Overview: Average Accounting Costs and Accountant Fees

Reaching a place in your business or personal life where your finances warrant hiring an accountant is exciting. Here at AdvisoryHQ, we’ve also noticed a large amount of trepidation or uncertainty regarding accounting costs. To help you navigate the waters of accountant fees, we’ve compiled this detailed review to break down the average accountant fees. We’ve encountered key questions from consumers, including:

- How much does an accountant cost?

- How much do accountants charge per hour?

- Do all accounting costs accrue on an hourly basis?

Image Source: Pixabay.com

On the other hand, current accountants and prospective accountants are often asking the same questions. Everyone wants to make sure that their fee structure lines up with the industry average for the cost of an accountant. These individuals are often searching for answers to questions, like, “How much do accountants charge?”

Our goal is to address all of these concerns and more so you can accurately assess the cost of an accountant, whether you work in the industry or need to hire your own accountant.

See Also: What is Business Accounting?

Accounting Cost and Accountant Fees

Type of Accounting Cost | Specific Situation | Average Accountant Cost |

| Hourly | Bookkeeping | $30-50 per hour |

| Hourly | Other Accounting | $50-150 per hour |

| Fixed-Fee | Payroll | $25-200 per month |

| Fixed-Fee | Taxes with No Deductions | $150 |

| Fixed-Fee | Taxes with Schedule A and Form 1040 | $275 |

Table: Accountant fees and cost

As in all things, there is more than one way to determine an accounting cost. In AdvisoryHQ’s detailed review, we will be taking a look at the average accountant fees. The average cost of an accountant can encompass a significant range depending upon the location of the accountant, the services offered, and the fee structure each accountant chooses to implement.

How much does an accountant cost? In order to determine that, we must first take a look at the primary ways accountant fees are calculated:

Hourly

A survey conducted by Intuit in 2015 revealed that hourly billing is the most commonly used for accountant services fees, with 66 percent of accountants employing this method. When it comes to accountant fees, hourly rates can vary drastically based on the individual you are working with. Some of the differentiation in rates can be accredited to the services rendered. For example, light bookkeeping work may cost less than a more extensive overview of your finances.

The accounting cost can also be affected by the amount of experience the individual possesses in the particular area you are interested in. Keep in mind that a more experienced worker might have higher accountant fees but can perform the work in a timelier manner. What may take a newcomer one hour to complete may take a seasoned accountant only half an hour. While their hourly rate may sound significantly higher, the time invested into your project may be less, bringing the grand total for your accounting cost into a very similar price range.

Fixed-Fee

Accountants hired to do regular or routine items, including bookkeeping or payroll, may find it simpler to incorporate a fixed-fee structure into their accountant cost. A fixed-fee structure gives you slightly more accuracy when determining how much to set aside in your budget for regular accounting costs. The use of fixed-fee structure is increasing, according to the same survey from Intuit. Approximately 43 percent of accountant prices are calculated this way.

Image Source: Pixabay.com

Accounting services fees for this type of fee structure are still loosely based on how much an accountant charges per hour. Those who specialize or spend a portion of their day assisting clients with monthly tasks such as these have a good idea of how much time will be invested in each project and thus what their accountant fees should be.

Don’t Miss: Top Accounting Certifications to Become an Accountant

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Much Do Accountants Charge per Hour?

As we covered in the previous section, the accounting cost for hiring someone who charges on an hourly basis can have some substantial differentiation. How much is an accountant? How much do accountants charge per hour on average? You could be looking at anywhere between $30 and $200 per hour depending on the services you need. In this section, we are going to break down the average accountant fees for those who charge by the hour to help you answer the question, “How much does an accountant cost?”

If you need to factor routine work into your accounting cost, the hourly rate is often significantly lower for this type of work than it is for others. Accountant prices for bookkeeping, on average, run between $30 and $50 per hour.

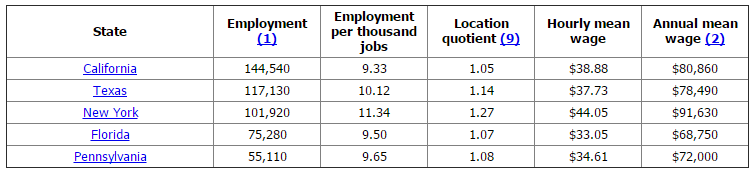

According to information reported by the Bureau of Labor Statistics, the average hourly wage for accountant fees (including basic tax preparation, bookkeeping, and payroll services) is roughly $38.16 per hour. This accounting cost varies depending upon location and the average cost of living for that area.

Chart from BLS

Accountants hired for more extensive or labor-intensive work such as drafting financial reports consultations, business structure management, or assisting with cash flow management will come with higher accountant prices. You might want to factor between $50 to $150 into your budget for these more extensive services. In fact, approximately 30 percent of accountant fees will fall into this pricing bracket.

Calculating the average hourly accounting cost can be difficult because a number of factors are involved. The most obvious difference will be the location, the experience of the individual you hire, and the type of accounting work you are looking to have completed.

To gather a better idea of the average accounting fees used by a variety of firms, the Management of an Accounting Practice (MAP) put together this chart to demonstrate how hourly rates vary based on experience and the prestige of the firm:

Image Source: Management of an Accounting Practice (MAP)

Average Accounting Cost for Fixed-Fee Services

How much do accountants charge if you are working off of a fixed-fee structure instead of an hourly wage? Before we can really answer the question, “how much does an accountant cost?” we need to first look at when a fixed-fee structure makes the most sense, both for consumers and for accountants themselves.

