Comparison Reviews: Wells Fargo Mortgage Rates vs Chase Mortgage Rates

Being saddled with a mortgage over the coming years is a necessary evil for most people, but you want to make the best of the situation.

Why pay more than you have to when it comes to your rates? Some people struggle to understand which banks truly offer the best rates that can save them money. Comparing large financial institutions can be difficult and time-consuming so AdvisoryHQ is here to help you make sense of it all.

Two of the more popular choices for a home mortgage are Wells Fargo and Chase Mortgage. But which are better: the Wells Fargo mortgage rates or the Chase mortgage rates? You’ll need to compare the current Wells Fargo rates and the Chase Bank mortgage rates to determine which one comes in lower.

Image source: Pixabay

If you can save money on the long-term mortgage you plan to borrow, you’ll want to do so. So take a closer look at the Wells Fargo mortgage rates and the Chase mortgage rates to figure out which one is the best option for you.

See Also: Best Savings Account Rates | Top Ways to Find the Best Savings Interest Rates

Understanding Interest Rates

Before you can begin to understand the subtle differences between the Wells Fargo rates and the Chase mortgage rates, you’re going to need a thorough understanding of interest rates themselves. On a 30-year fixed-rate conventional mortgage, your monthly payment is comprised of an amortized schedule that splits your payment between principal and interest.

The interest accrues and is paid each month on the total balance of your loan, which means it could be a huge waste of your money.

Shopping for a mortgage means comparing the interest rates is a critical method of saving money on your mortgage. Both the Wells Fargo interest rates and the Chase Bank mortgage rates can fluctuate on a daily basis. What causes the change in interest rates?

Lenders reserve the right to alter their current interest rate offerings at any point. However, certain economic indicators most often persuade them to shift the rates in one direction or another. Economic growth or slowdown can cause changes, as can forecasts, the country’s money supply, and mortgage market indicators.

In other words, whatever is going on both inside and outside the world of homeownership directly affects the Wells Fargo mortgage rates and the Chase mortgage rates. These factors can have a significant impact or none at all. During times where the market is significantly more volatile, you will often see interest rates change fairly quickly. At other times, they may remain stagnant for months with only small changes.

Whether you’re comparing the Wells Fargo interest rates or the Chase Bank mortgage rates, it’s important to note that the rates fluctuate over time. This means that it is absolutely critical to compare the Wells Fargo rates and the Chase Mortgage rates at the same time, even the same day if possible. You can’t expect either the Wells Fargo mortgage rates or the Chase Mortgage rates to remain the same forever.

Don’t Miss: The Best Savings Accounts & Rates | Ways to Find the Best Bank for Savings Accounts

Wells Fargo Overview

Wells Fargo is arguably one of the most recognizable financial institutions in the nation. With a company history spanning more than a century, Wells Fargo originally began as a form of “frontier commerce” linking pioneers across the eastern and western portions of the country.

In modern times, Wells Fargo now provides any number of financial services for customers that spans far more fields than simple geographic linking.

Consider the spread of services you’ll find under the Wells Fargo umbrella:

- Insurance

- Wealth management

- Credit cards

- Banking

- Leases

- Mortgages

They are not only known for their broad spectrum of financial services as a whole but also for their comprehensive mortgage department. Comparing the various mortgage rates for Wells Fargo can be tricky because of the sheer volume of lending programs that they offer. Their interest rates will vary from type to type.

Which products should you look at when investigating the overall Wells Fargo mortgage rate? Well, you’ll want to consider which mortgage type is best for you as a whole and specifically compare those programs between the Wells Fargo home mortgage rates and the Chase mortgage rates.

You can choose from mortgage products including fixed-rate loans (with conventional loan terms of both 15 and 30 years), Federal Housing Administration loans, Veteran Affairs loans (if applicaple), and adjustable-rate mortgages. You may want to consider investigating the Wells Fargo refinance rates through that program as well.

