Intro: What You Need to Know about Financial Consultants (Job Function, Salary and How to Become One)

Becoming a financial consultant is not an easy task, but it can be an excellent career fit for the right person.

Before deciding whether or not financial consulting is the perfect career choice for you, read on to find out more about the necessary education, salary, and job availability of a financial consultant as well as how to become a financial consultant should you decide on this career path.

Financial Consultant: A Career Overview

So, what is a financial consultant? Quite simply, a financial consultant, also known as a financial advisor, meets with clients to advise them in handling their finances.

Financial consultants can have individuals or businesses as clients who depend on the consultant to manage investments, retirement accounts, budgets, and even their nest eggs for their children’s futures. Financial consultants may also take care of their clients’ taxes and insurance decisions.

The financial consultant job description can be rather broad. A financial consultant is an all-around money manager that clients rely on to assess and manage their financial situations.

But exactly what do financial consultants do? What specific tasks might they complete day to day? Here are some of the most common daily duties of a financial consultant to more completely answer the question, “What is a financial consultant?”

- Financial planning of short- and long-term goals

- Make investment recommendations

- Discuss financial risks

- Create and help implement a budget

- Make or suggest financial changes to accommodate life changes, such as marriage, divorce or the birth of a child

- Inform clients of new financial opportunities

- Buy or sell financial products, like bonds, stocks, and insurance

- Give tax advice, keep tax records, and file taxes for clients

- Market their services through conferences, seminars, and other networking opportunities

An investment consultant salary largely depends on the type of services a financial consultant offers within his/her practice.

Financial consultants can choose to provide a variety of these services as a general financial consultant, or they can hone in on one or two specialties, such as retirement investments or tax consultation.

See Also: Questions to Ask a Financial Advisor (Do You Need a Financial Advisor?)

The Financial Consultant Work Environment

Now that the questions, “What is a financial consultant?” and “What do financial consultants do?” have been answered, let’s delve a bit deeper into the day-to-day work environment and schedule of a financial consultant.

Financial consultants can work in a variety of environments, ranging from an on-site office to long-distance traveling for clients to working from a home office and traveling locally to clients’ homes or businesses. Financial consultants can work within a business or, as 1 in 5 financial consultants do, choose to become self-employed.

Image Source: What do Financial Consultants do?

What do financial consultants do if they are self-employed and trying to score clients? Some financial consultants hold meetings, conferences or classes to bring in more potential clients. Overall, financial consulting can, in many ways, be a flexible job with varying hours and days of work and meeting with clients.

Financial consultants are not typically restricted to a 40-hour, 5-day per week schedule; the majority do work about 40 hours per week, but many self-employed financial consultants have the option of a flexible schedule in which to meet clients and perform financial tasks.

Don’t Miss: How to Become a Financial Advisor

Financial Consultant Education & Certification

A financial consultant position often requires a college degree; at minimum, a bachelor’s degree in business, accounting, finance or a similar degree. A master’s degree can allow for further advancement as it is usually a sign of a financial consultant with a vast understanding of finances and possible on-the-job experience.

Some financial consultants also pursue degrees or experience in sales; self-employed financial consultants especially find that marketing their services is extremely beneficial in gaining new clients.

Most financial consultant job descriptions will require a business, finance, accounting or similar degree and might also prefer or require specific licensures or certifications depending on the type of financial consulting needed. Some institutions offer financial consultant certification programs that students can enter while completing their degree program, and others offer the programs after completion of a financial consultant degree.

Specific financial consultant certifications include:

- Certified Financial Planner (CFP)

- Personal Financial Specialist (PFS)

- Chartered Financial Consultant (ChFC)

- Chartered Financial Analyst (CFA)

For a more in-depth look into each type of certification, click the link to be taken to the official websites that explain each certification, how to obtain it, and the types of jobs that might require it.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Choosing an Accredited Financial Consultant Program

When searching for a degree program that will cast you in the right direction to make financial consulting a career, it is important to do your research. Not all degree programs are created equal, and some do not come from accredited institutions and, therefore, will lower your chances of obtaining a worthwhile financial consultant career. The first step in choosing the appropriate degree program that will effectively show you how to be a financial consultant is deciding what type of degree you should obtain that best relates to the type of financial consultant career you desire.

