2017 RANKING & REVIEW

TOP RANKING BEST ONLINE CHECKING ACCOUNTS

Intro: Finding the Best Online Checking Accounts

With advances in technology and the wide spread use of the internet, more people are deciding to open a checking account online.

While doing business with an online bank may have seemed risky to some a few years ago, today these types of banks are being embraced by the mainstream.

Even many big name brick-and-mortar banks have embraced many of the hallmarks of online banks, including user-friendly websites with the option to open an online checking account instantly.

Award Emblem: Top 10 Best Online Checking Accounts

With the convenience of mobile options such as remote check deposit and money transfers becoming more and more popular, it should be no surprise that online checking accounts have begun to gain popularity.

In this article we will review the 10 best online checking accounts the internet has to offer. Our list offers a wide range of online checking accounts to choose from and includes many online banks that offer a free online checking account.

No matter what you look for in a checking account online, this list is sure to offer a best online checking account for you.

Why Choose an Online Checking Account

Because they have no brick-and-mortar locations to maintain, online banks are able to pass on savings to their customers in the form of higher interest rates and fewer fees associated with their online bank accounts.

In fact, many online banks offer free online checking accounts to their customers. Some also offer other types of free online bank accounts as well, such as an online savings account.

They also cater to busy customers whose hectic schedules make it hard for them to visit a brick-and-mortar branch location. With online banks, customers are able to get a checking account online from the comfort of their own home at a time that is convenient for them.

Most online banks are FDIC insured, so that customers’ money is just as safe and secure with them as it would be at a brick-and-mortar bank.

See Also: Best Bank for Small Business Banking (Best Business Bank Accounts)

AdvisoryHQ’s List of Top 10 Banks with the Best Online Checking Accounts

- Ally Bank

- Bank of the Internet USA

- Bank5 Connect

- CapitalOne 360

- Discover Online Bank

- EverBank

- First Internet Bank

- FNBO Direct

- iGobanking

- Simple Bank

List is sorted alphabetically (click any of the names above to go directly to the detailed review section for that bank)

Methodology for Selecting the Best Online Checking Accounts

What methodology did we use in selecting this list of top online checking accounts?

Using publicly available sources, AdvisoryHQ identified a wide range of online banks that provide checking accounts online.

We then applied AdvisoryHQ’s “Breakthrough Selection Methodology” to identify the final list of best online checking accounts that provide the most value for consumers.

Top Rated Best Online Checking Accounts | 2017 Ranking

Banks | Websites |

| Ally Bank | https://www.ally.com/ |

| Bank of the Internet USA | https://www.bankofinternet.com/ |

| Bank5 Connect | https://www.bank5connect.com/home/home |

| CapitalOne 360 | https://home.capitalone360.com/ |

| Discover Online Bank | https://www.discover.com/online-banking/ |

| EverBank | https://www.everbank.com/ |

| First Internet Bank | https://www.firstib.com/ |

| FNBO Direct | https://www.fnbodirect.com/site/ |

| iGobanking | https://www.igobanking.com/home.aspx |

| Simple Bank | https://www.simple.com/ |

Table: Top 10 Best Online Checking Accounts | above list is sorted alphabetically

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Detailed Review – Top Ranking Best Online Checking Accounts

Below, please find the detailed review of each firm on our list of top online checking accounts.

We have highlighted some of the factors that allowed these online banks’ online checking account to score so highly in our selection ranking.

Don’t Miss: Best Banks in Pennsylvania | Ranking of Top Banks in Philadelphia, Pittsburgh, etc.

Ally Bank – Interest Checking Review

Ally Bank is an online bank based in Utah. This online bank actually got its start in the auto finance industry in 1919 as GMAC. In 2010, the company transformed its banking subsidiary into Ally Bank, a completely online bank without physical bank locations.

Today, the online bank offers a myriad of traditional banking services to consumers, including online bank accounts such as an online checking account and online savings account. Since its inception, Ally Bank has been recognized as a leader in the online banking industry with countless awards, including awards for Best Online Bank and Best in Sales and Customer Service.

Key Factors That Enabled This Bank’s Checking Account to Rank as a Best Online Checking Account

Below are key factors that enabled Ally Bank’s online checking account to be rated as one of this year’s best online checking accounts.

