Barclays Bank Review

Barclays bank is a newcomer to the United States banking world and provides its customers with online banking options for savings accounts as well as certificates of deposits (CDs). Barclays does not provide the typical brick and mortar bank experience but has a solely online presence in the United States.

Image Source: BigStock

Barclays bank reviews across the Internet explain the many features of Barclays’s savings accounts, including no minimum balance, no monthly fees, daily compounding of interest, and insurance provided by the Federal Deposit Insurance Corporation (FDIC).

High praise has been given by Barclays savings account reviews claiming that Barclays provides the best option for an online savings account in the country. Barclays’s extensive history overseas has given the company a great reputation and a boosted rate of success in the United States.

Here at Advisory HQ, we want to provide you with a Barclays review that truly tells the consumer about Barclays. This review will attempt to help possible customers learn the ins and outs of the company, its banking platform, and how it can possibly benefit their financial endeavors.

See Also: Best Credit Unions in the US (Top Ranking List and Reviews)

History

Barclays bank has had a presence in the United Kingdom for over 300 years, beginning in 1690. It began with two trading goldsmith bankers named John Freame and Thomas Gould. In 1736, Mr. Freame’s son-in-law, James Barclay, joined the company, which gave the company its current name.

With huge milestones in history such as funding the first industrial steam railway, declaring the first female bank branch manager in the United Kingdom, and initiating the invention of the ATM machine, Barclays has become a worldwide name in the banking world.

The question, “what is Barclays?” has many answers. Barclays provides financial services throughout the world including retail, corporate, and investment banking. As their website says, “Barclays moves, lends, invests, and protects money for 48 million customers and clients worldwide.”

Image Source: Barclays

Barclays’ online banking business is headquartered in Wilmington, Delaware. Barclays is proud to have renovated an historic property in the town and continually contributes to the community’s success. Barclays even has a community service initiative that focuses on building life skills for children.

How to Sign Up

Signing up for a Barclays online savings accounts or an online certificate of deposit with Barclays is very easy and only involves a few clicks. For both accounts with Barclays, you simply create an account, set up your account, link your other bank accounts, and accept the terms.

Image Source: Barclays

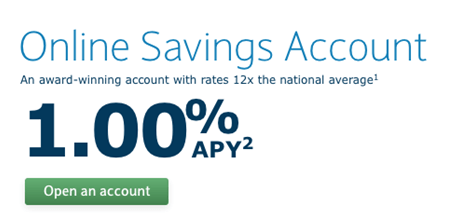

Barclays savings account reviews emphasize Barclays’s 1% annual percentage yield for their online savings accounts, which is twelve times the national average. Barclays CD reviews also boast a high annual percentage yield of 2.05% for 60-month certificates of deposits.

Don’t Miss: Best Bank for Small Business Banking (Best Business Bank Accounts)

What Barclays Provides

With the high annual percentage yields presented above for both Barclays’s online savings accounts and online certificates of deposits, it is helpful to learn more about Barclays and its different provided services.

Barclays Online Savings Account Review

The Barclays online savings account, along with its 1% APY, allows customers to make online transfers to and from accounts at other financial institutions as long as they are within the United States. Also, the online savings account provides a direct deposit feature.

The online savings account with Barclays also boasts no monthly maintenance fees, no minimum balance to open an account, and no monthly deposit limit. By linking your Barclays savings account to your regular bank account, you will also be able to withdraw and/or deposit money through an ACH (Automated Clearing House) transfer; however, this will take 2 or 3 days to process. Barclays also allows checks to be mailed to the bank in order to deposit them.

Image Source: Barclays

Lastly, a great feature of Barclays savings accounts is the ability to open savings accounts for minors. As long as there is a joint account holder of age, any minor under the age of 18 can open an online savings account. The minors are provided their own username and passwords in order to manage their own money. Barclays even provides a saving assistant tool.

