Overview: 6 Tips to Find the Top and Best REIT funds to Invest In

Navigating the world of financial investment can be complicated. Each person’s financial abilities and goals are unique, and finding the best investments to suit your needs will require some research.

Many people encounter REIT funds and are attracted to their practicality. As they search for REIT investment opportunities, people often want to learn the following things:

- What is a REIT?

- How do I invest in REITs?

- Are REITs a good investment?

- How can I find the top REITs?

Image Source: BigStock

Use the following tips to guide your journey in search of the best REIT funds. They will help you find the most useful information, ask the right questions, and streamline your search for investment opportunities.

Armed with top-notch information, you can make well-informed decision to answer the question: “Are REITs a good investment for me?”

See Also: How to Make Money in Real Estate | Ways to Get into Real Estate and Make Money

1. Answer the Question, “What Is a REIT?”

Before you can ask the question, “Are REITs a good investment?” you must first ask, “What is a REIT?” It would be nearly impossible to decide if REITs are a good investment for you before you understand what they are.

Choosing to make an investment is a personal decision—your goals for your finances are your own. The first step in choosing whether the best REITs will help you reach your goals is to understand what they are.

REIT is an acronym that stands for Real Estate Investment Trust. A real estate investment trust is a company that owns investment or income-producing real estate property and sells shares to investors in exchange for dividends.

The best performing REITs can own a huge range of commercial properties including: hotels, hospitals, apartment buildings, shopping centers, hotels, warehouses, and office buildings.

The best REITs allow investors to diversify their financial portfolios, provide them with a regular income stream, and provide a long-term investment appreciation.

REITs are designed to function like mutual funds and provide the same kind of structure for real estate investment that mutual funds provided for stock investment. Stockholders earn shares, according to their investment, of the revenue generated by the properties held by the trust.

There are certain qualifications and regulations that a trust must adhere to in order to be legally considered a REIT. In order to qualify as a REIT, trusts must:

- Have at least 100 shareholders

- Have a managing board of directors or trustees

- Be a taxable corporation

- Have no more than 50% of shares held by five or fewer individual investors

- Pay at least 90% of annual taxable income to shareholders

- Invest at least 75% of total assets in the real estate market

- 75% of income must come from rent income, mortgage interest, or real estate sales all from actual physical properties

Don’t Miss: Top Real Estate Investor Websites and Strategies | This Year’s Guide

2. Consider Different Kinds of Top REITs

In order to decide how to invest in REITs and determine which REITs are a good investment to best suit your needs, it is important to understand that there are a few different kinds of REITs.

Even the top REITs come with advantages and disadvantages, but different kinds of REITs do have different kinds of strengths. You must look closely at the kinds of investments that you would like to make so that you can decide if they are best REIT for you.

REITs can be divided in two ways. They can be categorized based upon what kind of properties and industries they are invested in, and they can be categorized according to the manner in which they have invested capital.

These differences are important to understand because even top performing REITs can be affected by changes in different markets.

There are two ways to invest capital:

- Equity REITs produce income by renting or selling long-term properties.

- Mortgage REITs invest in mortgages and mortgage securities in either residential or commercial real estate.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

There are a few different kinds of industries that top performing REITs are usually involved with:

Retail REITs

Retail REITs make up about 24% of all REIT investment, and it is the single largest kind of investment in the United States.

Retail REITs invest in shopping malls, freestanding retail buildings, shopping centers, and any other commercial real estate properties dedicated to housing retail businesses.

REITs make their profits from charging rent to the retailers operating in their properties. This means that retail REITs can be dramatically affected by the local economy.

If the local economy is in decline, businesses may not be able to thrive and make their rent payments. This would hurt the returns that the REIT is capable of generating. The best REITs will invest with the strongest possible tenants, such as grocery stores.

Healthcare REITs

Healthcare REITs are invested in properties like nursing homes, retirement communities, hospitals, and medical centers. These investments tie directly to the state of healthcare and healthcare costs in the United States.

