Investing With TradeKing (Review)

The stock market moves with a frenzied pace, and today’s investors need to move with it. This is why our TradeKing review might show that this online broker is for you.

The all-in-one platform offers a robust yet effective interface for managing your investment portfolio. In minutes, a new user can set up an account and engage in valuable services including:

- $4.95 stock and ETF trades (+$0.65 for each option contract).

- A strong customer service base, as seen by TradeKing reviews.

- Investment research tools and calculators

- SIPC protection of your assets

- Transfer fee reimbursement

- No account minimum

- No minimum initial deposit

- A TradeKing Forex platform

First-time investors and experienced ones alike will be attracted to the sleek usability. The site features plenty of attributes designed to keep the user within their ecosystem of tools. A surface level review of TradeKing presents an inspiring choice for those searching for an online broker. In this article we’ll take a deeper look at TradeKing reviews and characteristics to discover what true, ultimate value is offered.

See Also: Can Capital Reviews – Get All the Facts Before Using Can Capital

The Most Important Question: “What Are TradeKing Fees?”

Much like nasty germs fees are everywhere but rarely seen, there are three primary fees to consider in a TradeKing review:

- Individual trading fee

- Portfolio management fee

- Expense ratio fee

Image Source: TradeKing

Investors interested in trading individual securities and ETFs will be pleased at the prospect of a $4.95 commission per trade. TradeKing fees are designed to capture those vigilant against costs. This fee is an aggressively low-cost option even when compared to big players in the field of low fee online brokers. Notice the fee per trade difference below:

- Vanguard: $7.00 for the first 25 trades, then $20 per trade

- Fidelity: $7.95

- Charles Schwab: $8.95

- TD Ameritrade: $9.99

- E-Trade: $9.99

TradeKing fees have been built around a low-cost ethos that eclipses the competition. These numbers illustrate value in opening a TradeKing account. The TradeKing fees for purchasing mutual fund shares is $9.95 per trade. Keep this in mind before opting for a dollar-cost averaging style.

But Be Careful…

Any TradeKing review should act as a reminder that a low trading fee might actually encourage frequent trading. This can be problematic. If a low-cost trading fee is a means to rapid fire trading, think twice.

In research findings from The Graduate School of Management at The University of California-Davis, the authors write that investors “trade frequently and have perverse stock selection ability, incurring unnecessary investment costs and return losses. They tend to sell their winners and hold their losers.” Seeking out low TradeKing fees is wise. Using them as a license to trade more frequently is a strategic mistake.

Finally, the $0 account minimum comes with a catch: a TradeKing inactivity fee of $50 will be assessed for those with no executed trades within the last 12 months or those holding an account with a balance less than $2,500. Strictly speaking, this is not contradictory to the TradeKing minimum policy of “no account minimum,” which refers to the balance of your account when you start with TradeKing. The absence of a TradeKing minimum makes it easy for any player to step onto the field.

Don’t Miss: CuraDebt Customer Reviews – Get all the Facts before Starting with CuraDebt

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Do TradeKing Fees Impact My Investment?

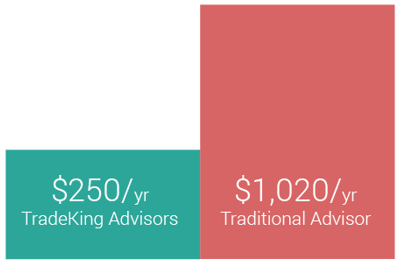

There is another important fee to consider: the management fee. This will not apply to an investor interested in identifying, buying, and holding their own stocks, ETFs, and mutual fund shares. For those interested in a managed, personalized portfolio, an annual 0.25% fee will be assessed. For this, TradeKing reviews your risk preference and builds a custom portfolio.

