Overview: Woodforest National Bank

If you’ve shopped inside a Walmart store, chances are you’ve seen one of the many branches of the Woodforest National Bank located there. You may have even spotted bank employees wandering Walmart aisles enticing new customers to apply for a Woodforest Bank Second Chance checking account.

But who is Woodforest National Bank, and should you use this bank? We’ve gathered a number of Woodforest Bank reviews and examined their products for ourselves in order to give you the full run down.

About Woodforest National Bank

Woodforest National Bank is a privately owned bank with over 740 branches scattered across 17 states. The Wall Street Journal reports that 37 of these branches are traditional bank stores while the remainder are located within Walmart branches, making Woodforest National Bank Walmart’s leading outlet banking service provider compared to other banks such as First Convenience Bank (176 of its 300 branches), Citizens Community Federal Bank (13 branches), and Landmark Credit Union (2 branches).

BusinessWire states that the bank’s assets are currently in the region of $4.3 billion, making it one of the top earning banks in the U.S. The bank is headquartered in The Woodlands, Texas, and celebrated 35 years in operation in 2015.

See Also: Best Banks to Bank with – No Fees, High-Yield Savings, Largest Banks, and Credit Unions

Woodforest National Bank Reviews

Woodforest National Bank reviews are freely available on the internet and are mixed in opinion, making it confusing to decide whether their banking services are better than those offered by other financial institutions. Woodforest offers a range of personal and business banking services and some branches are open 24/7/364 days a year.

Image Source: Pixabay

“Banking Your Way…EVERYDAY AND NIGHT!”

But what services do they offer, and should you consider Woodforest National Bank as a banking services provider? Let’s examine Woodforest National Bank reviews and their service offerings to help you form an educated opinion.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Personal Banking

Woodforest National Bank offers a range of products for personal customers, including:

- Checking accounts (including second chance checking)

- Savings accounts

- Credit cards

- Mortgage loans

- Personal loans

- Vehicle loans

- Investments

“You’ve got more important things to think about. That’s why we’re here.”

Checking Accounts

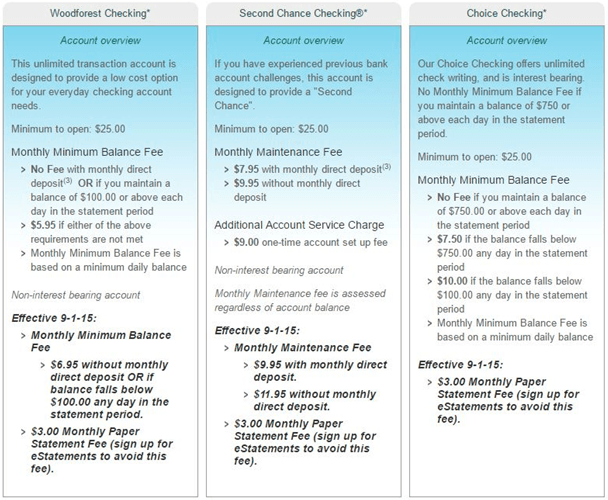

Image Source: Woodforest National Bank

Woodforest National Bank offers five options for checking accounts:

The three interest-bearing checking accounts are Choice Checking, Sterling Advantage, and Platinum Plus Checking. All three require a minimum of $25 to open. Sterling Advantage is for customers over 50 and offers no monthly maintenance fee plus daily interest when the balance of the account is over $1000.

The Platinum Plus Checking, Choice Checking, and Woodforest Checking accounts are only exempt from a monthly fee (other than the $3 monthly paper fee) provided balances meet a minimum amount.

For the Choice Checking, a fee of $7.50 is charged if the balance falls below $750 and $10 if the balance falls below $100 on any day in the statement period. For Platinum Plus Checking, the minimum account balance is $10,000, with $25 charged should the balance fall below that figure on any day in the statement period.

The Woodforest Checking account offers no monthly fee provided the balance remains above $100 or there is a monthly direct deposit set up for the account. Otherwise, the account is subject to a monthly fee of $6.95. A $3 monthly paper statement fee is also charged (signing up for eStatements avoids this). This particular account does not bear interest.

Don’t Miss: Best Free Checking Account Banks – No Fees, Best Yields

Second Chance Checking

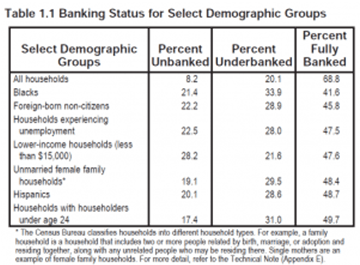

The Woodforest National Bank Second Chance Checking account is designed for those who might otherwise not qualify for banking services. A 2009 study by the Federal Deposit Insurance Corporation (FDIC) reported this number to be around 8% of U.S. households, or 17 million adults. FDIC updated this figure in 2013, reporting 7.7% (1 in 13) of U.S. households as unbanked and 20% (24.8 million) of U.S. households as underbanked.

Source: FDIC, 2009

It’s no surprise to see why the Woodforest National Bank Second Chance Checking account is so popular. Designed for those with no previous banking history or who have negative credit reporting against them by agencies such as ChexSystems, this non-interest bearing account can be opened for a one-time account charge of $9 and a minimum deposit of $25.

The account offers variable monthly maintenance fees ($11.95 without monthly direct deposit or $9.95 with), a $29 Insufficient Item (NSF) Fee, and various overdraft options. An Account Overview and full list of fees, rates, and policies are available from their website.

Is Second Chance Checking for You?