If funds for healthcare systems are questionable, that will make healthcare REITs questionable as well. The best REITs in this industry will focus on diversity. Diversity in customer and property type will greatly lower the risks of the investment.

Office REITs

Office REITs invest in office parks and buildings. Office tenants are generally pretty stable and sign long-term leases. The rental income from office buildings tends to be reliable.

Office REITs will be greatly affected by employment rates and by the economic stability of the surrounding geographic area. If unemployment rates are high or the local economy is weak or unstable, it can make it more likely that offices will close, and investments in the REITs may be lost.

The best REITs for this industry will invest in areas with strong local economies.

Residential REITs

Residential REITs own—and possibly operate—commercial residential buildings. It is important to keep in mind that areas where housing is more expensive will have the best REIT investment return.

This is because when it is expensive to purchase housing, the demand for rental properties increases. It then becomes possible to charge top-dollar for rental properties. Higher rents mean larger returns for REIT investors. So, if you are considering an investment in residential REITs, look for a company that focuses on urban areas with higher rents.

Related: Top Flipping Houses Seminars for Investors & Consumers

3. Lean How to Invest in REITs

The best REITs are popular with all kinds of investors. Individuals can invest in top performing REITs through REIT mutual funds or directly. Organizations can also invest in the best REIT funds if they have the capital and inclination.

Organizations that invest in REITs tend to be endowments, pension funds, insurance companies, or bank trusts, just to name a few.

The easiest way to invest in top REITs might be to hire a broker, investment advisor, or financial planner.

These are trained professionals who can make recommendations about the best performing REITs and investment opportunities based on your financial abilities and goals. The down side to using a professional is, of course, that they must be paid for their time and service.

Image Source: NYSE

Investors can purchase shares from stock exchange–listed REITs, which can be found on the major stock exchanges. Public non-listed REITs and private REITs can be invested in but will not be listed on major stock exchanges.

Shares can also be purchased through mutual funds or exchange-traded funds. Mutual funds allow you to pool your money with other investors, which will then be used by money managers to make stock market purchases. Exchange-traded funds are like mutual funds except that they can be traded in the same way as common stock on the stock market.

Even if you do choose to work with a broker, it is never a bad idea to be well informed.

If you are considering making and investment in the best REITs, you must carefully consider the trusts and their performance in the past. Make sure they have little or no debt and strong profits.

4. Know the Benefits of Investing in Top REITs

When answering the question, “Are REITs a good investment?” it is imperative to understand the benefits of REIT investment. This is the only way to decide if REITs are a good investment for your own finances. The top REITs have proven again and again to be extremely competitive in the ever-changing market.

Many investors use the FTSE NAREIT Equity REIT Index to determine the state of the U.S. real estate market. From 1990 to 2010 the index showed that the average annual return on investment for REITs was 9.9%.

This lands the REIT solidly in second place behind mid-cap stocks, which had an average of 10.3%. That would make top-performing REITs one of the highest producing investments during that time.

To compare, the return on investment for the commodities stock market only averaged 4.5% over the very same time frame.

Aside from being a high performing investment the best REITs offer many more benefits to investors including:

Liquidity

REITs listed on the stock exchange are very easy to sell and buy. This means that investors can adjust their investments quickly and easily if they choose. REITs are also very flexible in how they can be traded.

They can move publicly on major financial exchanges, they can move privately, or they can move publicly but remain unlisted.

Stable Dividends

The best REIT funds tend to provide stable, reliable income for investors. REITs must pay out at least 90% of their taxable income each year. This goes directly to their investors, which makes them some of the highest paying investments.

Portfolio Diversification

A diversified portfolio protects investors from losses. Because top REITs tend to invest in a wide range of property types and locations, it protects investors from losses if one or two properties go under.

