What Is Affirm? Is Affirm Safe to Use?

If you’ve done some online shopping at stores like Casper.com, Delta Vacations or Warehouse Direct USA, you may have noticed an option at checkout to use Affirm for your payment.

But what is Affirm? Is Affirm safe to use? What do the Affirm reviews say?

Affirm credit is not like PayPal, it’s a form of financing that allows shoppers to buy now and pay later for larger purchases. But before you use any new payment option like an Affirm account, you need to know what you’re getting into.

Affirm Financing Review

To keep you informed, we’ve researched the company and gathered together Affirm loan reviews to help you decide if you should use an Affirm loan to make your next purchase.

We’ll also go over Affirm financing to understand the terms and whether it’s a good way to buy or if it’s going to cost you much more in the end.

What Is Affirm?

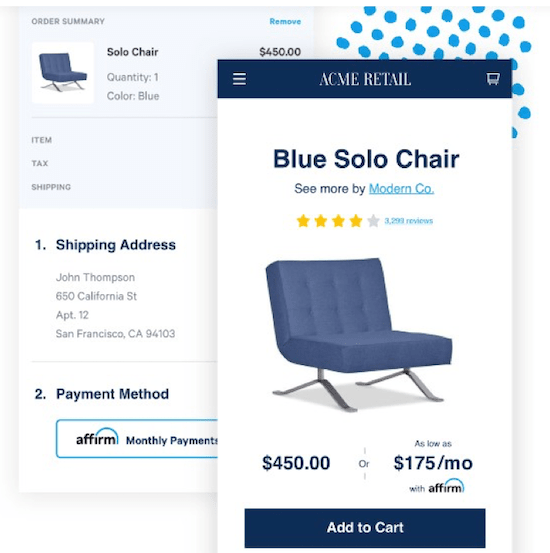

Affirm is a way to quickly and easily finance purchases without a credit card. Affirm financing is available at checkout at over 2,000 online merchants and also offers an Affirm virtual card that you can use almost anywhere online and in many physical stores.

The virtual card works like an Affirm credit card for a one-time-use purchase that can be done anywhere you make credit card purchases and can also be used with Google Pay or Apple Pay. We’ll go into more detail about the Affirm credit card shortly.

The company does not currently offer Affirm home loans or other loan types, but they hope to add more loan products in the future.

On their website and in several Affirm loan reviews, the company describes its services as “easy financing without a catch.” Their goal is to make it simple for people to finance purchases through Affirm without a credit card and to streamline the financing process by being completely transparent about what you’ll pay and explaining everything in plain language.

Affirm.com reviews the loan applications, provides the potential users with a useful interface and customer service, and services the loans, but the actual loans are backed by Cross River Bank, founded in 2008 to bridge the gap between banks, businesses, and technology.

See Also: How to Find & Get Loans with Poor Credit or No Credit History

A Startup Trying to Shake Things Up

Affirm was founded in 2012 by PayPal co-founder and serial entrepreneur Max Levchin. In April 2016, the company raised $100 million dollars in equity financing to help Affirm credit grow their list of merchants and expand their loan offerings.

Affirm Credit Review

But what is Affirm trying to do? Affirm seeks to bring transparency and modern technology to the financial industry and free people of the burden of late fees and compounding interest that come with using traditional credit cards.

Some may wonder, “Isn’t the Affirm virtual card a credit card?” It’s not technically the same thing, but they’ve enabled it to be used as if it were an Affirm credit card, at least for a one-time purchase.

Affirm currently only offers point-of-sale financing, but their end goal is to “build the next generation of consumer bank,” according to Levchin, eventually offering Affirm home loans, car loans and small business loans for startups.

Affirm has positioned itself to specifically target tech-savvy millennials and offer them a way to easily finance purchases that fit within their lifestyles and priorities.

Millennials are very different from other generations in their use of credit and Affirm reviews note that there is a big gap in how the financial industry services this generation, which leaves an opening for their more modern Affirm financing model.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Affirm Loans Review: A Financial Firm for Millennials

Coming of age during the Great Recession, millennials are known to have a very negative view of credit cards and generally prefer using debit over credit.

Based on Affirm reviews of various demographic surveys, only about 23% of millennials carry any kind of credit card balance and 67% don’t have a credit card at all. So, when it comes to making larger purchases or building a credit history, they’re at a disadvantage.

Largely because of this lack of credit history, millennials have the lowest average credit scores of any generation, which makes it more difficult for them to qualify for the credit, including car loans, mortgages, and small business loans for startups.

Affirm Review

No credit can definitely be an obstacle, even when it comes to consumer purchases such as mattresses and furniture. Not everyone has a large supply of cash ready to spend, and many people find it difficult to save long enough to make bigger purchases with cash.

