2017 RANKING & REVIEWS

TOP BEST ONLINE SAVINGS ACCOUNTS

2017 Guide to Finding the Top 10 Best Online Savings Accounts

We are living in the digital age, and, as such, many of us do the majority of our banking online through our bank’s Internet and mobile banking platforms.

With so many consumers utilizing digital banking, more and more banks are emerging with a focus of conducting business solely online.

Due to the establishment of so many online banks, opening a high interest online savings account has become a popular option with consumers.

Without the high overhead that comes with operating brick-and-mortar offices, many online banks are able to offer a high yield online savings account with a rate much higher than most traditional banks offer.

Award Emblem: Top 10 Best Online Savings Accounts

Opening a savings account online can be a great way to build up funds for emergencies, a vacation or the holidays.

With such a large selection of online banks that offer high interest savings accounts online, it can be difficult to determine which one truly offers the best savings account online for your specific financial needs.

AdvisoryHQ has taken the time to research online banks that offer online savings accounts, and, through the use of our advanced Selection Methodology, we have created a list of the top 10 best online savings accounts available today.

Many online banks claim to have the best online saving account available, which is why it is important to compare options to be sure that you are getting the best online savings account for you.

In our research, we compared many features of online bank savings accounts and narrowed the list down to the top high interest online savings accounts. Each online savings account on this list offers high value to consumers through a great interest rate and little to no fees.

See Also: Best Bank for Small Business Banking (Best Business Bank Accounts)

Is an Online Bank Savings Account Right for You?

There can be many benefits to getting a savings account online. Since they have fewer expenses than banks that operate with physical locations, many of the best online savings accounts on this list offer extremely competitive interest rates that are five to eight times higher than the national average rate for bank savings accounts.

Online banks also tend to have fewer fees than traditional banks, and what fees they do have are usually much lower than those charged by most traditional banks.

While the benefits of utilizing an online bank are many, there are also drawbacks to banking entirely online. While most of the best online savings accounts on this list offer a remote deposit feature for depositing checks via mobile or their online platform, it can be difficult to deposit cash.

Image source: Big Stock

Without a physical location for withdrawing cash, it is also important to evaluate how important quick access to cash is for you. Many of the online savings accounts on our list have an option for an ATM card, but withdrawing money may incur fees if their ATM network is not local to you.

Funds can be transferred from high interest online savings accounts to external accounts but, depending on the bank, can take up to three to five business days for the transfer to go through.

For these reasons, before choosing an online bank, you should evaluate how much importance you place on the ability to deposit and withdraw cash quickly.

Online savings accounts tend to work best as a place to park money and let it grow without the need for quick access. These are things to keep in mind when considering an online savings account versus an account at a brick-and-mortar local bank.

List of Banks with the Best Online Savings Accounts

- Ally Bank

- American Express

- Bank of Internet USA

- Bank5 Connect

- Capital One 360

- Discover Online Bank

- First Internet Bank

- FNBO Direct

- iGObanking

- Synchrony Bank

List is sorted alphabetically (click any of the names above to go directly to the detailed review section for that bank)

Methodology for Selecting the Best Online Savings Accounts

What methodology did we use in selecting this list of top online savings accounts?

Using publicly available sources, AdvisoryHQ identified a wide range of online banks that provide savings accounts online.

We then applied AdvisoryHQ’s “Breakthrough Selection Methodology” to identify the final list of best online savings accounts that provide the most value for consumers.

Top Online Savings Accounts | 2017 Ranking

Banks | Websites |

| Ally Bank | https://www.ally.com/ |

| American Express Personal Savings Bank | https://personalsavings.americanexpress.com/home.html |

| Bank of Internet USA | https://www.bankofinternet.com/ |

| Bank5 Connect | https://www.bank5connect.com/home/home |

| Capital One 360 | https://home.capitalone360.com/online-savings-account?external_id=360b_SAV_SS_Static_Z_T |

| Discover Online Bank | https://www.discover.com/online-banking/ |

| First Internet Bank | https://www.firstib.com/ |

| FNBO Direct | https://www.fnbodirect.com/site/ |

| iGObanking | https://www.iGObanking.com/home.aspx |

| Synchrony Bank | https://www.synchronybank.com/banking/products/high-yield-saving/?UISCode=0000000 |

Table: Top 10 Best Online Savings Accounts | above list is sorted alphabetically

Detailed Review – Top Ranking Best Online Savings Accounts

Below, please find the detailed review of each firm on our list of top online savings accounts.

