Intro: Could the Uber Credit Card be the New Best Millennial Credit Card?

In a world where convenient and affordable rides can materialize through simply opening an app, there’s no doubt that Uber has revolutionized the way that we view transportation.

Now, the company is hoping to revolutionize the credit card industry, offering the same convenience and affordability through their own rewards-based credit card.

Effective November 2, Uber will be teaming up with Barclays with the new Uber credit card, marking a distinct and innovative supplement to their popular ride-hailing service.

Consumers can apply for the Uber Visa card online or directly through the app, making the application process inherently millennial-friendly. In fact, Mashable calls it “the ultimate millennial credit card.”

With a surprisingly solid rewards program, no annual fee, and perks seemingly tailored to a technology-loving crowd, this makeshift moniker isn’t too far off.

Whether you are looking for the next best millennial credit card or if you simply want to explore your options for a better line of credit, you may want to consider signing up for the new Uber rewards card.

In our Uber credit card review, we’ll provide you with everything you need to know about this new credit card for millennials, including:

- What are the rates and fees like for the Uber Visa card?

- How does the new Uber credit card rewards program work?

- Are there any additional benefits to having the Uber Visa card?

Finally, we’ll provide you with a list of pros and cons to help you determine whether the new Uber rewards card could be the best credit card for you.

Uber Credit Card Review | Rates & Fees

Before signing up for any credit card, it’s important to know exactly what type of rates and fees are included.

According to the Terms and Conditions, the APR for purchases and balance transfers will either be 16.74, 22.49, or 25.49 percent, depending on credit scores.

What about their fee structure? Compared to other credit card offers, the Uber credit card fee structure is fairly standard. Balance transfers and cash advances will both incur a fee of $10 or 3 percent, whichever is greater.

Where the new Uber Visa card truly stands out is with their annual fees and foreign transaction fees—both are nonexistent.

Cardholders will pay $0 in annual fees and $0 for foreign transactions, making it easy to maintain an affordable, manageable line of credit.

See Also: How to Get a Debit Card | Guide on Getting the Best Debit Cards

Uber Credit Card Review | Credit Card Rewards Program

The Uber Visa card has a surprisingly comprehensive point-based rewards program, enabling credit cardholders to earn a significant percentage of points back for things like dining out, booking an Airbnb, and of course, hailing an Uber driver.

Here’s a quick look at how the Uber credit card rewards system works:

- 4% back on dining—Restaurants, takeout, bars, and UberEATS

- 3% back on hotels & airfare—Airfare, hotels, and home share exchanges (Airbnb)

- 2% for online purchases—Shopping, video streaming, music streaming, and Uber rides

- 1% back on all other purchases

Not only does the Uber Visa card offer a variety of ways to earn points, but it also gives cardholders a variety of redemption options. Points can be redeemed for credits towards Uber rides, cash back, or gift cards.

As long as your account is in good standing, points are unlimited and have no expiration date, making the Uber rewards card beneficial over the long-term.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Transferring Points into Ride Credits

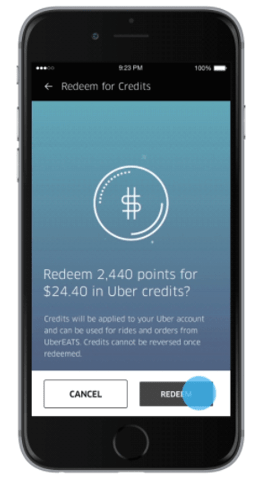

Perhaps the biggest advantage to having the Uber credit card is the ability for cardholders to convert their points into in-app payments (called Uber credits) that can be applied towards rides and UberEATS.

Points will be transferred towards Uber credits at a 1 percent value. For example, 500 points will get you $5 in credit towards your next Uber ride, which is also the minimum redemption amount.

Converting points into Uber credits can be easily done through the app, which takes anywhere between a few seconds to 24 hours.

For frequent users of the Uber app, the ability to redeem points towards future rides could be a significant benefit of the Uber Visa card.

