Overview: A Brief Look at 15 Year Refinance Rates

If you are ready to refinance your mortgage, one of the first things you should look for is 15-year refinance rates. While 15 years may sound like a short time to finish paying off your house, a 15-year refinance rate comes with several benefits, such as lower interest rates and greater savings in the long run.

Throughout this review, our goal is to give you a better understanding of how 15-year mortgage refinance rates work and how to find the best ones for you. Some of the questions we will answer include:

- What are the major differences between 15-year refinance rates and 30-year rates?

- What are some of the best 15-year refinance rates today?

- How do I start looking for 15-year refinance rates?

Refinancing your mortgage is one of the most important decisions you will make as a homeowner. If you choose wisely, you can save more money than you ever knew was possible. Therefore, you should weigh all of your options, keep your future income in mind, and only make a decision once you’ve gathered the necessary information. To begin, we will discuss the potential benefits and setbacks of getting a 15-year refinance rate.

See Also: Home Interest Rates | 6 Tips for Finding the Best Home Mortgage Interest Rates

The Pros and Cons of 15-Year Mortgage Refinance Rates

When deciding how to refinance your mortgage, you should be aware of the pros and cons of both 15-year mortgage refinance rates and 30-year rates. While these are not the only two options you will have, they are some of the most common choices for homeowners.

Image source: Pixabay

One of the main differences between the two is that 15-year fixed refinance mortgage rates take a shorter amount of time to pay off. Obviously, you didn’t need us to tell you that. But a shorter time comes with two major benefits.

The first is that you are mortgage-free sooner. The second is that the difference between 15-year refinance rates (180 payments) and 30-year rates (360 payments) is often tens of thousands of dollars in savings. By paying off your mortgage quickly, the less you can be charged by a lender.

The other benefit to choosing 15-year mortgage refinance rates over 30 years is that 15-year fixed refinance rates tend to charge three-quarters of a percentage point less in interest.

To put that into perspective, your interest rates will be $750 lower per $100,000 of your mortgage. Plus, when you factor in the time span of a 30-year rate, the interest gap gets larger and larger.

At the same time, you should consider some of the potential downsides of getting refinanced rates for 15-year fixed mortgage loans. When choosing a shorter time span, you will encounter both of the following:

- Higher monthly payments

- Restricted flexibility when money is tight

These two downsides essentially go hand in hand. Since you are paying more money for 15-year refinance mortgage rates, you will have less disposable income for when you need it.

This is why you will have to consider your future income before committing to 15-year mortgage refinance rates. If you cannot afford the higher payments, try sticking to a longer mortgage. If you can afford them, however, save money in the long run by refinancing rates for 15-year fixed mortgage loans.

An Example: 15-Year Mortgage Refinance Rates

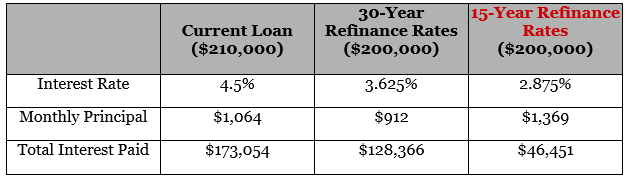

To clarify the difference between 15-year mortgage refinance rates and 30-year rates, consider the following example. In this scenario, a homeowner originally took out a loan for $210,000.

In the time that has passed, this homeowner has gotten her mortgage down to $200,000 and wants to refinance in order to save money. Her original interest rate was 4.5%, but now that she is refinancing, a 30-year rate will charge 3.625%, while 15-year refinance rates charge 2.875%.

Clearly, there are benefits to choosing 15-year mortgage refinance rates. In this example, the interest rate was 0.75% lower (a common difference), which ultimately will save the homeowner $81,915 of interest. While these 15-year refinance rates will charge the homeowner $457 more each month, the amount of interest she will save in the long run is more than 40% of the loan’s total value.

Clearly, there are benefits to choosing 15-year mortgage refinance rates. In this example, the interest rate was 0.75% lower (a common difference), which ultimately will save the homeowner $81,915 of interest. While these 15-year refinance rates will charge the homeowner $457 more each month, the amount of interest she will save in the long run is more than 40% of the loan’s total value.