This also falls below the industry average described by contributing Forbes writer Rick Ferri who explains, “The typical investment adviser charges about 1.0% per year on the first $1 million of assets under management.” Again, TradeKing fees rival the competition. Consider the per year impact a lower fee has on a hypothetical $100,000 investment:

Image Source: TradeKing

Drive Costs Down With a Passive Approach

Yet, even this fee can be avoided. By engaging in a passive style of investing (e.g., focusing on one or two index funds), you will not need to pay this management fee. Studies reveal that actively managed portfolios underperform simple indexing.

Research firm Morningstar makes this finding clear in their 2015 study concluding, “actively managed funds have generally underperformed their passive counterparts, especially over longer time horizons.” Your performance will be greater without the “managed” option.

The simple truth for all investors to remember is again best summarized by the Morningstar report, “…failure tended to be positively correlated with fees.” TradeKing fees for a managed portfolio are low, but passive management is better. Before investing with TradeKing, review your options; you’ll find simple is smart and cheap.

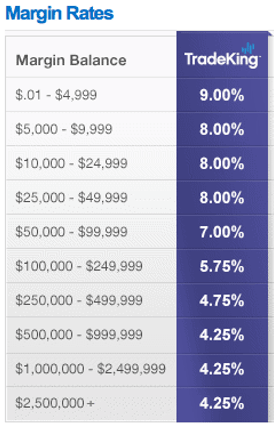

Understanding TradeKing Margin Account Rates

A TradeKing margin account allows users to borrow against the value of their funds. This is subject to a $2,000 minimum equity requirement. As the margin balance increases, the rate falls. These rates are calculated daily and debited monthly.

Image Source: TradeKing

As TradeKing explains, “If the value of any investment bought with borrowed money (“on margin”) decreases, your equity will also decrease. TradeKing will generally allow your equity to go as low as 30% before it will require you to deposit more funds.” Be careful to understand all of the costs and risks before engaging in a TradeKing margin account.

Related: OptionsHouse Review – Fees, App, Commission, Services, Speed, Trading

Mobilized Investing

In keeping with their technology-enabled style, the TradeKing app carries a suite of interactive tools. Users will be able to act on real-time market data on the go. Many of the market reporting metrics are available in other apps; however, the TradeKing app allows fast movement as it’s connected to your account. Trades can be made on the spot. No re-logging in is required.

The TradeKing app pricing data and charts are surprisingly detailed for a mobile optimized experience. Price alerts, market news, and streaming quotes are all available. More sophisticated charts are available for those looking to optimize key trading positions.

A More Complex App

For those comfortable trading in the Forex world, there is TradeKing Forex. The app offers the ability to trade 50 Forex pairs as well as gold and silver. Trade types can be selected for market orders, limit stop orders, trailing stops, and more.

Image Source: TradeKing

The interface is well designed to meet the challenge of incorporating multiple, dynamic data sets in a small space. The TradeKing reviews for these optimized apps are strong: 2,525 TradeKing reviews yield an average 4.1 stars out of 5 for the mobile app.

TradeKing Forex, however, might work better via the ordinary site. With a larger screen, users will be able to dive deeper into the research and currency spread tools. One user posted a TradeKing review lamenting, “A good app but doesn’t let you see transaction history which is annoying.” People such as a TradeKing penny stocks investor might need superior execution to capitalize on fine-tuned trades.

What Do the Customer TradeKing Reviews Say?

SmartMoney awarded a stellar ranking of #1 in customer service for 2010-2012. An online broker survey from Barron’s awarded four out of four stars spanning 2007-2015.

While these numbers speak volumes, what do the ordinary TradeKing reviews from customers reveal? One customer reported having a few negative experiences with slow execution and illiquid nature of assets transferred into a TradeKing account. This complaint is minor but not uncommon.

Another TradeKing review explains, “I’ve been with them over 3 years and my only complaint is their execution sucks.” These few dissenting voices represent a minority. The vast numbers show a positive customer experience.

Popular Article: CreditRepair.com Reviews and Overview (Before You Sign-up)

What About TradeKing IRA Options?