Transparency

REITs listed with the stock exchange are regulated in the same way as a public company, which protects investors from shady practices and makes financial reporting compulsory.

The REIT market is very closely monitored. Independent analysts, auditors, and media coverage of publicly traded REITs make it easy for investors to gauge the market and also offers even more protection from questionable business practices.

Solid Middle Ground

Long-term payouts for top REITs are not usually as substantial as high-risk stock, but are a considerably lower risk for capital loss. They also usually have a higher return on investment than low risk bonds and function as a safe, middle ground as far as investments are concerned.

Popular Article: Investment Property for Sale | Guide on Buying & Selling Investment Properties

5. Understand the Best Performing REITs

In order to answer the burning question, “Are REITs a good investment for me?” it is important to find the best performing real estate investment trusts. Finding the best performing REITs is not usually very difficult.

Because REITs depend on investors, and investors gravitate toward the best trusts, REITs can only benefit from advertising high return rates. The REIT industry is also heavily documented by finance media, which makes it easier to find up-to-date information.

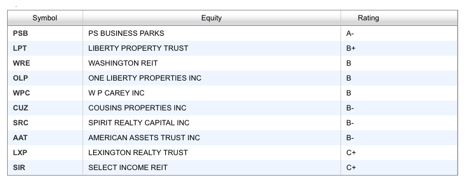

The Street publishes the top 10 highest rated REITs based on investment return daily. On September 30, 2016 they published the following list:

Image Source: The Street Ratings

Even though top REITs are relatively stable, they do depend on many different industries and markets.

Because there is so much diversity in the top REITs they are usually protected from major market dives, however, it is important to remember that even the best REITs can be subject to change.

It is also possible to find projections that judge which REITs are likely to perform well in the future. Forbes and other outlets can offer predictions of dividend growth for the future.

These predictions are based on the profit margins and past dividend payouts made by top REITs. The past performance of a trust can be a helpful indicator of its profitability in the future.

Image Source: Forbes

6. Know the Difference between Top REITs and Investment Properties

Even with all of this information, you might still be wondering if REITs are a good investment for you. You might wonder about properties as a form of real estate investment.

The best REITs provide all the benefits of investing in the real estate market with much less hassle and financial risk. Because top REITs create distance between investors and the actual properties owned by the trust, they allow anyone to invest in the real estate market competently.

Investors do not need to have specialized knowledge about real estate or property management to benefit from REITs.

Property ownership, while in the same general market as the best REITs, is not really comparable. Property ownership does not produce income in the same way as REIT investment. This is because properties come with pretty considerable overhead costs such as: mortgage interest, real estate taxes, insurance costs, and maintenance costs.

Investment in top performing REITs distills the best of real estate management and investment. Because top REITs consist mostly of commercial properties, they streamline and maximize profits for a better return on investment.

REITs are attractive to investors because they offer professional management and oversight. Top REIT managers have real estate experience and can bring specialized knowledge to the endeavor. This makes it much easier for investors with little or no real estate experience to reap the benefits of the real estate market.

Read More: Vanguard vs. Fidelity | Detailed Comparison, Reviews, Competitors & Fees

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: How Do You Find the Best REITs?

There are many factors to consider when finding the best REITs and determining if REITs are a good investment for you. Absorbing and organizing that much information can seem overwhelming at first.

However, with the right guide, this is a challenge you can easily face. Keep our 6 tips in mind as your search for the top REITs:

- Answer the question, “What is a REIT?”

- Consider different kinds of top REITs

- Lean how to invest in REITs

- Know the benefits of investing in top REITs

- Understand the best performing REITs

- Know the difference between top REITs and investment properties

It is important to keep many factors in mind when finding top REITs. Some factors may be more important to some people than to others.

For example, a prospective investor might be interested in finding the trust with the highest return on investment, while another might be looking to invest in a specific industry.

You must look at as much information as possible and then decide which REITs are a good investment for you and can help you meet your financial goals.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.