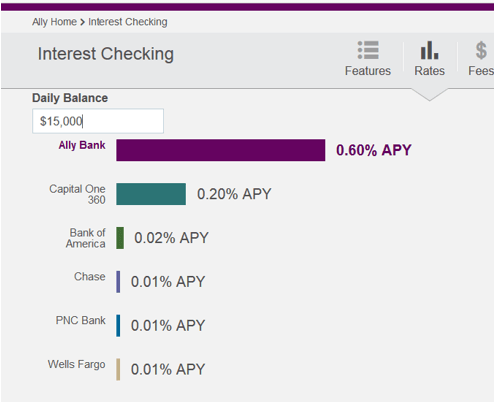

Interest Checking

When looking for a checking account online, Ally’s Interest Checking Account is hard to beat. This online checking account features strong interest rates for a checking account. Customers earn 0.10% on balances less than $15,000 and an impressive 0.60% on balances over $15,000.

Rates on interest checking accounts offered by many big name banks such as Wells Fargo, PNC Bank, and Bank of America pale in comparison to the rates paid on Ally’s online checking account.

Image Source: Ally

Offering online checking account rates that are consistently competitive is a main reason we labeled Ally’s Interest Checking Account as a best online checking account.

Low Fees

One of the biggest advantages of choosing an online bank over a brick-and-mortar bank is the fact that online banks usually have fewer fees associated with their online checking accounts. Ally Bank does not disappoint in this area, offering their Interest Checking Account with no monthly maintenance fees and no minimum balance requirements.

But Ally doesn’t stop there. There are also no fees associated with the following checking account services that many banks charge for:

- ACH transfers to non-Ally Bank accounts

- Overdraft transfer service

- Debit MasterCard

- Incoming wires (domestic and international)

- Postage-paid deposit envelopes

- Cashier’s checks

- Ally Bank standard checks

ATM Access

One point of hesitation for many people when it comes to opening a checking account online is the inability to walk into a branch location and withdraw money when needed. Ally understands that having access to cash is important, which is why they provide customers of their free online checking account with free access to more than 43,000 ATMs nationwide.

Ally Bank customers are able to use any Allpoint ATM in the U.S. for free. For those customers who don’t have an Allpoint ATM in their vicinity, they also provide reimbursement for up to $10 in ATM fees charged at other ATMs each month.

Additional Features

There are many other features that make this online bank account a good fit for those looking to open a checking account online.

Additional features of this best online checking account included at no cost are:

- Remote deposit

- Ability to send money with Popmoney

- Mobile banking

- MasterCard debit card with cash back

- Online bill pay

- 24/7 live customerservice hotline manned by real people

Related: Banks in Illinois | Ranking | Banks in Chicago, Aurora & Other IL Cities

Bank of Internet USA – Rewards Checking Review

Founded in 1999, Bank of Internet USA is the oldest online bank in the United States. They are a federally chartered, full-service bank, and their deposit accounts are FDIC insured. As an online bank they are chartered to operate in all 50 states.

Bank of Internet USA offers a wide spectrum of financial products to consumers, including online bank accounts, certificates of deposit, IRAs, mortgages and refinancing, and home equity loans.

Key Factors That Enabled This Bank’s Checking Account to Rank as a Best Online Checking Account

Below are key factors that enabled Bank of Internet USA’s online checking account to be rated as one of this year’s best online checking accounts.

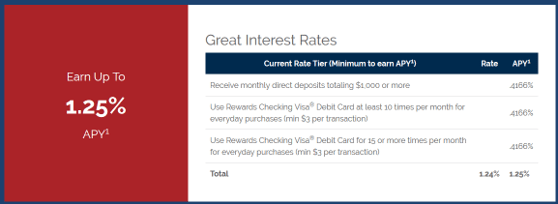

Interest Bearing Checking

With their Rewards Checking account, Bank of Internet USA customers get the perks of a premium, high interest-bearing checking account while maintaining the convenience of an online bank account.

Account holders of this online checking account enjoy top-tier interest rates and have the ability earn as much as 1.25% APY on their funds.

Interest rates are tiered, with activity associated with the account determining what interest rate will be used each month.

