Overview: Best Savings Account Comparison, How to Compare Savings Accounts and Rates

If you are in the happy position to have some money to put into savings, you may have a lot of questions about savings account comparison.

This is because there are so many different types of savings accounts out there. Choosing the right savings account when you compare savings rates will depend on what kind of saver you are and what you would like to do with your money.

In this article, we will help you consider some key questions relating to savings accounts comparison. This will include:

- Where to find great savings account comparisons

- What to look out for when you compare savings accounts

- How to compare interest rates

- Recommendations on interest rate comparison sites

Economic Landscape: Is Now a Good Time to Save?

In this article, we will compare savings accounts. However, you may have heard that now is not a good time to putyour money into savings due to generally low interest rates whaen you compare savings rates.

It is unquestionable, regardless of interest rate comparison, that there is never a bad time to start saving. Even if you are not making a massive return on your money with high interest rates, it is always good to get into the habit of saving.

Even if you can only afford to set aside a tiny bit of money every month, when you compare savings to checking accounts, the money will accumulate, and you will be thankful if you happen to have an emergency or decide to treat yourself with your hard earned cash.

If you were to compare interest rates now to before the economic crash, you might be disappointed, but there are lots of reasons to save, especially in times of economic instability.

Image Source: Visual Economics

AdvisoryHQ is here to help you to start saving now! Keep reading for a comprehensive savings account comparison.

See Also: Free Money Management Tools & Discount Offers

Before You Compare Savings Accounts, Compare Savings

One of the main factors that will help you to decide what kind of savings account is right for you is to understand what kind of saver you are. Before we compare savings accounts, look at your own habits! There are some fun quizzes out there that can help you understand what kind of saver you are (and how you can save more!) and that will help you to do a thorough savings account comparison. We liked:

- Go Compare: What Type of Saver Are You?

- Quibblo Personality Quiz – What Kind Of Saver Are You?

- Geico – What’s your savings style?

Understanding the way that you save – for example, how much, how often – will help you to compare savings accounts. This is because some accounts require minimum opening deposits or minimum monthly deposits.

We started with a savings comparison in some of the main banks. For example, Wells Fargo has a savings account option with a manageable $25 opening deposit minimum but a $300 balance required to avoid maintenance fees.

Brazen Woman

If you do a savings account comparison with First National Bank, they require a $100 minimum opening balance.

Don’t Miss: Finding the Best High-Interest Checking Accounts & High-Interest Online Savings Accounts

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Compare Savings, Compare Spending

Another aspect of your finances that you should analyze before you start to compare savings interest rates is what kind of a spender you are – or what you are saving the money for. This will help you to decide the type of savings account that is best for you.

For example, let’s compare interest rates between long- and short-term savings. If you put your money into long-term savings, like a CD deposit account, you will get a better rate, but you may not be able to access the money in the first five years of saving without being penalized. You can read more on CD account interest rate comparison in AdvisoryHQ’s article: 2015-2016 Guide: Investing in a High Yield CD (Best CD Rates).

When it comes to savings account comparison, regular checking is a good option to tie-in instant savings access. If you just have a little bit extra in your checking account and you would like to remove it from your daily budget, but might also like to splash out on a nice handbag without having to contact your bank about it, you will need a savings account that you can get instant access to.

The thing about regular savings accounts is that they do not offer much in interest rate comparison.

However, there are lots of different savings accounts in between. This is something to bear in mind when you are doing a savings comparison.

Compare Savings Accounts: Different Types of Savings

There is a huge range of savings accounts available in banks, online banks, credit unions, and other financial institutions. Before you start to compare savings interest rates, it is important to understand what each account offers, and whether they will suit you as a saver and a spender.

Image Source: YFinadvisor

- Regular Savings Accounts

Most banks and financial institutions offer a regular savings account, but when we compare interest rates in these accounts, they are generally low (around 0.1%).