To fill this gap, Affirm reviews millennials (and others) with limited credit history and offers them a way to finance purchases even with a low credit score or limited credit history.

Affirm financing works to provide an environment where the purchaser knows exactly what they’re paying in interest, what monthly payments will be, and to remove the fees that come with traditional credit card agreements.

But is Affirm safe and is making an Affirm account a good idea? Below, we dig further into Affirm loan reviews to find out.

What Is Affirm’s Loan Process?

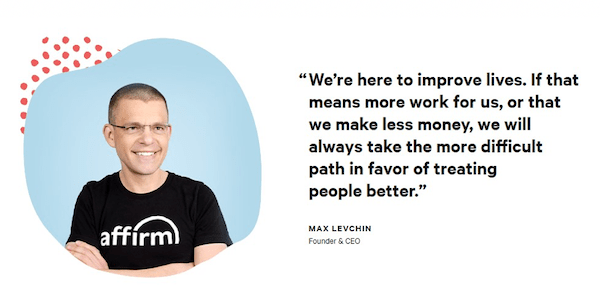

Getting an Affirm loan is simple. Affirm financing appears as a payment option on a growing number of online merchants their mobile app also allows you to apply for a loan.

You can sign up for an account ahead of time at affirm.com/account, or you can create an account at the checkout by choosing the Affirm credit option at one of the Affirm merchants.

To apply for an Affirm loans review of your creditworthiness, you’ll need to enter the following:

- Age (you must be 18+)

- S. address

- S. mobile number or VOIP that can receive text messages

- Name

- Email address

- Your Social Security Number

If the Affirm financing review cannot evaluate your creditworthiness or identity based on the information you provide, they may ask you for your bank login information. If you see this pop-up, you may ask yourself, “Is Affirm safe?”

They use this to confirm your ability to make payments and do not store any of this data. They may also require a down payment if they can’t approve you for the full amount that you’re asking for.

Affirm.com reviews all your information and instantly decides to approve or deny you for a loan. If you are approved, you can choose between loan terms of:

- 3 months

- 6 months

- 12 months

- Up to 48 months (for large purchases)

- Between 1-3 months (for very small purchases)

How much does Affirm financing cost you?

Affirm’s credit review of your ability to pay back the loan will dictate the type of rate you’re offered. They do not charge any fees, and their interest rate ranges from 0% to 30% APR.

Don’t Miss: All You Need to Know About Disability Loans | Disability Rights, Grants, & Law

When Affirm Reviews My Loan, What Are They Looking for?

Most lenders simply look at your credit report and FICO score when they make loan decisions, but Affirm.com reviews other aspects of your life and does things a little differently.

If you’re applying for Affirm financing or an Affirm credit card (aka virtual card), the company says your credit score will not be affected, although they do perform a credit check.

Millennials, who are Affirm’s target customers, may have a lower credit score or no credit history, which would make it difficult for them to qualify for a loan in the traditional way.

While the exact method that Affirm uses when they review your loan application isn’t public, they look at things as diverse as social network profiles, how often you use your cell phone, how often you send text messages, and other factors related to your online life.

According to Levchin, “there’s lots of data there about someone, and a lot of it is completely relevant.” Affirm believes that credit history alone is not a good indicator of a borrower’s creditworthiness, so the Affirm loan reviews incorporate all information about a person and their habits — not just their FICO score.

What Is Affirm’s Credit Limit, and Are There Hidden Fees?

The company does not offer revolving credit limits. Affirm reviews each loan application separately, even if you’re a returning customer. Each time you request to purchase through Affirm credit, it’s one loan with its own payment term and interest rate.

An Affirm financing review shows that the company does not place a limit on the number of loans a person can have at one time.

However, this isn’t your first Affirm loan, you can be denied if you made late payments or failed to repay a previous loan on time, or if you display a history of excessive borrowing.

As noted in many Affirm.com reviews, Affirm is completely upfront about the fees that they charge. There are no late fees or early repayment penalties. The APR is the only fee that you pay, and they tell you at the beginning of the process exactly how much you’ll pay for your loan.

What Is Affirm’s Payment Process?

Making payments on your Affirm.com loan is just as simple as getting it in the first place.

Affirm Credit Payments

After Affirm reviews and approves your loan, your first payment is due one calendar month after the date of your purchase. Your payment is due on the same date each month and due dates on Affirm financing can’t be changed.

You can sign up for autopay or pay your bills online or through the Affirm app with a debit card or bank transfer. You can also mail them a check every month if you prefer and some loans can be paid by credit card.

To make the process even easier, Affirm sends you a text message each month to remind you of your upcoming payment, and you can manage your account from their iPhone and Android apps.

What about Affirm refunds?

You would request a refund for the item you purchased from the retailer. Once the refund is provided to Affirm credit, your account balance will reflect it. However, any interest charged is not refunded.