A breakdown of how tiered interest works for this online checking account is shown below:

Image Source: Bank of Internet USA

No ATM Fees Ever

Many consumers, especially those who are frequent travelers, are used to frequently being hit with out-of-network ATM fees when an ATM in their bank’s network is not readily available. With Bank of Internet USA, out-of-network ATM fees will never be a problem. In fact, account holders of this online bank’s Rewards Checking online checking account don’t need to worry about ATM fees of any nature ever again.

That’s because Bank of Internet USA’s Rewards Checking account comes with unlimited ATM fee reimbursements nationwide. This allows customers quick access to their money wherever there is an ATM without having to work about incurring fees.

No Monthly or Overdraft Fees

The Rewards Checking account is a completely free online checking account with no monthly maintenance fee and no minimum monthly balance requirement. But what really sets this account apart from other free online checking accounts is the fact that there are no overdraft or non-sufficient funds fees associated with it either.

Not having to worry about overdraft or non-sufficient funds fees racking up in the case of a miscalculation can be a great relief for many consumers. For those who want to make sure their items get paid if their account becomes overdrawn, Bank of Internet USA offers overdraft protection options.

Additional Features

Additional features of this best online checking account include:

- Free online banking with bill pay

- Free mobile banking

- Free mobile deposit

- Free MyDeposit

- Cashback purchase rewards

- Free access to FinanceWorks software

- Popmoney

- Green Dot Reload at the Register to deposit cash nationwide

Popular Article: Best Banks in Indiana | Ranking of Banks in Indianapolis, Fort Wayne, Evansville

Bank5 Connect – High-Interest Checking Review

Bank5 Connect is an online-only bank that is a division of BankFive, a Mssachusetts-based bank that’s been serving its community for close to 160 years. Though they are an online-only bank with no brick-and-mortar locations, Bank5 Connect offers everything a traditional bank does.

Financial products offered by this online bank include an online checking account, online savings account, and CDs. They also offer convenience to the customers through online bill pay, eStatements, and free mobile banking.

Key Factors That Enabled This Bank’s Checking Account to Rank as a Best Online Checking Account

Below are key factors that enabled Bank5 Connect’s online checking account to be rated as one of this year’s best online checking accounts.

High-Yield Interest Rate

Bank5 Connect’s high-interest online checking account makes it easy to manage day-to-day spending while earning a highly competitive interest rate. While many banks set tiered interest checking account rates and make customers jump through all sorts of hoops to earn a high rate, Bank5 Connect makes it easy to earn a high rate on all balances in the account.

All that is required to earn their competitive rate, currently set at 0.76% APY, is to have a minimum average balance of $100. While there may be banks that offer slightly higher rates for their online checking accounts, such rates won’t be nearly as easy to qualify for as it is with Bank5 Connect.

Low Fees

If you are looking for a free online bank account that pays high interest without a long list of requirements, then look no further than Bank5 Connect’s checking account online.

The online bank’s High-Interest Checking is a completely free online checking account, with no monthly maintenance fee and only a $100 minimum balance requirement to earn interest.

In addition to no monthly service fee, customers of this best online checking account also save on overdraft fees. In the event of the online checking account becoming overdrawn, Bank5 Connect’s overdraft penalty fee is a low $15 — that’s less than half the national median of $34.

UChoose Debit Rewards Program

Account holders of Bank5 Connect’s free online bank account receive the added benefit of a debit card with UChoose Debit Rewards. With this program, debit card users earn points while going about their everyday spending. Accumulated points can be redeemed for thousands of items online.

Customers earn 1 point for every $2 spent when they choose the signature option at checkout. Points can be redeemed for vacation packages, gift cards, electronics, and many other great items.

Additional Features

Additional features that helped rank Bank5 Connect’s High-Interest Checking account as one of this year’s best online checking accounts include:

- Free online banking

- Free online bill pay

- Free eStatements

- Free mobile banking

- Free first order of basic checks

- Reimbursement of up to $15 in ATM fees each month

CapitalOne 360 – 360 Checking Review

CapitalOne 360 is the online banking division of Capital One. The online bank got its start in 2000 as ING Direct, which was acquired by Capital One in 2011. The online retail bank offers consumers an array of financial products, including online bank accounts and investment services.

