Introduction: Guide to Finding the Best 15-Year Mortgage Rates and 10-Year Mortgage Rates

When it comes to financing a house, many people simply look for the bank that will give them the lowest monthly payment.

It can be tempting to find a way to get into the house of your dreams and end up paying less than $1,000 a month. However, to get a low monthly payment, you may have had to set a 30- or 40-year mortgage term and could end up paying your monthly mortgage bill for the rest of your life.

Ten-year mortgage rates and 15-year mortgage rates will obviously entail a higher monthly payment, but there are a number of advantages we’ll discuss below.

Image Source: BigStock

Today’s interest rates for mortgages are lower than they’ve ever been, and this has led many people into the housing market. While almost every potential buyer should be able to find 30-year mortgage rates for under 5%, the 10-year fixed mortgage rates and 15-year fixed mortgage rates will be considerably lower.

If you are considering purchasing a home or refinancing your current mortgage, you should seriously consider the home interest rates on shorter-term mortgages. In this brief article, we will look at some of the most obvious benefits of opting for a 10-year mortgage or a 15-year mortgage.

We will then offer our top six tips to help you find the best 10-year mortgage rates and 15-year mortgage rates on the market. We will compare how adjustable rate mortgages compare to 10-year fixed mortgage rates and 15-year fixed mortgage rates as well as offer a 15-year mortgage rate chart to help you identify the trends for the lowest home loan rates available.

See Also: Best Banks for Mortgages – A Complete Guide (Best Mortgage Rates & Reviews)

Aren’t Mortgages Based on 30-Year Home Loan Rates?

When many first-time buyers approach the bank for a mortgage, there is often the mistaken assumption that mortgages are only offered under 30-year terms. The banks may prefer longer term lengths because it allows them to charge a higher home interest rate and collect more profit through interest payments, but they would be the first to admit that you have other options.

Investopedia reports that in February 2015, over 86% of Americans who decided to purchase a home did so through a 30-year mortgage. While the vast majority of home buyers do opt for the more traditional 30-year mortgage, 10-year fixed mortgage rates and 15-year fixed mortgage rates can offer much better benefits and save you money in the long run.

Most banks, credit unions, and other financial institutions do in fact offer competitive 10-year mortgage rates and 15-year mortgage rates, but they may not offer them to you upfront. They may assume that, like most other buyers, you prefer a 30-year mortgage and will simply show you the best mortgage interest rates today on that type of mortgage.

Even if you think that you can’t afford the higher monthly payment on a 10-year mortgage or a 15-year mortgage, you should still compare rates while shopping for your best financing options.

If your financial situation changes and you are able to afford a higher monthly payment, it may be in your best interest to opt for a 10-year fixed mortgage rate or a 15-year fixed mortgage rate to save money on interest and get out of debt sooner.

The 15-year mortgage rate trend shows that shorter-term mortgages tend to remain fairly constant, so even if you plan to refinance 5-10 years down the road, the 10-year fixed mortgage rates and 15-year fixed mortgage rates should still be considerably lower.

Don’t Miss: Capital One Mortgage Reviews – Get What You Need to Know! (Home Loans, Complaints & Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Benefits of Opting for a 10-Year Mortgage or 15-Year Mortgage

The most obvious benefit of opting for 10-year mortgage rates or 15-year mortgage rates is that you’re going to spend a lot less money over the time you pay off your home. The Mortgage Reports at the time of this writing shows that at today’s interest rates, a 15-year fixed mortgage rate will end up costing 66% principal and 34% interest. A comparable 30-year mortgage will cost 35% principal and 65% interest. A 10-year fixed mortgage rate will pay even less interest over the term of the loan.

Thus, opting for 10-year mortgage rates and 15-year mortgage rates will allow you to pay down principal more aggressively over the term of your mortgage, save money on interest, get out of debt more quickly, and build equity faster in your home investment.

In a rapidly changing housing market, it can be important to build equity as fast as you can so that you can make smart financial decisions according to market trends.

