Introduction: VA Mortgage Rates as a Way to Finance Your Home

The men and women who serve our country in the military deserve certain benefits and support.

Taking the time out of their lives that they could have dedicated to professional development or climbing the corporate ladder is admirable.

For many military veterans, one of the biggest challenges of returning from overseas is finding a place to live. VA mortgage rates are designed with special advantages to help military veterans find a home and get back to their everyday lives.

Image source: Pixabay

VA mortgage rates today are especially favorable considering the difficulty that comes with trying to finance a home loan from a regular bank.

Nonetheless, there are certain things you need to know about how to negotiate the VA interest rate on your home loan. Furthermore, signing your name to a VA loan with a low-interest rate requires more than just simply signing your name to the dotted line.

In this brief article, Advisory HQ will look at the benefits and advantages of VA home loan rates today. Furthermore, we’ll look at the reasons why VA rates have been dropping and how VA home loan rates compare to regular mortgages.

We’ll then go on to offer the top six tips to help you find the best VA mortgage rates today, as well as look at some of the lenders that you can turn to in your search for the best VA mortgage rates.

See Also: What is a VA Loan | All You Need to Know About VA Loan Rates

Why Should You Consider Financing Your Home with the Best VA Mortgage Rates?

What are the benefits of VA interest rates and other considerations regarding financing home loans with the VA?

Why shouldn’t you simply go to your local bank to apply for a home loan? The VA offers exclusive benefits when it comes to home loans. A favorable VA loan interest rate is only one of those benefits. Below are five other advantages that come with VA loans.

- No down payment

In today’s market, it is almost impossible to finance a home without at least a 5% down payment. The VA, however, understands that returning veterans may not have a lot of extra income. Besides offering competitive VA home loan interest rates, they also offer 100% financing to most applicants.

According to Veterans United, “even in an era of strict lending, VA loans continue to offer 100 percent financing to qualifying home buyers.

These no-money-down loans have connected thousands of military homebuyers with dream properties over the years. While always an important benefit of military service, the VA loan program is an incredibly powerful tool in today’s tight lending climate.”

- No private mortgage insurance

Another benefit of VA mortgage rates is that you won’t have to pay private mortgage insurance (PMI). While PMI usually costs between 0.5% and 1% of mortgage costs, veterans who apply for exclusive VA rates will completely avoid that cost, potentially saving thousands of dollars on the cost of financing a home.

- Relaxed credit standards

One of the biggest challenges of applying for a mortgage is getting your credit in order. While most banks have raised the bar on minimum credit scores, most veterans who apply for a VA loan with low VA interest rates will only be required to have a credit score of around 620.

- Competitive VA home loan rates

While VA home loan rates will waver with market conditions, VA loan interest rates are generally much lower than most banks and credit unions. Furthermore, since VA home loan rates are assumable, you can get a hand upon the market if you choose to sell your home. Future buyers may be attracted to the favorable VA rates that you can offer them.

- No prepayment penalty

No one should be penalized for paying off their mortgage early. While many banks may charge hefty prepayment penalties that can amount to several months of interest on the loan, lenders are prohibited by law from charging any sort of prepayment fee on VA mortgages. Besides offering competitive VA mortgage rates, veterans can also rest assured that they won’t be charged for getting out of debt early.

Don’t Miss: How to Get VA Small Business Loans for Veterans | Guide

Why VA Rates Have Been Dropping Recently

Around the nation, mortgage rates, in general, have been dropping like wildfire. VA loan rates today are no different. The average mortgage rate today hovers around 3.64% for a thirty-year fixed mortgage. Comparable VA interest rates today are around 3.4%.

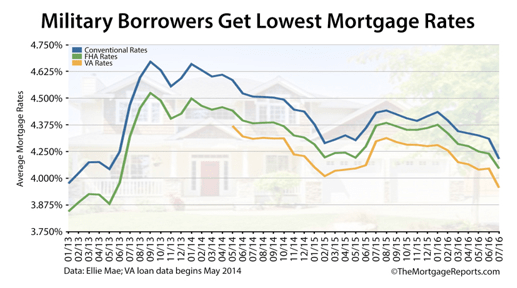

The website mortgagereports.com shows that VA interest rates have been the lowest on the market for the past two years.

Image source: Mortgage Reports

Related: How to Find the Best VA Mortgage Calculator?

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Top Six Tips for Finding the Most Favorable VA Home Loan Rates

- Get Pre-Approved so You Know Your VA Interest Rate Before You Start House Hunting

Before you start searching for your dream home, it’s best to know how much you’ll be approved for and what VA home loan interest rate you qualify for. Since the housing market in many areas is highly competitive, you may be able to convince a motivated seller to sell with you if other buyers haven’t already been pre-approved.