Though mostly known as a credit card company, Capital One is actually a much diversified company. In addition to online retail banking, the company also offers auto financing through Capital One Auto Finance, has a budgeting app for consumers called Level Money, and is the principal sponsor of the college football Florida Citrus Bowl.

Key Factors That Enabled This Bank’s Checking Account to Rank as a Best Online Checking Account

Below are key factors that enabled CapitalOne 360’s online checking account to be rated as one of this year’s best online checking accounts.

No Fees

With CapitalOne 360 Checking, customers don’t have to worry about being surprised by hidden fees. In fact, there are no monthly fees associated with the account and no minimums to earn interest. CapitalOne 360 Checking is a truly free online checking account.

No fees also includes no overdraft fees. Account holders of this free online bank account have three options when it comes to handling overdrafts:

- Let the bank decline to pay items when there are not enough funds in the account to cover them

- Apply for an overdraft line of credit at a reasonable rate with no transfer fees

- Link a 360 Savings account for overdraft protection and the bank will transfer funds from it into checking to cover any overdraft items

There are no fees associated with any of these options, which means that with a CapitalOne 360 Checking account, overdraft fees will be a thing of the past.

Interest Earning

This free online checking account earns interest with no minimum balance required in order to earn. This means that interest is earned on the everyday money in the account.

Interest is earned at tiered rates determined by the funds residing in the account. Tiered interest rates are:

- 0.20% APY on balances of $49,999 or less

- 0.75% APY on balances of $50,000 – $99,999

- 0.90% on balances of $100,000 or more

While the highest interest rates are reserved for those who regularly carry large balances, the rate of 0.20% that most consumers will earn is still extremely competitive when compared with many big name banks and is much higher than the national average of 0.04%.

Deposit Options

One concern some people have when considering an online bank account is how they will make deposits. Customers of the CapitalOne 360 Checking account have many options when it comes to making deposits into their online checking account.

Deposits can be made by:

- Remote capture via Capital One’s mobile app

- Uploading a check image online from a computer

- Direct deposit

- Transferring funds from another account

- Depositing checks into an ATM

- Sending checks in by snail mail

Additional Features

Additional features of this best online checking account include:

- Access to over 38,000 fee-free Allpoint ATMs and 2,000 Capital One ATMs

- Free MasterCard debit card

- One free checkbook

Read More: Best Banks in North Carolina

Discover Online Bank – Cashback Checking Review

Discover Online Bank is the online banking division of Discover Financial Services, the issuer of the Discover credit card. In addition to their credit card offerings, they also function as an online bank where they offer many of the same banking products that traditional banks do, including an online checking account, online savings account, certificates of deposit, and bill pay.

Key Factors That Enabled This Bank’s Checking Account to Rank as a Best Online Checking Account

Below are key factors that enabled Discover Online Bank’s online checking account to be rated as one of this year’s best online checking accounts.

Free Account

Perhaps the greatest benefit of Discover Bank’s Cashback Checking account is that it is a completely free online checking account. There are no fees to worry about, and it goes much further than just no monthly maintenance fees.

There are also no fees for these services that most banks charge for:

- ATM use

- Online bill pay

- Ordering paper checks

- ACH online transfers

- Incoming wires

- Ordering a copy of a canceled check

Rewards

Just as the name suggests, Discover’s Cashback Checking account gives customers the ability to earn cashback rewards. In fact, with this free online checking account, customers can earn up to $10 a month in rewards. That can add up to $120 a year of extra cash in your pocket.

Discover pays customers of this free online bank account $0.10 for each qualifying transaction they make, up to 100 transactions a month.

Qualifying transactions are:

- Debit card transactions

- Paying a bill online

- Cleared checks

Customers can redeem their cashback rewards for cash in their account or they may add it to the Cashback Bonus account associated with their Discover credit card.

Easy to Open

Discover Online Bank makes it extremely easy to open a checking account online. All customers need to do is fill out some personal information and they are able to open an online checking account instantly.

At Discover Online Bank, it only to takes a few minutes to get a checking account online. Customers just need to provide their name, phone number, address, and Social Security number or tax ID number to get started.

They then have the option to fund their new online bank account immediately or can do so later. That’s really all there is to it. Once funded, a confirmation email will be sent and a debit card and checks will arrive in the mail within a short while.