Furthermore, you will also most likely be able to find better home loan rates on a shorter-term mortgage. Mortgage interest rates today are at an all-time low.

However, there is still a large difference between finding 3.5% home loan rates and 4% home loan rates. Because of the shorter term, most banks will offer much lower 10-year fixed mortgage rates and 15-year fixed mortgage rates than on a longer term mortgage.

Related: Average Mortgage Interest Rates & Historical Mortgage Rates | Mortgage Rate Chart & Guide

Top Six Tips for Finding the Best 10-Year Mortgage Rates and 15-Year Mortgage Rates

If you feel that you’re ready to purchase a home and have the financial stability and monthly income to cover the higher payments on a 10-year mortgage or 15-year mortgage, then follow these top six tips to help you find the best home loan rates and make the best financial decision for you and your family.

1. Make Sure You Have a Steady Financial Future Before Opting for 10-Year Mortgage Rates or 15-Year Mortgage Rates

One of the biggest dangers of opting for 10-year fixed mortgage rates or 15-year fixed mortgage rates is that the monthly payment can be significantly higher. At today’s interest rates you can plan on paying at least 50% more per month for a 10-year mortgage or 15-year mortgage than for a more typical 30-year mortgage.

Take the following example:

“On a $250,000 loan amount, a 10-year fixed with an interest rate of 3% would come with a monthly mortgage payment of $2414.02.

Compare that to a monthly payment of $1787.21 on a 15-year fixed at 3.5%, and a payment of $1193.54 on a 30-year fixed at 4%.”

If you don’t have a steady income or reliable savings, then you could end up defaulting on your mortgage payments. The penalties and fees for late payments are usually pretty stiff and can lead you into even deeper debt.

Though many people are determined to pay off their home quickly through 10-year fixed mortgage rates or 15-year fixed mortgage rates, you never know when your financial situation can suddenly change, leaving you with the inability to make your monthly mortgage payment.

Furthermore, many lenders will require you to pass a debt-to-income ratio before accepting you for a 10-year mortgage rate or 15-year mortgage rate. If you don’t have a high enough monthly income, you may not even apply for the best 10-year fixed mortgage rates or 15-year fixed mortgage rates.

2. Consider Fixed Rates for the Best Home Interest Rates

When it comes to finding the best mortgage interest rates today, consider fixed rates over adjustable rates. Fixed rate mortgages set an interest rate that won’t change throughout the term of the mortgage while adjustable rates start lower than market value and increase with time as the market goes up.

A 15-year mortgage rate chart will show that interest rates in the past decade or so have maintained steady. People interested in a 10-year mortgage or a 15-year mortgage are probably most interested in paying off their home loan as quickly as possible. A fixed rate will allow you to calculate exactly how much you’ll be spending over the term of your mortgage.

Though you may not benefit from an initial lower interest rate, the combined interest paid over the entire term of a 10-year fixed mortgage rate or a 15-year fixed mortgage rate will be lower than with adjustable rate mortgages.

3. Look Online for Competitive 10-Year Mortgage Rates and 15-Year Mortgage Rates

As with anything, it’s important to do your homework and compare prices before deciding on the banks that will be financing your 10-year mortgage or 15-year mortgage. There are a number of online mortgage calculators and websites that will help you stay on top of today’s interest rates.

Bankrate.com offers a quality current interest rate chart for 10-year mortgage rates, 15-year mortgage rates, and 30-year mortgage rates. Furthermore, on the same web page, you can find a 15-year mortgages rates chart to help you compare the weekly changes in the best home loan rates for different term mortgages.

Mortgagecalculator.org is another website that easily allows you to research the best home loan rates for 10-year mortgage rates and 15-year mortgage rates.

4. Analyze 15-Year Mortgage Rate Trend if You’re Planning on Refinancing in the Future

If you don’t have enough financial stability to qualify for a 10-year mortgage or 15-year mortgage, you should look at the 15-year mortgage rate trend to plan for an eventual refinance on your mortgage.