We have highlighted some of the factors that allowed these online banks’ online savings accounts to score so high in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Ally Bank – Online Savings Account Review

Source: Ally Bank

Ally Bank is the direct banking division of Ally Financial, a bank holding company founded in 2008. Headquartered in Midvale, Utah, Ally Bank has no physical branches, with customers of the bank handling their banking transactions entirely online.

Ally Bank is well known for its high yield online savings account, often offering one of the top rates in the market. In addition to its online bank savings account, the top online bank also offers an online interest checking account, a money market account, certificates of deposit, and IRAs.

Key Factors That Enabled This Bank’s Online Savings Account to Rank as a Best Online Savings Account

Below are key factors that enabled Ally Bank’s savings account online to be rated as one of this year’s best online savings accounts.

High Yield Interest Rate

Ally’s Online Savings Account features a variable interest rate that is currently at a 1.00% APY. Perhaps the best thing about its high yield online savings account is that customers earn the same high APY across all balance tiers, meaning there is no minimum balance requirement to earn the top rate.

What’s more, interest on the account is compounded daily, allowing customers of this best online savings account to grow their money even faster.

No Monthly Fees

This high interest online savings account features no monthly maintenance fees and no minimum balance requirement.

But the benefits don’t stop there – there are also no fees for these services, which are typically charged by traditional banks:

- ACH transfers to a non-Ally Bank

- Statement copies online

- Incoming wires (domestic & international)

- Postage-paid deposit envelopes

- Cashier’s checks

Around-the-Clock Customer Service

The vast majority of traditional bank customers have to wait until business hours to contact their bank about a problem, but not so with Ally. When customers of this top online bank savings account find themselves locked out of their online banking or see an unusual transaction in their account, they don’t have to spend a sleepless night worrying about it.

That’s because Ally offers a 24/7 customer service help line that actually connects customers to live people instead of a machine. For those customers who don’t like talking on the phone, they can also be contacted via online chat and Twitter.

Additional Features

Additional features that helped us rank Ally Bank’s high interest online savings account as one of this year’s top high interest savings accounts online include:

- Unlimited deposits

- Free online banking

- Free mobile banking

- Remote deposits online or via mobile

For more information on Ally’s online savings account, check out its upfront Straight Talk Product Guide.

Don’t Miss: Best Free Checking Account Banks – No Fees, Best Yields

American Express – Personal Savings Account Review

Source: American Express – Personal Savings

Source: American Express – Personal Savings

In business for more than 150 years, American Express credit cards account for 24% of the volume of credit card transactions in the United States by dollar value. American Express ranked number 20 on Fortune’s list of the most admired companies in the world.

It is best known for its credit cards and traveler’s checks. Many people are unaware that, in addition to these offerings, the credit card company also has a direct banking division that offers a personal online savings account for individuals.

Key Factors That Enabled This Bank’s Online Savings Account to Rank as a Best Online Savings Account

Below are key factors that enabled American Express’s savings account online to be rated as one of this year’s best online savings accounts.

Competitive Interest Rate

There are many online savings accounts to choose from, but not many of them offer a strong competitive interest rate. The American Express Personal Savings Account offers a truly competitive interest rate – which stands today at 0.90% APY.

With many big name banks offering miniscule rates, such as 0.10% APY, American Express’s rate certainly rises well above most banks. It also makes it easy for all customers to earn their top rate, with no minimum balance requirement to earn. As an added bonus, interest is compounded daily so customers’ money grows even faster.

No Fees

No one likes paying fees, and many consumers have been taking the time to do their research so they can actively avoid them. American Express doesn’t charge any monthly fees for its high interest online savings account – it wants your money to earn for you, not the other way around.

No Minimum Opening Deposit

Many banks, especially those that offer high interest online savings accounts, have a minimum opening deposit requirement of $100 or more. Some banks even require $1,500 or higher to open an online bank savings account featuring their best rate.