Additional Features

These additional features are also part of what makes Discover Online Bank’s Cashback Rewards Checking a best online checking account:

- Access to over 60,000 free ATMs in the U.S.

- Free replacement debit card

- Free official bank checks

- Free expedited delivery for replacement debit cards

- Free outbound ACH transfers

- Free incoming wires

Related: Best Banks in Minnesota (Ranking & Review)

Free Wealth & Finance Software - Get Yours Now ►

EverBank – Yield Pledge Checking Review

Everbank is a financial services company that provides consumers with banking, mortgage, and investment services. Based in Jacksonville, FL, EverBank operates through its direct banking division. The bank operates primarily online but also performs operations via telephone and mail as well.

EverBank’s banking products include an online checking account, online savings account (money market), CDs, and FDIC-insured deposits held in foreign currency. As of 2015, the company held $25 billion in assets.

Key Factors That Enabled This Bank’s Checking Account to Rank as a Best Online Checking Account

Below are key factors that enabled EverBank’s online checking account to be rated as one of this year’s best online checking accounts.

High-Yield Introductory Interest Rate

EverBank’s Yield Pledge Checking account offers an extremely competitive, high-yield introductory interest rate for new account holders. The current introductory rate offered by EverBank is an impressive 1.11% on balances up to $250,000, a high-yield rate that is hard to find anywhere else.

It is important to note that this is just an introductory rate, so it does come with an expiration date. The high-yield rate applies for the first 12 months from the date the online checking account is opened. After 12 months, the rate drops to their standard APY ongoing rate, which is currently 0.25% on balances under $10,000.

Yield Pledge Promise

EverBank makes a promise to their online bank account customers that they will always earn rates that are competitive with the top 5% of their competitors’ account rates. They have coined this commitment to high-yield earning as their Yield Pledge Promise to their customers.

EverBank’s Yield Pledge Promise states that the yield on their online bank accounts will stay in the top 5% of competitive accounts based on the Bankrate Monitor National Index survey data from the last week of each month. The online bank defines “competitive accounts” as being similar accounts from the 10 largest banks and thrifts in 10 large U.S. banking markets.

This pledge is EverBank’s way of guaranteeing that their interest rate on their online checking account will always remain competitive.

No Monthly Fees

The Yield Pledge Checking account is a completely free online bank account with no monthly maintenance fee. Though it has no monthly minimum balance requirement, it does have a minimum opening deposit of $1,500, which is much heftier than most other free online checking accounts require.

It is also important to note that EverBank does not have its own ATM network, nor do they partner with any existing networks. While EverBank itself does not charge a fee for using an ATM, the foreign establishment that owns the ATM most likely will. EverBank will reimburse their online checking account holders up to $6 a month in ATM fees, but only those who keep an average balance of $5,000 or greater in the account can access this benefit.

Additional Features

Additional features of this top free online bank account include:

- Mobile check deposits

- Free bill pay

- Apple Pay-supported debit card

- No overdraft transfer fees from linked account

- Option of overdraft line of credit for overdraft protection

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

First Internet Bank – Free Checking Review

Founded in 1997 and open to the public in 1999, First Internet Bank was one of the first state-chartered, FDIC-insured institutions to operate entirely online without any physical branches. The company primarily engages in online retail banking and investment securities.

Headquartered in Indiana, services offered by the top online bank include online checking accounts, online savings accounts, CDs, IRAs, credit cards, and check cards. They also offer personal lines of credit, installment loans, real-time account transfers, and the ability to display checking, savings, and loan information on a single screen.

Key Factors That Enabled This Bank’s Checking Account to Rank as a Best Online Checking Account

Below are key factors that enabled First Internet Bank’s online checking account to be rated as one of this year’s best online checking accounts.

Free Checking

First Internet Bank’s Free Checking account is perfect for those seeking a simple and basic free online checking account. This online bank account offers all of the basics without all the hassle that comes with many banks’ free online bank accounts.

With the Free Checking account, customers enjoy no monthly fee and no minimum monthly or daily balance requirement. The account also has a low minimum opening deposit requirement of only $25, making it easy for anyone to get a checking account online.