According to the Baltimore Sun, if you’ve never had a bank account before or have a bad credit history, then chances are you’re a candidate for a product like the Woodforest Second Chance checking account. A bad credit report from a past financial indiscretion can stay with you for anywhere from 5–7 years. If you’ve closed a bank account at another bank previously and owe an unpaid amount, a negative report will have been lodged against you. Been tardy on credit card payments or defaulted on a previous loan? All will contribute to a credit history that will leave most banks looking unfavorably on your application for a checking account, let alone loan products.

Fees are higher than a standard checking account, according to Woodforest reviews, and the bank requires you to build a solid payment and banking history for 12 months with this account before they will allow you to move up to a regular checking account option like the Woodforest Checking account or Choice Checking.

Not many banks offer second chance accounts to those who have been previously shut out of the banking system, but as Woodforest National Bank CEO Robert Marling Jr states, “We believe in giving that customer an opportunity…some will use the system the way it’s supposed to be, and others will abuse it.”

Related: Union Bank Reviews – What You Will Want to Know! (Mortgage, Credit Card, & Reviews)

Interest-Bearing Accounts and Savings

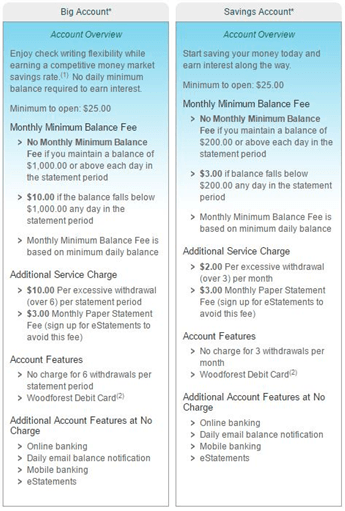

Woodforest National Bank offers two different interest-bearing savings accounts: the Big Account and the Savings Account.

Image Source: Woodforest Bank

The Big Account is targeted for serious savers, with minimum balance fee of $10 payable if the account balance dips below $1,000 on any given day, and service charges of $10 per transaction that kick in once you’ve made more than six withdrawals in any one statement period. A full account overview and list of fees and rates is available on the bank website.

By comparison, the Savings Account is aimed at the more modest saver with a minimum balance fee of $3 payable if the account balance falls below $200 on any day of the statement period, and a change of $2 per transaction applicable once you have made more than three withdrawals in the same statement period. A full account overview and list of fees and rates is available on the bank website.

Online banking, eStatements, email notifications and mobile banking are available for no additional charge.

Additional savings products offered by Woodforest National Bank include:

- Certificates of deposit (CDs)

- Individual retirement accounts (IRAs)

- Minor savings accounts

- Platinum plus checking

Loans

Woodforest National Bank offer a range of consumer loan products to its customers, including:

- Mortgage loans

- Home equity loans

- Home equity lines of credit

- Home improvement loans

- Vehicle loans

- Unsecured revolving line of credit (ReLi Unsecured)

- Secured revolving line of credit (ReLi Secured)

Mortgage Loans

Woodforest itself does not offer mortgage loans. All mortgage lending is provided through Quicken Loans Inc., as subsidiary of Rock Holdings Inc., and not an affiliate of the bank itself. A full breakdown of loan options, up-to-date rates, calculators, and disclosure statements are available on Quicken Loans’ main website along with full contact details, house buying advice, and access to a paperless mortgage loan application process.

The Fees

The Wall Street Journal report that in its analysis of 6,766 banks in the U.S., 15 counted a fee income that was higher than their loan income, including the top five banks that operate out of Walmart, one of which is Woodforest National Bank. A large proportion of their fee income (78 % of it, according to the Wall Street Journal) comes from overdraft fees.

Woodforest National Bank reviews feature a common theme in complaint about fees charged, in particular NSF and overdraft fees, as well as unexpected closing of customer accounts and complaints of bad service. Mybanktracker.com reports 2 out of 5 stars (62 reviews).

One reviewer there in March 2016 expressed exasperation over the switch from the old debit cards to new, chip-enhanced cards; because of the switch, their old card was shredded and the new one would not be available for use for 24 hours. The reviewer did acknowledge that the bank offered them the option to take out cash for the in-between, but as the reviewer’s business is largely online, this did not fix the problem.

In addition, the Better Business Bureau (BBB) of Greater Houston and South Texas report 97 lodged and closed complaints against the bank over the last three years.

In contrast, WalletHub.com’s Woodforest bank review gives the bank a score of 4 out of 5 starts (81 reviews). Happy customers there cite consistently good customer service, convenient locations and hours, and the ease of their mobile banking app, among other factors, as satisfying aspects of holding a Woodforest account.

Related: NatWest Banking – Should You Use Its Services? A Complete Guide (Business, Mortgage & Review)

Free Wealth & Finance Software - Get Yours Now ►

Woodforest Cares about Community

Woodforest National Bank reviews show the bank contributes to community development through a number of initiatives, including:

- Financial investment in community non-profit organizations like affordable housing initiatives

- Employees volunteering within the community

- Financial literacy through Woodforest U, providing online and classroom courses as well as articles on money skills and saving

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Is Woodforest National Bank for Me?

Woodforest National Bank reviews all show that the bank is both well-known and centrally located with over 700 branches based within Walmart stores.

One of the main differentiators about Woodforest National Bank is its second chance checking product offering. If you’re looking for a banking service that will accommodate a less than positive credit history, then the Woodforest National Bank Second Chance Checking account may be for you.

As with anything, however, it’s important to shop around and compare fees with product benefits so that you can make an informed decision. We hope that this review of the bank’s services and product offerings will help you make the best decision for your personal financial needs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.