Source: 15 year refinance rates

Don’t Miss: How to Find the Highest Savings Account Rates | This Year’s Guide | Highest Savings Rates

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Beginning Your Search: 15-Year Refinance Rates Today

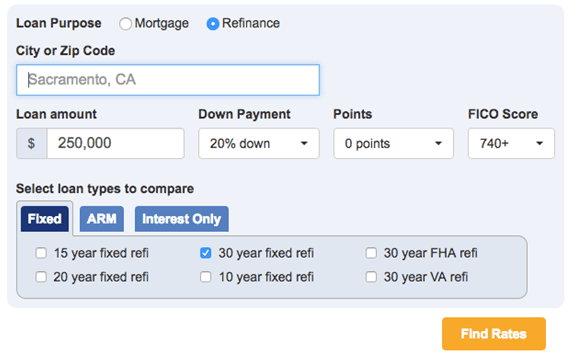

Assuming you have decided to pursue 15-year mortgage refinance rates, it is time to get a sense of what is currently available. To begin, enter some of your information into an online refinance calculator to get a sense of what your 15-year fixed refinance rates would be. You will be asked to answer the following:

- Where do you live?

- What is your credit score?

- How much of a loan do you need?

All of your answers will contribute to the 15-year mortgage rates refinancing estimates you receive.

Also, consider how much money you can afford to put toward your down payment. The more you put down now, the lower your 15-year refinance mortgage rates will be in the long run.

One of the most common amounts is 20%, but these numbers will be entirely dependent upon your current finances.

Once you calculate your 15-year fixed refinance mortgage rates, a list of lenders will appear with potential offers. You will be shown the interest rates that each lender is willing to give you as well as an estimate of your monthly fees for the 15-year period.

You will also have access to the lender’s contact information so you can speak directly with someone who will discuss the specific details of your 15-year mortgage refinance rates and how they will affect you in the future.

It will be critical that you don’t settle for the very first offer simply because the 15-year refinance rates are lowest. You will want to check two more aspects of the loan in order to get the best possible 15-year fixed refinance rates:

- Fluctuations in rates

- Hidden costs

Before you choose the 15-year refinance mortgage rates, be sure to look at both of these variables. The following information is to give you a better sense of what you should really be looking for before making a final decision.

What to Observe: Rate Fluctuation

Before you pick which lender will refinance your rates for 15-year fixed mortgage loans, do a little research on current mortgage interest rates.

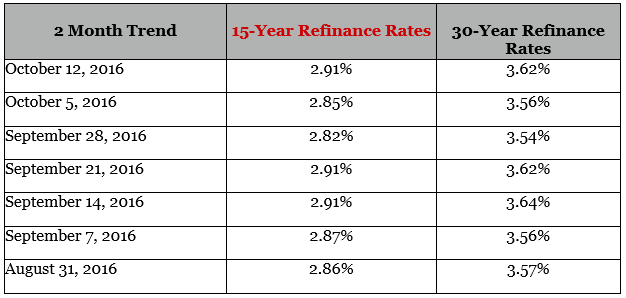

The interest rates vary daily, and if you are looking for the best possible 15-year refinance rates, you will want to take into account the latest trends. The following table gives you a sense of how mortgage rates have fluctuated over a two-month period.

Once again, it is important to note that despite the variation in interest rates, the 15-year refinance rates today and any day will always be lower than the 30-year rates. But even more importantly, you should ask yourself: should I refinance my rates today for 15-year fixed mortgage loans, or should I wait for the interest rates to go down?

Once again, it is important to note that despite the variation in interest rates, the 15-year refinance rates today and any day will always be lower than the 30-year rates. But even more importantly, you should ask yourself: should I refinance my rates today for 15-year fixed mortgage loans, or should I wait for the interest rates to go down?

It will always be a bit of a gamble to wait if you have found what appears to be excellent 15-year mortgage refinance rates, but keep in mind that the rates will never be static. One thing to note in the table is that 2.91% is the highest that 15-year fixed refinance mortgage rates have been in recent months.

The trend has shown that the rates have either stayed the same for a short time or gone down the very next week.