These types of accounts go by a variety of names, but they are the most basic type of savings account: normally easy to open, easy to move money to and from, and cheap to maintain. Most of these banks also offer these accounts online, making it easy to compare online savings accounts.

The downside of these types of accounts, when doing a savings comparison with other types of accounts, is that interest rates on these accounts is usually very low. In other words, if you compare savings, you are not going to gain much interest on this type of account.

- Online Savings Accounts

When you compare interest rates between regular savings accounts and online savings accounts, online banks may come out on top. Online banks have fewer overhead costs than bricks-and-mortar nationwide banks; therefore, if we are to compare savings interest rates between traditional and online banks, the latter offer higher interest rates to their clients.

To compare online savings accounts against regular accounts may seem like a no-brainer – you do nearly everything online anyway these days, right? There may be a few downsides. Unless you happen to do your regular checking with the same online bank, there may be delays and costs associated with transferring funds in and out of your savings account.

For more to help you to compare online savings accounts, read AdvisoryHQ’s Top Best Online Savings Accounts.

Related: The Best Checking Accounts | Tips to Finding the Best Bank for a Checking Account

- Money Market Deposit Accounts

Let’s do a savings account comparison between a regular savings account and a money market account. The money market account has the attraction of normally offering better numbers in interest rate comparison. However, they may need a higher opening deposit and a higher minimum balance. Also, these types of accounts usually have restrictions when it comes to number of transactions one can perform in a month and barriers in terms of ATM cards and checks.

- Certificates of Deposit

Certificates of Deposit, known as CD accounts, are more suited to people who do not mind having no access to their money for a number of years. When the investor begins to compare savings rates, they will find that the longer they are willing to part with their money, the more interest they are likely to make on their investment.

Although there are plenty of options in terms of the amount of time you have to lock your money into a CD account, and the fact that they can be attractive in savings comparison, they often have high minimum deposits. You can withdraw the money early if you need to, but it is standard practice for banks to financially penalize customers who do this.

Advisory HQ has reviewed these types of savings accounts in detail here: AdvisoryHQ Best CD Rates.

- Automatic Savings Accounts

In interest rate comparison, automatic savings accounts are a great option for regular savers that can work with their bank to agree to a set amount to be transferred from their checking to savings account at regular intervals. Banks often offer attractive rates and other benefits for these types of savers.

Before choosing an automatic savings account, you need to be confident about the amount you will be able to contribute to your savings account on a monthly basis. A good way to go about this is to do a budget.

Popular Article: How to Find The Best Banks with Free Checking and No Minimum Balance

Interest Rate Comparison

Research is key when you compare interest rates. Once you know all your numbers and are confident about your interest rate comparison, some savvy savers say that the best thing to do is to spread your savings around in order to make the best of interest rates but not be paralyzed by savings accounts that penalize you for withdrawing money.

If you do an interest rate comparison and like the sound of a high-interest rate on your savings but would also like to access money quickly in an emergency, consider opening two or more savings accounts!

Image Source: Creveling and Creveling

So, in practical terms, let’s say you want to put money aside for long-term and short-term uses, here is a savings comparison:

- Christmas presents and a family vacation next year

- A college fund for your child who will graduate school in 5 years

In this dilemma, compare savings between different types of accounts – and consider splitting your money between different types of savings accounts could be the best way to keep the short-term savings accessible and the long-term savings earning from higher interest rates.

Compare Interest Rates: The Numbers

It can be quite hard to do a proper savings comparison without seeing the numbers in front of you. Here is the bottom line – the national average APY on savings accounts for 2016 was 0.11%. So, if you put $1,000 into an account at this rate, at the end of 365 days (1 year), you will have accrued $1.10 – making for a total of $1001.10.

Compare savings rates like this with some of the higher rates that circle around the 1% APY rate. If you made the same deposit at this rate, you will have $1010 at the end of the year.