Image Source: What is a Financial Consultant?

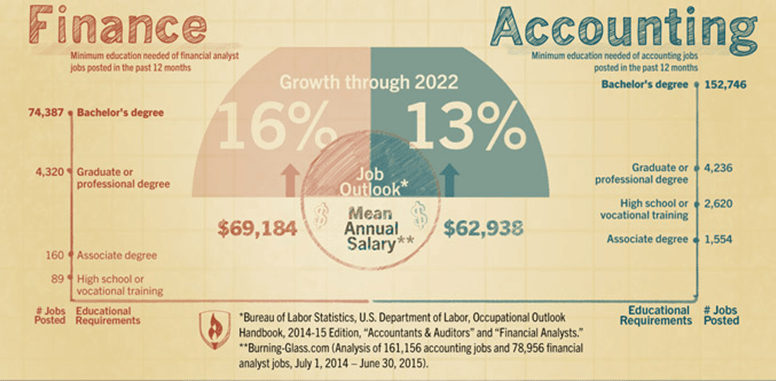

Finance and accounting are terms that are often used interchangeably when referring to degrees. However, these degree programs consist of different courses for different career outcomes and largely depend on the institution. Additionally, a business degree can bring a new realm of consulting opportunities to the table.

Remember to ask yourself the questions, “What do financial consultants do?” and “What type of financial consultant do I want to be? Here is a brief explanation of each of the three main degrees that can result in a financial consulting career:

- Finance: Think of a finance degree as a money management degree. A finance degree provides an in-depth look at managing money through investments, understanding the stock market, statistics in terms of finances, and research skills. A finance degree is highly-coveted by employers: Learn How to Become a Financial Advisor states, “According to the National Association of Colleges and Employers (NACE), finance is the #1 degree that employers want.” This type of degree often helps one to earn a high investment consultant salary.

- Accounting: An accounting degree helps one learn to track where money is going and keep finances organized. Once money is invested, spent or credited, an accountant will ensure proper tracking through a filing system, making it easier for a client to understand where his/her finances are spread and his/her financial outlook. An accounting degree often focuses on keeping tax records and filing taxes. Those interested in becoming a financial consultant can benefit from an accounting degree if they are interested in tracking income and expenditures.

- Business: A business degree is typically a more generalized degree than accounting or finance but covers many of the same types of courses. For those seeking self-employment as a financial consultant, a business degree might be the best option to teach best business practices as well as provide a thorough financial background.

The question “What is a financial consultant?” is so broad because the financial consultant career itself can be broad. It is important to fully research the financial consultant job description when you are considering degree programs.

When searching for an accredited institution to obtain a degree to pursue a financial consultant career, consider the certification programs the institution offers, if any, while pursuing a degree. Also take into consideration the career development resources the institution offers, such as help with writing a resume or help with job placement upon degree completion. The more help you get after graduating a degree program, the better your chances for success in financial consulting.

Related: How to Become a Mortgage Broker (Completed Guide: Requirements, Income, Broker Licence…)

How Much Do Financial Consultants Earn?

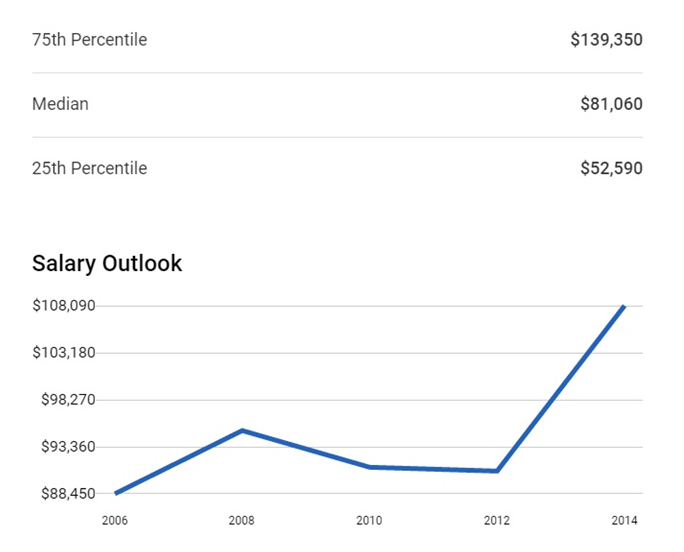

Financial consulting can be a profitable career. According to U.S. News, the median salary for a financial consultant in 2014 was $81,060, with the highest earnings totaling $187,199. The higher end of the investment consultant salary range came from financial consultants in metropolitan areas. New York, Connecticut, Massachusetts, Maine, and Kansas are currently the top-earning states for financial consultants.

