American Express Savings Account Pros and Cons | Using Amex Savings Online Bank

About 54% of Americans are invested in the stock market, and for the rest, one of the things they rely on to grow their money is the interest earned from savings accounts or Certificates of Deposit (CDs).

While these vehicles don’t typically garner the same potential gains as stocks can, they also don’t risk your money either. So, finding a high yield savings account is the preferred method for those not willing to take risks with their family’s nest egg.

Where do you find the best savings account with the highest interest rate?

MagnifyMoney recently updated its list of “The Best High-Yield Online Savings Accounts,” and it included American Express Personal Savings Bank, Synchrony Bank, CapitalOne, and Barclays.

NerdWallet and Investopedia also regularly update their best savings accounts lists, and near the top of both was the American Express high yield savings account.

AMEX Online Savings & CDs

Most people don’t know about AMEX Savings Bank

American Express is well known for providing personal and business credit cards. But, not as many people realize that American Express also has a banking arm that provides AMEX personal savings and CD products.

Their AMEX high yield savings account is consistently listed as offering one of the best interest rates you can find in a traditional or online bank that’s significantly higher than the U.S. national savings interest rate average of 0.09%.

This review provides a detailed analysis of American Express Savings Bank, including the various pros and cons of opening and maintaining an Amex savings account or investing in an American Express CD.

American Express Bank Reviews – Pros, Cons and Analysis

- History – American Express Online Banking

- American Express Online Savings Review

- American Express CD and CD rates Review

- Pros of Using AMEX Online Savings & CD Products

- Cons of Banking with AMEX personal savings bank

- American Express Savings Account Review Conclusion

See Also: Best Savings Account Comparison | How to Compare Savings Accounts & Rates

American Express Personal Banking | History

The company that bought us the AMEX card and the American Express personal savings account did not start out in the credit or banking business.

American Express was founded in 1850 as a freight forwarding company that earned a reputation of trust for the ability to safely transport all kinds of items including a person’s most valuable possessions.

In the subsequent years after its founding, AMEX expanded rapidly.

In 1882, the firm entered the financial services arena when it launched a money order business. American Express also provided travel services during the late 19th and early 20th century to support the daily lives of their customers.

During the post-war boom of the 1950s is when the company first introduced their charge card, which they’re most known for.

On November 10, 2008, at the height of the financial crisis, Amex received approval from the US Federal Reserve bank to become a bank holding company.

Today, American Express Bank provides a range of banking services to individual consumers (like you and me) and also to corporate clients. These include the American Express Savings account and American Express CD.

Don’t Miss: Best Banks for Savings Accounts | How to Find the Best Bank to Open a Savings Account

American Express Personal Savings Review

The generous American Express savings rate, that’s higher than the average, is what causes many to use them for an online savings account.

That’s also why it’s referred to as an American Express high yield savings account because the rate of return is higher than typical bank savings accounts.

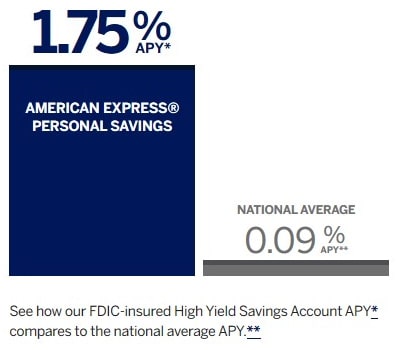

You can immediately see what to expect for a return on your money. They display the American Express savings interest rate as compared to the average clearly on their site. While rates can fluctuate, as of this writing those comparisons are:

- American Express savings rate: 1.75% APY

- National average: 0.09% APY

American Express Savings Review

You can apply for AMEX online savings on their website without needing to visit any physical location, which makes signing up for their online savings very convenient.

The information you’ll need to have on hand when filling out the application for an American Express Savings account includes:

- Your SSN or Individual Taxpayer ID

- Email Address

- Phone Number

- Address (U.S. based)

- External bank name, routing and account number (for an external linked account)

As you’re going through the application, you’ll get the option to choose an AMEX high yield savings account or American Express CD (we’ll get into the American Express CD rates and how they compare to AMEX personal savings shortly).

If you’d rather not apply for an American Express online savings account over their website, you can also apply by phone by calling 1-800-446-6307.

American Express High Yield Savings Account | Common Questions

It’s natural to be curious when signing up for any type of online-only banking since it doesn’t work in quite the same way as going to a branch in person.

Here are answers to some of the most common questions about opening an AMEX savings account.

Q: Can I open an AMEX checking account too?

A: No. they only offer the AMEX high yield savings or American Express CD.

Q: Can I get a debit card with the American Express online savings account?

