Guide to Qualifying for Loans for Veterans

Most of us carry a healthy amount of respect for those who serve our country with dedication and bravery. It only seems natural to us that we would reward them in some way for the incredible sacrifice they are willing to make daily to help us maintain our freedom. And yet, how many of them are aware of the loans for veterans that are right at their fingertips?

For those who have served in our armed forces, the United States government and many other financial institutions offer better financial incentives. After a length of time spent in service to their country, members of the armed forces are eligible for a number of VA loans and all of the VA loans benefits those can entail.

Image Source: Pixabay

Loans for veterans tend to come with a handful of perks. Most notably, VA loans are subject to lower interest rates and more favorable terms overall. These can be split into two broad categories: VA personal loans and a VA house loan.

AdvisoryHQ wants you to be prepared with all the knowledge you’ll need to see if you qualify for these loans for military veterans. We will cover the basics of how to get a VA house loan and how to qualify for other loans for military veterans.

See Also: What is a VA Loan ?

What Is the VA House Loan?

Consumers who are familiar with the term “VA loans” most likely have heard of the most common type of program—the VA house loan. This program is funded by the Department of Veterans Affairs to assist active duty and retired military members who meet specific eligibility criteria with the purchase of a new (or new-to-them) home. How does it work?

First, a VA loan that falls into this category is not issued by the Department of Veterans Affairs itself. Instead, you will find it through third-party lenders and financial institutions who are willing to work with the program. Your VA house loan will be backed in part and guaranteed by this department of the federal government.

Because of the extra security, this presents to potential lenders, a VA house loan typically comes with more favorable terms. It is easier for consumers to meet their monthly obligations on these VA loans because it significantly shaves down the cost on a month-to-month basis. A VA mortgage loan features some of the most competitive interest rates, in part because of the security afforded to lenders.

Additionally, a VA mortgage loan tends to be easier for consumers to qualify for in terms of the up-front costs. No down payment is necessary for these loans for veterans. Apart from this program, even the most lenient lending programs typically require at least a small percentage of the cost of the home as a down payment to grant the lender peace of mind.

In most scenarios, a financial institution will require the payment of private mortgage insurance for any consumer who has a down payment of less than 20% of the cost of the home. Loans for veterans are able to waive the private mortgage insurance (PMI) due to the added security afforded by the guarantee from the Department of Veterans Affairs.

There is also a VA funding fee required to help offset the cost of backing by the federal government. This generally constitutes approximately 2% of the actual cost of the home, though it can increase for subsequent uses of the VA house loan.

This loan can be used multiple times over the course of your lifetime but must always be used for a primary residence that you intend to occupy. It cannot be used for rental properties or income-generating real estate.

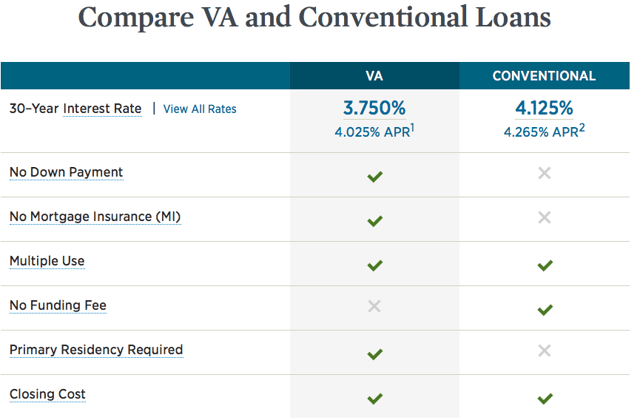

For a more detailed look at the fundamental differences between a VA house loan and a conventional mortgage product, see the comparison chart below from USAA. USAA is a financial institution that specializes in offering financial services of all types to military service members.

Image Source: USAA

Don’t Miss: Guide on How to Get VA Small Business Loans

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

VA Loan Qualifications

VA personal loans that are used as a mortgage will require you to meet some specific criteria before you can apply. While some of the VA loan qualifications will be similar or identical to those on conventional loan products, VA personal loans of this variety will have some unique requirements as well.

First and foremost, you must have sufficient credit and be able to demonstrate your ability to repay the loan in a timely manner to get military loans. This should come as no surprise to consumers. Lenders are not interested in making loans to consumers, even loans for veterans if they cannot rest assured that they will receive their money back over the course of the loan term.

VA loan qualifications also require you to meet the standard for a Certificate of Eligibility. This form states that you have met the serving requirements set out by the Department of Veterans Affairs, including your area of service and the length of time you were considered active duty.

You may apply for VA personal loans if you are an active duty member of the armed forces, a veteran, or a member of the National Guard or Reserve. In certain circumstances, spouses and surviving spouses may also apply for a VA house loan if they can meet the VA loan qualifications.

Details on which types and lengths of service qualify for VA loans are fairly complex and lengthy. For more information on whether you would qualify for a Certificate of Eligibility, see the Department of Veterans Affairs website for full details.

There is no maximum debt ratio on these military loans. Unlike many conventional products that require the debt-to-income ratio to be less than 41%, this does not automatically exclude you from VA personal loans. Lenders will have to show compensating factors for the qualification of military veteran loans if the debt is over this amount, though.

Military House Loans Requirements for the Home

Loans for veterans have general requirements set out by the Department of Veterans Affairs and the financial institution handling the loan, but the homes must also meet the standard. VA loans will not apply to every property or situation, so you should be aware of what they can be used for in advance.

A VA house loan can be used to purchase or pay for any of the following:

- Buying or building a new home

- Buying a condo

- Buying a manufactured home or a lot of land

- Repairing or improving an existing property owned by a veteran

- Installing energy-efficient systems

In order for the VA personal loans to cover the cost of your home, they must typically be move-in ready when you sign at closing. While there are no maximum military house loans through this program, a VA house loan will only be guaranteed up to $417,000. If you are hoping to take advantage of the no-down-payment feature of a VA mortgage loan, your home will need to come in under this amount.