Visa Debit Card

This free online checking account comes with a Visa debit card for ease of purchasing while on the go. The card can be used to make purchases anywhere that Visa is accepted, both in retail stores and online.

Customers can also add their First Internet Bank card to Apple Pay through the Wallet app. Apple Pay enables customers to make purchases with a single touch using Touch ID technology, so that paying with the First Internet Bank debit card is more convenient and secure than ever.

Unlimited Check Writing

This online bank account provides customers with the convenience of unlimited check writing. Account holders of this top checking account online have the ease of writing as many checks as they need to without worrying about transaction fees or limits.

As an added bonus, the first order of checks for this free online checking account are absolutely free.

Additional Features

Additional features that help make this free online bank account one of this year’s best online checking accounts are:

- Free online banking

- Free mobile banking

- Free online and mobile bill pay

Don’t Miss: Best Private Banks | Ranking | Top Private Wealth Management Banks

Free Wealth Management for AdvisoryHQ Readers

FNBO Direct – Online Checking Account Review

FNBO Direct is the direct banking division of the First National Bank of Omaha (FNBO), a subsidiary of First National of Nebraska. Founded in 1857, FNBO has a strong banking heritage that spans more than 150 years.

The bank is currently in its sixth-generation of family ownership, and First National of Nebraska is one of the largest family-owned holding companies in the U.S. FNBO is one of only four banks to issue all four credit card networks: Visa, MasterCard, Discover, and American Express. The company holds $20 billion in assets.

Key Factors That Enabled This Bank’s Checking Account to Rank as a Best Online Checking Account

Below are key factors that enabled FNBO Direct’s online checking account to be rated as one of this year’s best online checking accounts.

Interest-Bearing Checking

FNBO Direct’s Online Checking Account is a high-yield online checking account. The phenomenal online bank account features an interest earning rate of 0.65% APY on all balances. That’s with no catch or gimmicks like with many other banks.

At FNBO Direct, there are no major hoops to earn the top rate like at many other online banks. Here everyone earns the same high-yield interest rate on all of the funds they hold in the account, period.

Overdraft Forgiveness

No one is perfect; sometimes mistakes are made, and checking accounts are accidentally overdrawn from time to time. That’s why this top notch online bank account comes with the added perk of overdraft forgiveness.

As long as a customer’s account is otherwise in good standing, FNBO Direct will waive their $33 Overdraft Item fee once every 12 months. Customers do not have to enroll in anything to be eligible for this feature; it is an automatic benefit that comes with the account. With this program, customers automatically receive one free instance of overdraft forgiveness every 12 months from the date of their last automatic refund.

No Monthly Fees

There are no monthly maintenance fees associated with FNBO Direct’s Online Checking Account, making it a completely free online bank account. There is also no minimum balance requirement, and the $1 minimum opening deposit makes it extremely easy for potential customers to open a checking account online.

The account also comes with a free Visa debit card and features free online banking, bill pay, and account alerts.

Additional Features

Additional features of this top checking account online include:

- Access to over 2 million ATM locations worldwide

- Free person-to-person payments with Popmoney

- Free debit card fraud monitoring

- Free incoming wires

- Free stop payments

Free Money Management Software

iGobanking – High Interest Checking Account Review

iGobanking.com is the online banking division of Flushing Bank, a New York state-chartered commercial bank insured by the FDIC. While Flushing Bank serves consumers through its 19 banking offices located in Queens, Brooklyn, Manhattan, and Nassau County, iGobanking.com is able to provide services to consumers in all 50 states.

iGobanking offers competitively priced deposit products to consumers, including an online checking account, online savings account, and CDs.

Key Factors That Enabled This Bank’s Checking Account to Rank as a Best Online Checking Account

Below are key factors that enabled iGobanking’s online checking account to be rated as one of this year’s best online checking accounts.

Interest-Bearing

iGobanking’s High-Yield Interest Checking account is an online checking account that offers an above average interest rate. The current interest rate for their checking account online is 0.25% APY. While not the highest we have seen on our list, it is well above what most banks pay for interest checking.

As an added plus, earnings on this online bank account are compounded daily. Along with no minimum requirement to earn, account holders of this online bank account are always earning interest, no matter how much they have in the account.