Because fixed-fee pricing does not allow for modifications to be made after the project has been completed, accountants will generally want some experience under their belt first. In order to know how much an accountant is, you have to estimate the length of time the project at hand will take to complete and then multiply it by a reasonable hourly wage.

These types of accounting services fees will likely only be used on very routine services such as uploading payments or deposits, processing payroll, or doing other basic accounting work in a software program such as Quickbooks. On open-ended tasks such as consulting, cash flow management, or anything that has the potential to run longer than anticipated, the cost of an accountant will likely be determined by an hourly rate.

Determining an average accounting cost for fixed-fee services is tricky because it often depends on the exact type of work completed. In our accounting fees review, we will look at two of the most popular areas consumers consider when asking the question, “How much does an accountant cost?”

Related: The Different Types of Accounting Professions | What You Should Know

Tax preparation

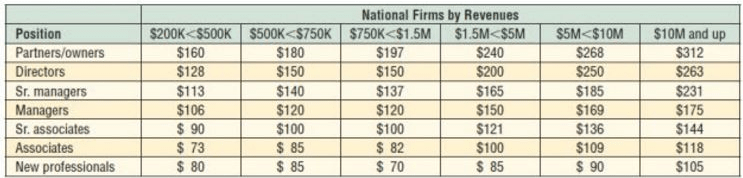

Accounting Today, a well-known magazine featuring information for accountants and prospective accountants collected data regarding the national average for accounting costs for tax preparation. In this instance, the fixed-fee rate was again drastically different depending upon location, but most prices fell around $200 to $350 for those with an itemized form 1040 with a Schedule A and a state tax return.

Image Source: Accounting Today

Even in this, variations in the way that taxes are filed caused a difference in the accountant fees. For consumers with a Form 1040 and a state return with no itemized deductions, the average cost of tax preparation was significantly lower, around $150 versus the above situation that averaged $273.

Bookkeeping

Bookkeeping seems like it would be simple to put a dollar sign on when it comes to accountant fees, but there are several variables that make determining an average accountant cost challenging. The pricing can vary depending on the level of detail that a business currently has in its recordkeeping, how neat those records are, and the sort of services that will be included in the bookkeeping.

For payroll services alone, the number of employees you have will be a large contributing factor to how much an accountant is. Expect to pay somewhere between $25 and $200 each month for paycheck processing, direct deposit, online access, and basic tax filing.

The fee for a bookkeeper on an hourly basis can be as low as $15 per hour, but the median cost is between $30 to $50 depending on location. If you want to determine an approximate fixed-fee price for the specific services you need for your business or personal finances, ask your accountant approximately how many hours it should take to complete your project. Multiply the number of hours by a reasonable hourly rate for your area to see how their accounting services fees line up with the industry averages. This will give you a good answer to the question, “How much is an accountant for bookkeeping?”

Other Pricing Methods

How much does an accountant cost? Do they all bill based on hourly or fixed-fee billing? While hourly and fixed-fee pricing are the most commonly used methods to determine accounting costs, an accountant may suggest using value pricing or value billing to conclude your accountant’s cost.

Value pricing works much like fixed-fee pricing, with the negotiation for the cost of the work being set in place prior to the start of the work. Value pricing often puts together a package of services that would be beneficial to the client with emphasis placed on the value to the customer instead of the cost itself. More often than not, there are three tiers of value pricing to consider when it comes to accounting costs. There is a “good, better, best” mentality when an accountant presents the choices and explains how much an accountant costs for each scenario.

Value billing is similar to value pricing in that it is based on the services provided rather than the length of time necessary to complete each task. How much do accountants charge when they institute a value billing policy? They usually take a percentage of what their services were worth. For example, if your accountant was to find a $20,000 tax break, they may claim a percentage of the $20,000 they saved you or your business as their accountant services fees.

Because these two methods are based on the specific services, savings, or worth of the work performed, finding an average accounting cost for these two methods of payment can lead to inaccurate numbers. Fixed-fee and hourly rates are easier to calculate average accountant costs because they are not always such specific situations.

Popular Article: The Association of Chartered Certified Accountants (ACCA)

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: How Much Does an Accountant Cost?

The question still remains: how much does an accountant cost? Determining the various factors that contribute to the fluctuations in accountant prices can be difficult, but we wanted to cover the basics of what you can expect to pay on average for your accounting cost. In order to summarize the information we reviewed above, we’ve compiled this chart for easy reference:

Type of Accounting Cost | Specific Situation | Average Accountant Cost |

| Hourly | Bookkeeping | $30-50 per hour |

| Hourly | Other Accounting | $50-150 per hour |

| Fixed-Fee | Payroll | $25-200 per month |

| Fixed-Fee | Taxes with No Deductions | $150 |

| Fixed-Fee | Taxes with Schedule A and Form 1040 | $275 |

Figuring out the exact accounting cost for your personal or business finances would require a quote from a local and well-qualified accountant. However, our review is here to help you find a foothold when it comes to answering key questions such as “How much do accountants charge per hour?” and “How much does an accountant charge?”

The cost of an accountant will be influenced by the market you reside in, the experience of the professional you hire, and the scope of work to be completed. At least you know that when it comes time to negotiate your accountant fees, you have a rough approximation of what you should expect based on national average accountant fees.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.