As of May 2015, the U.S. Bureau of Labor Statistics stated the median salary of a financial consultant as $89,160 – just over a 1% increase in less than a year. The salary of a financial consultant has shown a significant increase since 2006 as demonstrated in the graph below.

Image Source: U.S. Bureau of Labor Statistics

To learn more about the investment consultant salary in specific cities of the United States, check out this Financial Advisor Salary Comparison Tool. Input a specific state and two cities to compare the average yearly and hourly salaries of financial advisors within those cities. If you would like to compare financial consultant salaries in your state to other states, use this interactive map by hovering over your state.

Popular Article: How to Become an Investment Banker – Get Started! A Complete Guide! (Definition, Explanation & Advice)

Job Outlook of Financial Consultants

What is the future of financial consulting, and is it worthwhile for you to research how to become a financial consultant? According to the United States Bureau of Labor Statistics, a financial consultant career has one of the highest expected job growths projected through 2024, at 30%.

Due to the aging population of baby boomers now heading toward retirement, the financial consulting demand is expected to increase as this population seeks to secure their finances for retirement.

Additionally, as the economy wavers, many companies are lowering their retirement benefits or dropping them from benefit packages completely, making it even more important for workers to secure retirement funds through their own savings and investments.

Therefore, the need for financial consultants is expected to rise significantly over the next several years, resulting in about 60,000 more jobs. The following five states are expected to see the most growth in the financial consulting career, respectively:

- New York

- California

- Texas

- Florida

- Illinois

The financial consultant position is highly sought after because of its flexibility and opportunities for advancement, benefits, and raises. The interview process can be competitive; however, the future of this career is promising as a job-producing and job-securing field.

How Can You Become a Financial Consultant?

Wondering what the first step should be in deciding how to become a financial consultant? Refer to the “Choosing an Accredited Financial Consultant Program” section first; read, take notes, and ensure that this is a top priority on your to-do list before moving any further with the process. Your degree is what will start you off on the right path to getting your foot in the door of the financial consultant career.

Next in your research about how to become a financial consultant – check with your state regarding its requirements for licensure or certification for financial consulting practices. Some states require special licenses or certifications to practice financial consulting depending on the type of consulting you plan on practicing, such as insurance sales or stock investments. The best place to start your research is with your state’s Department of Securities.

You should also find out if you need to register with the U.S. Securities and Exchange Commission. Mandatory registration is dependent upon the amount of money you manage as a financial consultant; however, registering can be good business practice, even when not required, as it will allow potential clients to review your qualifications.

The more information about you and your business available to the public, the better your chances are of creating a solid foundation for a consultant-client relationship.

Free Wealth & Finance Software - Get Yours Now ►

When you are ready to begin your job search, consider joining The National Association of Personal Financial Advisors (NAPFA). NAPFA is a fee-only association for financial advisors who are paid by the client only, meaning they receive no commission, finder’s fees or other incentives to work with a particular client other than providing the best financial planning and management services they can to that client.

What do financial consultants do in NAPFA? Each consultant in the association is held to extremely high standards so that clients can ensure they are hiring a trustworthy financial consultant. After becoming a member of this association, you are immediately entered into a network of highly-credible financial consultants which can lead to better employment opportunities.

Once you have gained experience for at least 1-2 years at an entry-level position, you might want to consider furthering your education with a master’s degree or more specialized courses or training for other areas of the field you are interested in.

Financial laws and strategies are ever-changing, and keeping up to date with the changes can provide you with the knowledge that clients are searching for.

Read More: Mortgage Banker (Full Job Description) – What Do Mortgage Bankers Do?

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.