However, not American Express – there is no minimum opening deposit requirement for its online savings accounts. Customers of this top online bank’s best savings account online can fund their new account with as little as $1.

Easy to Open

The process to open an American Express high interest savings account online is quick and easy. As with any bank account, you will need to be prepared to provide some personal information in order to open an account.

When opening a new account, new customers will have to enter the following information:

- Name

- Social Security number

- Mailing address

- Email address

- Date of birth

- Existing banking account information in order to fund account electronically

The account may be opened as an individual or joint account. Once personal information has been entered, the customer will be asked to answer a personal question garnered from information found in their credit report history in order to confirm identity.

Once this has been done, the account is opened and ready to be funded. The entire process only takes a few minutes to complete.

Additional Features

These additional features helped rank this high yield online savings account as a best savings account online.

- Ability to link up to 3 current bank accounts

- 24/7 account access

- FDIC-insured

- Easy to transfer funds from linked accounts

- Ability to make fund transfers online or by phone

Bank of Internet USA – High Yield Online Savings Account

The Bank of Internet USA was one of the first banks to offer online banking services, such as deposits, accounts, and loans, entirely online with no physical locations. Established in 1999, it coined itself as the Internet’s oldest online bank.

Today, the online bank offers an array of financial products and services to consumers, including an online checking account, online savings account, online money market account, CDs, IRAs, and mortgage loans. The bank offers financial solutions for both individuals and businesses and is FDIC-insured.

Key Factors That Enabled This Bank’s Online Savings Account to Rank as a Best Online Savings Account

Below are key factors that enabled Bank of Internet USA’s savings account online to be rated as one of this year’s best online savings accounts.

No Monthly Fees

Due to its low overhead, online banks are able to offer consumers online savings accounts with fewer fees than savings accounts offered by traditional banks, and the Bank of Internet USA does not disappoint.

This top online bank’s high yield online savings account features no monthly fees and no monthly minimum balance requirement. The freedom of monthly restrictions and requirements makes it the perfect fit for consumers looking for a hassle-free savings account online.

Interest Compounded Daily

Interest on this best online saving account is compounded daily. This method applies a daily periodic rate to the daily balance in the account, helping funds grow faster, versus online bank savings accounts that compound interest monthly.

At 0.61% APY, Bank of Internet USA’s interest rate may not be as high as some of the other high interest savings accounts online found on this list, but it is still highly competitive when compared to most big name banks.

FinanceWorks

This high interest online savings account has the added perk of providing access to FinanceWorks.

FinanceWorks is an online money management tool that helps consumers manage all of their financial accounts on one platform. It allows customers to import account information from other financial institutions so that they can see their whole financial picture in one place.

The software also lets users see where they are spending money and helps them identify ways to save and budget.

Additional Features

Additional features of this best online saving account include:

- Free online banking with bill pay

- Free mobile banking

- Free mobile deposit

- Free MyDeposit

- Free ATM card

Related: Best Free Checking Account Banks – No Fees, Best Yields

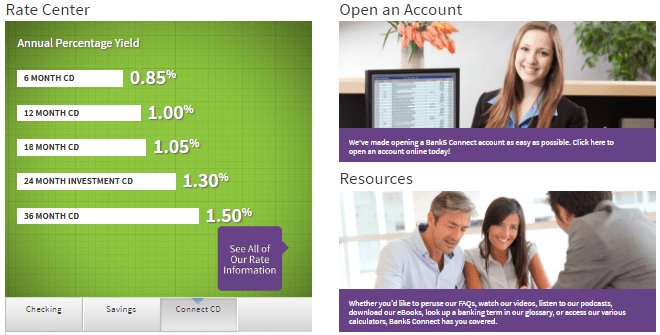

Bank5 Connect – High Interest Savings Account Review

Bank5 Connect is the direct banking division of BankFive, a bank located in Fall River, Massachusetts. While BankFive is a traditional banking operation with physical locations, Bank5 Connect offers financial products to consumers solely online.

Even though it is an online-only bank, Bank5 Connect still offers many of the same financial services and products as brick-and-mortar banks do. Its products include an online checking account, online savings accounts, and CDs.

Key Factors That Enabled This Bank’s Online Savings Account to Rank as a Best Online Savings Account

Below are key factors that enabled Bank5 Connect’s high interest savings account online to be rated as one of this year’s best online savings accounts.