Chase Bank Overview

Chase is perhaps better known as the banking branch for personal and commercial purposes from JPMorgan Chase & Company. This international parent company serves customers all over the globe, laying claim to more than $2.6 trillion in assets. Equally impressive, Chase has a wide scope all over the country to assist customers with their banking needs in person, online, and via their customer service hotline.

Similar to Wells Fargo, they offer an array of financial services spanning from personal banking, auto financing, wealth management and investment advice, credit cards, payment processing, small business loans, and mortgages. Any of their 5,200 branches can assist you with these services for your convenience.

And what can you expect from Chase mortgage rates? Well, the answer is fairly complicated, just as it was when it came to the Wells Fargo mortgage rate. Chase also specializes in a number of mortgage options, each of which has the potential to come with a separate Chase mortgage rate.

You’ll find a new Chase mortgage rate for their 15- and 30-year conventional fixed-rate loans, adjustable-rate mortgages, VA loans, and jumbo loans in addition to the Chase refinance rates. They have a handy education center to help you determine the difference between the various loan types and ultimately guide you toward the right type of loan. This will make it far easier to compare the Wells Fargo mortgage rates and the Chase mortgage rates.

Related: Best CD Interest Rates | Ways to Find the Best CD Bank Rates

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Current Interest Rates

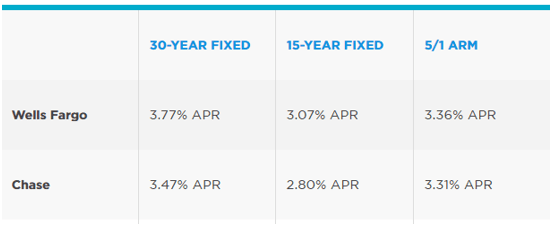

We are going to cover the specific Wells Fargo mortgage rates and Chase mortgage rates in this section. Please keep in mind that they were valid at the time of this writing and may fluctuate from these numbers at any time.

This is simply included in our comprehensive review to give you an idea of the comparison between the Wells Fargo interest rates and the Chase Bank mortgage rates. Looking at the rates side-by-side can be helpful, even if the rates are no longer current.

When it comes to fixed-rate conventional mortgages, a thirty-year loan term is the most common choice for homeowners. It features the lowest down payment but it also has the higher interest rate than 15-year loans. At the moment, Chase mortgage rates significantly trump the Wells Fargo mortgage rates. Compare the Chase mortgage rate of 3.375 percent to the 3.75 percent rate boasted by Wells Fargo.

Moving onto the 15-year loan term, the disparity is even greater. The Wells Fargo mortgage rates come in at an even 3 percent while the Chase mortgage rates dip further below at 2.75 percent.

For those interested in adjustable-rate mortgages, or ARMs, the Chase Bank mortgage rates are again the winners. Their 5/1 ARM comes in at 2.75 percent while the 7/1 ARM comes in at just 3 percent. In comparison, the Wells Fargo mortgage rates are 3.125 percent for both the 5/1 and the 7/1 ARM.

Mortgage Type | Wells Fargo Mortgage Rates | Chase Mortgage Rates |

30-year fixed rate | 3.75% | 3.375% |

15-year fixed rate | 3.0% | 2.75% |

5/1 ARM | 3.125% | 2.75% |

7/1 ARM | 3.125% | 3.0% |

In the table above, we’ve listed all of the current Wells Fargo mortgage rates as well as the Chase mortgage rates to help you visualize the differences. There was a clear winner across the board for both fixed-rate and adjustable-rate mortgages: Chase mortgage rates came in lower in every single category.

Current Refinance Rates

When we compared the difference in the Wells Fargo mortgage rates and the Chase mortgage rates, there was a clear winner in which company offered the best rates across the board. Chase Bank was hands-down the winner for each category that we examined and compared to the mortgage rates for Wells Fargo.

Will the same hold true for the Wells Fargo refinance rates and Chase refinance rates?

When refinancing with a 30-year or 15-year loan term and a fixed interest rate, the Chase refinance rates are at 3.5 percent and 2.875 percent respectively. Again, Wells Fargo had higher interest rates in comparison by a fairly large amount. Their loan terms clocked in at 3.75 percent (for their 30-year fixed rate term) and an even 3 percent (for their 15-year fixed rate term).