Barclays CD Review

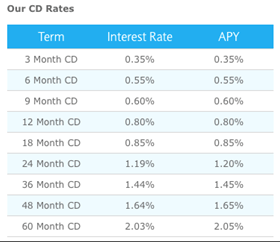

Certificates of deposit with Barclays bank allow you to choose between nine different term lengths from 3 months up to 60 months. Each of these term lengths provides a different annual percentage yield from 0.35% to 2.05%.

Also with this flexibility, Barclays CDs have no minimum balance when opening account or depositing money, no monthly fees, and email notifications that notify the customer one month before their certificate of deposit matures. Also, CDs with Barclays are insured by the FDIC.

Image Source: Barclays

Security

Because Barclays bank has been around for so long and has an amazing reputation worldwide, you can be sure that their security measures are up to par. Barclays’s website explains that they provide a 128-bit secure link between their customers’ browser and their website. They also use a time-out system that will log you out after a certain length of inactivity in order to keep your information safe.

Barclays also uses firewalls and encryptions methods like many United States banks in order to keep things confidential. Security is an area in which a historically successful name such as Barclays has significant meaning. Barclays reviews all agree that customers can feel protected with a company like Barclays.

Know the Fees

Some fees associated with the Barclays online savings account include an excessive transaction fee of $5 each (after the first 6 transactions, which are free), an express mail fee of $15 for sending documentation by rush delivery, a statement copy fee of $.50 per mailed paper statement, a $5 cashier’s check fee, and non-sufficient funds fee of $5 per item.

Image Source: Barclays

Related: Best Banks in Australia (Ranking: Biggest Banks, Best Savings Accounts)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The Downside of Barclays

The first downside that many Barclays bank reviews will explain is the lack of physical branch locations throughout the United States. Without a brick and mortar store to walk into, Barclays loses the personal feel of the banking experience that many Americans enjoy. While many Americans find comfort in knowing their bank tellers and going to their local bank, the growth of the digital world over time will make Barclays’s lack of physical locations irrelevant.

Along with the lack of brick and mortar stores, Barclays does not provide Americans with the typical checking account option for managing their money. This means that in order to use the money in your Barclays account, it must be transferred out. As long as you go into your Barclays experience expecting that this is not an option at the present time, you won’t be disappointed.

Image Source: Barclays

One last downside of the Barclays bank, which will surely be fixed over time, is the lack of a mobile phone application to manage your Barclays online savings account. This means if you are out and about and need to transfer money, you must go online through your phone’s web browser and navigate from there. While this is not the end of the world, it does provide an inconvenience for people who are always on the go.

What Other Barclays Reviews Are Saying

Barclays bank reviews across the board are very positive and praise Barclays for having lower fees than competitors. Also, Barclays reviews claim that Barclays other online banking options.

The Huffington Post ranked Barclays number three on their list of “The 10 Best Savings Accounts For 2015.” Barclays has also been listed on Forbes.com as a top savings account because of its high interest rate.

Is Barclays Right For You?

Barclays may be the right bank for you if you are looking for a trustworthy and reputable name in banking that allows you to save your money and access that money at any time when necessary. If you want a savings account where you are unable to touch or see that money for a certain period of time, Barclays may not be the best choice.

Also, if you prefer the personal experience of a physical branch location, Barclays will not be suitable. However, with the world gradually becoming more and more digital, adjusting to Barclays’s online system should not be difficult. In the future, Barclays will continue to grow in the United States and will hopefully offer a mobile application as well as a possible checking account option.

Popular Article: Top Banks in Canada – Ranking | Best High Interest Savings Accounts – Canada

The Lowdown

When learning about Barclays and its banking options, take into consideration your financial needs and the options Barclays provides. While Barclays is a worldwide name, be sure to remember that their options are somewhat limited in the United States. If you are looking for an online savings account option with high interest rates, low fees, and a great company behind it, Barclays is a winner. Also, if you want an option for online certificates of deposit, Barclays will provide you with many term options and, again, high interest rates.

Barclays as a company has some great core values that they seek to abide by at all times. Their five core values include respect, integrity, service, excellence, and stewardship. With Barclays, you can be sure that both your money and your time are invested in a trustworthy and honorable place.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.