High Earning

Source: Bank5 Connect

Bank5 Connect features a highly competitive interest rate for its High Interest Savings Account. The online bank savings account currently features a rate of 0.90% APY, which can be pretty tough to beat.

With big name banks like Wells Fargo paying a rate of just 0.03% on its savings accounts, consumers get much more earning potential with Bank5 Connect’s high interest online savings account.

Low Required Opening Deposit

Bank5 Connect only requires that customers make an initial investment of $10 to open its high interest online savings account.

While only $10 is required to open an account, it is important to note that interest will not be earned until the balance in the account has reached $100. Due to this, it best to consider funding the account with $100 when it is opened so you can start earning interest right away.

Low Fees

As with many online bank savings accounts, there is no monthly maintenance fee with Bank5 Connect’s savings account.

The savings, however, don’t stop there. Customers of this best savings account online also enjoy no charge for:

- Cashier’s checks

- Overdraft transfers to checking

- Incoming wires

There are fees associated with things such as overdrafts and stop payments, but they are much lower than what is generally charged by most traditional banking institutions.

Additional Features

These additional features helped rank this online bank’s savings account as a best online savings account:

- Free online banking

- Free e-statements

- Savings can be linked to Bank5 Connect checking account for overdraft protection

- FDIC-insured

Popular Article: Banks in Illinois | Ranking | Banks in Chicago, Aurora & Other IL Cities

Capital One 360 – 360 Savings Review

Capital One 360 is the online banking arm of the popular credit card provider. Launched in 2013, when Capital One acquired ING Direct, Capital One 360 offers many traditional banking products and services such as online savings accounts, checking accounts, home loans, and investing services.

Unlike the majority of online banks, Capital One does have physical branch locations in a andful of states where local customers can go to make banking transactions in person. It alsos operates its own ATM network.

Key Factors That Enabled This Bank’s Online Savings Account to Rank as a Best Online Savings Account

Below are key factors that enabled Capital One 360’s high interest savings account online to be rated as one of this year’s best online savings accounts.

No Fees and No Minimums

There are no fees or minimums required to open this best online saving account. There are also no monthly fees or minimum requirements for the account either, making it an economical choice for an online savings account.

Capital One 360 makes it easy to open a savings account with the bank and keep it open without the hassle that comes with all the requirements and restrictions that many other banks place on their high-earning accounts.

Savings Tools

Capital One 360 offers customers three tools to help them save more, faster.

This top online bank helps customers of its high interest online savings accounts save more with these tools:

- Automatic savings plan: allows customers to put saving on autopilot by setting up automatic transfers from a linked checking account

- Multiple accounts: customers can open as many as 25 savings accounts at once, all free

- My savings goals: allows customers to set a savings goal and track their progress as they work toward achieving it

Competitive Interest Rate

Capital One 360 currently offers a variable interest rate on its online savings account of 0.75%. While not the highest interest rate on this list, it is still highly competitive at more than eight times the national average, according to Bankrate.

After being opened, interest begins accruing on the account the following business day. Interest is accrued daily, compounded monthly, and credited to the account balance at the end of each month.

Additional Features

Additional features that helped rank this account as a best online savings account include the following:

- Customer service line manned by real people

- 24/7 access to account through online and mobile banking

- FDIC-insured

- Mobile check deposit

- Easy account management through online platform

Discover Online Bank – Discover Savings Account Review

Most people are familiar with the Discover Card, but many do not realize that the prominent credit card company also offers traditional banking products through its online banking division, Discover Bank. The online bank offers consumers a full range of financial solutions, including CDs, IRAs, high interest online savings accounts, and money market accounts.

Discover Bank also offers modern banking technology, such as online and mobile banking platforms and interactive calculators. Customers of the online bank also get to take advantage of Discover’s high-ranking customer service department, which has aided this leading credit card provider in ranking number one in customer loyalty for 18 consecutive years.

Key Factors That Enabled This Bank’s Online Savings Account to Rank as a Best Online Savings Account

Below are key factors that enabled Discover Bank’s high interest savings account online to be rated as one of this year’s best online savings accounts.

