Intro: EveryDollar Budgeting App

Creating and maintaining a budget is a great way to meet your savings goals, both long-term and short-term.

The best budgeting apps will help you see a complete picture of your financial health while supporting solid, healthy financial habits.

While there are plenty of budget planner apps on the market today, how do you know which is the best budget planner app for you to use?

One such app is EveryDollar, a budget planning app that promises to help users “live more and worry less.”

Finding the best budgeting app for you requires diligent research into the features, tools, and basic budgeting processes of each app, which can be a time-consuming process. Luckily, we’ve done the hard work for you to help you decide whether EveryDollar is the best app for budgeting.

If you’re interested in creating an EveryDollar budget but aren’t sure if the EveryDollar budgeting process is right for you, this review was made with you in mind.

We’ll look at every aspect of the EveryDollar budgeting app to help you determine whether creating an EveryDollar budget is the right decision for your personal financial needs and goals.

See Also: Moneydance Review – What Is Moneydance? (Help, How To Use & Reviews)

EveryDollar Budget Review | What is the EveryDollar Budgeting App?

Part of the success behind the EveryDollar budgeting app comes from its creator and popular financial guru, Dave Ramsey.

As a Dave Ramsey budget tool, the EveryDollar budget app is closely connected to the ideology behind his 7 Baby Steps to Financial Peace.

In fact, according to the EveryDollar budgeting FAQ, this Dave Ramsey budget tool is meant to be a supplement for users working through the seven-step process. These steps include:

- Keep $1,000 cash in an emergency fund

- Use the debt snowball method to pay off all debts (minus your mortgage)

- Create a fully-funded emergency fund of 3-6 months of expenses

- Invest 15 percent of your income into retirement

- Start saving for college

- Pay off your home early

- Build wealth and give generously

Don’t Miss: Best Payroll Software for Small Business Firms | Ranking & Reviews

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

EveryDollar Budget Review | How Does the EveryDollar Budgeting App Work?

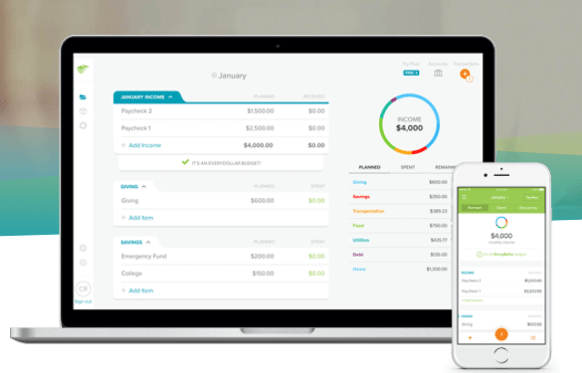

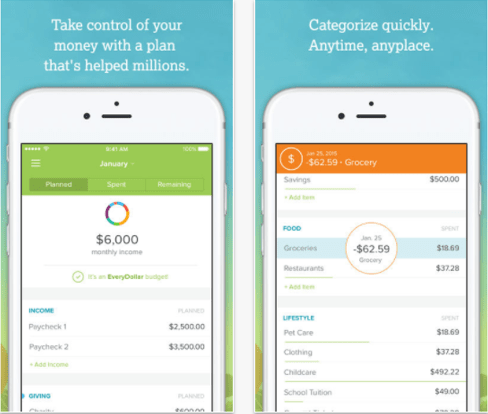

EveryDollar is a budget planning app that helps users save and effectively budget by giving every dollar a specific name.

This means that daily expenses are grouped into categories of spending, allowing users to see where their money is going and adjust their spending habits accordingly.

Users can assign expense categories with specific spending limits and can create new categories. Some of these categories include:

- Giving

- Savings

- Housing

- Transportation

- Food

- Lifestyle

The EveryDollar budgeting app is available on iTunes and Google Play as a free download, making it a best budgeting app for users that don’t want to spend a ton of money on budgeting tools.

EveryDollar Plus

There are two versions of the EveryDollar budgeting app—a free, basic version and a paid version, called EveryDollar Plus.

With the free version of the EveryDollar budget app, users will have to manually enter in each transaction. For some users, this can quickly become a tedious process.

Additionally, manual entry makes it possible to forget to enter transactions into your EveryDollar budget, decreasing the effectiveness of the budget planning app.

With EveryDollar Plus, however, bank transactions will automatically sync to your EveryDollar budget, making EveryDollar a best app for budgeting in terms of convenience.

Of course, this does introduce a significant price difference. Upgrading to EveryDollar Plus will incur a fee of $99 per year.

Although EveryDollar Plus comes with the convenience of automatic syncing, this fee does make it one of the more expensive budget planning apps.

Related: YNAB Review – What Is YNAB? How to Use YNAB (Free Trial & Reviews)

EveryDollar Budget Review | Advantages & Disadvantages of the EveryDollar Budget App

Just as with any budget planning app, the Dave Ramsey budget tool has its own strengths and weaknesses.

If you’re wondering whether the EveryDollar budget app could be the best budgeting app for you, consider the following advantages:

- Helps users identify overspending through categorized transactions

- Allows users to add new categories when needed

- Help Center provides EveryDollar budgeting tips and tricks

- Focuses solely on budgeting

- Can create an EveryDollar budget for free

Conversely, you may want to consider the following disadvantages of this budget planning app:

- Using the free version can be time-consuming, as users will need to manually add transactions

- At $99 per year, the paid version is significantly more expensive than other competing budget planner apps

- Users cannot pay bills or track investments with the EveryDollar budget app

Popular Article: Personal Capital App Review | What You Should Know About Personal Capital

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Is the EveryDollar Budget App the Best Budgeting App for You?

The EveryDollar budget app uses a very simple, effective approach to budgeting—create a proactive budget through consciously assigning each dollar a specific job. As a result, many users consider EveryDollar the best app for budgeting for its straightforward approach.

It also comes backed by a well-recognized name in the financial world. With six best-selling books and a nationally syndicated radio show, Dave Ramsey certainly has a strong track record for financial strategy.

However, the EveryDollar budget app does have some significant downfalls. Not only is it an expensive budget planning app, but there are also plenty of competing best budgeting apps that accomplish a lot more for a lot less.

If you’re looking for a comprehensive, all-in-one budget planner app that can help you monitor all aspects of your finances—including bill payments, credit score, and investments—then you may want to skip EveryDollar and choose another top budget planner app.

Not only do Mint and Personal Capital offer a wide range of budgeting and financial services, but they offer them free of charge, making them much better options for the best budgeting app.

Read More: Robinhood App Review – What You Should Know! (Robinhood Trading & Review)

Image sources:

- https://www.everydollar.com/

- https://itunes.apple.com/us/app/everydollar-budget-manage-money-track-spending/id942571931?mt=8

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.