Affordability

iGobanking’s online checking account is extremely affordable, and with no monthly fees, it ranks highly among the internet banks who offer completely free online checking accounts.

There is also an extremely low minimum opening deposit requirement of just $1, making this account a snap for those who wish to open an online checking account instantly without having to save for high minimum balance requirements. The absence of a minimum balance requirement just adds to the affordability of this top online bank account.

Access to Allpoint ATM Network

While iGobanking does not have their own ATM network, they do partner with Allpoint to give customers of their free online checking account access to their ATMs surcharge-free.

Through this partnership, account holders of this online bank account have access to more than 43,000 surcharge-free ATMs nationwide through the Allpoint network. Allpoint is the nation’s largest surcharge-free ATM network and operates in all 50 states, allowing convenient access to funds.

Additional Features

These additional features helped rank this free online checking account as one of this year’s best online checking accounts:

- Ability to import bills directly into your account to be paid through bill pay

- Free MasterCard iGodebitcard

- Funds transfer service allows person-to-person payments

Popular Article: Best Kentucky Banks | Ranking | Top banks in Kentucky

Simple Bank – Simple Checking Review

Simple is an American direct bank based in Portland, Oregon. Simple is part of the BBVA Group, one of the largest banks in Europe and also enjoys a strong presence in the U.S.

Simple provides FDIC-insured online checking accounts through a partnership with The Bancorp and is part of the STAR network for surcharge-free access to ATMs. The company has no physical branches, with customers utilizing their online banking system and mobile apps instead.

Key Factors That Enabled This Bank’s Checking Account to Rank as a Best Online Checking Account

Below are key factors that enabled Simple Bank’s online checking account to be rated as one of this year’s best online checking accounts.

No Fees

With no monthly maintenance fees or minimum balance requirement, Simple is the epitome of a free online checking account. But this free online bank account goes beyond just no monthly maintenance fees: there are virtually no fees associated with account whatsoever.

There are no card replacement fees in case of a stolen or lost debit card, and no inactive account fees to worry about either. There are also no overdraft fees, ACH bank transfer fees, or account closing fees associated with this online bank account.

Safe-to-Spend Budgeting Tool

Safe-to-Spend is a mobile budgeting tool that helps customers of this best online checking account keep track of how much of their available balance is safe to spend. The tool keeps a running tally of how much money in the account is safe to spend after accounting for funds the customer has designated for payment of bills, a savings goal, or transfers.

Being able to see the amount that is readily available for spending can help customers of this free online bank account stay on track with their financial goals.

ATM Access

While Simple has no physical branches, they do partner with the STAR network of ATMs. This partnership gives customers of their free online checking account surcharge-free access to 55,000 ATMs worldwide.

None of the ATMs in the Allpoint network should charge owners of this free online checking account a fee, but customers can rest assured that if for some reason they do, Simple will refund it back to them.

Additional Features

Here are additional features of this top rated online checking account:

- Remote deposit

- Debit card with Visa Zero Fraud Liability Policy

- Account can be linked to external bank accounts

- Simple Instant allows Simple account holders to instantly transfer money to each other

Conclusion – Top 10 Best Online Checking Accounts

Checking accounts are an essential component of modern day banking. For many, they play an important role in the management of everyday finances. With the rise of technology and the convenience of not having to go to a bank location, many people have decided to get a checking account online.

Online checking accounts are a good fit for consumers who don’t mind the absence of a physical bank branch that they can visit and are comfortable conducting all of their banking virtually. Before you open a checking account online, it is also important to consider how important the ability to deposit cash is to you.

Image Source: BigStock

When choosing the best online checking account for you, make sure to verify ATM accessibility and whether ATM surcharges are refunded or not. You should also make sure to review any fees associated with the account and verify whether the bank offers free online checking accounts or not.

This list provides the best online checking accounts the internet has to offer. Many of the banks on this list provide customers with the ability to open an online checking account instantly and provide a free online checking account option.

With their easy-to-use online platforms, consumers don’t need to be extremely tech savvy to take advantage of the benefits offered by a checking account online.

On this list, you will find everything consumers want in an online bank account. Most of the banks listed here provide a free online bank account for consumers. Many also offer an online savings account and other features you’re sure to love.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.