Therefore, if you were going to refinance your mortgage in the month of October, it would be good to wait at least a day or two for the rates to go down. You can keep an eye on interest rates and determine when it will be best to pursue 15-year mortgage refinance rates by knowing a little bit about how these particular interest rates work.

Related: Money Market Interest Rates | Ways to Find the Best Money Market Rates

How Interest Rates Are Affected

To better understand interest rates and when it is best to get 15-year mortgage refinance rates, you should keep an eye on a two different things:

- Supply and demand

- Governmental actions

When thinking about the well-being of a free market economy, supply and demand always plays a primary role. It is no different when pursuing 15-year mortgage refinance rates.

When the economy is strong, interest rates rise because more people can afford a home, thus increasing the demand.

The demand decreases, however, when the economy is on a downward slope, and consequently the interest rates will fall. Therefore, when debating if you should refinance your rates today for 15-year fixed mortgage loans, consider the trends in the economy.

Governmental action will also have a big effect on your 15-year fixed refinance rates. The federal government has invested in giant mortgage loan companies like Freddie Mac and Fannie Mae in order to keep interest low.

If the agreement changes between one of these companies and the government, the interest rates will increase, and your 15-year mortgage rates refinancing estimates will follow.

Additionally, when the economy improves, the government has no choice but to raise the federal interest rates in order to combat inflation. By increasing federal rates, the government is indirectly increasing mortgage costs, leaving borrowers with more expensive 15-year fixed refinance rates in the end. With this in mind, you should always keep track of the economy.

Popular Article: Mortgage Interest Rates Trend | Key Mortgage Rate Predictions, Trends, and Graphs

What to Observe: Hidden Costs

As previously mentioned, one of the primary things to look for when getting the best 15-year refinance rates is rate fluctuation. The second observation you should be making, however, is whether a lender is charging hidden costs.

If you calculate your refinanced rates today for 15-year fixed mortgage loans, you may notice that one lender charges a significantly lower interest rate. Don’t be fooled by a lender that sounds too good to be true. Often times, this lender will have hidden costs that will cost you thousands in the end. Hidden costs that you should look for include:

- Points

- Balloon payments

- Pre-payment penalties

When a lender offers you very low 15-year mortgage rates refinancing estimates, look to see if they are charging points first. Points help make 15-year refinance rates far more profitable for a lender at the expense of the borrower.

You will encounter these charges either at the time of closing or in each of your monthly payments. A lender that charges points will be able to lower your interest rate by 0.125%. Yet the points will cost about 1% of the total loan balance.

Another hidden cost to look for in your 15-year fixed refinance mortgage rates is if the lender charges balloon payments. Balloon payments give a lender the right to charge you the entire outstanding balance whenever it sees fit. If you cannot afford the balance, the lender then has the right to foreclose the home or default the loan.

The final hidden cost that you should avoid in your 15-year fixed refinance rates is a pre-payment penalty. Pre-payment penalties are rare compared to the first two, but are dangerous nonetheless.

If you find that a lender is charging you pre-payment penalties, you will be unable to pay off your home before a certain date and cannot refinance your mortgage even if you find better 15-year refinance rates. Additionally, these pre-payments could cost as much as 2% of the total balance.

Therefore, the only way to know if you are getting the best 15-year mortgage refinance rates is by keeping these costs out of the equation. You will often save far more money by choosing a loan with higher interest rates than one with low interest and hidden costs.

Conclusion: Look at All the Variables

The most important thing to keep in mind when looking at 15-year fixed refinance rates is that the lowest interest rate does not always mean that you are getting the best deal.

While 15-year refinance rates are often a better choice than 30-year rates due to their lower interest, you must remember to look for a lender’s hidden costs and the general fluctuation in rates.

Owning a home is no simple task. The amount of time and money you will spend might feel overwhelming at times, but 15-year mortgage refinance rates are here to help. By lowering your interest rates and cutting your mortgage time in half, you will automatically save thousands in the long run. First, make sure you can afford the monthly payments, and then begin to search.

Getting the best 15-year refinance rates may be tricky, but if you approach a lender with the right amount of information, you will get the mortgage that is right for you. Now it’s just time to look.

Read More: How to Find the Best VA Mortgage Loan Rates Today | Tips for U.S. Veterans

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.