Don’t Miss: The Best Prepaid Cards for Good or Bad Credit | Guide | How to Find the Best Prepaid Cards

Uber Credit Card Review | Additional Perks

Aside from the Uber credit card rewards system, cardholders can enjoy a few additional perks, including:

- $50 credit for eligible streaming and shopping subscriptions after spending $5,000 annually

- $100 bonus for new cardholders that spend $500 within the first 90 days (redeemable for Uber rides, statement credits, or gift cards)

- Up to $600 in damage and theft protection for your mobile phone when using the Uber Visa card to pay your phone bill

The company also plans on providing Uber Visa cardholders with access to exclusive events and offers, which are anticipated in larger cities like Chicago, NYC, San Francisco, Los Angeles, and D.C.

Related: Top Ways to Get the Best Free Prepaid Cards with No Monthly Fees | Guide

Uber Credit Card Review | Pros & Cons

Uber Rewards Card—Pros

If you’re unsure about whether the Uber credit card is right for you, consider the following pros:

Dynamic Rewards Program

The Uber Visa card is one of few rewards-based credit cards that provides a wide range of ways to earn cash back.

Whether you are out to dinner with friends, buying a pair of shoes online, or booking a hotel room, the Uber credit card makes earning cash back convenient, which is a great quality.

Integration with Uber App

Not surprisingly, the integration with the ride-hailing app is a great benefit of the Uber Visa card, particularly for consumers who regularly schedule Uber drivers.

The ability to redeem points directly for credits towards an Uber ride is certainly the card’s most unique quality, making the process of ordering an Uber into a seamless—and more affordable—process.

Low Fees

Rewards-based credit cards are notorious for having high annual fees attached, which is part of what makes the Uber credit card into such a desirable credit card for millennials.

Without an annual fee, the Uber Visa card becomes much more affordable over the long-term, supporting responsible credit card management.

Additionally, cardholders that love to travel can truly benefit from the Uber credit card, since it carries zero foreign transaction fees (another rarity among rewards-based cards).

Uber Rewards Card—Cons

Of course, there are also some potential downfalls that should be taken into consideration before signing up for the Uber credit card, including:

Potentially High APR Rate

For consumers with lower credit scores, the Uber Visa card may not be the best option. APR rates for lower credit scores can be as high as 24.74 percent, which is far above the national average of 15.96 percent.

This is not a downfall that is unique to Uber. In fact, most rewards-based credit cards impose higher APRs to make up for their cash back programs.

Still, higher APR rates carry the potential for greater debt over time, and should always be taken into consideration before applying for a new credit card.

Sign-Up Perks are Expensive

At first glance, the ability to earn a $50 credit for streaming services seems fantastic, particularly for younger consumers looking for millennial credit card.

However, the fine print requires the cardholder to spend $5,000 each year on their card to get this benefit, which seems like a hefty milestone.

That means that you would have to spend—and pay off—roughly $415 on your Uber Visa card each month for an entire year.

For consumers that regularly make purchases with credit cards, this may not be an issue—but for many, continuously maxing out their credit card could cause more financial stress than the $50 credit is worth.

Questionable Corporate Practices

Uber has not always maintained completely ethical business practices, particularly when it comes to privacy and data security.

According to TechCrunch, the company has had to address issues with monitoring employee access to consumer personal information, following up on automated alerts regarding the potential misuse of information, and a number of security failures.

Although the company is striving to improve their privacy and data security policies, their past performance may make some consumers wary about opening a line of credit with Uber.

Popular Article: Best Credit Cards For Groceries & Gas | Guide | Finding Best Cards for Buying Gas & Groceries

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Is the Uber Visa Card Worth It?

Determining the value of a new credit card—whether it’s a credit card for millennials or not—will ultimately come down to examining your unique financial situation and your personal spending habits.

If you’re considering applying for the Uber credit card, ask yourself the following questions:

- Do your current spending habits align with the Uber credit card rewards program?

- Would you prefer to have multiple options when redeeming your points?

- Do you use Uber often enough to benefit from Uber credits?

- Can you find a better rewards program from competing rewards credit cards?

The Uber rewards card has a lot of desirable qualities as a credit card for millennials or for virtually any generation. The rates are reasonable, the fees are low, and the points program is both unique and comprehensive.

If you like the idea of combining a dynamic app with a solid credit rewards program, the Uber credit card just might be your new favorite line of credit.

Read More: The Best Credit Card for Airline Miles | Guide | How to Find and Get the Best Credit Cards for Miles

Images courtesy of:

https://www.uber.com/newsroom/uber-visa-card/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.