High Yield Interest Rate

Discover Bank’s high yield online savings account offers an extremely competitive interest rate, which is currently set at an impressive 0.95% APY. Its rate is one of the best rates currently available and is tough to beat elsewhere.

To top it off, customers of this best savings account online earn the high yield rate on all balances, meaning there is no minimum balance requirement to earn. Discover Bank does have a higher opening deposit requirement than most of the banks on this list, at $500, but once the account has been set up, customers begin earning interest immediately.

As another added benefit, interest on the account is compounded daily and credited monthly.

Little to No Fees

In today’s fast-paced society, it can sometimes feel like every time we turn around, someone else is asking for money, and free services are rarely actually free. However, at Discover Bank, free really does mean free.

The online bank’s best online saving account is free with no monthly maintenance fee and no minimum monthly balance requirement. There is also no charge for:

- Official bank checks

- Expedited delivery for official bank checks

- Incoming wire transfers

The company also prides itself on being transparent with customers and not surprising them with hidden fees or charges. It does charge fees for certain banking items, but even most of those fees are much cheaper than what is typically charged by big banks.

Fees include:

- Deposited item returned: $15

- Excessive withdrawal: $15

- Stop payment: $15

- Insufficient funds: $30

The excessive withdrawal fee is charged when withdrawals from the account exceed six per month. This is a federal guideline that all banks must follow and is not unique to Discover Bank.

Insufficient funds fees are limited to one per day.

Mobile App

In modern times, having access to bank accounts while on the go is more important than ever. In addition to its easy-to-use online banking platform, customers of this best online savings account are also able to utilize Discover Bank’s mobile app.

With the mobile app customers have the ability to:

- View account activity

- Check balances

- Deposit checks

- Transfer funds

- Pay bills

Additional Features

Additional features that allowed this best online savings account to rank so highly include:

- 24/7 live customer support

- Auto saver plan

- No fee for transferring funds

Read More: Best Banks in Arizona (Ranking & Review)

Free Wealth & Finance Software - Get Yours Now ►

First Internet Bank Review – Regular Savings Account Review

First Internet Bank is an online-only bank that offers its financial services and products to consumers nationwide. Founded in 1999, it is one of the longest-standing Internet banks.

First Internet Bank is a wholly-owned subsidiary of its financial holding parent company, First Internet Bancorp, which holds a four-star rating for financial strength with Bauer Financial, Inc.

The top online bank offers a full suite of online banking products to consumers, including an online checking account, online bank savings account, CDs, credit cards, loans, and mortgage products.

Key Factors That Enabled This Bank’s Online Savings Account to Rank as a Best Online Savings Account

Below are key factors that enabled First Internet Bank’s high interest savings account online to be rated as one of this year’s best online savings accounts.

Competitive Interest Rate

At 0.60% APY, First Internet Bank’s online savings account may not offer as high a rate as some of the other best online savings accounts on this list, but it is still a highly competitive rate. With many big name banks only offering 0.10% APY or less on their savings accounts, 0.60% APY is certainly nothing to turn your nose up at.

It’s also nice that interest is compounded daily, helping the funds grow faster. Interest is credited at the end of each month.

ATM Surcharge Rebate

Unlike most savings accounts online, First Internet Bank lets customers of this best savings account online link their account to an ATM card. Since this top online bank does not have its own ATM network, it offers an ATM surcharge rebate program to customers.

All account holders of its Regular Savings Account are automatically enrolled in the ATM surcharge rebate program, so customers do not need to worry about signing up in order to be covered for ATM surcharge refunds.

Account holders are refunded their ATM surcharge fees each month, up to $10. The refund is issued at the end of each month and is automatically credited to the online savings account.

Low Monthly Fee

While First Internet Bank does charge a monthly maintenance fee for its regular savings account online, it is an extremely low fee. When compared to what many traditional banks charge for their savings accounts, which can be as much as $10 a month, First Internet Bank’s $2 monthly maintenance fee is a much better deal.

The monthly fee is waivable and can be avoided by keeping an average daily balance of $1,000 in the account.

