Guide: Understanding VA Loan Qualification

Purchasing a home can be a very stressful, confusing, and difficult undertaking, and doing so as a veteran or an active member of the military can be even more challenging. Buying a home is never easy and rarely affordable. But, the VA loan program offers military service members and their families the chance to make purchasing a home just a little bit easier.

Many prospective borrowers often have questions concerning VA loans, VA loan limits, VA loan qualification, and VA loan requirements. A few questions that many people ask include:

- What is a VA loan?

- Do VA loans have limits?

- What are VA loan eligibility requirements?

- What are the benefits of a VA loan?

Qualified veterans or service members are offered the chance to take advantage of a program that can make the process of buying a new home easier and more affordable. The keyword, however, is “qualified.” Navigating the program to determine who can take advantage of it and how they are allowed to use it can be time-consuming and frustrating.

However, our detailed guide will examine the VA loan program in depth and bring to light its many requirements, benefits, and functions. We will examine who is able to qualify, how it may be beneficial for their finances, and what limitations should be considered. Armed with the highest-quality information possible, each individual can choose the best course of action for their needs.

See Also: Best VA Loans Guide

What Is a VA loan?

A VA loan is a type of guaranteed mortgage. A guaranteed mortgage is a loan for which protection is guaranteed to the lender by a third party in the event that the homeowner defaults on their mortgage. Lenders are often able to offer very attractive rates and qualification requirements for guaranteed loans because of this protection.

VA Loan Requirements, Limits, &; Eligibility

VA loans are guaranteed by the U.S. Department of Veterans Affairs, which is also known as the VA. VA loans are intended to help qualifying veterans access private housing.

Loans of this nature are subject to VA loans guidelines that dictate how it can be used, who is able to qualify, and the level of financing that can be offered. Qualifications for VA loan applicants will be different depending on a number of factors including the nature of their military service.

Qualifications for VA loan applicants can also change depending on where they choose to finance their mortgage. This is because, while the loans may be backed by the government, they are offered by private lenders who may impose their own qualifications for VA loan approval.

Don’t Miss: What is a VA Loan | All You Need to Know About VA Loan Rates

What Are the Benefits of a VA Loan?

Getting a VA loan offers qualifying veterans and their spouses a number of benefits. The benefits of VA loans offer borrowers the chance to save money with each monthly payment. Qualifying veterans can also use the benefits of a VA loan to help them achieve the dream of homeownership more quickly and easily than many traditional mortgages.

Down Payment

Many traditional mortgages will not finance the entire purchase cost of a home. This requires borrowers to cover the difference out of their own pockets. This can quickly become expensive, and it can be difficult for many prospective homeowners to save enough money to cover the cost.

One of the most obvious benefits of VA loans is that qualified borrowers can avoid making any kind of down payment on their new home. By getting a VA loan, borrowers have the chance to finance 100% of their homes. This makes homeownership much more affordable for qualifying service members.

Private Monthly Mortgage Insurance

With many traditional mortgages, borrowers generally have two options concerning private monthly mortgage insurance or PMI. Either borrower can make a down payment covering at least 20% of the cost of their home, or they can add the cost of PMI into their monthly mortgage payments.

This insurance is designed to help protect lenders in the event that a borrower defaults on a mortgage. However, both choices may end up costing prospective homeowners. In many cases, a 20% down payment is a significant amount of money to save up, and PMI can add a significant amount to a borrower’s monthly mortgage payment.

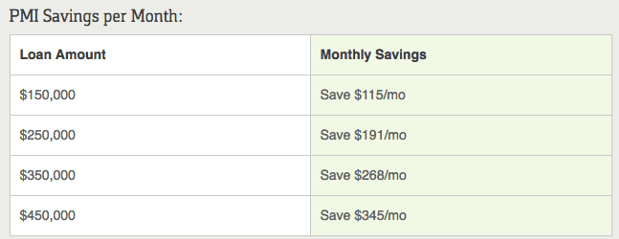

The benefits of a VA loan can help qualified borrowers avoid these costs altogether. Because VA loans are guaranteed by the federal government, lenders are protected against default and do not require borrowers to carry PMI. In this regard, the benefits of VA loans can make it easier for borrowers to build equity and save money on each mortgage payment.

Image from Veterans United

Interest Rates

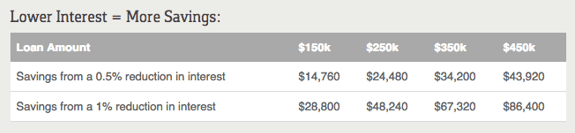

Other benefits of VA loans come in the form of reduced interest rates. Since these loans are guaranteed and offer lenders protection, this generally allows borrowers to access lower than average interest rates.

