great account option for any member who wants competitive returns but doesn’t want the rigidity of a fixed-term deposit.

Additionally, this account is one of the best offered by credit unions in Sydney because there are no monthly service fees.

Financial Assistance

One of the reasons United Bank ranked on this list of credit unions in Sydney is because of its dedication to getting to know members and always searching for the best ways to serve their needs.

One area of service offered by this Syndey credit union is financial assistance.

Unity Bank offers resources and guides to help members of this top credit union in Sydney manage their money more effectively, and if their problems go beyond that, there are professionals available to help them find solutions.

There are also financial hardship options for members that are having difficulties repaying their loans. These individuals can work with the Member Credit Management Team.

Free Money Management Software

Woolworths Employees’ Credit Union (WECU) Review

Woolworths Employees’ Credit Union (WECU) is a Melbourne credit union designed to offer a value-creating alternative to banks and other deposit institutions. WECU was included in this ranking of credit unions in Sydney and Melbourne because all members are part owners, and they’re only required to invest in one $10 share to become a voting member.

WECU is also a Melbourne credit union regulated under Commonwealth legislation and supervised by the Australian Prudential Regulation Authority. WECU is part of the Member Customer Owned Banking Association and the Business Council of Co-Operatives and Mutuals as well.

Key Factors That Led to Our Ranking of This as One of the Best Credit Unions in Melbourne

Notable reasons why WECU was included on this list of credit unions in Sydney and Melbourne and ranked as a best Melbourne credit union are detailed below.

Loan Protection Insurance

There are any number of reasons a consumer might opt to get a loan from a Sydney credit union or a Melbourne credit union, including to purchase a new vehicle, consolidate debt or take a holiday. When repaying loans, however, people may encounter unforeseen circumstances that make it difficult.

WECU offers a range of insurance products including Loan Protection Insurance through a partnership with QBE Insurance.

QBE Insurance was founded in 1886 and is one of Australia’s top insurance companies. With this insurance, members will receive protection if they have a loan with this Melbourne credit union and, for some reason, become unable to make on-time payments.

Loan Protection Insurance is just one of the many insurance products members of this credit union in Melbourne have access to through QBE.

Goal Account

Each of the names on this ranking of Sydney credit unions and Melbourne credit unions offers savings accounts, some which have similar features and others which are unique from one another. One of the accounts available from WECU that’s unique from other accounts at Sydney credit unions and Melbourne credit unions is the Goal Account.

This account is specifically designed to help members of this Melbourne credit union to save for particular goals. It features a higher interest rate than a standard access account, can be managed with online banking, and offers a good way to save money while still maintaining liquidity.

Internet Banking

As mentioned in the above reviews for other Sydney credit unions and Melbourne credit unions, accessibility was extremely important in this ranking. All of the names on this list have some of the best Melbourne and Sydney credit union online banking options, and this includes WECU.

Internet banking from WECU provides the following features and benefits:

- Stringent security

- Easy-to-see account balances and transaction history

- Pay bills to more than 10,000 registered BPAY billers

- Make payments to other individuals and businesses

- See interest earned and charged

- Transfer money between accounts

This Melbourne credit union also offers mobile banking.

Conclusion – The Top 10 Best Credit Unions in Sydney and Melbourne

Is there a way to take control over how you bank and avoid paying exorbitant fees? The short answer is yes, and that’s why so many consumers are choosing to work with Sydney credit unions and Melbourne credit unions as opposed to conventional banks and financial institutions.

The benefits of working with Sydney credit unions and Melbourne credit unions include a broad range of services designed with the consumer in mind, such as everyday accounts, savings accounts, and investment accounts.

The names on this list of credit unions in Sydney and Melbourne also include modern technology and innovation that makes it easy to bank from anywhere, at anytime, and they’re fully transparent with all fees and interest rates.

While the names on this list of credit unions in Sydney and Melbourne have many things in common, there are also distinctions to be found between each which makes every option a standout in the financial field.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.