Additional Features

Additional features that enabled First Internet Bank’s online savings account to rank as a best online savings account include:

- Low minimum opening deposit of $100

- Easy real-time funds transfers

- Free online banking

- Free mobile banking

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

FNBO Direct – Online Savings Account Review

FNBO Direct is the direct banking division of the First National Bank of Omaha. While many online-only banks are relatively new to the banking world, having been established within the last twenty years, FNBO Direct is part of a long-standing bank with more than 150 years of experience in the banking industry.

FNBO is built on a solid foundation backed by $20 billion in assets and has banking locations across Nebraska, Colorado, Illinois, Iowa, Kansas, South Dakota, and Texas. The top online bank is FDIC-insured and offers an array of financial products for consumers, including an online checking account, online savings account, CDs, and credit cards.

Key Factors That Enabled This Bank’s Online Savings Account to Rank as a Best Online Savings Account

Below are key factors that enabled FNBO Direct’s high interest savings account online to be rated as one of this year’s best online savings accounts.

High Yield Interest Rate

FDIC Direct consistently offers one of the best rates in the market for its savings account online. Currently standing at 0.95% APY, its rate is one of the best you will find in a high interest online savings account.

Not only does FDIC Direct offer a savings account rate that is nine times the national average, but the bank also makes it easy to earn, with no minimum balance required to qualify for its top rate.

Interest is calculated daily on all collected balances and begins accumulating on the following business day after the account is opened and funded.

Easy to Open

While many banks require a high opening deposit for their high interest online savings accounts, an FNBO Direct savings account online can be opened with as little as $1.

The top online bank also features a simple application process that generally takes less than ten minutes to complete. New customers should be prepared to have some basic information handy when applying, such as Social Security numbers and existing bank account information for funding.

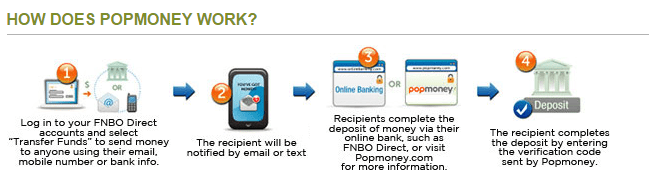

Popmoney

Source: FNBO Direct – Popmoney

Source: FNBO Direct – Popmoney

Account holders of this best online saving account have access to Popmoney for people-to-people transfers. Popmoney offers a secure and easy way to make person-to-person payments for things such as giving a cash gift to a friend, paying for an item purchased from an individual or splitting the lunch check.

Popmoney makes it simple to send money to friends and family via mobile on the online banking platform. The best part? Standard transfers with Popmoney are free and able to be sent at no cost to the sender or recipient.

Additional Features

Additional features that helped rank this online bank savings account as a best online savings account this year include:

- Free Visa Debit card

- 24/7 account access via online banking and mobile

- Ability to easily link existing checking and savings accounts for transfers

Related: Best Kentucky Banks | Ranking | Top Banks in Kentucky

Free Wealth Management for AdvisoryHQ Readers

iGObanking – High Interest Online Savings Account Review

iGObanking is the online bank division of Flushing Bank, a state-chartered bank in New York. Backed by Flushing Bank’s 80 years of experience in banking, iGObanking offers a wide array of personal banking services to consumers nationwide.

By not having the high cost of operating brick-and-mortar locations, iGObanking is able to offer highly competitive financial solutions, such as online checking accounts, online savings accounts, CDs, and money market accounts.

Key Factors That Enabled This Bank’s Online Savings Account to Rank as a Best Online Savings Account

Below are key factors that enabled iGObanking’s high interest savings account online to be rated as one of this year’s best online savings accounts.

Highly Competitive Interest Rate

At 1.00% APY, iGObanking offers one of the best interest rates on our list of best online savings accounts. A rate that high for a savings account online is hard to find, and it is almost impossible to find such a high yield rate on a traditional bank savings account.

What’s more, there is no minimum balance requirement to earn, so every customer earns the same great rate across all of their balances. Interest on this high yield online savings account is compounded daily and credited monthly, helping funds grow even faster.

No Fees and No Minimum

With no monthly maintenance fees and no minimum balance requirements, a high interest online savings account with iGObanking is extremely easy to maintain. While many traditional banks make their customers jump through hoops to earn their highest rate, with iGObanking, it is as simple as opening an account and beginning to earn.