Furthermore, getting pre-approved for the best VA interest rates today can help you start planning a monthly budget around your mortgage terms. This can be an important financial step for people facing a tight economic situation.

- Check Your Credit Before Asking for VA Mortgage Rates Today

Military.com reports that “over 70 percent of all credit reports in the United States contain errors. Your lender will be looking at your credit report and making important decisions based on the information that is contained within — decisions that could make a big difference in the bottom-line.”

Before applying for the best VA mortgage rates, it’s important to check your credit so that you can be approved for the best VA loan rates today. You can get a free annual credit report here.

- Choose a Fixed Rate or Adjustable Rate VA Home Loan Interest Rate

When applying for your VA mortgage rates, it’s important to decide between a fixed-rate loan or an adjustable-rate loan. An adjustable-rate mortgage may very well go up 1% annually and up to 5% over the course of the loan. However, an adjustable-rate will allow you significant savings up front if you are strapped for cash. If you prefer the peace of mind of a steady VA home loan rate, then a fixed-rate mortgage is probably your best bet.

- Get the Funding Fee on Your Loan Paid

Most VA loans offering the best VA mortgage rates today require a funding fee that can be anywhere between 1.25% and 3.5% of the full loan on the mortgage. Luckily you can choose from a variety of options to pay that fee.

If you have the extra cash, you can pay the fee up front and be done with it. Since VA mortgage rates today are so low, many people choose to add the fee to the overall loan amount and pay it off as part of their monthly VA mortgage rate. If you are a good negotiator, you may be able to convince the seller to assume the cost of the funding fee as well.

- Read the VA Loan Guide Before Committing to the VA Interest Rates

Before making any final decisions regarding a VA loan with a low interest rate, it’s important to read through the VA Loan Guide to educate yourself on the specifics regarding VA mortgage rates. You can find the VA Loan guide for free download here.

- Shop Around for the Best VA Loan Rates Today

While many people are attracted to VA loans because of the no down payment option, the elimination of private mortgage insurance fees, and the relaxed credit standards, most people find the low VA interest rates to be the most important part of VA mortgages.

It is important, however, to shop around for the best VA mortgage rates today. Since many banks and lending institutions do offer rates that vary widely, it is in your best interest to search for a VA home loan rate that will best fit in with your financial situation.

Bankrate.com offers a helpful mortgage rate calculator that updates daily. You can easily compare the top rates between traditional 30-year fixed mortgage rates and the best VA home loan rates today to discover potential savings.

To use this calculator, you simply have to plug in the purpose of your loan (for purchase or refinance), your location, the loan amount, and your credit score. You can then choose from the product menu that includes a 30-year VA mortgage loan.

Veterans United offers another service that can help you find quotes online where you can compare the best VA mortgage rates today. According to Veterans United, “Because VA Loans are backed by the federal government, lenders have the luxury of charging competitively low-interest rates. Service members who are eligible find that rates are generally lower with a VA home loan than a conventional mortgage.”

Lastly, veterans should consider military credit unions as a way to find the best VA mortgage rates. These financial institutions cater directly to the needs of military veterans and current military members. They understand the challenges of being in the military and offer certain flexibility that can be important for military personnel and veterans.

Furthermore, these credit unions also offer a number of perks and freebies including free tax help and free tickets to certain theme parks. They are also a great choice to find the best VA mortgage rates.

To give just one example, the Navy Federal Credit Union offers competitive VA home loan rates. Eligible service members may be able to apply for a VA mortgage rate as low as 2.5% and also benefit from 100% financing options and no mortgage insurance fees. A list of the best military credit unions and the services they provide can be found here.

Popular Article: The Best VA Loan Rates | How to Find & Get the Best VA Interest Rates

How Low VA Interest Rates Today Can Help Get You into the Home of Your Dreams

Finding a home for your family to enjoy is an important and necessary step for everyone. Military members and veterans face unique challenges that stem from the time they live abroad and dedicate to protecting our country. Fortunately, VA home loan rates today make it a little bit easier for many veterans to find and finance the home of their dreams.

Image source: Pexels

Nonetheless, it is important to take the time to shop around for the best VA home loan rates. Since VA rates can change with the market, looking for the best VA mortgage rates today may help you save thousands of dollars over the 30-year term of your mortgage. Even a few percentage points difference on a VA loan interest rate can make a large difference.

If you are a veteran of the U.S. military, finding the most favorable VA home loan rates today is a benefit you deserve so that you can move your family into the home of your dreams.

Read More: How to Qualify for a VA Loan | VA Loan Requirements, Limits, & Eligibility

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.