By following the 15-year mortgage rate trend, you can start to financially plan for the best time for a refinancing of your current 30-year mortgage.

Ycharts.com offers an easy-to-read 15-year mortgage rate trend graph to help you see how rates fluctuate over time. While no one can completely predict how mortgage rates will move in the future, it can be helpful to analyze historical movements of 15-year mortgage rates.

5. Consider Other Ways to Invest Potential Monthly Savings on a 10-Year Mortgage Rate or 15-Year Mortgage Rate

While most people consider the equity they build up in their homes to be one of their primary investments, there are other ways to invest for your future. If you are a financially savvy investor, you may find that you can earn more profit through investing the savings on your monthly mortgage payment in other, more lucrative investments.

For example, if your 10-year mortgage rate or 15-year mortgage rate has left you with a $2,000 a month mortgage payment while a more typical 30-year mortgage monthly payment would be around $1,200, the $800 in monthly savings could be invested in profitable mutual funds or even in more high-risk, high-reward day trading.

Though 10-year fixed mortgage rates and 15-year fixed mortgage rates will help you pay off your home loan faster and thus build equity more quickly, there are other ways to plan for your financial future.

6. Consider Home Repairs as Another Source of Increased Equity

If you’ve bought a rundown home that is in need of repairs, you may also consider it worthwhile to opt for a longer term mortgage so that you can invest your monthly mortgage payment savings into home repairs.

Though 10-year mortgage rates or 15-year mortgage rates will help you get out of debt quicker, you may not build much equity in a house that is badly rundown. In that case, it may make more financial sense to opt for a longer term mortgage and save money month by month to repair the home and increase equity that way.

You can always choose to refinance into a 10-year mortgage or 15-year mortgage once you finish remodeling your home.

Popular Article: HomeBridge Financial Services Review | The Truth about HomeBridge Mortgage

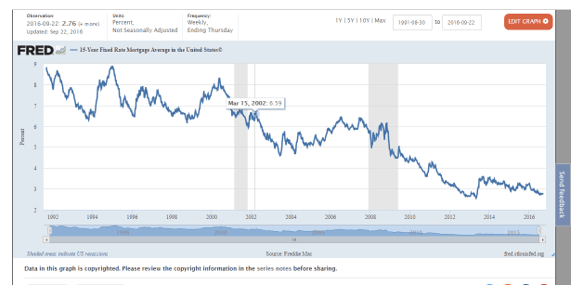

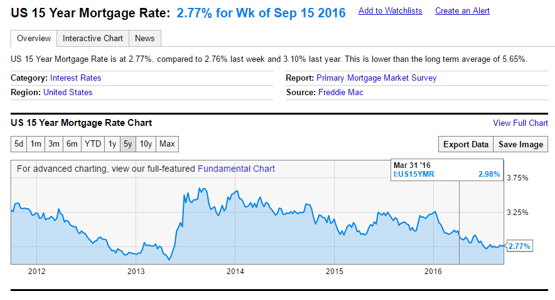

15-Year Mortgage Rate Chart

However you decide to finance the home you recently purchased, it is important to analyze charts that show the different interest rates available. Below we’ve included two 15-year mortgage rate charts to help you begin your research for the best rates on the market.

FRED 15-Year Mortgage Rate Chart

Image Source: FRED

Y Chart 15-Year Mortgage Rate Chart

Image Source: Y Chart

Free Wealth & Finance Software - Get Yours Now ►

How Researching Mortgage Interest Rates Today on 10-Year Mortgages and 15-Year Mortgages Can Save You Money

Searching for the best mortgage interest rates today doesn’t only entail looking for the lowest rates for the traditional 30-year mortgage. If you have the financial means to afford the higher monthly payments, a 10-year mortgage rate or 15-year mortgage rate may very well be your best option.

You can save thousands of dollars on interest payments while building equity quickly.

Read More: FHA Mortgage Rates Today | Where to Find FHA Loan Daily Rates

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.