With this high yield online savings account, there are no requirements to worry about meeting month after month. iGObanking gives customers everything they want in this hassle-free savings account online.

Mobile Banking

iGObanking offers a solid mobile banking platform to account holders of its high yield online savings account.

Features of the top online bank’s mobile app include:

- Remote deposit

- Bill pay

- Account balances

- Track account activity

- Transfer funds

- Locate an ATM

Additional Features

Additional features that helped iGObanking’s online bank savings account rank as a best online savings account include:

- Free bill pay

- FDIC-insured

- 24/7 account access

- Easy to open

Don’t Miss: Top Credit Unions in North Carolina | Reviews & Ranking

Free Money Management Software

Synchrony Bank – High Yield Online Savings Account Review

Many people recognize Synchrony as a credit card provider. In fact, Synchrony is the largest provider of private label credit cards in the United States. It has provided credit cards for such recognizable companies as Lowes, Walmart, Gap, and Amazon.

Synchrony Bank is the credit card company’s online banking division. The bank does have one brick-and-mortar location in New Jersey but offers its deposit products online to consumers nationwide. Its product offerings include high interest online savings accounts, money market accounts, CDs, and IRAs.

Key Factors That Enabled This Bank’s Online Savings Account to Rank as a Best Online Savings Account

Below are key factors that enabled Synchrony Bank’s high interest savings account online to be rated as one of this year’s best online savings accounts.

Award Winning Rates

Synchrony Bank’s high yield online savings account offers the highest interest rate on our list of the best online savings accounts. At an impressive 1.05% APY, Synchrony currently offers one of the highest rates in the market.

The top online bank consistently offers highly competitive rates and has won a litany of awards for its high yield savings rate, including:

- America’s Best Rates by moneyrates.com – 2014 and 2015

- Best High Rate Savings by mybanktracker.com – 2016

- 5x The National Average Rate award by depositsaccounts.com – 2016

- Top Tier Highest Yield by bankrate.com – 2016

- Best Savings Accounts by nerdwallet.com – 2016

- Hassle-Free Savings Award by Kiplinger’s Personal Finance – 2016

Hassle-Free Savings

Synchrony Bank’s high yield online savings account is the epitome of hassle-free savings. Customers who choose to utilize this account don’t have to worry about monthly fees or minimum balance requirements – because there are none.

What’s more, there is no minimum balance requirement to earn the top rate of 1.05% APY either. While many banks only offer their best rate to customers who maintain a high average balance, Synchrony Bank pays the same great rate across all balances. As long as the account has a balance of at least $1, it will earn the high yield rate.

Easy Withdrawals

One of the biggest concerns that those considering online banking have is losing the ability to walk into a bank and withdraw funds. Customers of this top online bank’s high interest online savings account don’t have to worry about that.

Despite being primarily an online bank, Synchrony Bank is a member of three major ATM networks. As a member of the Visa/Plus, Star, and NYCE networks, Synchrony provides its customers with fee-free access to more ATMs than most other major banks and credit unions do.

Additional Features

Additional features that helped this best online savings account rank so high include:

- Easy withdrawals and transfers online, over the phone or via ATM

- 24/7 account access through online banking and phone

- FDIC-insured

Popular Article: Best Building Societies in the UK | Ranking & Reviews

Conclusion: Top 10 Best Online Savings Accounts

There are many factors to consider when deciding which online savings account will house your money. The ideal savings account online should be free or have a low monthly maintenance fee that is easily waivable.

Since they don’t have as much overhead as brick-and-mortar banks, online-only banks often have high interest online savings accounts. It is important to shop around and compare rates to ensure that you are getting the best savings account online for you.

If access to cash is important to you, then be sure to take note of which online savings accounts come with an ATM card and how big the online bank’s ATM network is. Also, keep in mind that high interest savings accounts online have a limit of six withdrawals per month, which is a federal regulation that applies to all savings accounts.

Make sure to read the fine print and check out an online bank’s fee disclosures before opening an online bank savings account with them. Even the best online savings accounts have some common fees, such as overdraft and excessive withdrawal fees.

There is no shortage of high yield online savings accounts to choose from, and this list provides you you a good starting point in your search. With some due diligence and research, you are sure to find the best online savings account option for you.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.