Under similar circumstances, a VA house loan can also be used to refinance an existing property that you own and occupy. Eligibility remains the same, requiring consumers to have sufficient credit, income, and a certificate of eligibility to apply for this type of program.

Related: Best VA Loans Guide

How Does a VA Mortgage Loan Work?

As we already mentioned, the VA house loan comes with a number of benefits that consumers who qualify will want to take advantage of. The question at this point becomes: where do I go to get started for military loans?

Because the Department of Veterans Affairs doesn’t lend the full amount required for the purchase of the home, consumers will need to find a trusted financial institution. Not all lenders participate in servicing and funding VA loans, but many of the top banks do. You can search for a lender that meets your needs based on factors that are important to you.

Important criteria to consider are:

- Location of the bank and convenience of making it to a brick-and-mortar location

- The reputation of online banks that offer a VA loan

- Hours of business

- Customer service

One of the biggest criteria you will want to consider in a potential lender is the interest rate. A VA loan doesn’t come with an interest rate set by the federal government for this program. Instead, you will need to evaluate the various rates offered by lenders that are on your list of potential choices.

From here, you will fill out an application at this institution and begin searching for a home. Being prequalified for VA loans prior to shopping allows you to set realistic expectations for what you can afford to purchase. The lender will be able to walk you through the final steps of what is required to close on your mortgage.

Consumers who are worried about paying closing costs on a VA house loan will love the final process from lenders. Closing costs, as well as some of the funding fees required by the VA house loan program, can be bundled into the final amount of your loan.

Image Source: FreeImages.com

Popular Article: How to Find the Best VA Mortgage Calculator with Taxes and Insurance?

Where to Get a VA House Loan or VA Personal Loans

Loans for veterans aren’t hard to find from lenders these days. In fact, many of the top names in the mortgage lending industry are now offering the VA house loan as one of their many selections in mortgage products.

If you’ve been searching for a lender that could assist you with military house loans, one of these options may be a good fit for you. We will break them down into three categories: online lenders, brick and mortar financial institutions, and those that offer VA personal loans.

Bear in mind that these sections are by no means an exhaustive list of all the lenders and resources available for a potential VA house loan. These are simply some of the more popular options available.

Online Lenders

Online lenders offer a level of convenience and ease that appeals to many consumers. Applying for VA personal loans through an online lender allows you to fill out paperwork from the convenience of your home at a time that works best for you. It saves you the hassle of planning face-to-face meetings with customer service representatives during normal working hours.

- Quicken Loans: This option gives you the backing of a well-known company along with the attention of highly specialized mortgage representatives. You can even use their apps to keep track of your VA loan progress and potential rates while you’re on the go.

- Lending Tree: Unique among online lenders for VA loans, Lending Tree does not actually service any loans for veterans. Instead, it allows you to fill out a very short and simple application before matching you with potential lenders that are a good fit for you.

- Veterans United: Boasting a 97.8% customer satisfaction rating, this lender for VA loans has already assisted more than 100,000 families with the purchase of a new home. You can make good use of the calculators, educational resources, and purchase and refinance options for your next VA house loan.

Brick-and-Mortar Financial Institutions

Brick-and-mortar financial institutions are great for consumers who prefer the traditional aspect of meeting their customer service representative face to face. If you don’t mind the need to schedule appointments and appear in the office during business hours, selecting a lender with a physical location could be a good fit for your military house loans.

- Bank of America: Bank of America has plenty of locations around the United States, as well as competitive interest rates on their VA house loan program. Consider getting prequalified online with this lender.

- Wells Fargo: Wells Fargo offers loans for veterans when they are looking to purchase or refinance a property that they will occupy as a primary residence. Well-known and with many locations, this lender could be a convenient source for a VA loan.

- USAA: Specializing in providing banking services exclusively to members of the armed forces and their families, USAA should be well acquainted with the VA loan process. You can even get prequalified online and manage your mortgage via the Internet.

VA Personal Loans

While the most common type among military veteran loans is a VA house loan, VA personal loans do exist. They are not typically backed by the federal government, but some lenders are more apt to issue personal loans to members returning from active duty overseas or armed forces members in general.

You may find VA personal loans to have lower interest rates than their civilian counterparts. Unsecured personal loans are frequently issued for things such as cars, appliance purchases, and more under the VA personal loans umbrella.

- VA Financial: VA Financial specializes in offering VA loan benefits such as low rates and flexible terms. They feature unsecured VA personal loans that do not require any type of collateral or deposit. The VA personal loans offered by this company come with a fixed interest rate.

- USAA: Like their VA house loan, USAA can also offer personal loans to members of the armed forces and their families. These loans for military veterans have competitive interest rates and great flexibility in terms of use. Apply for different VA personal loans for everything from a general-purpose loan to auto loans for military veterans.

Read More: VA Loan Requirements, Limits, & Eligibility

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Finding the Right VA Loan

Knowing where to go and what to expect from the best VA loans can be an overwhelming process. The inner-workings of a VA house loan are not quite as straightforward as a conventional mortgage. However, you also won’t have the same VA loan benefits with a conventional product.

Those who have served with dedication and bravery will want to take advantage of the numerous benefits associated with military veteran loans. Consumers will find significant savings in interest rates, down payments, and private mortgage insurance with a VA house loan. Combined over the course of thirty years, that makes for some impressive savings.

Take a look at some of our tips for discovering whether a VA house loan or VA personal loans are the right choice for you. Loans for veterans can be extremely beneficial to qualified individuals. You’ll want to begin taking advantage of all the VA loan benefits as soon as possible.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.