If you choose to refinance with an ARM instead of a fixed-rate mortgage, you see a similar disadvantage to the Wells Fargo refinance rates. The Chase refinance rates are much lower at 3 percent for a 7/1 ARM compared to the 3.25 percent from the Wells Fargo mortgage rate. Likewise, the 5/1 ARM for the Chase refinance rates comes in at just 2.875 percent, while the current Wells Fargo interest rates are at 3.125 percent.

Refinance Type | Wells Fargo Mortgage Rates | Chase Mortgage Rates |

30-year fixed rate | 3.75% | 3.5% |

15-year fixed rate | 3.0% | 2.875% |

5/1 ARM | 3.125% | 2.875% |

7/1 ARM | 3.25% | 3.0% |

It’s clear that the all-around winner when it comes to the refinance rates is also Chase Bank. In the table above, it’s easy to see the direct comparison in the numbers between the Chase mortgage rates and the Wells Fargo mortgage rates when it comes to refinancing your property.

Popular Article: Home Interest Rates | Tips for Finding the Best Home Mortgage Interest Rates

Past Comparison

Because mortgage rates tend to fluctuate on such a regular basis, we decided to do a little investigating to see if this trend has held on for quite some time. What we found were the rates from just a few months ago in another side-by-side comparison of the Wells Fargo mortgage rates and the Chase mortgage rates from Nerd Wallet. Their table from June 24, 2016,offers even more insight.

Source: NerdWallet

You can see from the table above that Chase mortgage rates came in lower across the board when directly compared to the Wells Fargo mortgage rates in this scenario. Even a brief look at the Wells Fargo mortgage rates and the Chase mortgage rates from previous updates shows the same sort of pattern.

If you know that you’re searching for the bank that can offer you the lowest interest rates on your mortgage, no matter which type you end up selecting, the Chase mortgage rates are certainly attractive when compared to the rates of the well-known Wells Fargo.

However, you may want to keep in mind that interest rates aren’t necessarily the only thing to consider when you’re searching for a mortgage lender or a company through which to refinance your current home mortgage.

Company Reviews

When you compare the consumer reviews of both mortgage companies, they come in roughly equal, with a slight advantage again to Chase Mortgage. Consumer Affairs collects consumer reviews of the services they receive from companies and provides an average rating based on a scale of five stars.

Wells Fargo received a one-star rating with the collection of 1,100 reviews, while Chase Bank received a 1.25-star rating based on more than 1,600 consumer reviews.

The common theme in the reviews for both companies seems to be centered on poor customer service across a variety of personal circumstances. The reality is that having a live representative that you trust and value is a significant part of the process with any mortgage company. If you’re torn between the two banks still, remember that you are likely to receive better rates with the Chase mortgage rates than the Wells Fargo home mortgage rates.

You may still want to consider having conversations with both lenders to see which one makes you feel more at ease. After all, you could be maintaining your mortgage for thirty more years. You want to be sure you’re satisfied with the rates and the service you receive for your account.

Conclusion

There’s no denying the obvious fact that, based on the current and recent interest rates, the Wells Fargo mortgage rates can be substantially higher than those offered by the Chase Bank mortgage rates. No matter which loan product you choose to go with, the answer is still the same. The rates are most likely going to be lower at Chase Bank.

Among consumer reviews, the companies tend to rate very similarly with complaints of customer service abounding. We would highly advise having conversations with both companies before making a commitment to either one solely based on the mortgage rates from Wells Fargo or the Chase mortgage rates.

You may find that you value the customer service and responsiveness of one lender or representative more than another. In the long run, that may be worth more to you than the difference in interest rates.

Being a wise steward of your money when it comes to your mortgage means paying close attention to the Wells Fargo home mortgage rates and the Chase Bank mortgage rates. Even a small difference in the rates can add up over the course of a long loan term, so be sure to choose wisely.

Read More: Money Market Interest Rates | Ways to Find the Best Money Market Rates

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.