Interest rates associated with getting a VA loan tend to be between 0.5% and 1% lower than those offered with traditional mortgages. This can be a huge help for military service members because reduced interest rates can add up to thousands of dollars saved during the lifetime of a mortgage.

Image from Veterans United

Pre-Payment Penalties

Every mortgage comes with a built-in maturity date indicating when it will be completely paid off. For many traditional mortgages, borrowers who pay off their mortgage before this date can face a fine called a pre-payment penalty. This is designed to help lenders gain back any interest profit they may lose due to an early mortgage termination.

Getting a VA loan can help borrowers avoid this because they do not come with any pre-payment penalties. With the benefits of a VA loan, borrowers have the added freedom to pay off their home at any point in time, whether that is to purchase a different home or refinance their mortgage.

Related: Guide on the Best VA Loans

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Income and Credit Requirements for a VA Loan

Qualifying service member spouses must meet a few minimum VA loan requirements in order to qualify for a loan. Applicants must meet service requirements for a VA loan with a valid certificate of eligibility, but they must also meet certain credit and income levels to achieve VA loan eligibility.

VA loan requirements by themselves do not include stipulations concerning a particular credit score. However, private lenders are free to (and often do) have their own standard minimums included in their VA loan requirements. Often, lenders will have VA loan requirements for a minimum credit score of around 620.

Private lenders will also often have standard debt-to-income requirements for a VA loan applicant. A debt-to-income ratio measures an applicant’s debt and debt payments against their monthly income. The VA recommends that applicants have a ratio of 41%. However, private lenders will often have higher requirements.

The VA itself has income requirements for VA loan applicants. These requirements measure residual income, meaning capital left over after all significant debts are paid each month. These VA loan requirements vary depending on the size of an applicant’s family or where they live. This is because residual income minimums are meant to ensure that basic living costs can be covered, and these cost change by region and family size.

VA Loan Limits

There are VA loan limits to the amount of liability that the VA can take on for any one loan. This does not mean that there is a definitive cap on the amount of money that can be borrowed through a VA loan. However, there are VA loan limits to the amount that the VA will guarantee, which can affect the amount of money that a private lender will offer a borrower.

This limits the amount of money that a qualified applicant is allowed to borrow without making a down payment. Applicants will be able to exceed this limit if they provide a large enough down payment to cover the difference. This is still a pretty good deal considering that VA loan limits do not affect PMI and down payments can be of various sizes without penalty.

The VA loan limits for the basic entitlement offered to each qualified applicant is $36,000. Usually, lenders will approve an applicant for four times the amount of their entitlement without requiring an additional down payment. However, approval is still subject to VA loan limits concerning income and credit qualifications as defined by the VA and the lending company.

VA loan limits can vary based on the county in which the purchase property belongs. These limits are changing on January 1, 2017, and will be identical to the Federal Housing Finance Agency’s limits.

Popular Article: All You Need to Know About VA Loan Rates

What Is a VA Loan Able to Purchase?

VA loans guidelines dictate how a loan can be used. Unlike traditional mortgages, which can be used to finance the purchase of a home in a variety of ways, there are limits to VA loan eligibility and use.

Traditional mortgages can be used to purchase a rental property or vacation home. However, VA loans guidelines dictate that a home purchased through the program must be used as the borrower’s primary residence.

In order to comply with VA loan limits, the property must be occupied by the borrower. According to VA loans guidelines, this means that, in most cases, the buyer must occupy the property within 60 days of closing.

There are some exceptions to the occupancy requirements for VA loan homeowners. Borrowers who are active duty service members and are deployed away from their home may be granted an occupancy extension up to 12 months. Occupancy requirements for VA loan holders can be circumvented in the event that the property is occupied by the spouse of the borrower.

Along with occupancy rules, there are also VA loan limits concerning the type of home that may be purchased and how the loan can be used. Acceptable home types and uses include:

- New home construction

- Purchase of a manufactured home

- Purchase of a home

- Purchase of a VA-approved condominium

- Improvement of a home through the installation of energy efficient features

- Simultaneous improvement and purchase of a home

Property Requirements for a VA Loan

VA loan requirements stipulate that all properties purchased through the program must meet certain structural standards. In order to finance a property with a VA loan, it must first meet VA loan requirements called minimum property requirement, or MPRs.