The simple, low-cost investing style extends into the TradeKing IRA offerings. Those interested in opening a retirement account can choose from the following:

- Traditional TradeKing IRA

- Roth IRA

- Rollover IRA

- SIMPLE IRA (Savings Incentive Match Plans for Employees)

- SEP IRA (Simplified Employee Pension)

- ESA (Educational Savings Account)

These options will cover the retirement needs of any investor. TradeKing fees are low here also. There is no charge for maintaining an IRA account. However, the TradeKing inactivity fee discussed above does still apply here. A $50 TradeKing fee also applies in both scenarios of closing an account and/or transferring the full balance out of the account.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: What Does A TradeKing Review Tell Us?

The complete picture of our TradeKing review is strong. Investors will find the fast, technology-driven, low-cost platform to be an attractive home for almost any account. Those engaged in frequent trading are unlikely to find a lower-cost option.

However, a TradeKing penny stocks strategy is unwise here given the flat-fee trade setup and additional $.01 charged per share for stocks valued under $2.00.

Let’s break down some other elements.

Low Costs

As illustrated above, they’re among the lowest in the field. The aggressive, flat-fee for stock & ETF trades and a competitive mutual fund trading fee make TradeKing fees a leader in the market place. Buy-and-hold investors will reap an even greater value from fees they’re only likely to incur once or twice a year. Dollar cost averaging strategists should be cognizant of how fast even low costs can add up. Opting for TradeKing mutual funds will yield a higher cost at $9.95 a trade.

Strong Customer Service

TradeKing reviews for customer service are exemplary by any standard. Both a review of individual customers and larger reporting agencies show a great experience. Email inquiries receive a response within 24 hours. A live representative can be reached between 8am and 6pm EST Mondays through Fridays.

User Interface and Research Tools

Up to the minute reporting and a broad cross-section of market data will appeal to even the most devoted technical analyst. Those with a TradeKing margin account will appreciate the value here. The host of options includes:

- Market and company snapshot data

- Watch lists

- Live quotes

- S&P STARS recommendations for over 1,500 companies

- Interactive charts

- Option chains

- Diverse technical analysis tools

- Robust mobile apps for stock and TradeKing Forex trading

Ease Of Implementation

The intuitive interface and freedom from any TradeKing minimum make getting started a breeze. While some will be dissuaded by the TradeKing inactivity fee, the reality is that even the most infrequent trader will not be subjected to the $50 charge. Customized portfolios come in just minutes with a few answers to short questions. Blogs, FAQ pages, and customer service personnel support the investor every step of the way.

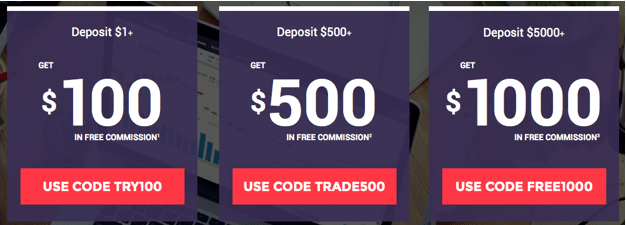

Bonus Savings and TradeKing Promotional Codes

TradeKing fees also work in reverse. When you transfer your assets from a previous broker to TradeKing, you will be reimbursed for any fees incurred from your departing firm up to $150 making the move is easy.

You can earn $50 by referring a friend to TradeKing. If you refer someone who opens an account with $3,000 while executing a minimum of 3 trades within 90 days, you’ll be eligible for a $50 reward. Your friend will also receive a $50 bonus.

Image Source: TradeKing

Earn more value by getting free trades. The free commission offered builds as your total account balance increases. Use the TradeKing promotional codes above to get in on the action. This will be especially valuable to TradeKing Forex players who are likely to make more trades.

TradeKing will also reimburse a wire transfer fee up to $25 when funding your new account (retirement accounts excluded). The message is clear: TradeKing wants your business and they’re willing to pay for it in more ways than one.

Whether you’re a frequent trader or simply a long-term investor, our TradeKing review illustrates immense value for the individual.

Read More: First Choice Capital Resources Review

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.