Related: Best VA Loans | How to Find & Get Best Military Loans for Veterans

What Is Affirm’s Impact on My Credit Score?

According to the company, you can apply for an Affirm loan without affecting your credit score.

When you apply for a loan, Affirm reviews your credit history by doing a “soft” credit check, which does not show up as an inquiry on your credit report and does not have a negative impact on your credit score.

As far as the loan itself, this can have a positive effect on your credit score or a negative one.

If you make your payments on time, taking out an Affirm loan can help you build your credit history and get some good marks on your credit report. Making late payments will harm your credit history, so as with any loan, you need to make sure you pay on time.

What is the Affirm Virtual Card (aka Affirm MasterCard)?

What if you want to make a purchase somewhere that doesn’t directly support Affirm?

If you have the Affirm iPhone or Android App, you can apply for a loan for the total amount of the purchase and you’ll get a virtual card, which is somewhat like an Affirm credit card as far as how it works to make a purchase.

One Affirm reviews and approves your application you get an Affirm MasterCard number loaded with the loan amount. You can use it almost anywhere online and in many physical stores. The Affirm virtual card isn’t a physical card, but you receive the 16-digit card number.

For some people, the idea of having an Affirm MasterCard number on their phone makes them ask, “Is Affirm safe to use? What if my phone gets stolen?”

A safeguard is that the Affirm credit card number expires within 24-hours and is good for one-time use only. If the Affirm virtual card expires before you use it, it’s like the loan never happened in the first place, and you owe nothing.

If there is additional loan money left on your Affirm MasterCard that wasn’t used, it will be taken off the full loan amount, usually after 21 days.

You can use your Affirm credit card number both online and at a physical store:

- Online, by entering the digits as you would any other credit card

- Offline, use the virtual card with either Apple Pay or Google Pay or enter the number as a “card not present” Affirm MasterCard transaction (where allowed)

Where Is Affirm Available?

Affirm is available at checkout at a large and growing list of 2,000+ online merchants and Affirm is adding more merchants all the time. Some of their featured merchants include:

- Casper

- Delta Vacations

- Peloton E-commerce

- Purple

- Warby Parker

- Pat McGrath Labs

- Bellami Hair

- Motorola

- Razer, Inc.

- Joybird

- Tradesy

You can also use an Affirm virtual card almost anywhere online and at many brick-and-mortar retail stores.

Is Affirm Safe and Secure?

Affirm puts a lot of time and energy into making sure your Affirm account is safe and secure. Because of their many safeguards, they may even be safer than using a credit card. Affirm has the following security features:

- They employ the latest and best encryption available to protect your information.

- Their system connects directly to the merchant’s, so there are no card numbers being transmitted for hackers to steal.

- Affirm reviews their system security constantly to make sure it’s top-notch.

- Any time you buy something using an Affirm loan, they’ll send you a text message to confirm the purchase.

Additionally, they state that you’re not responsible for any unauthorized loans and Affirm will do all they can to help you remedy any issues of unauthorized account activity.

Popular Article: VA Loan Requirements, Limits, & Eligibility | How to Qualify for a VA Loan

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Are the Affirm Reviews Positive? And Is It Right for Me?

There are many Affirm.com reviews out there, and most of them give Affirm high marks for their simple process, easy-to-use interface, transparency, and general usability.

However, there are some Affirm financing reviews relating to difficulty getting mobile numbers updated, customer service, and problems when an item is returned.

Still having to pay interest in the case of a refund was one of the main issues we saw in negative Affirm reviews. In the company’s defense, it’s fully disclosed on Affirm’s site that customers aren’t refunded for interest charges on a returned item that’s refunded.

Overall, we could find any shady practices by the company and found that they go out of their way to be very straight forward about Affirm credit and how it works, but their customer service could use some improvement.

If you have no credit history or just hate the idea of a revolving credit card, then an Affirm loan may be right for you if you’re facing a large purchase without the cash to cover it.

Affirm loans reviews applications instantly, even if you don’t have much credit. They offer fixed payment terms, so there’s no way that you’ll build up debt that’s spiralling out of control.

If you make your payments on time, an Affirm loan can help you build a positive credit history.

This Affirm loans review should give you a good idea of how Affirm works and whether it’s right for you.

As with any form of financing, you need to be careful about how you use it. Financing might make sense for a major purchase like furniture, but don’t get into the habit of borrowing money for every purchase you make online.

Eventually, Affirm hopes to offer direct-to-consumer loan products such as Affirm home loans, car loans, and small business loans for startups.

With their simple process, easy interface, and focus on the specific needs of millennials, Affirm could certainly revolutionize the lending industry in the future.

Image sources:

- https://www.affirm.com/

- https://www.affirm.com/about

- https://www.affirm.com/how-it-works

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.