A: No. The account is meant as a savings vehicle, not for regular debit transactions.

Q: How do I add money to my Amex online savings?

A: You can transfer funds online by linking your current bank account to American Express savings bank or by mailing a check.

Q: Does the American Express savings rate fluctuate?

A: Yes. The American Express savings interest rate and APY are subject to change at any time without notice before and after you open your American Express personal savings account.

Related: Free Money Management Tools & Discount Offers

American Express CD Rates & CD Review

The other option you have with American Express personal banking is to open a Certificate of Deposit account. The American Express CD rates can be either less than or more than the American Express savings rate, depending upon the term of your CD.

When you’re doing an American Express savings account review and wondering whether you should choose a CD or AMEX online savings for the best investment, these current rates and terms below should help you decide.

American Express CD Rates*

- 6-month term: 0.40% APY

- 12-month term: 0.55% APY

- 18-month term: 1.90% APY

- 24-month term: 2.00% APY

- 36-month term: 2.05% APY

- 48-month term: 2.10% APY

- 60-month term: 2.15% APY

* All rates/yields shown in this article are subject to change at any time without notice. Please visit American Express Bank’s website for the most updated rates and figures.

What are the American Express savings account pros and cons compared to the American Express CD?

When considering the best American Express personal banking savings product for your needs it’s important to know the main differences between a CD and an American Express personal savings account.

If you want the flexibility of being able to withdraw your money when you need it, then an American Express high yield savings account will be your best option because it allows withdrawals without penalty up to 6 times per payment cycle.

There is a penalty if you decide to withdraw money early from your AMEX CD.

If you’d rather lock in your interest rate for a specified time period, then the CD will be better for you because the American Express CD rates stay the same throughout the CD term.

As noted earlier in our American Express personal savings review, the American Express savings interest rate can be changed at any time, so you may end up earning less than you anticipated when you first opened your account.

Next, we’ll go over the American Express savings account pros and cons overall.

Popular Article: The Best High Yield Savings | Ways to Find High Interest Savings Accounts

Pros – High Yield American Express Savings Account & CDs

Our American Express savings account review found that you can open a savings account with no minimum deposit and there are no fees to open or maintain a personal savings account or CD. You can even open an AMEX high yield savings account or CD with as little as a dollar.

Amex Savings Bank has a very user-friendly website and an account interface that allows you to access your account at any time of the day or night.

With American Express personal banking, you can manage your account from wherever you are without needing to visit a branch. You have 24/7 account access both online and by phone.

You also have the flexibility to link your existing checking or savings account with your Amex personal savings; this way you don’t need to switch banks.

Our American Express savings review found that you can link up to three bank accounts to your AMEX savings account.

In addition, your deposits are insured by the Federal Deposit Insurance Corp. (up to $250,000). As such, you can save with confidence and feel as secure banking with AMEX as you do at any other bank.

Aside from the banking products and services provided, American Express also offers prepaid cards that allow those with bad or developing credit to build a good credit history.

Your monthly payments are reported to the major credit bureaus and making payments on time reflects well on your credit history.

Cons – American Express Bank Savings & CDs

As great as the above benefits are, American Express Savings Bank does come with a few concerns.

One of these is the limited availability of physical branches where you can walk in and have an actual person resolve any issues you might have.

While our American Express personal savings review found that you do get 24/7 phone support, that’s not quite the same as being able to get help in person at a branch.

A lot of people do not ever need to visit a branch to conduct business, as most banking transactions today can be done online, via phone or using an ATM. Technology has opened the door to online banking being more widely accepted.

However, many consumers still like the convenience of a physical branch or the personal relationships that comes with physical bank branches. So, this is one area where American Express online savings falls short of traditional banks.

Another con is that AMEX Bank does not currently provide checking account services – just the American Express personal savings account and CDs. However, as noted above, you can easily link your Amex savings account with any checking account you currently have with a different bank.

Read More: Best Online Savings Account | How to Find the Best Online Savings Account

American Express Savings Account Review Conclusion

When looking at American Express savings pros and cons, we’d say that they’re an excellent option if you don’t mind doing all your banking online and not having a physical branch.

The website for the American Express Savings Bank is very simple and easy to navigate and has an excellent and extensive set of FAQs to answer just about any questions a person may have.

While the American Express savings rate can change at any time, that’s typical in the banking industry. If you’re looking for a longer-term locked-in rate, the American Express CD rates offer that.

Overall, if you’re looking for high yield savings, AMEX is a very attractive option and has the advantage of a being a well-known and trusted name in the financial industry.

Image Sources:

- https://pixabay.com/photos/online-banking-online-bank-banking-3559760/

- https://www.americanexpress.com/personalsavings/home.html

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.