We have done an interest rate comparison for you, and here are the results:

- Synchrony Bank: This bank is offering a rate of 1.05% APY, which is high in our savings comparison. They have a handy online calculator that can help you calculate what this actually means for you and your money. For example, if you make an initial deposit of $1,000 and make a monthly deposit of $100, by the end of twelve months, you will have $2,216. By the end of 60 months (five years), you will have $7,209.

The bank is also popular because it has comparably low monthly maintenance fees and other perks for long-term customers. Furthermore, customers enjoy good ATM access.

- Ally Bank: Ally Bank is offering a slightly lower rate of 1% APY. Although this is a fraction lower than Synchrony in terms of interest rate comparison, they have been named best all-around savings account by reviewers who enjoy some of their features, such as being able to deposit checks by sending photos of the checks taken on your smart phone. It also has a good reputation for easy online experience.

- Everbank: This financial institution is offering an attractive rate of 1.11% APY on their money market accounts. Interestingly, they also give first time customers a rate of 1.6% on the first six months, which is quite a bonus. Be careful when you compare savings rates and always read the small print, as after the first 6 months, the rate could drop to as low at 0.6% APY. Another condition of note is a minimum opening balance of $1,500.

- Mountain America Credit Union: This credit union is offering a whopping 2.30% on a 5-year CD account. Customers’ reviews have been generally positive, but some have complained about difficulties with their account while traveling. If you compare savings potential here, this offer is tempting, but remember that this will mean not accessing your money for five years.

Savings Account Comparison: Helpful Websites

AdvisoryHQ’s savings account comparison is a snapshot of the some of the top savings accounts. In order to help you compare interest rates, we have tested out several comparison sites that you could use to compare savings rates.

- The Simple Dollar: This provides a guide based on analysis of interest rates and other features that are important to customers such as ATM access check writing and lodging, customer service, and more. The analysis concluded that when it comes to interest rate comparison, online banks have some of the best rates. Read through the guide to compare online savings accounts.

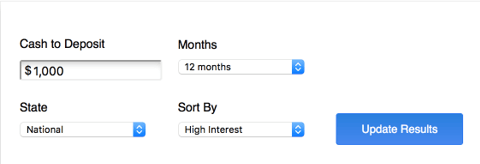

- MyBankTracker: We really liked this site, which has a helpful tool in which you can enter your opening deposit, amount of time you are planning on saving, and which state you are in. As well as letting visitors compare savings interest rates, it lists some of the highest-yielding accounts and explains APY.

Image Source: MyBankTracker

- Bankrate: Bankrate has carried out some interesting surveys on high-yield savings accounts that will give you an understanding of savings comparison between traditional banks, online banks, and credit unions. They also have a calculator tool.

- OnlineBanks: This site allows visitors to compare online savings accounts, as they have gathered information from hundreds of active online banks in America.

Read More: Best Bank Accounts for Bad Credit | How to Find Great Accounts When You Have Bad Credit

Although rates of 0.1% may not be very enticing, it is never a bad time to start saving.

When you compare interest rates of savings accounts, differences of less than 1% may seem small, but they can have major long-term ramifications; it is important to make sure that all the other features of the account are working for you.

Image Source: Technology Advice

Some factors to remember in your savings account comparison include:

- Ease of transferring funds in/out of savings account

- Maintenance fees

- Minimum deposits

- Minimum balance

- ATM and check facilities

- Reputable customer service

Through our savings account comparison, we have shown that unless you are willing to lock your money away for a few years in a CD account, the best rates in terms of regular savings are on offer from online banks such as Synchrony and Ally. When you compare online savings accounts, remember that it is not just online banks that offer online accounts. Credit unions also offer good bonuses on savings accounts, but the benefits may be short lived.

So, what is our top tip on how to compare savings accounts? If you are a good planner and have a good grip on your budget and your future expenditures, think about splitting your savings into short-term and long-term accounts so that you are prepared in the event of needing quick access to cash, as well as covering your bets with high-interest CD accounts.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.