What Is a Shell Bank? Definition, Exceptions & Everything You Need to Know about Shell Banks

Definition: A shell bank is any domestic or foreign bank that has no physical address or location in the country where it is incorporated.

Shell banks (also known as "foreign shell banks") normally operate by using a PO box address for mailing and other correspondence or by having a representative agent or person accept mail on behalf of the shell bank.

Image Source: Big Stock Photo

Anti-Money Laundering Mandate on Shell Banks

Because foreign shell banks do not have any actual place of business in any country, it is next to impossible to regulate them or to ensure that they are not violating anti-money laundering regulations.

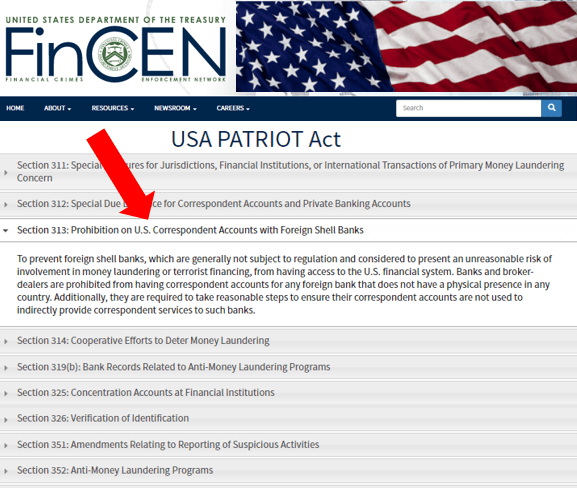

As such, US anti-money laundering laws restrict individuals, businesses and firms from engaging in business with shell banks. In particular, Section 313 of the USA PATRIOT Act specifically prohibits financial firms from doing business with a foreign shell bank or opening an account on behalf of a shell bank.

Section 313: Prohibition on U.S. Correspondent Accounts with Foreign Shell Banks

"To prevent shell banks, which are considered to present an unreasonable risk of involvement in money laundering, from having access to the U.S. financial system. Banks and broker-dealers are prohibited from having correspondent accounts for any foreign bank that does not have a physical presence in any country"

Source: FinCEN (Financial Crimes Enforcement Network)

Types of Shell Banks that are Excepted from Prohibited Status

There are some types of shell banks that are not restricted under the USA PATRIOT Act.

- A shell bank that is an affiliate of (or a subsidiary of) a registered bank or a registered non-banking financial institution within US jurisdiction is exempted from a prohibited status.

- A foreign shell bank in a non-US country that is regulated or supervised by a financial regulator within the country of operations is also exempted from a prohibited status.

Although the above types of shell banks are not restricted, they are faced with an extremely high level of due diligence requirements.

Section 31 CFR 1010.630 of the USA PATRIOT Act specifically requires any bank doing business with a regulated shell bank to "take reasonable steps to ensure that any correspondent account established, maintained, administered, or managed in the United States for a foreign bank is not being used by that foreign bank to provide banking services indirectly to foreign shell banks."

To avoid taking on unncessary risk, most US banks do not have any relationship with any type of shell banks.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.