These VA loan requirements are designed to assess major structures of the house in question, like the roof, water supply, and heating. Properties must meet these VA loan requirements in order to prevent the purchase of homes that are likely to have serious problems.

In order for a property to meet VA loan eligibility, it must comply with all MPRs by the time that the loan is finalized. The loan will not close if the property does not meet VA loan requirements at this time. VA loan requirements for properties include but are not limited to the following:

- Roof cannot have any leaks

- Must have proper drainage

- Property must be in good repair without any dry rot, mold, termites, or pests

- Property must have separate shutoff for utilities, including power, gas, sewers, and water main

- Water supply must be potable and continuous

- Property must have hot water system

VA Loan Eligibility Requirements for Service

VA loan eligibility is limited to qualified veterans, active duty military, National Guard and Military Reserve members, and in particular cases, military spouses. There are a number of different VA loan eligibility requirements that can vary depending on the circumstances the service for individual applicants.

In order to meet VA loan eligibility requirements, an applicant must meet at least one of the following conditions:

- Served at least 90 consecutive days of active duty during a wartime

- Served at least 181 days of active service during a peacetime

- Served more than 6 years in the National Guard or Reserves

- Be the spouse of a service member who died in the line of duty or as the result of a service-related disability

- Be the spouse of a service member who is missing in action or a prisoner of war

Service members who are currently serving active duty are only required to have served at least 90 continuous days to achieve VA loan eligibility. It is also important to note that military service members who are dishonorably discharged do not meet qualifications for VA loan requirements by default.

Wartime and Peacetime Qualifications for a VA Loan

As there are different VA loan eligibility requirements for veterans who served during time of war or peace, it is important to understand how those times are defined. These times are defined by the VA as follows:

- World War II wartime service: September 16, 1940-July 25, 1947

- Post World War II peacetime service: July 26, 1947-June 26, 1950

- Korean War wartime service: June 27, 1950-January 31, 1955

- Post-Korean War peacetime service: February 1, 1955-August 4, 1964

- Vietnam War wartime service: August 5, 1964-May 7, 1975

- Vietnam War wartime service for those who served in the Republic of Vietnam: February 28, 1961-May 7, 1975

- The Post-Vietnam War peacetime service: May 8, 1975-September 7, 1980

- The Post-Vietnam War peacetime service for officers: May 8, 1975-October 16, 1981

More Recent Service Qualifications for a VA Loan

VA loan eligibility service requirements for service performed after the end of the post-Vietnam peacetime follow a few different rules. The 24-month rule determines veteran qualifications for a VA loan based on:

- Active service provided between September 8, 1980 and August 1, 1990

- Active service for officers provided between October 17, 1981 and August 1, 1990

- Served for at least 24 continuous months or the entire period for which they were called or ordered to active duty for at least 181 days

Requirements for VA loan applicants who served in the Gulf War are also a little different. These veterans must have served between August 2, 1990 and the present. To meet their VA loan qualification requirements, they must have active duty for 24 continuous months or served for the entire period for which they were called or ordered to active duty for at least 90 days.

Other Kinds of VA Loan Qualification Requirements

In addition to their service time VA loan qualification requirements, National Guard or Reserve members must also meet the proper discharge requirements. These service members must have been discharged honorably, gone on the retired list, transferred to the Standby Reserved or Ready Reserve with Honorable Service, or still serve in the Selected Reserve.

Some veterans who did not serve the specified length of time required may still fulfill VA loan qualification in some cases. Those discharged due to hardship, the convenience of the government, reduction-in-force, particular medical conditions, or a disability connected to their service may still meet qualifications for a VA loan.

Read More: All You Need to Know About VA Loan Rates

Conclusion: Understanding VA Loans Can Help You Achieve Your Goal

VA loans are a great way for military service members and their families to achieve the dream of homeownership. The best way to make the VA loan program work for your needs is to understand it. It is important to understand its limits as well as what it has to offer you.

Keep some of our larger points in mind as you search for your new home:

- VA loans can offer military members and veterans lower interest rates, no PMI, and eliminate down payment requirements.

- VA loans can only be applied to your primary residence.

- VA loans will only work for homes that meet the VA’s minimum property requirements.

- Qualifications are different depending on when your service took place.

Navigating the VA loan program does not have to be hard or intimidating. With the information in our guide helping you better understand VA loan limits, requirements, qualifications, and guidelines, you can route your course and make your dream of homeownership a reality.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.